Record Leverage, Record Calls, Zero Fear — Volatility Could Explode At Any Moment

Description

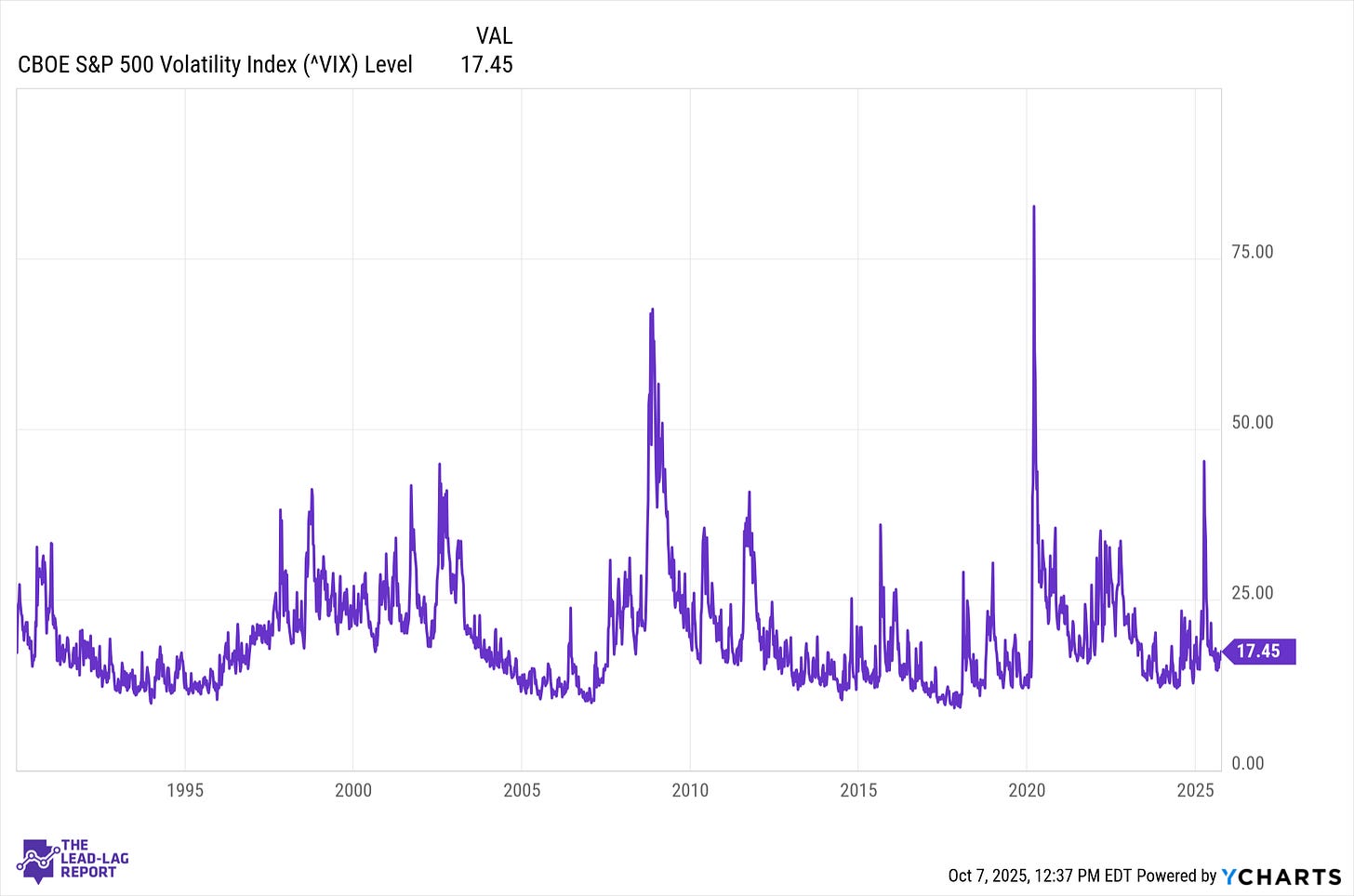

The CBOE Volatility Index (VIX) has stayed relatively tranquil in the mid-teens over the past month, dipping below 14-15 in mid-September and just settling around 16 as October started.¹ This sort of quiet is staggeringly complacent. Yet less volatility leads investors to take on more leverage and risk. This is exact type of condition under which accidents occur.

