Building Equity via Public Companies

Description

This segment first appeared in the 12/30/22 episode of the Atlanta Real Estate Report…

Discussion Outline

* What defines a “public” company?

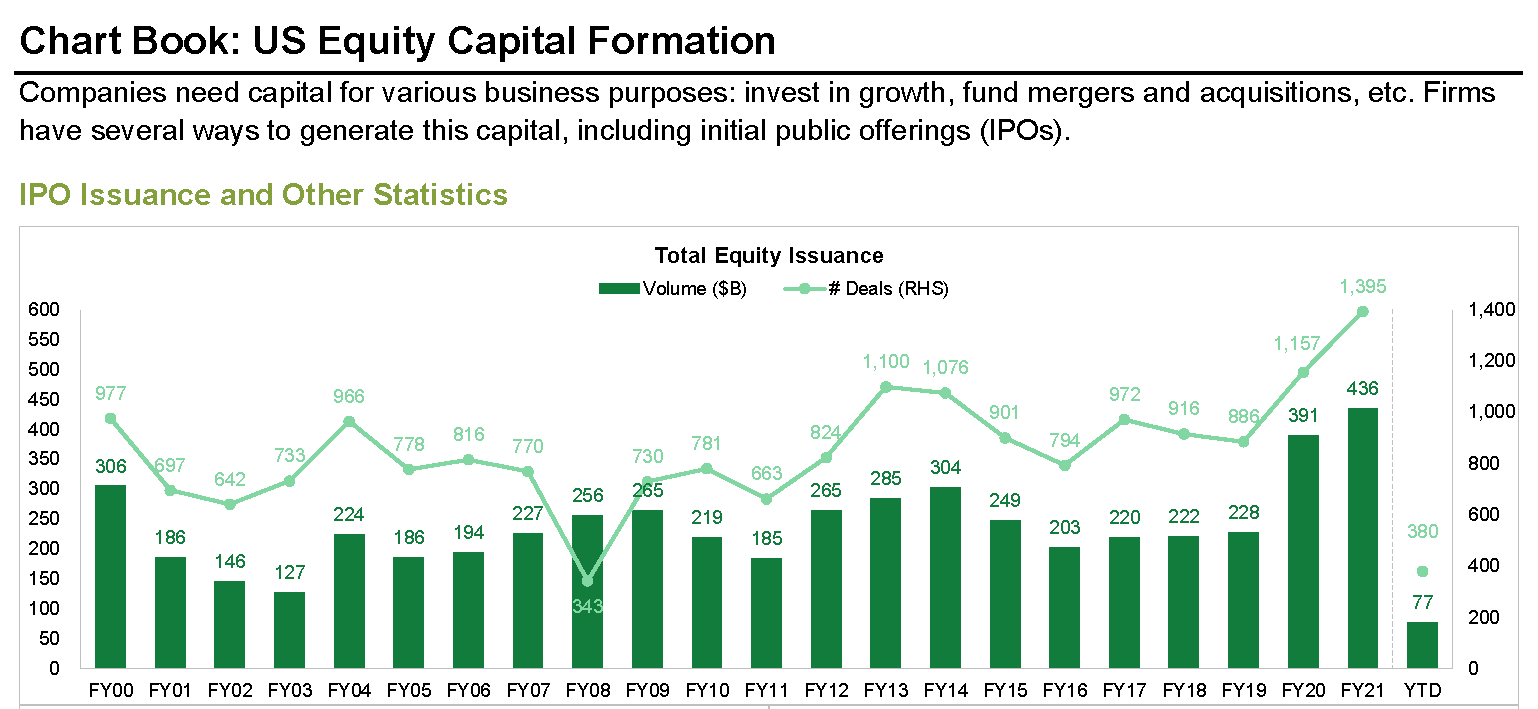

* They go from private to public via an Initial Public Offering (IPO)

