Nvidia, AI and the Big Picture

Description

There are currently many moving parts to the tech industry, and as tech becomes more and more pervasive in society, it is getting roped into discussions and being judged by standards that never applied in the past. Debates are ranging from whether or not big tech has built unmatched and unrivalled monopolies, whether those monopolies are legal or not, to whether big tech is going to be responsible for the downfall of democracy and ultimately the next world war. I can’t give you a credible answer, but I can say that it is mentally draining to follow the tech industry. Not because there’s nothing to read and write about, precisely the opposite. The fire-hose of news in this industry has relentlessly increased, driving an information flow-rate that is impossible to manage.

Too much choice is ultimately a bad thing.

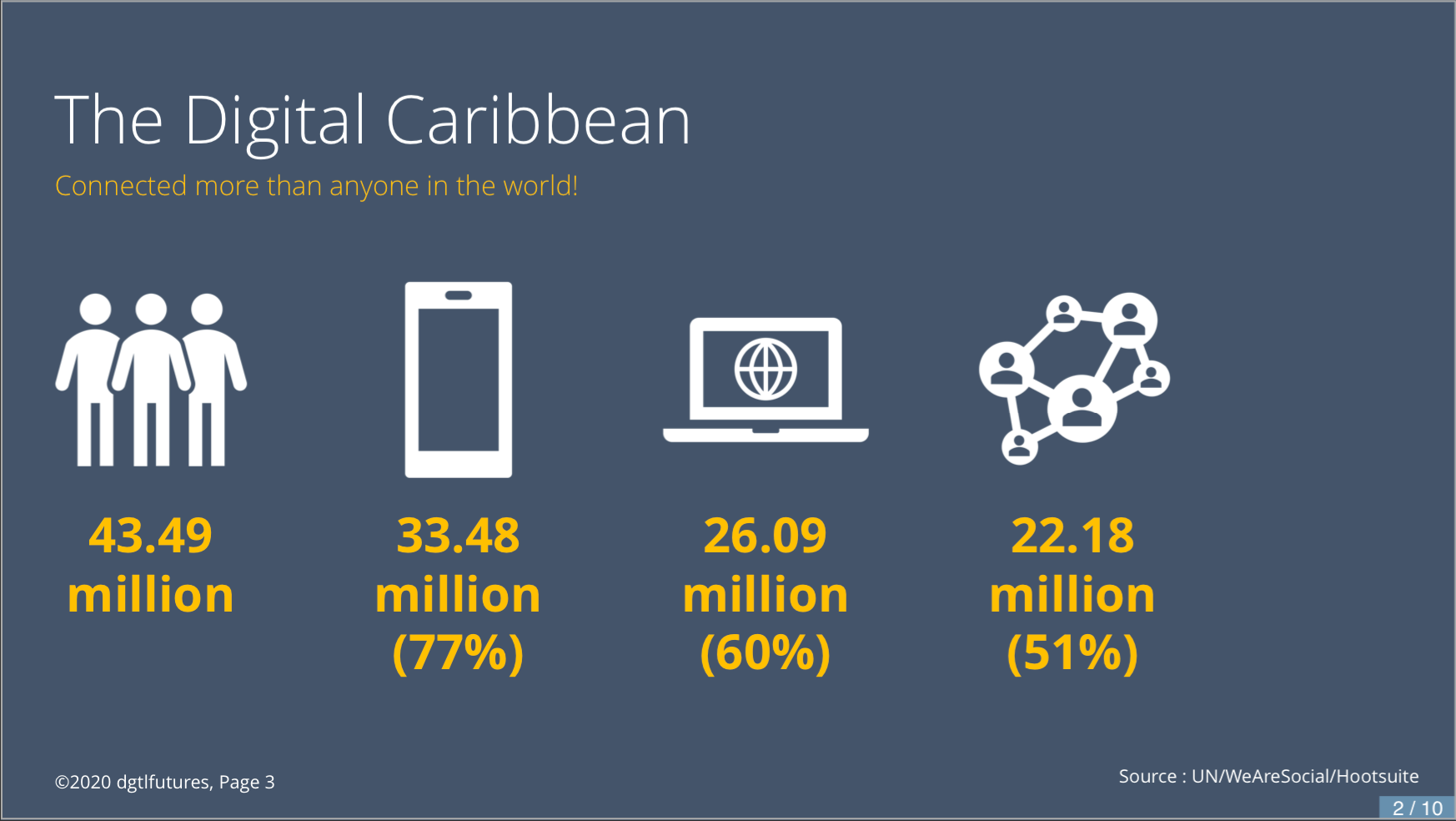

I’m currently researching the ICT industry in the Eastern Caribbean, and the same data points appear continually. Small businesses are trying to survive by offering the same services competing with the same compatriots on the same value propositions. It is not only a zero-sum game, but it is also so misaligned to what is possible if we consider internet assumptions.

I’ll write more about this topic in the future as I clarify my thoughts and the research reveals further insights.

I thought I’d write a follow-up on the last newsletter, as pretty-much right after I’d recorded and published news broke about the sale of the subject of that issue, ARM. Read on for my thoughts on this.

ARM’s History

When I wrote about the disruption of a part of Intel’s processors’ design and build process, in the issues: The Tale of Intel’s Disruption and Blockchain is Useless and Intel’s Pohoiki Beach and Disruption Theory, and I delved further into Disruption Theory, in Disruption Theory. Is Wizzee a Disruptor? I was trying to give you an overview of Disruption Theory and how it may apply to your own business. I recommend you read those articles for a better context of this essay.

Getting back to that news. I was aware of the potential sale of one of the most important actors in that field, ARM Holdings. What I didn’t expect was such a quick sale and a sale to a company that logic would reason is not best suited to the type of business it was buying.