In the past, periods of reduced volatility have often taken place right before violent spikes. Investors take it for granted that stability is eternal, but one shock — geopolitical, macroeconomic or credit-related — can spark an increasingly big move. All it takes is a spark.

It’s Call Option Mania: A Warning Sign for the Stock Market

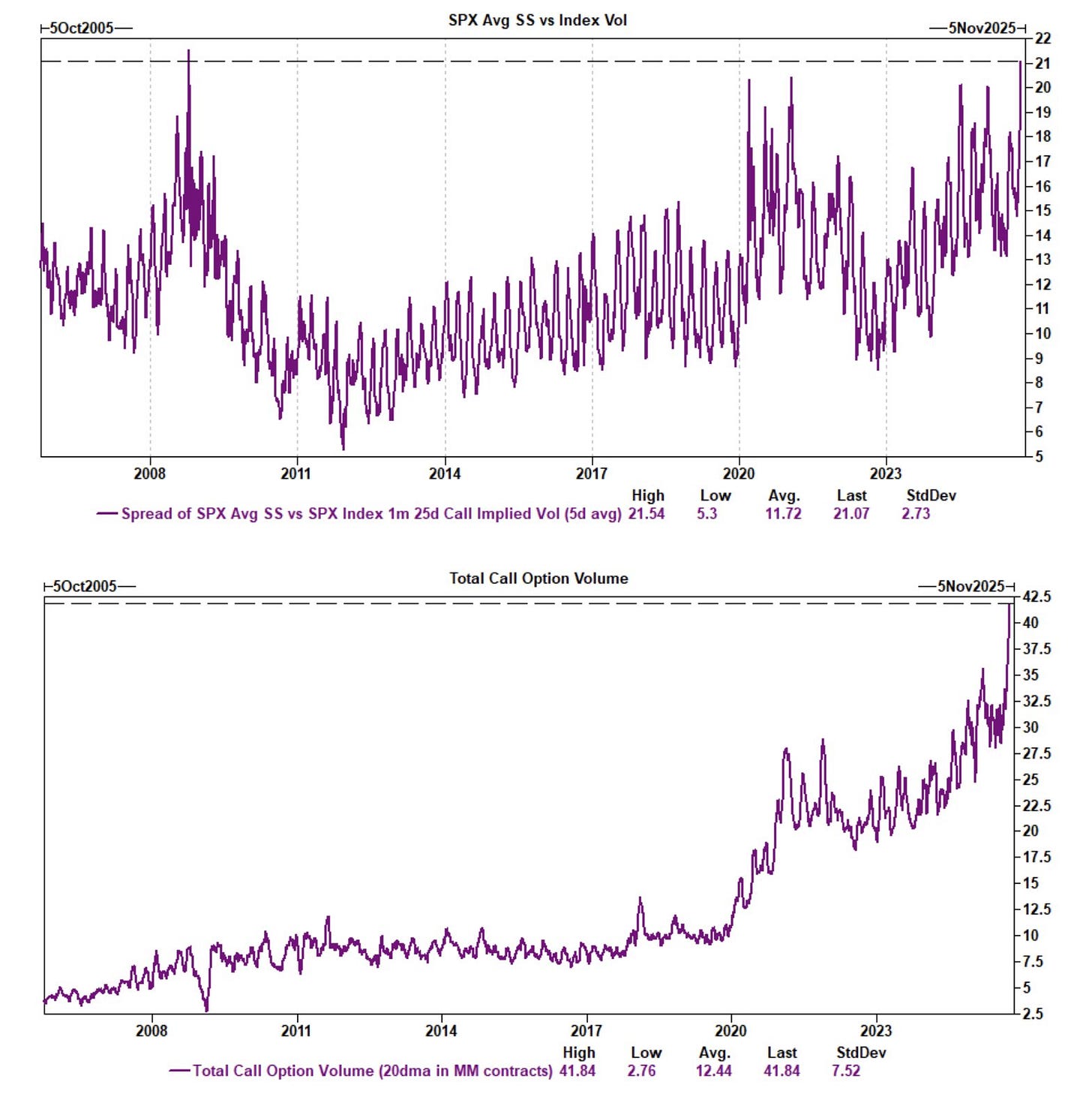

The signs of excess are now evident: record call-option activity. U.S. call option volumes have recently jumped to record levels in the past four weeks. ² This isn’t optimism — it’s speculation. When call volume spikes, dealers typically hedge their bets by buying stocks, a move that artificially extends upside momentum. When that changes, the feedback loop goes into reverse, magnifying declines.

We’ve seen this movie before — the dot-com blowoff of 1999 also involved surging call activity. Too much buying of calls is a contrarian indicator because it shows not simple confidence, but overconfidence. And the kind of speculative options exposure we see now leaves the market structurally fragile. When volatility returns, those positions can unravel in a matter of hours.

October’s Seasonal Trap

October has so often been the most volatile month for stocks. The S&P 500 has seen more than its average of 1 percent daily swings in October every month since 1950.³ There was the month of the panic of 1907, the crash in 1929 and Black Monday 1987. In tranquil cycles like this, October almost invariably provides at least one volatility spike as institutions rebalance into the end of year.

