Why Can’t I Afford a Home?

Description

Act 1: The Insurmountable Challenge

In 1817, New York voted to dig a ditch. And not just any ditch. A grand canal! Dug by hand, 363 miles long, across forests, swamps, and rock. Most experts scoffed. George Washington had dismissed similar ideas decades earlier. Thomas Jefferson called it “a little short of madness.”

At the time, farmers and manufacturers in the West faced a brutal choice. To reach markets, they had to send their goods down the Mississippi River to New Orleans, the country’s greatest seaport. From there, shipments went out through the Gulf, around Florida, up the Atlantic, and finally to cities like New York or Philadelphia. It was slow. It was costly. And it made western settlers dependent on a southern trade route they couldn’t control.

The Erie Canal wasn’t dreamed up by powerful men in Albany. The idea came from a flour merchant named Jesse Hawley. He had a strong customer base, but to move his flour to market, he had to ship it by wagon over the Appalachian trails or float it on rivers that ran the wrong way. He went broke, ended up in debtors’ prison, and there picked up a pen. In a series of essays in 1807 and 1808, he sketched a bold plan: a canal from Lake Erie to the Hudson River. He mapped the route, described the locks, and argued the benefits. He didn’t have all the details, but he had vision, and he put it on paper.

New York City mayor and later Governor DeWitt Clinton picked up that vision and ran with it. He wasn’t an engineer or a canal man. He was a politician with a sense of scale. Clinton saw what Hawley’s prison essays meant: an inland waterway would break dependence on the Mississippi, open the interior, and turn New York into the nation’s gateway.

As Governor, Clinton pushed the legislature to back the canal in 1817. The cost was staggering. Seven million dollars, one state spending roughly a third of the entire federal government’s annual budget. Critics mocked it as “Clinton’s Ditch.” They predicted it would bankrupt New York. Some said it would never be finished.

But Clinton pressed forward. He didn’t sell the canal as an engineering marvel. He sold it as a doorway. At the time, moving freight from Buffalo to New York City cost one hundred dollars a ton and took weeks. Clinton promised the canal would cut that to under ten dollars, and in just a few days.

The Erie Canal wasn’t just a ditch. It was America’s first true megaproject, built long before steam shovels, bulldozers, or dynamite. It was the biggest engineering challenge of the 19th century.

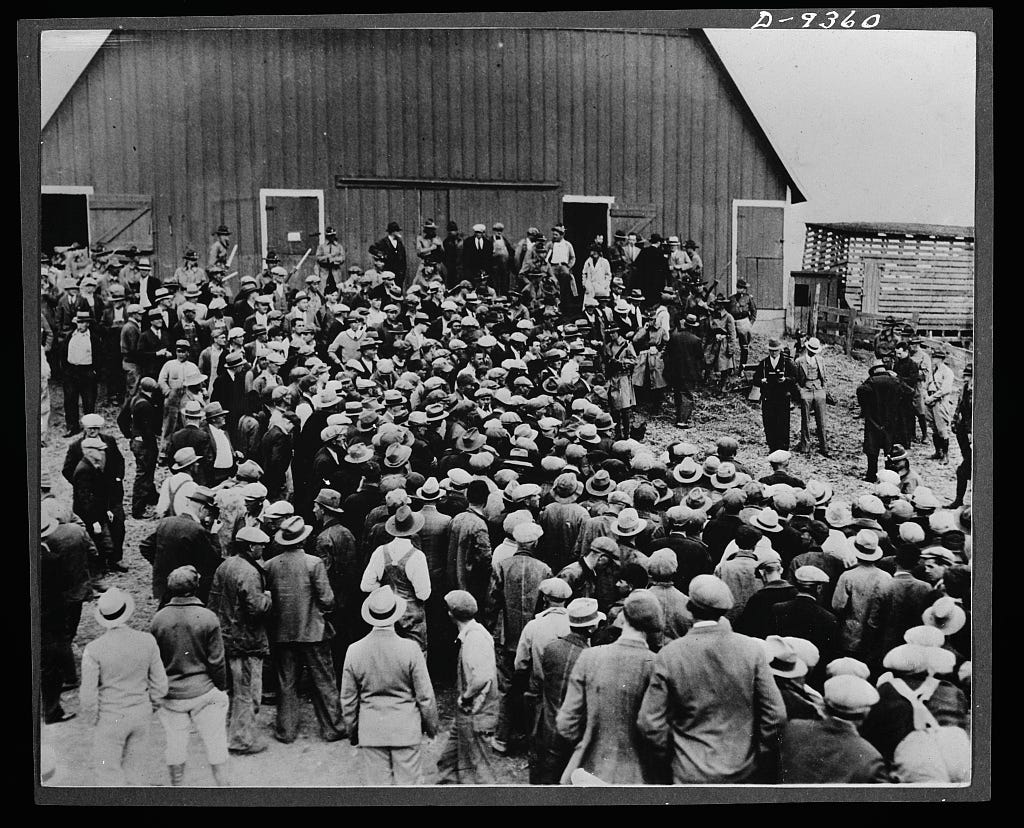

How did they dig it? By hand. Tens of thousands of laborers, mostly Irish immigrants and local farmers hired in the off-season, used picks, shovels, wheelbarrows, and horse-drawn carts. There were no roads. When they hit swamps, they laid down logs to make floating roads so carts wouldn’t sink. When they hit limestone cliffs, they drilled holes by hand, packed them with black powder, and blasted inch by inch.

