Ep. 81: Assessing the Effects of the 2017 Tax Cut and Jobs Act

Description

In 2017, then-President Trump signed into law the Tax Cut and Jobs Act, which was arguably the largest corporate tax cut in US history. The TCJA significantly lowered the statutory rate that corporations pay in taxes and reshaped numerous tax rules. Proponents said it would boost US competitiveness on the international stage and juice business investment. But its overall effects are still being debated among economists.

In a paper in the Journal of Economic Perspectives, authors Gabriel Chodorow-Reich, Owen Zidar, and Eric Zwick explored the current understanding of the TCJA, discussing its costs and benefits, as well as future policy implications. They argue that, contrary to what some proponents said, the tax cuts significantly reduced tax revenues.

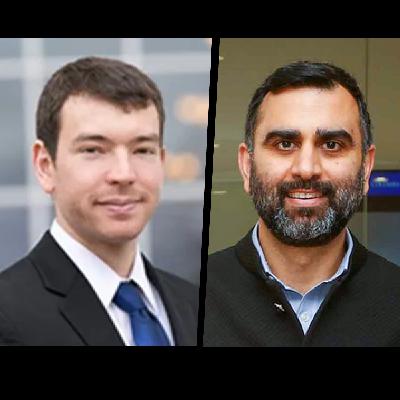

Zwick recently spoke with Tyler Smith about the legislation, who benefited the most from the bill, and whether provisions that are set to expire in the coming years should be retained.