$JOJO: CMBS Are Flashing Stress Signals

Description

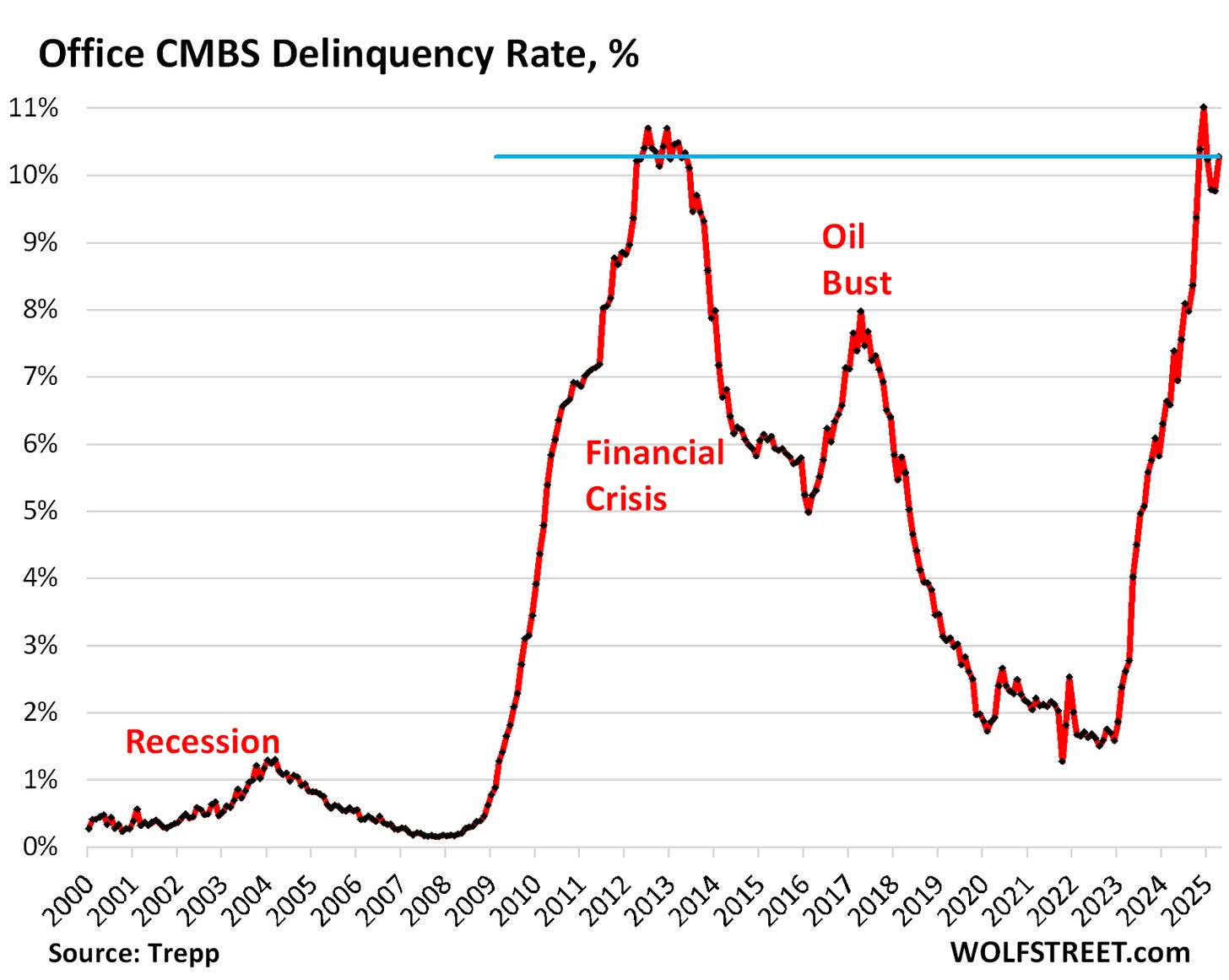

Investors are watching commercial real estate through a split lens. On one side, public CMBS (commercial mortgage-backed securities) are flashing stress signals. On the other, private office loans seem to be holding their ground. Trepp’s latest report shows CMBS office delinquencies at 5.58% in September, pushing the overall CMBS delinquency rate to 4.39%, the highest level since the pandemic¹. Fitch similarly reported a spike in U.S. office CMBS delinquencies to 8.12% in September, driven largely by a $180 million default on a Manhattan property². More than $1 billion of newly delinquent CRE loans that month came from the office sector².

By contrast, loans held by banks and life insurers are showing fewer cracks—at least for now. The Mortgage Bankers Association noted delinquency rates of 1.29% for bank CRE loans and 0.51% for those held by life insurers as of mid-2025, compared to 6.36% for CMBS loans³. While this gap partly reflects different reporting methods, it also stems from how distress is handled. CMBS loans follow a rigid servicing process, with less flexibility and higher costs for borrowers. Private lenders often renegotiate terms quietly, sidestepping public scrutiny and regulatory constraints⁴.