The VIX has increased an average 4 percent in October each year since 1990.⁴ This year, that is being compounded by an especially serene summer — markets mostly shrugged off soft data and geopolitical risks through September. When calm lasts this long, it rarely ends in a whisper.

Leverage Builds the Bomb

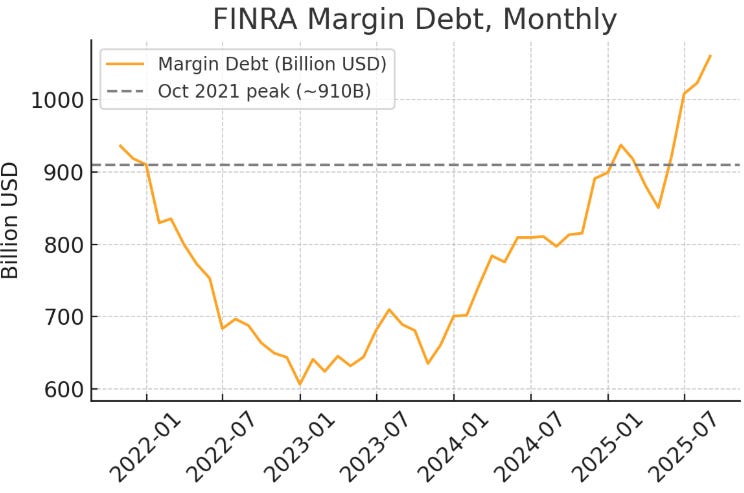

As for options, margin debt — money borrowed to buy stocks — has recently risen to about $1 trillion, close to its peak. ⁵ Leverage doesn’t cause crashes, but makes them worse. As prices decline, margin calls lead to forced selling that amplifies the slide.

The risk this time around is that leverage and complacency are feeding off each other. When a trader’s exposure is high they must borrow it and the closing of low-return trades that exist primarily if not solely to fulfill leverage requirements increases demand for borrowing. Retail margin balances have spiked, hedge-fund leverage is near a decade high, and derivative exposure has never been greater. To be sure, similar setups like this occurred prior to the 2007 credit unwind and drawdown in tech stocks earlier this year. When repricing takes place, leverage turns a correction into contagion.

Small-caps Are Signaling Trouble Underneath the Surface

The Russell 2000 — a barometer of small-cap performance — has quietly taken a turn for the worse. Following a decent third quarter that for a time was better than large-caps, small stocks rolled over again in early October.⁶ That reversal is meaningful. Small-caps are higher-beta, more sensitive to credit spreads and liquidity moves; when they lag large-caps even as the latter continue to edge higher, it is a sign of shrinking breadth and fading confidence.