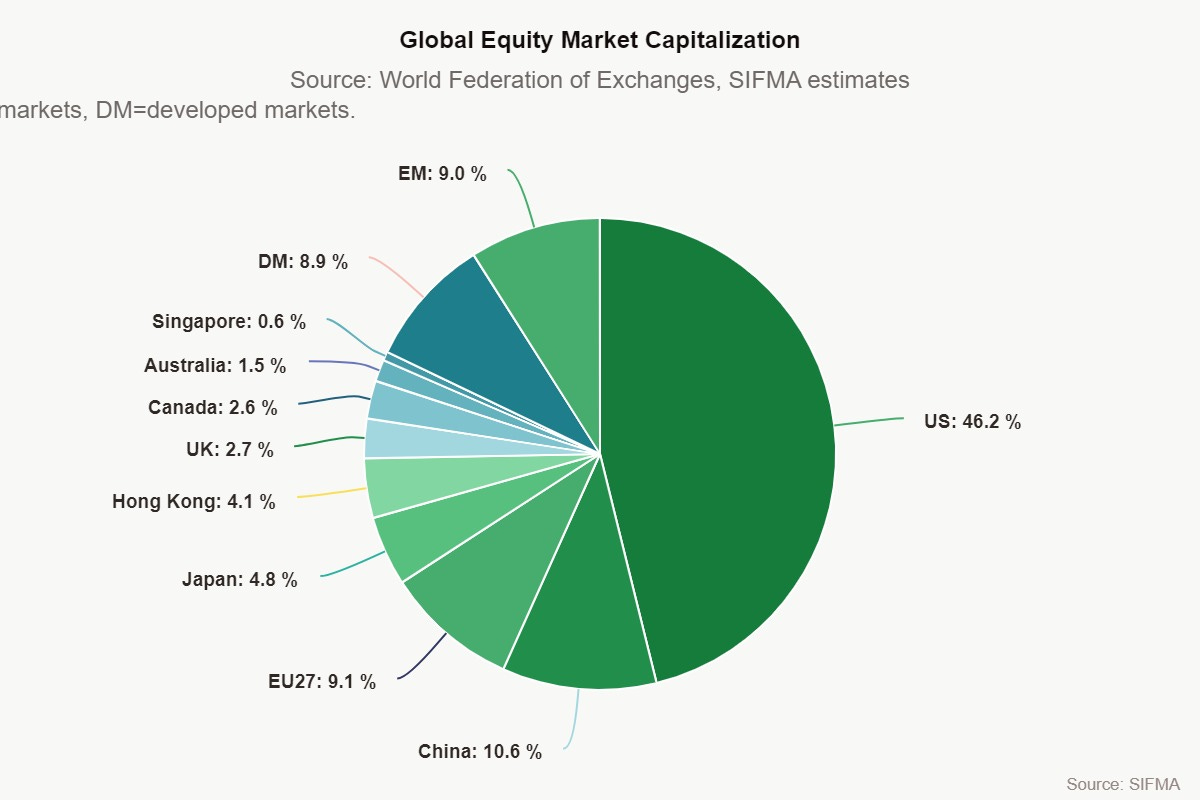

* Securities trade in the public markets (NYSE, NASDAQ)

* Business and financial information disclosed to the public on a regular basis

* Ways to invest in publicly traded companies

* Stocks = Equity = Owner = Wealth Creation

* Bonds = Debt = Creditor = Income Generation

* Derivatives (options & futures) — hedging, speculation and income generation

* Investing vs. Trading (own vs rent; local vs tourist)

* Many people own public companies directly in the form of individual stocks and/or participate indirectly via ETFs, mutual funds and 401k plans