Those structural differences influence how problems show up. In the CMBS space, servicers are modifying loans faster than in past cycles. Trepp found that since 2010, the median time from delinquency to modification dropped to about 2.7 months, down from roughly 14 months pre-2009⁵. Foreclosures, however, have slowed—loans now sit delinquent for more than 19 months before reaching REO status⁵. That leaves CMBS investors with faster discounts but slower recoveries. On the private side, lenders might stretch out modifications longer, hoping to avoid taking immediate losses.

Which side breaks first? Based on recent data, CMBS is already showing strain. That could foreshadow broader trouble ahead. Nearly $4 trillion in commercial real estate debt is set to mature by 2028, much of it in the office sector. If refinancing remains tight, even private loans could tip into distress.

For investors, this creates a complex backdrop. The divergence between CMBS and private credit suggests volatility will rise as more data comes to light. It may be time to think tactically. The ATAC Credit Rotation ETF (ticker: JOJO), my fund, offers one approach. It shifts between high-yield bond ETFs and long-duration Treasuries based on volatility signals, aiming to adjust exposure dynamically depending on market stress⁶. Rather than staying locked into one segment, JOJO adapts to changing credit conditions, potentially limiting downside in tougher environments.

No strategy can eliminate risk. Still, as office loans move from slow-burn to spotlight, an active approach may offer an edge. The cracks in CMBS today might be tomorrow’s headlines in private credit. Staying nimble could be the difference between reacting to stress and positioning ahead of it.

Footnotes

¹ Trepp, CMBS Delinquency Report: September 2025.

² Matt Tracy, “U.S. Office Loan Delinquencies Rise in September – Fitch,” Reuters, October 3, 2025, https://www.reuters.com/markets/us/us-office-loan-delinquencies-rise-september-fitch-2025-10-03/.

³ Mortgage Bankers Association, “Commercial/Multifamily Mortgage Delinquency Rates for Major Investor Groups: Q2 2025,” https://www.mba.org/.

⁴ Womble Bond Dickinson, “CMBS vs. Portfolio Loans: Workout Considerations for Commercial Real Estate,” https://www.womblebonddickinson.com/us/insights.

⁵ Trepp, “Three Eras of CMBS: How the Past Two Cycles Shape Today’s Workouts,” https://www.trepp.com/.

⁶ ATAC Funds, “ATAC Credit Rotation ETF (JOJO) Overview,” https://www.atacfunds.com/.

Junk debt, also known as high-yield bonds or speculative-grade debt, refers to fixed-income securities issued by companies or governments with lower credit ratings, offering higher interest rates to compensate investors for the elevated risk of default.

The VIX index, often called the "fear gauge" of Wall Street, is a real-time market index that measures the market's expectation of 30-day forward-looking volatility derived from S&P 500 index options prices, serving as a key barometer of investor sentiment and market risk.

The ICE BofA BB US High Yield Index Option-Adjusted Spread measures the yield differential between BB-rated corporate bonds and a spot Treasury curve, quantifying the risk premium for below-investment-grade debt with a BB rating in the US market.

As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shares will trade at any volume, or at all, on any stock exchange. Low trading activity may result in shares trading at a material discount to NAV.

Because the Fund invests in Underlying ETFs an investor will indirectly bear the principal risks of the Underlying ETFs, including but not limited to, risks associated with investments in ETFs, equity securities, growth stocks, large and small capitalization companies, non-diversification, fixed income investments, derivatives and leverage. The prices of fixed income securities may be affected by changes in interest rates, the creditworthiness and financial strength of the issuer and other factors. An increase in prevailing interest rates typically causes the value of existing fixed income securities to fall and often has a greater impact on longer duration and/or higher quality fixed income securities. The Fund will bear its share of the fees and expenses of the underlying funds. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying funds.

Because the Fund expects to change its exposure as frequently as each week based on short-term price performance information, (i) the Fund’s exposure may be affected by significant market movements at or near the end of such short-term periods that are not predictive of such asset’s performance for subsequent periods and (ii) changes to the Fund’s exposure may lag a significant change in an asset’s direction (up or down) if such changes first take effect at or near a weekend. Such lags between an asset’s performance and changes to the Fund’s exposure may result in significant underperformance relative to the broader equity or fixed income market. Because the Adviser determines the exposure for the Fund based on the price movements of gold and lumber, the Fund is exposed to the risk that such assets or their relative price movements fail to accurately predict future performance.

Past performance is no guarantee of future results.

The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory or summary prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfunds.com. Please read the Prospectuses carefully before you invest.

Investing involves risk including the possible loss of principal.

JOJO is distributed by Foreside Fund Services, LLC.

Learn more about $JOJO at https://atacfunds.com/jojo/ Lead-Lag Publishing, LLC is not an affiliate of Tidal/Toroso or ACA/Foreside.