U.S. Industries With the Most Fines, Ranked

Description

U.S. Industry Fines, Ranked: Finance & Healthcare Lead

See visuals like this from many other data creators on our Voronoi app. Download it for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Key Takeaways

- Two storylines explain the leaders in industries with the most fines between 2020–2024: crypto and opioids.

- Crypto fines (in FTX and Binance) explain much of financial services penalties.

- Meanwhile, opioid cases span drugmakers, distributors, and retail pharmacies, together explaining why the healthcare sector is first by number of fines and second by dollars paid.

For several industries, fines are just the cost of doing business.

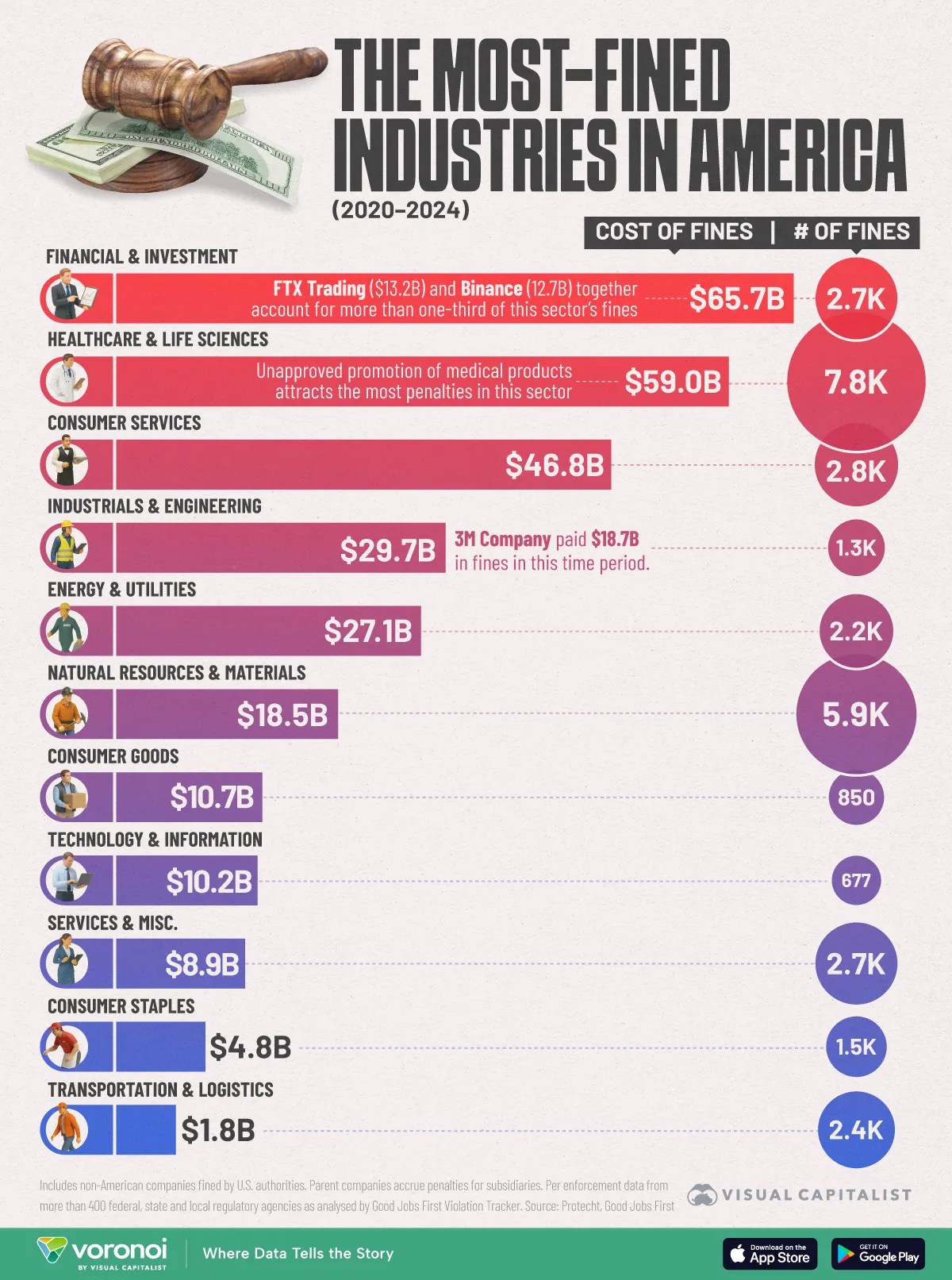

This visualization tallies nearly 31,000 federal and state penalties between 2020–2024, mapping the scale and frequency of fines across 11 broad industries.