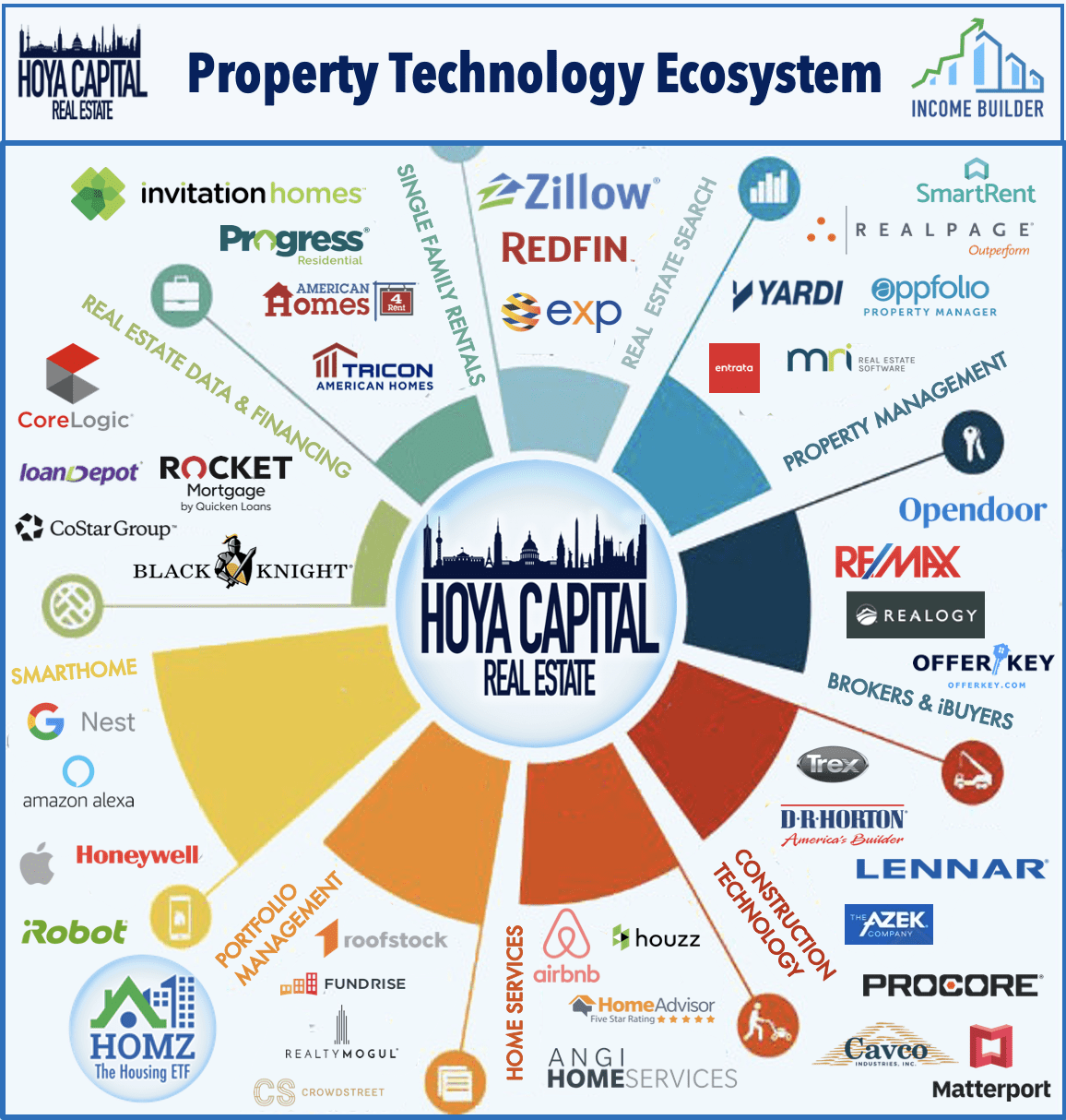

* Typically, larger than private companies

* Regional, national or international footprint

* Private companies tend to be local, especially in the residential RE space

* Continuous and real time “price discovery” while the markets are open

* Subtle but important point

* Makes them highly liquid

* Contrast this to direct ownership of real property

* Highly efficient vs highly inefficient pricing (objective vs subjective)

* This is the key difference between stocks and real property!

* Stock prices are a leading indicator of…

* Economic activity at the index level (DJIA, S&P 500, etc.)

* Industry trends at the industry level (banks, home builders, etc.)

* A company’s outlook at the stock-specific level

Atlanta Real Estate Report by ATLsherpa is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit atlantarealestate.substack.com