Despite sustained weakness of won against dollar, shifting landscape restrains panic

Update: 2025-10-22

Description

This article is by Kim Kyung-hee and read by an artificial voice.

The Korean won closed at 1,427.8 to the U.S. dollar on Tuesday, marking its 11th consecutive trading day above the 1,400 mark. The won weakened by 8.6 won from the previous session. It has remained above 1,400 since re-entering that territory on Sept. 30.

A currency as weak as the 1,400 won level often sets off alarm bells in Korean financial markets, recalling past crises like the 1997 Asian financial crisis and the 2008 global meltdown, when the country faced capital flight and currency volatility.

This 11-day streak is the third-longest stretch since the 2008 global financial crisis. In comparison, the won stayed above 1,400 for 31 sessions starting on Sept. 22, 2022, due to the U.S. Federal Reserve's aggressive rate hikes. It remained there for 101 sessions from Dec. 2, 2024, with its streak influenced heavily by the political turmoil surrounding the Dec. 3 martial law declaration.

Still, current conditions differ.

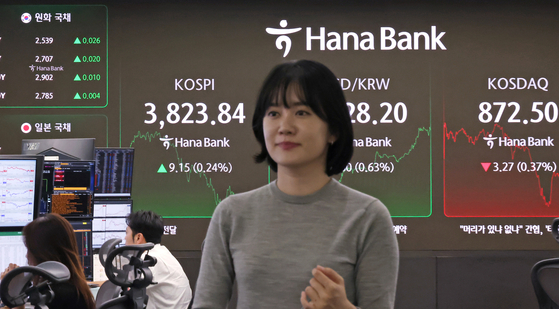

The Kospi is rallying, hitting record highs in recent sessions. Korea's trade balance is strong, and semiconductor exports are booming. The country is also on track for a record current account surplus this year.

Typically, a rising Kospi draws foreign capital into Korean assets, strengthening the won. But this time, the currency continues to slide. Analysts say the rules of the foreign exchange market may be changing.

Baek Seok-hyun, an economist at Shinhan Bank, pointed to growing demand for dollars from Korean retail investors buying overseas stocks and bonds.

"The increase in overseas equity and bond purchases by Korean investors - such as retail traders investing in U.S. markets - is pushing up demand for dollars and weakening the won."

He also cited a shift in how foreign investors hedge against currency risks when buying Korean equities.

Data from the Korea Securities Depository shows that from Sept. 18 - when the won touched an intraday low of 1,375.7 - to Oct. 20, Korean investors made $6.49 billion in net purchases of foreign stocks - about 40 percent more than the $4.65 billion in net purchases made by foreign investors in Korean stocks.

The current stock rally is led by chipmakers like Samsung Electronics and SK hynix, which are benefiting from the global artificial intelligence boom. However, uncertainty over U.S. tariffs still lingers.

"Even if strong earnings by domestic chipmakers bring more foreign currency into Korea, much of it must be used for U.S.-based investment rather than local reinvestment," Baek said.

A strong dollar also continues to weigh on the won, but despite the currency pressure, market sentiment remains calm. Korea's credit default swap premium, a measure of sovereign risk, stood at 24.15 basis points on Monday - stable compared to the 74.9 points seen in November 2022.

The government's response has also been subdued. On Oct. 13, authorities made a verbal intervention after the won neared 1,430 to the dollar - the first such move in 18 months.

In contrast, the Bank of Korea signed a $10 billion currency swap with the National Pension Service in 2022 and raised the limit to $65 billion in late 2024.

Analysts expect the won to stay near the 1,400 level in the near term, driven by Korean retail investors and growing outbound investments in the U.S. market.

"There's no need to burn through our reserves if the trend can't be reversed," a foreign exchange source said.

Still, a prolonged weakness of the won could push up import costs, especially for raw materials, and stoke domestic inflation.

Some experts say Korea should focus on increasing global demand for the won. Inclusion in the MSCI World Index, for example, would attract more foreign capital to Korean markets.

Kim Young-ik, an economics professor at Sogang University, predicted that "the won could strengthen to the 1,200 range in the second half of next year if tariff uncertainty eases and Korean investors who previously focused on foreign stocks return to ...

The Korean won closed at 1,427.8 to the U.S. dollar on Tuesday, marking its 11th consecutive trading day above the 1,400 mark. The won weakened by 8.6 won from the previous session. It has remained above 1,400 since re-entering that territory on Sept. 30.

A currency as weak as the 1,400 won level often sets off alarm bells in Korean financial markets, recalling past crises like the 1997 Asian financial crisis and the 2008 global meltdown, when the country faced capital flight and currency volatility.

This 11-day streak is the third-longest stretch since the 2008 global financial crisis. In comparison, the won stayed above 1,400 for 31 sessions starting on Sept. 22, 2022, due to the U.S. Federal Reserve's aggressive rate hikes. It remained there for 101 sessions from Dec. 2, 2024, with its streak influenced heavily by the political turmoil surrounding the Dec. 3 martial law declaration.

Still, current conditions differ.

The Kospi is rallying, hitting record highs in recent sessions. Korea's trade balance is strong, and semiconductor exports are booming. The country is also on track for a record current account surplus this year.

Typically, a rising Kospi draws foreign capital into Korean assets, strengthening the won. But this time, the currency continues to slide. Analysts say the rules of the foreign exchange market may be changing.

Baek Seok-hyun, an economist at Shinhan Bank, pointed to growing demand for dollars from Korean retail investors buying overseas stocks and bonds.

"The increase in overseas equity and bond purchases by Korean investors - such as retail traders investing in U.S. markets - is pushing up demand for dollars and weakening the won."

He also cited a shift in how foreign investors hedge against currency risks when buying Korean equities.

Data from the Korea Securities Depository shows that from Sept. 18 - when the won touched an intraday low of 1,375.7 - to Oct. 20, Korean investors made $6.49 billion in net purchases of foreign stocks - about 40 percent more than the $4.65 billion in net purchases made by foreign investors in Korean stocks.

The current stock rally is led by chipmakers like Samsung Electronics and SK hynix, which are benefiting from the global artificial intelligence boom. However, uncertainty over U.S. tariffs still lingers.

"Even if strong earnings by domestic chipmakers bring more foreign currency into Korea, much of it must be used for U.S.-based investment rather than local reinvestment," Baek said.

A strong dollar also continues to weigh on the won, but despite the currency pressure, market sentiment remains calm. Korea's credit default swap premium, a measure of sovereign risk, stood at 24.15 basis points on Monday - stable compared to the 74.9 points seen in November 2022.

The government's response has also been subdued. On Oct. 13, authorities made a verbal intervention after the won neared 1,430 to the dollar - the first such move in 18 months.

In contrast, the Bank of Korea signed a $10 billion currency swap with the National Pension Service in 2022 and raised the limit to $65 billion in late 2024.

Analysts expect the won to stay near the 1,400 level in the near term, driven by Korean retail investors and growing outbound investments in the U.S. market.

"There's no need to burn through our reserves if the trend can't be reversed," a foreign exchange source said.

Still, a prolonged weakness of the won could push up import costs, especially for raw materials, and stoke domestic inflation.

Some experts say Korea should focus on increasing global demand for the won. Inclusion in the MSCI World Index, for example, would attract more foreign capital to Korean markets.

Kim Young-ik, an economics professor at Sogang University, predicted that "the won could strengthen to the 1,200 range in the second half of next year if tariff uncertainty eases and Korean investors who previously focused on foreign stocks return to ...

Comments

In Channel