Let’s back up here just a little and recap on the timeline and where I think this is going.

ARM Limited, as it is now known, was initially incorporated in 1990 under the name Advanced RISC Machines. Funnily enough, even that wasn’t its original name. It was born as Acorn RISC Machine, from the Acorn Archimedes computer that was powered by the new microprocessor design. The change was apparently at the request of Apple that objected to the name of a competitor in the name of one of the processors it was responsible for jointly designing and using in that ill-fated (but arguably necessary step) of the Apple Newton. Advanced RISC Machines became ARM Holdings for the Initial Public Offering (IPO) that took place in 1998.

In 2016, Softbank, a Japanese Telecoms company with an appetite for Venture Capital, purchased ARM for an amount of approximately 32 billion USD. That transaction guaranteed the operations to continue as they were. That is a UK headquarters and offices in Silicon Valley and Tokyo. It allowed ARM to be close to the world’s disrupters and designers (Silicon Valley) and the world’s builders (Taiwan and China). ARM capitalised on this, and the catalogue of products that currently use ARM chips designs is un-fathomable. Just about every device that requires a processor of some kind, that isn’t a computer, contains an ARM chip. And that’s before we even talk about the just-starting revolution of the Internet of Things, or IoT.

Image: nvidia

ARM has just sold to Nvidia for an announced price of 40 billion USD, an 8 billion USD premium over its purchase price, or a 25% profit over four years. SoftBank will retain a 10% stake in ARM too. This money will go some way to stopping the haemorrhage it recently suffered when it indicated that it might lose up to 80 billion USD from failed investments—WeWork (cough, cough).

As a recap, ARM makes no processors itself. And in some cases, it doesn’t even design the subsequent generations of some of its processor designs. ARM licenses its intellectual property, or IP, to anyone, following a long tradition of British tech design houses that have sprung up of the last couple of decades, like Imagine Technologies and ARC International. Depending on the license terms, companies are more or less free to use the designs as they see fit. ARM presents itself as the Switzerland of processor designs i.e., neutral. ARM reports that its designs are in around 180 billion processors in use to date.

Qualcomm uses them for their processors that run a majority of Android phones, and most famously Apple has a lifetime license (from the days it was one of the original designers) and uses its asset to design and implement the most advanced mobile processors on the planet currently. But even Apple doesn’t build those processors; it farms that work out to the specialist I mentioned in the last newsletter, Taiwan Semiconductor Manufacturing Corporation, TSMC. You can’t get a more explicit name that reflects the companies’ primary purpose than that! Which leads me to where I think this is going.

ARM-ing the Future

The big question is why a graphics card builder like Nvidia would splash for a chip designer?

Part of the answer lies in the fact that Nvidia, itself, is a licensee of ARM, and presumably that annual fixed cost will be removed from the books being that it is now the owner of the company it used to buy a licence from. It’s an upfront investment that pays off over several years, and if the value accumulation of ARM continues, the investment might be justified relatively quickly (from an accounting point of view).

But I think it goes beyond that. I hinted earlier that ARM processors are just about everywhere and are integrated into more and more devices in the form of SMART tech. The fridge, the toaster, the Espresso machine are all candidates for a coming home-smarts revolution. And the already processor-enabled world of home appliances like washing machines will be enhanced by the technological possibilities available to their builders.

The TAM, or Total Addressable Market, for their IP is almost infinite. The ubiquity of wifi and the incoming 5G avalanche only goes to reinforce the inclusion of ARM-type processors in devices: even the comms technology itself, the routers, switches and amplifiers, use ARM processor designs. ARM is set to become the de facto processors of things that are not traditional PCs.

Besides Apple, Microsoft is using more and more of the technology in its designs. The new Surface Duo is an ARM-based foldable phone/tablet hybrid with impressive screen technology, all running on a customised ARM design. The Surface X Pro is a new generation of the popular Microsoft Surface PC line, and is also ARM-based, running a customised ARM compiled version of Windows.

Beyond Computers

But again, it goes beyond this, to what will inevitably be as pervasive a technology as oil-powered personal transport has become. I’m talking about AI or Artificial Intelligence.

From simple statistical models to more advanced nuanced-based algorithms like GPT3, AI is set to be included in everything from your everyday carry phone to the entertainment system of the future. Think Bladerunner 2049. Where does Nvidia step in then?

From the Nvidia Deep Learning AI website:

I AM A VISIONARY, A HEALER, A CREATOR, AND SO MUCH MORE. i am ai.

POWERING CHANGE WITH AI AND DEEP LEARNING

AI doesn’t stand still. It’s a living, changing entity that powers change throughout every industry across the globe. As it evolves, so do we all. From the visionaries, healers, and navigators to the creators, protectors, and teachers. It’s what drives us today. And what comes next.

Many Data Scientists and technology teams around the world realised that they needed powerful processors to perform a highly reduced and specific set of calculations, for which only specialised and extremely expensive super-computers could perform. Super-computer makers like Cray and IBM sold their systems to large research institutes and universities with high profit-margins on the back of their uniqueness in their ability to calculate rapidly and massively parallel, an important factor when designing calculations of that type.

On the other end of the computing spectrum, users wanted to get better quality graphics for video-gaming and image manipulation. Nvidia started to design and build and sell specialised video cards to OEMs (Original Equipment Manufacturers) like DELL, for integration on their motherboards for a win-win situation. Better graphics meant that computers became more desirable as games or design machines. These designs evolved over the years and are sold as separate cards for builders to include in their offerings.

In a quirk of circumstance, the type of processing required to produce detailed and fluid graphics for games was also ideal for the type of calculations required for AI. At a fraction of the cost, scientists and researchers could equip banal PCs with a bank of processors that could compete with the multi-million $ super-computers. As you’ve guessed by now, these cards are powered by ARM processors