Inclusive finance is necessary, but 'financial caste system' is an overreach

Update: 2025-11-17

Description

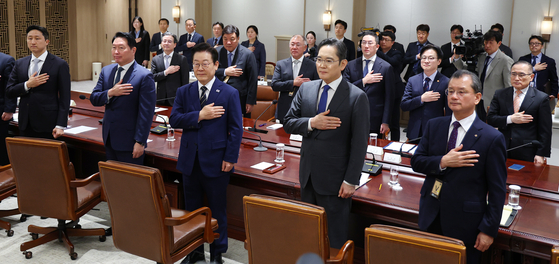

President Lee Jae Myung last week identified regulation, finance, the public sector, pensions, education and labor as six areas in urgent need of structural reform. His view that reforms must begin now, as signs of economic recovery start to emerge, is sound. Structural reform is painful, but it is also essential for raising Korea's potential growth rate and advancing the economy.

Still, concern has grown over the way he framed the need for financial reform. Lee questioned whether the current financial system has become a "financial caste system," where the poor are forced to pay high interest rates. The problem is that low income and low creditworthiness do not necessarily overlap.

Credit ratings are not determined by a person's income level. They reflect how consistently borrowers repay their loans. According to data compiled by Rep. Chun Ha-ram's office, 6.74 million people in the top 30 percent income bracket have high credit scores of 840 or above. But more striking is that 2.02 million people in the bottom 30 percent income bracket, earning less than 21 million won a year, also have high credit scores. Many low-income borrowers have maintained strong credit histories through steady repayment.

By contrast, among borrowers with low credit scores of 664 or below, high-income borrowers outnumber low-income borrowers by 430,000 to 340,000. The idea of a "financial caste system," where the poor are systematically victimized by predatory rates, does not match the data. Treating low-income and low-credit borrowers as a single group risks penalizing low-income borrowers who have managed their credit responsibly.

President Lee made similar remarks in September, saying that a 15.9 percent interest rate is "cruel" to ordinary citizens. But as he suggested then, raising interest rates on high-credit borrowers to lower rates for lower-credit borrowers would inevitably increase interest burdens for low-income but high-credit borrowers. A well-intentioned plan to help the vulnerable could end up harming them.

Recent months have also seen a "rate reversal" in the banking sector, where high-credit borrowers pay more than low-credit borrowers. Banks have adjusted rates on policy lending products, concentrating benefits on borrowers with credit scores below 600. Inclusive finance plays an important role in easing income inequality and expanding opportunities for financially vulnerable citizens. Policy lending that reduces interest burdens for low-income borrowers has value.

But the government must seek balance and minimize distortions in market interest rates. When political logic defines financial policy too heavily, Korea's carefully built credit system risks being undermined.

The administration should also ensure that low-income borrowers who have repaid their debts faithfully receive appropriate support under inclusive finance programs. Financial inclusion is necessary, but policy must be calibrated, not framed through sweeping metaphors that obscure how credit markets actually work.

This article was originally written in Korean and translated by a bilingual reporter with the help of generative AI tools. It was then edited by a native English-speaking editor. All AI-assisted translations are reviewed and refined by our newsroom.

Comments

In Channel

![[WHY] Good luck? Good energy? Or just a good time? All about Korea's lottery hot spots. [WHY] Good luck? Good energy? Or just a good time? All about Korea's lottery hot spots.](https://s3.castbox.fm/2b/d3/77/20af79ea99110b2a84c8f9e7eb415074ae_scaled_v1_400.jpg)

![[WHY] Good luck? Good energy? Or just a good time? All about Korea's lottery hot spots. [WHY] Good luck? Good energy? Or just a good time? All about Korea's lottery hot spots.](https://s3.castbox.fm/08/e0/9b/7c604594b1f527acf0345208b7aac32050_scaled_v1_400.jpg)