Credit Repair Explained: Should You Pay a Company for Help?

Description

Credit repair is the process of fixing your credit report, and ideally improving your credit score.

Bad credit can limit your ability to do a lot of things, including purchasing a car, home, getting a credit card, and in some cases, even a job. Being creditworthy certainly has its advantages.

If you don’t have good credit, there are steps you can take to fix it. The process is called credit repair. You can do it by yourself or have someone help you, for a fee of course.

Let's break down what credit repair is and if it is worth paying someone to help repair your credit.

Table of Contents

How Does Credit Repair Work?

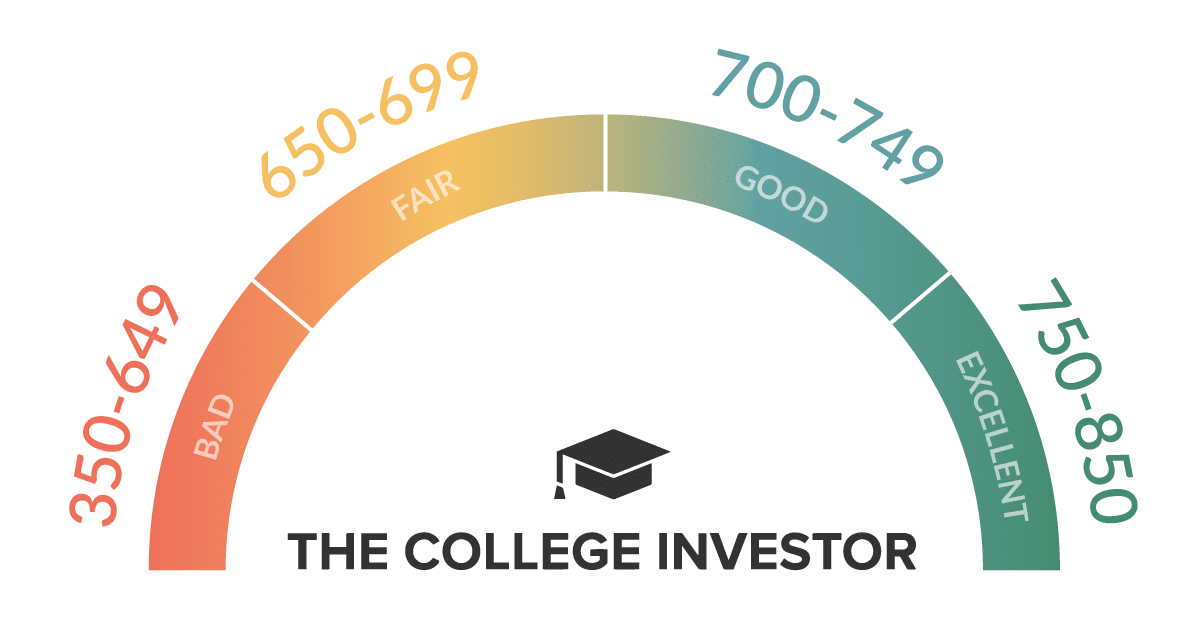

Credit repair is often a long-term process that gradually raises your credit score. A credit score is a number that reflects your creditworthiness. The higher the number, the better. If you want any type of loan or credit card, you’ll need a decent credit score.

There are a number of ways to approach credit repair and each is unique to a specific situation.

Generally though, credit repair starts with getting a copy of your credit history, and looking for any errors or problems. Once you have your credit history, you can begin to see what issues might be causing a lower credit score.

Note: Make sure you get a copy of your credit report from all three major credit bureaus.

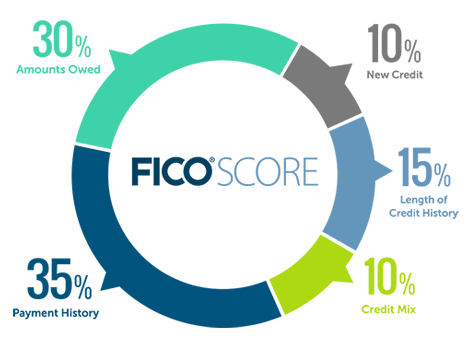

Here's how your FICO Score is calculated:

Source: MyFICO

Once you see the issues, you can start addressing them - focusing on the biggest areas that impact your credit score.

This usually starts with catching up on any late payments. From there, payments are consistently made on time. Being late on a payment is one of the worst things you can do to your credit.

Once debts are made current and you’ve been making on-time payments, you should start noticing an increase in your credit score. As more debt is paid down, your score will continue to rise.

Can You Do It Yourself?

Yes! You can absolutely repair your credit by yourself.

How successful you’ll be depends on the complexity of your situation. Credit repair does take time and lots of research — if you are starting from the beginning. But if you are ambitious, repairing your credit by yourself can certainly be done.

The first step is to get a copy of your credit report, which you can do at AnnualCreditReport.com. Then go through your report and identify all overdue accounts and anything that might be incorrect. You can contact each credit bureau to fix any mistakes.

Following the steps mentioned in the previous section are a good starting point:

- Bring any debts current by paying overdue amounts and late fees.

- Continue to make on-time payments.

From there, access to new credit can also help improve your credit score. If you have a low credit score, it’s unlikely any credit card company will issue you an unsecured credit card. However, you can apply and likely get approved for a secured credit card.

Secured credit cards require a deposit. You can spend up to the deposit amount. It works just like an unsecured credit card except with a lower credit limit. Your secured credit card activities will be reported to credit bureaus, which is what you want.

As an aside, try to put away $1,000 in cash for an emergency fund. This will help to pay for emergencies with cash rather than putting them on a credit card. Unexpected expenses may include car repairs, a broken hot water heater, or a medical bill.

The FTC website also has some DIY (do-it-yourself) tips on its website here.

If you don’t want to take on rebuilding your credit by yourself, there are plenty of companies out there who can help. But are they worth it?

What About Credit-Building Apps And Tools?

If you're going to do it yourself, you should probably get a credit monitoring tool to start with. These tools are generally free, and they can at least help you monitor your credit report "live".

That way, as you're making progress on your credit report, you can see the improvement in your score.

The most popular free tools are Credit Karma, <a href="https://thecollegeinvestor.com/go/CreditSesame" target="_blank" rel="nofollow" class="" style="outline: none