Data for this visualization comes from Protecht Group who accessed violation database maintained by Good Jobs First.

This data includes non-American companies fined by U.S. authorities.

This data includes non-American companies fined by U.S. authorities.Financial Services Lead U.S. Industries With the Largest Fines

The recent crypto implosions mean financial firms top the list with $65.7 billion in penalties between 2020–2024.

Settlements against Binance and the FTX bankruptcy estate alone add more than $26 billion to the industry’s total.

| Rank | Sector | Total Sum of Fines | Readable Label |

|---|---|---|---|

| 1 | Financial & Investment | $65,689,387,767 | $65.7B |

| 2 | Healthcare & Life Sciences | $58,979,301,448 | $59.0B |

| 3 | Consumer Services | $46,817,060,529 | $46.8B |

| 4 | Industrials & Engineering | $29,674,387,012 | $29.7B |

| 5 | Energy & Utilities | $27,123,835,119 | $27.1B |

| 6 | Natural Resources & Materials | $18,549,207,161 | $18.5B |

| 7 | Consumer Goods | $10,695,009,070 | $10.7B |

| 8 | Technology & Information | $10,215,907,587 | $10.2B |

| 9 | Services & Misc. | $8,910,383,117 | $8.9B |

| 10 | Consumer Staples | $4,818,850,728 | $4.8B |

| 11 | Transportation & Logistics | $1,756,588,983 | $1.8B |

| N/A | Total | $283,229,918,521 | $283.2B |

Even traditional banks continue to pay for past sins.

JPMorgan, Wells Fargo, and Bank of America have each written multi-billion-dollar checks for misconduct ranging from commodities trading fraud to sanctions violations.

Related: Take a look at the companies that attracted the most fines in this same time period.

Related: Take a look at the companies that attracted the most fines in this same time period.Healthcare Leads U.S. Industries With the Most Fines

Healthcare and life-science companies account for a staggering 7,815 separate fines—one-quarter of all cases tracked.

| Rank | Sector | Total No. of Fines |

|---|---|---|

| 1 | Healthcare & Life Sciences | 7,815 |

| 2 | Natural Resources & Materials | 5,885 |

| 3 | Consumer Services | 2,835 |

| 4 | Services & Misc. | 2,748 |

| 5 | Financial & Investment | 2,735 |

| 6 | Transportation & Logistics | 2,413 |

| 7 | Energy & Utilities | 2,217 |

| 8 | Consumer Staples | 1,502 |

| 9 | Industrials & Engineering | 1,317 |

| 10 | Consumer Goods | 850 |

| 11 | Technology & Information | 677 |

| N/A | Total | 30,994 |

Opioid litigation drives the bulk of the nearly $59 billion paid, but enforcement extends well beyond pharma giants.

Drug distributors, retail pharmacies, and even device makers have been pulled into nationwide settlements.

Related: We break down America’s opioid crisis, tracking the three separate waves since the 90s.

Related: We break down America’s opioid crisis, tracking the three separate waves since the 90s.Consumer Services and Industrials Round Out the Top Five

Consumer-facing industries like telecoms, airlines, and hospitality rank third by dollars and violations.

Service breakdowns, data breaches, and deceptive marketing frequently trigger class-action cases and Federal Trade Commission penalties.

In Industrials & Engineering, environmental spills and workplace safety failures dominate, pushing cumulative fines to $29.7 billion.

Notably, this sector has the highest average fine per case outside finance ($22.5 million), reflecting the high stakes of accidents in heavy industry.

<div style="background