The Forgotten Sector Set for a Comeback: 4 Mid-Cap Materials Stocks Ready to Break Out

Description

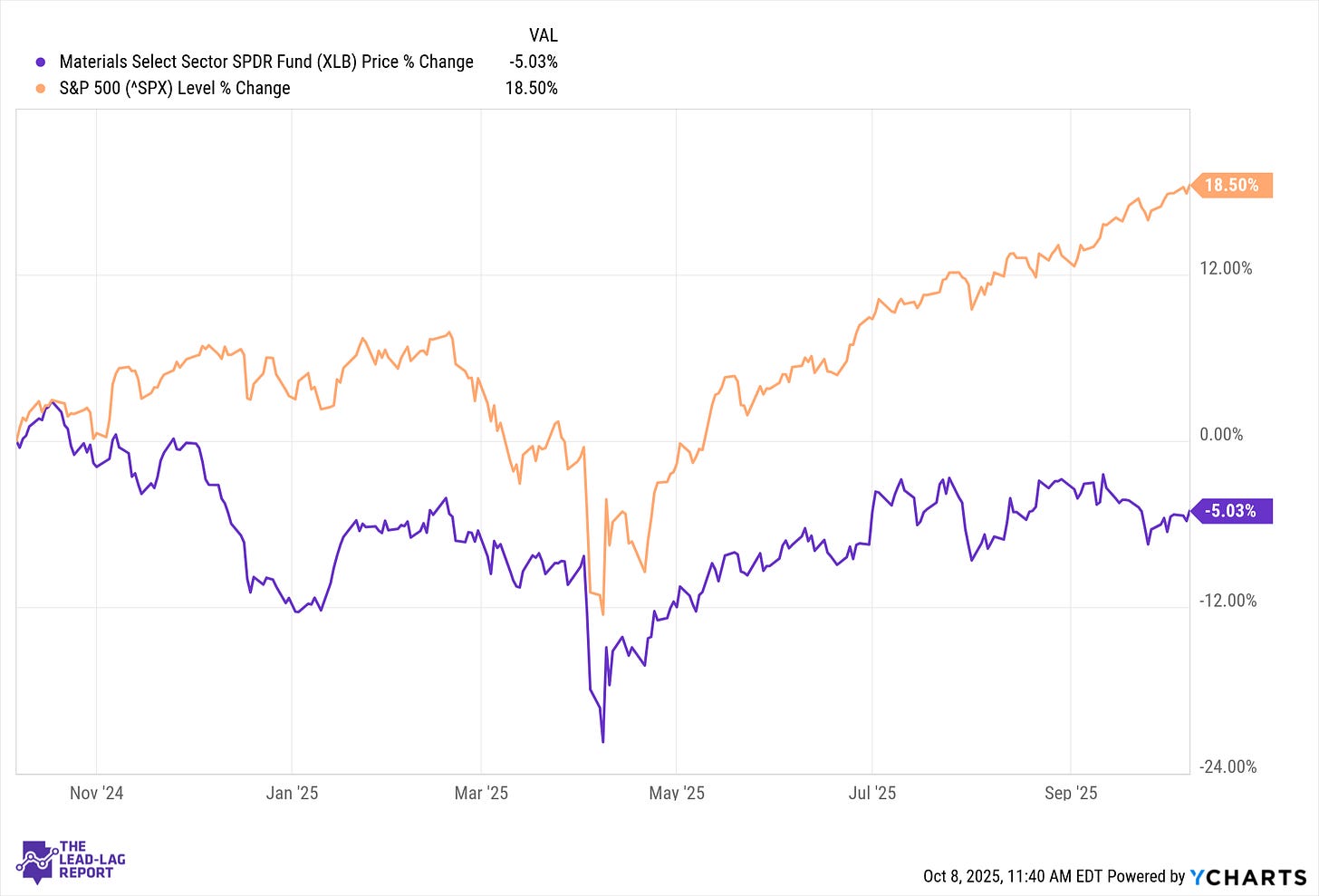

Over the past 12 months, the Materials sector has trailed the broader U.S. equity market. In 2024, it was the worst-performing S&P 500 sector, while the S&P 500 itself rose more than 20 percent.[1] High interest rates, weak Chinese industrial demand, and uncertainty around global manufacturing weighed on commodities from copper to steel. Yet, as 2025 continues to unfold, the case for a strong sectoral rebound is compelling.

The second half saw renewed optimism as investors anticipated the Federal Reserve’s pivot to rate cuts. The People’s Bank of China also injected liquidity and introduced new fiscal stimulus, including a 520 billion yuan tax package to revive domestic consumption—especially electric vehicles (EVs).[2] Historically, the Materials sector tends to rebound strongly after weak periods. Notably, it has not posted consecutive down years since 1990, and after a negative year, its subsequent 12-month returns have averaged more than 20 percent.[3]

Why Materials Look Poised to Win

Several forces now align in favor of Materials. First, monetary easing is broadening. Lower rates reduce capital costs for manufacturers and construction firms, both major users of metals and industrial inputs. Second, China’s growth cycle is bottoming. As the world’s largest consumer of steel, cement, and rare earths, even modest Chinese stimulus can tighten global markets.

Third, long-term secular trends are accelerating demand. AI and robotics infrastructure, along with the green-energy transition, are metal-intensive. Each new data center, EV, or wind turbine requires massive amounts of copper, aluminum, and specialty alloys. Some analysts estimate that U.S. AI data-center expansion alone could demand an additional one million tons of cement in coming years.[4]

Finally, policy tailwinds are materializing. The Trump administration has prioritized deregulation and domestic resource development, issuing executive directives in early 2025 to “facilitate mineral production to the maximum possible extent.”[5] Combined with the ongoing $1.2 trillion infrastructure law, Washington’s stance is increasingly supportive of U.S. Materials producers.

Four Mid-Cap Materials Stocks to Consider

1. Cleveland-Cliffs (C F) — Steel Benefiting from Onshoring and Infrastructure

Cleveland-Cliffs is the largest flat-rolled steel producer in North America, supplying automakers, construction firms, and heavy industry. With a market capitalization near $6 billion, the company’s shares have been roughly flat over 12 months but could soon gain momentum.

Management cites strong tailwinds from onshoring and renewed trade protection, themes echoed by the Trump administration.[6] The ongoing rollout of infrastructure spending—from bridges to energy grids—should lift steel demand. While auto-sector softness led Cliffs to idle one blast furnace in 2024, the company expects normal volumes to return in 2025 as auto production rebounds.[7] With tight supply, vertical integration, and political support for domestic manufacturing, Cliffs appears well-positioned for cyclical recovery.