The canal had to climb about 571 feet from the Hudson up to Lake Erie. To solve that, engineers built 83 locks; locks are stone elevators for boats. No one had done this on such a scale in America before. They were inventing the craft as they went.

But they finished it in just eight years.

When water first flowed in 1825, it wasn’t just an engineering triumph. It was an economic revolution. Shipping costs dropped from $100 a ton to under $10. A journey that took weeks now took days. It made bread cheaper. It put tools in the hands of farmers.

It made New York City the nation’s port. It opened the Midwest to settlement. Within a generation, roughly three-fifths of the nation’s trade moved through New York’s harbor, powered by the canal.

Today, we face another insurmountable challenge: a housing crisis.

Instead of a wilderness of rivers, swamps, and mountains, we face a wilderness of bureaucracy. A maze of zoning codes, permit boards, and fragmented governance. Each with its own tolls and delays. Builders spend months fighting hearings and paperwork before they ever turn a shovel, driving up costs and denying millions the chance to build equity through homeownership.

Then, as now, we face skepticism from critics who believe working-class Americans aren’t worthy of bold projects. Washington dismissed it. Jefferson called it madness. The rich, who owned the existing shipping lanes, mocked the project as “Clinton’s Ditch.” Today, skeptics argue that small, affordable homes aren’t profitable or that zoning reforms are too radical. Politicians treat it as impossible.

But every bold fix begins as madness.

Housing is our canal. It’s not a matter of skill or resources. We have both. It’s a matter of clarity, incentives, and purpose. Just as Clinton used a bold state project to open opportunity, we could use a Small Business Innovation Research program to open the housing market.

As of mid-2025, the US median home price sits at around $410,800, while median household income is estimated at $84,000. This makes homes over 4.8 times income, compared to just twice in the 1960s. A record 22 million renter households are cost-burdened, spending over 30% of income on housing, and affordability is at an all-time low. Programs like USDA’s SBIR for rural development and HUD’s $20 million innovation grants (with recent deadlines in July 2025) show the tools exist. We just need to earmark them for starter homes under $150,000, tied to zoning reforms that cut red tape.

This isn’t about handouts; it’s about competition driving innovation, much like Hawley’s essays sparked a revolution.

Instead of a canal, let’s build a pathway to the American Dream for the working class.

Act 2: The Crisis Today – Voices from the Ground

(Voice: Young Homebuyer; mid-20s female, fiery with a mix of grit, sarcasm, and unshakable hope. Think a teacher who’s had it but won’t quit. Background: Gritty urban soundscape. Honking cabs, slamming apartment doors, distant subway rumble, fading in and out.)

Picture me: 25, a teacher in a mid-sized city, grading papers by day, tutoring by night, slinging coffee on weekends. I’m hustling like my life depends on it...because it does. But the American Dream? It’s slipping through my fingers like sand in a busted hourglass.

I’m not asking for a penthouse. I just want a home. A small one! 600, maybe 1,000 square feet. A bedroom, a bathroom, a kitchen where I can burn my first attempt at dinner. But in 2025, that’s a fantasy. I looked it up... the median income is something like 84 grand a year. Median home price? Try 420 thousand. That’s nearly five times what I make. It’s crazy! Back in 1960, homes cost twice the income: twelve thousand on fifty-six hundred. Since then, prices ran past wages and never looked back.

And I hear the pushback: “Homeownership rates are fine.” Sure, overall. But at my age, it used to be higher. By thirty, nearly 6 in 10 Americans from the Silent Generation owned a home, 1 in 2 Boomers, just under half of Gen X, and about four in ten Millennials. Today, 25–34-year-olds sit in the high 30s, recently near 36%. The overall rate didn’t crash. The doorway for us did.

Builders don’t touch starter homes anymore. Why would they? Land’s a fortune, materials are through the roof, and zoning boards pile on fees like they’re playing Monopoly with my future. So they churn out McMansions, the sprawling status symbols for the rich. Me? I’m left scrounging for scraps, priced out of the game before I even roll the dice.

This isn’t just my story. It’s a crisis crushing millions. Over 22 million renter households are drowning, spending more than 30% of their income on rent. Twelve million are barely breathing, forking over half their paycheck. Since 2019, home prices have spiked 60%. If you’re pulling $50 grand a year, good luck! Only one in ten listings is even close to affordable.

It’s like rowing upstream in a boat made of tissue paper. You paddle; work overtime, skip vacations, eat instant noodles, but the leaks keep coming. Rent. Student loans. Fees. They drain you dry before you can save a dime for a down payment.

So we wait. We put off kids. We put off dreams. Some of us are still crashing in Mom’s basement, not because we’re lazy, but because the system’s rigged. We don’t need marble countertops or three-car garages. We need homes under $150,000! Twice today’s median income, like our grandparents had. Without that, the American Dream isn’t just delayed. It’s sinking, drifting downstream, out of reach for my entire generation.

But I’m not giving up. There’s a way to fight back. We need to drain this bureaucratic swamp and build a bridge to ownership. We just need the right tools, the right vision, and a whole lot of grit.

Act 3: Innovation – SBIR for Housing

(Voice: Policy Expert – Confident male, mid-40s, professor-like with a spark of enthusiasm, like a TED Talk speaker rallyi