Ep. 90: Understanding the US net foreign asset position

Description

For decades, the United States enjoyed what some called an exorbitant privilege—the ability to spend more than it earned without accumulating much debt to the rest of the world. But that privilege has ended.

In a paper in the American Economic Review, authors Andrew Atkeson, Jonathan Heathcote, and Fabrizio Perri found that the United States started accumulating significant liabilities to foreigners after the Great Recession.

The researchers say that a surge in the value of US corporations relative to companies in other countries is the driver of this development. Due to large international capital flows in recent decades, foreign investors now own about 40 percent of US corporate equity, while US investors also hold a large amount of foreign companies in their portfolio. When American companies become more profitable and their stock prices soar, much of the gains flow overseas, without a corresponding flow to US investors from foreign companies, and this erodes the net foreign asset position of the United States.

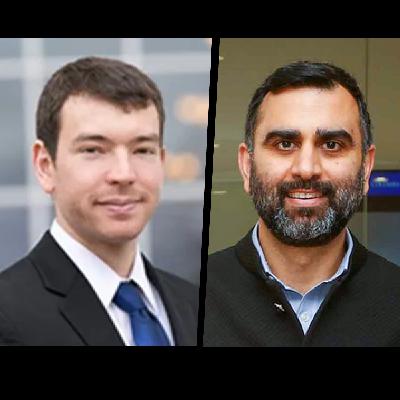

Atkeson recently spoke with Tyler Smith about how to interpret the US net foreign asset position and what its recent swings mean for American households.