Fixed Income Outlook - VP June 2024 Big Picture Discussion

Update: 2024-06-12

Description

This post is an excerpt from our June 11, 2024 market discussion video to VP clients. The full length, original video can be viewed here.

* We review our US Fixed Income Dashboard ahead of the June Fed Meeting and inflation data.

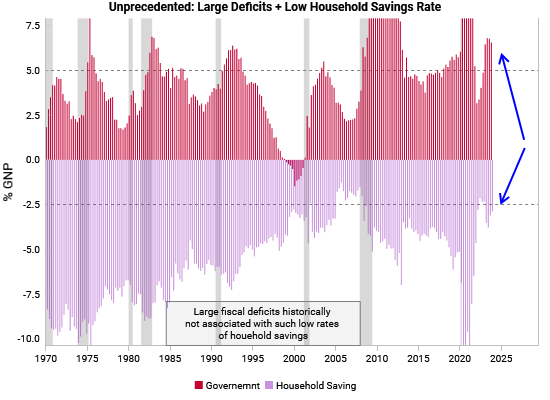

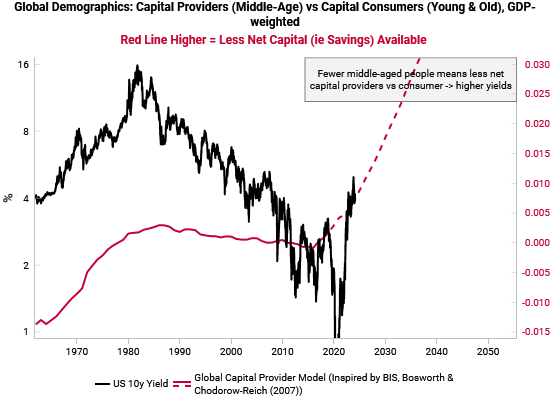

* Structurally: Fiscal deficits, demographics, geopolitical tensions, and pension funding ratios all bias yields higher.

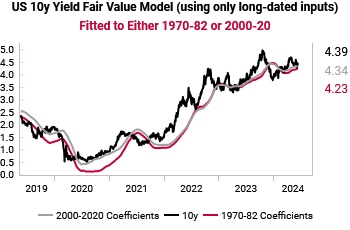

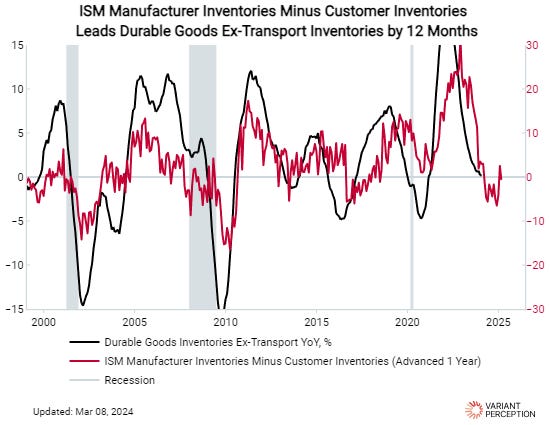

* Cyclically: Our US term-premium, fair value, and neutral-rate models indicate fixed income markets are fairly priced on a 6-12m forward basis.

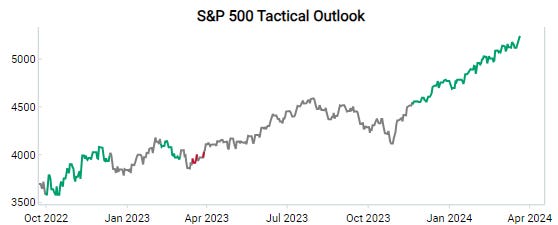

* Tactically: Our Fed Hiking Regime model has triggered, but Powell has made clear his reluctance to hike, with the risk-reward appearing limited when looking at STIR markets.

This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com

Comments

In Channel