How To Fill Out The FAFSA And Why It Matters

Description

The FAFSA stands for Free Application for Federal Student Aid, and nearly every college-bound student and their families should fill it out each year.

College students need all the financial help them can get - that's why every college student and prospective college student needs to fill out the FAFSA!

Even if you think you have enough money to pay for college, you should fill out a Free Application for Federal Student Aid (FAFSA) to avoid missing out on grants, scholarships and low cost financial aid.

It's important to know that beyond grants and scholarships, filling out the FAFSA is what's required to get Federal student loans. That's why you should also make sure that you're filling out the FAFSA every year you attend school.

Table of Contents

Why Do I Need To Fill Out The FAFSA?

Many students and parents don’t fill out the FAFSA because they think federal grants are only available to families earning less than $50,000. The truth? You could qualify for other financial despite your income or your family’s income. Why should you fill out a FAFSA? To maximize your chances to receive grants, scholarships and avoid student loan debt, and much more!

To qualify for grants, financial aid, and scholarships, you must fill out a FAFSA form. If you don’t meet the requirements for need-based scholarships, the college could award a merit-based scholarship instead.

When some schools have tuition over $65,000, need-based financial aid is even available to students from middle and upper-middle class income brackets.

Once you fill out a FAFSA form, you automatically qualify for low-interest and forgivable federal student loans, which are the best kind of student loans. The FAFSA form is also required to qualify a parent for a federal parent PLUS loan.

How can completing a FAFSA form improve your chances of getting into a particular school? If a student fails to submit a FAFSA form to an institution, they are less likely to enroll. Aside from qualifying for grants, scholarships, and other forms of financial aid, filling out a FAFSA form indicates that you are interested in that institution, making it more likely that the institution will try to entice you to attend by offering financial aid.

When Do You Fill Out The FAFSA?

Timing is important - the earlier you fill out the FAFSA, the more potential aid you can receive. It's also essential that you meet any college, state, or federal FAFSA deadline.

With that being said, parents and students of the class of 2025 fill out the FAFSA starting December 1, 2024 (hopefully - FAFSA delayed again).

Here's a quick guide:

- Starting College In Fall 2025: Fill out the FAFSA starting December 1, 2024

- Starting College In Fall 2026: Fill out the FAFSA starting October 1, 2025

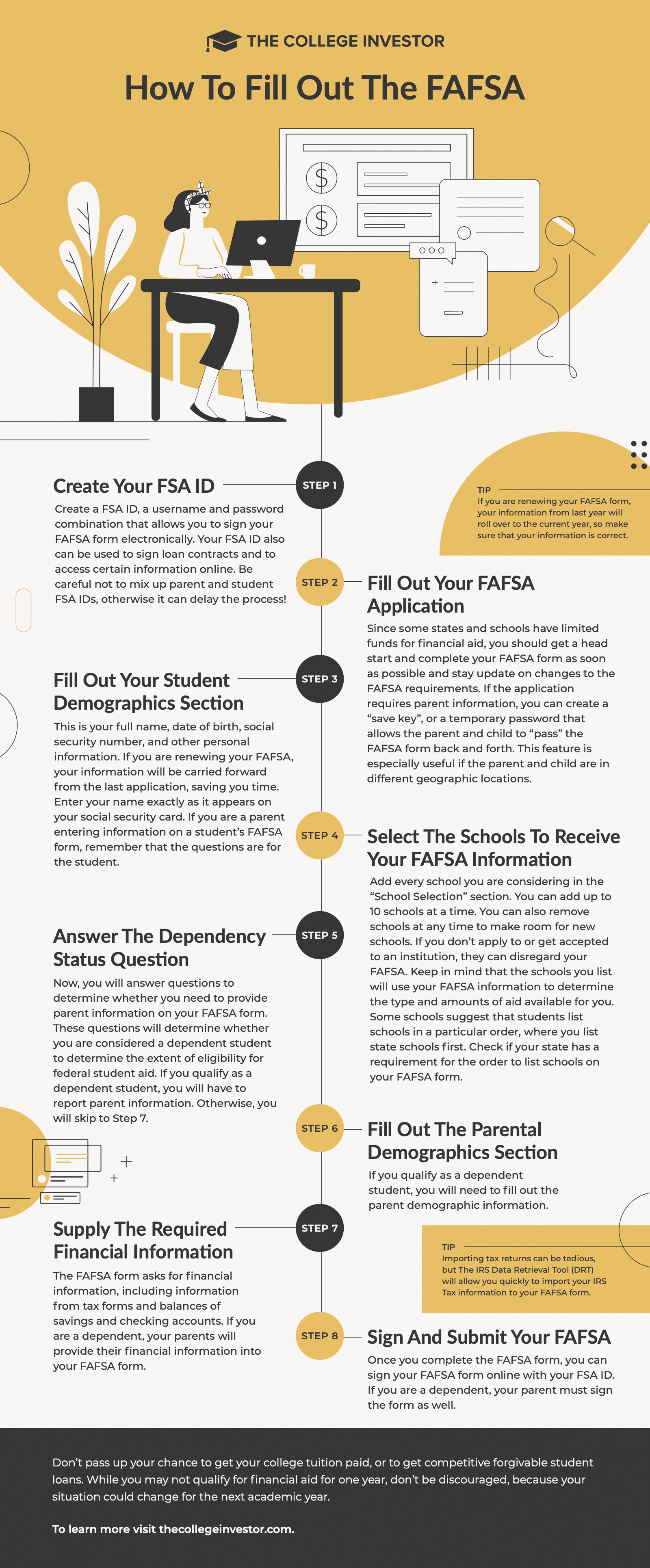

How To Fill Out The FAFSA

Whether you’re a student filling out a FAFSA, or a parent of a student, the steps below will help you fill out the FAFSA the right way and qualify for maximum benefits. Remember, you must complete a FAFSA form for each school year.

Now that you understand how your FAFSA form can affect your future, we’ll walk you through the process step by step.

Find this infographic helpful? You can download a hi-res version to print or use in your office here: [Download]

Gather Your Basic Personal Information

Expect to provide personal information such as your name, date of birth, address, and social security number. Depending on whether or not you’re a U.S. citizen or tax returns filed, you may need to provide additional information. Either way, have the following information ready when you begin filling out your application:

- Your Social Security number and your parents’ social security numbers if you are a dependent student.

- Your driver’s license number or state issued ID if you have one.

- Your Alien Registration number if you are not a U.S. citizen.

- Federal tax information or tax returns for you and for your parents if you are a dependent student.

- Nontaxable income records for you and your parents if you are a dependent student.

- Checking and savings account balances; investments, including stocks and bonds and real estate (aside from your primary residence).

Step 1: Create Your FSA ID

Create a FSA ID, a username and password combination that allows you to sign your FAFSA form electronically. Your FSA ID also can be used to sign loan contracts and to access certain information online.

- Student: Get your FSA ID is a username and password to sign the