Time to Pump the Brakes on Artificial Intelligence Finance?

Description

Artificial Intelligence dealmaking has surged in 2025 and looks to keep right on going in 2026 on the way to the stupidity where all booms eventually end up.

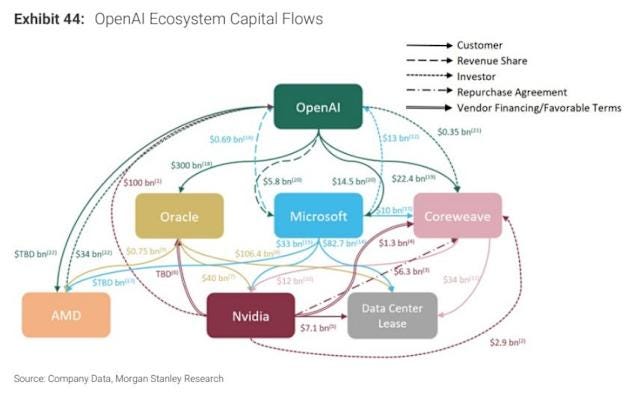

Deals among the major players have reached around $1 trillion. Nearly every week, tech giants like Oracle, Meta, Amazon, Microsoft, Google and Nvidia announce multi-billion dollar circular investment deals with AI, large language models, or “chatbot” creators such as OpenAI, Anthropic, and xAI, along with data center providers like Coreweave and several smaller firms. These are circular investments where the tech giants pour billions into AI chatbot companies, which rely on massive data centers and purchase or lease millions of graphic processing units (GPUs), the chips used for AI computing.

Amazingly, the deals closed in 2025 may be just the tip of the iceberg. A recent study by McKinsey & Co. concluded that data centers will require $6.7 trillion worldwide to keep pace with demand for computing power.

What could go wrong?

Concerns for hyperscaler stock investors

Hyperscalers provide large cloud-based computing services, the largest being Microsoft, Oracle, Meta, Amazon and Google. Institutional investors, including pension funds and insurance company portfolios, own large amounts of hyperscaler stocks. The tremendous and historic capital expenditures (“CapEx”) by hyperscalers could significantly weaken the financial position of companies that make up 26.1% of the S&P 500 as of November 26th. The spend now and expect revenues to catch up in 3 to 5 years plan is a perilous and perhaps fanciful proposition. Revenue is dependent on the success of the leading chatbot developers, the biggest being OpenAI. Fortune Magazine recently reported that investment bank HSBC doesn’t expect OpenAI to deliver profits that soon

HSBC Global Investment Research projects that OpenAI still won’t be profitable by 2030, even though its consumer base will grow by that point to comprise some 44% of the world’s adult population (up from 10% in 2025). Beyond that, it will need at least another $207 billion of compute to keep up with its growth plans. This stark assessment reflects soaring infrastructure costs, heightened competition, and an AI market that is surging in demand and cash-intensive to a degree beyond any technology trend in history.

Additionally, the AI ecosystem of hyperscalers, chatbot creators and AI chip makers is incredibly integrated.

This inter-connectivity could lead to a systemic meltdown as the problem of one major player could become a problem for all the players. Normally, I might say let the buyer beware, but considering the concentration of risk in companies that make up more than a quarter of the S&P 500’s market capitalization, anyone who owns stocks and mutual funds —including retirement accounts and insurance company portfolios — could lose substantially.

Private credit, including insurance and pension assets, will fund a good portion of these risky investments

Hyperscalers and other AI players will have to borrow billions each to fund all the necessary AI infrastructure. A recent article from the F.T. noted that hyperscalers are burning through cash, with Oracle leading the way down.

Of the five hyperscalers — which include Amazon, Google, Microsoft and Meta — Oracle is the only one with negative free cash flow. Its debt-to-equity ratio has surged to 500 per cent, far higher than Amazon’s 50 per cent and Microsoft’s 30 per cent, according to JPMorgan. While all five companies have seen their cash-to-assets ratios decline significantly in recent years amid a boom in spending, Oracle’s is by far the lowest, JPMorgan found.

In the old days of a few years ago, these hyperscalers — which Bloomberg reports have a combined $324 billion in outstanding corporate bond debt — would do a combination of investing their cash and borrowing in the corporate bond market. That’s no longer a complete option for this amount of funding, not even close. To achieve the level of spending the hyperscalers need, if they tried to raise all the funds in the public bond market, they would probably all be downgraded to junk by the ratings agencies, not to mention increasing interest rates for all of us (like mortgage rates).

To the delight of Wall Street, much of the needed funding will come from “Off Balance Sheet” sources, a lot of which come from private credit. As we have already reported, private equity firms have been snapping up life insurance companies and annuity providers, and funneling these companies’ assets into their private credit deals.

A good example is the recent Meta “Beignet” deal. Meta is constructing a massive data center in Louisiana in a deal that