VP January 2023 Market Outlook & Discussion

Description

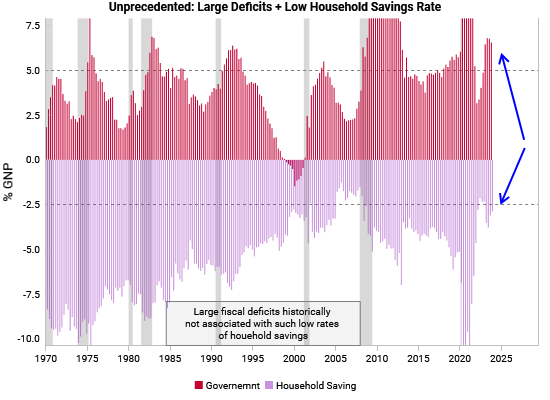

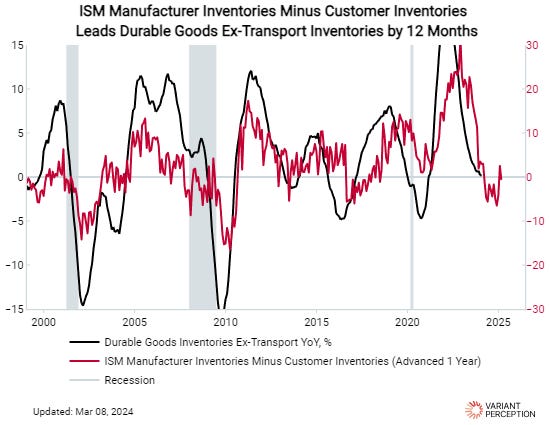

Macro themes:

• US Recession Signal active + LEIs point to deep downturn in 1H23. • Inflation LEIs showing a clear rollover across most of the world (ex Japan and eurozone). • Stick with risk-off asset allocation • When to buy back into risk assets: 1) policymakers panic and ease, 2) surge in selling exhaustion buy signals, 3) upturn in LEIs + Recession Signal falls to zero + market bottoms checklist confirmation. • Fed pivot unlikely in 1H23 and do NOT expect China reflation bonanza.

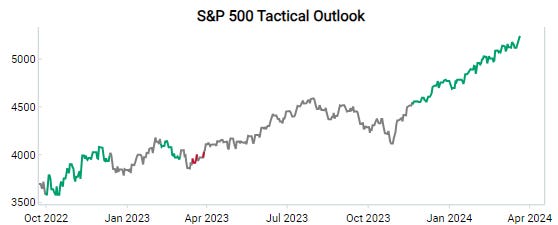

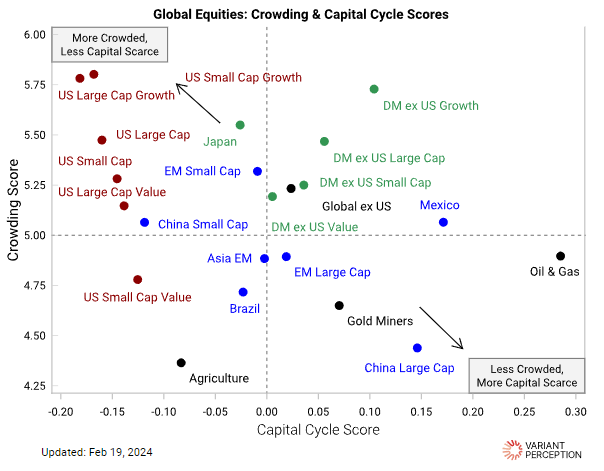

Equity themes:

• Short candidates: cyclical capex/industrial names + bad capital cycle (software + healthcare) • Long candidates: defensives (food, tobacco, telco) + beaten up cyclicals with positive capital cycle (homebuilders) • Regional themes: OW Brazil + UW Thailand, OW Switzerland + UW Canada

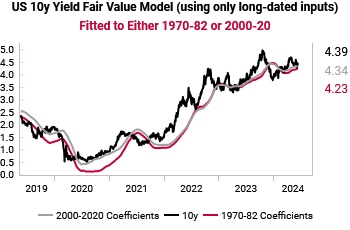

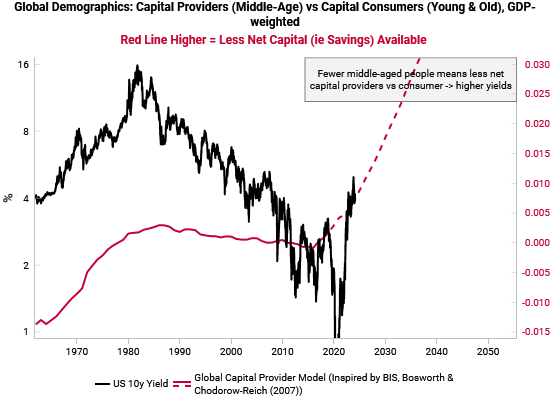

Fixed income themes:

• US 10y fair value in recession: 1.7-1.8% • Timing is key for steepeners • EM spreads not compelling. Stick with Brazil

Alternatives themes:

• Commodities: still in supercycle intermission, pare back energy euphoria • Credit: avoid HY, bet on spread blowout • FX: left-hand side of dollar smile but largely priced in. Play recession pairs: short CADJPY

This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com