Will targeting retail investors slow the won’s slide?

Update: 2025-11-16

Description

The author is an editorial writer at the JoongAng Ilbo.

"Foreign investors are selling Korean stocks and bonds and taking the money home, and we are even giving them a favorable exchange rate on the way out."

This was one of the comments posted beneath news articles on Friday, when foreign exchange authorities signaled a forceful intervention to halt a sharp climb in the won-dollar rate. The won, which had weakened toward 1,475 per dollar in intraday trading, bounced back into the 1,450 won range after verbal intervention, finishing the day at 1,457. In the course of one day, the government pushed the won's value up by roughly 20 won.

For anyone preparing to exchange won for dollars, it was a lucky break. By putting a floor under the won's fall, authorities effectively created an advantageous exit point for foreign investors. In fact, foreign investors net-sold 2.68 trillion won ($1.84 billion) worth of Korean shares that day alone. The intervention may have been aimed at reducing uncertainty in the currency market, but for many, it seemed the move came too late, benefiting foreigners more than stabilizing the market.

The market's view that intervention is lagging stems from a widespread sense that the "felt" exchange rate already exceeds 1,500 won per dollar. The dollar index, which measures the value of the U.S. dollar against six major currencies, stood at 99.3 on Nov. 14. A reading below 100 signals a relatively weak dollar. Since falling below 100 in May, the index has struggled to recover.

Ordinarily, a weaker dollar should mean a stronger won. Yet the opposite is unfolding. As the won approaches 1,500 per dollar, its value relative to the U.S. currency is falling rapidly. Given the dollar index's decline, many investors believe the effective depreciation of the won is even steeper. Analysts now say the real economic impact feels more like the won has moved well beyond 1,500.

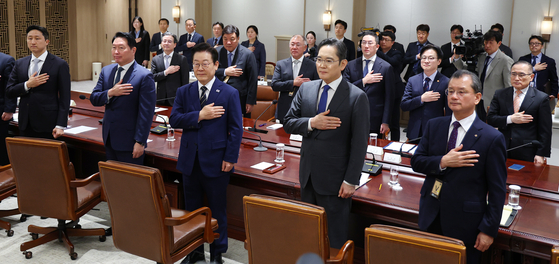

There was a time when 1,400 won per dollar was viewed as the first critical threshold. Before last year's martial law crisis, the won had crossed 1,400 only three times: during the Asian financial crisis, the global financial crisis and in 2022 when the Legoland incident ignited credit market turmoil. When the intraday rate breached 1,400 last April, President Lee Jae Myung, then the opposition leader, warned that the national economy was facing a serious crisis.

A steep exchange-rate spike can trigger alarm over the country's economic fundamentals. The question "Is the Korean economy truly sound?" grows louder. Yet the data seem contradictory. The current account, the main buffer for the won, shows no warning signs. From January to September, Korea posted a record current account surplus of $82.77 billion. Yet the exchange rate keeps rising. The most visible driver is the rapid pullback of foreign capital. In the first 14 days of November, foreign investors net sold 8.9 trillion won ($6.11 billion) of Korean stocks and 2.54 trillion won ($1.74 billion) of 10-year Treasury futures.

Authorities, however, are focusing on individual Korean investors who buy U.S. stocks. Bank of Korea Gov. Rhee Chang-yong said in a recent interview that recent exchange-rate movements have been driven more by domestic investors' overseas purchases than by foreign flows. The buying spree of U.S. equities by "seohak ants" - retail investors trading abroad - has created large dollar demand. According to the Korea Securities Depository, domestic investors bought a net $3.63 billion of U.S. stocks from Nov. 3 to Friday. In September, their net purchases reached $6.85 billion.

To offset the imbalance, authorities are turning to the National Pension Service and major exporters. They aim to use the pension fund's "strategic hedging" and encourage exporters to convert their dollar holdings into won to prevent expectations of prolonged won weakness from hardening.

Yet market expectations of a weaker won are unlikely to fade soon. A long period of accommodative monetary condi...

Comments

In Channel

![[WHY] Good luck? Good energy? Or just a good time? All about Korea's lottery hot spots. [WHY] Good luck? Good energy? Or just a good time? All about Korea's lottery hot spots.](https://s3.castbox.fm/2b/d3/77/20af79ea99110b2a84c8f9e7eb415074ae_scaled_v1_400.jpg)

![[WHY] Good luck? Good energy? Or just a good time? All about Korea's lottery hot spots. [WHY] Good luck? Good energy? Or just a good time? All about Korea's lottery hot spots.](https://s3.castbox.fm/08/e0/9b/7c604594b1f527acf0345208b7aac32050_scaled_v1_400.jpg)