How To Find Grants To Pay For College

Description

Grants for college are a source of financial aid that's effectively free money. Unlike scholarships, grants are aid that is offered from the government - usually the Federal government or your state government.

If you’re applying for college, you’ve probably heard students complain about grants and scholarships – everything from the application process to the stringent requirements. But it's extremely possible to find grants to pay for college.

If you explore all of your options and keep track of your results, the process doesn’t have to be painful. We’ve cut down on your research by providing you with resources that will help you find grants right for you.

While scholarships are awarded on merit and need, grants are primarily awarded based on need. For most grants, grades are not a determining factor. It’s no wonder that grants are the most sought after form of financial aid – grants are like “free money” that can be used for tuition and other college expenses.

Below, we’ll show you where to look for grants and how to apply. Keep reading!

The Difference Between Scholarships And Grants

Unlike student loans, you don’t have to pay back grants or scholarships. Both scholarships and grants for college are free money options to help you pay for higher education. Gants are typically awards by the Federal and state government, while scholarships are awarded by the college or private organizations.

People often confuse grants and scholarships or use the terms interchangeably because grants and scholarships share many similarities.

The biggest difference between college grants and scholarships is that grants for college are typically need-based, while scholarships may be need-based or merit-based. What does merit-based mean? It means the scholarship is awarded based on something you do, such as an ability, hobby or achievement.

Like grants, scholarships can also be awarded based on ethnicity, religion, or other background related criteria. Grants are considered free money for college that doesn’t have to be paid back except under these rare circumstances.

@thecollegeinvestor Replying to @dell🖖🏽 Here’s how you apply for grants to pay for college. #fafsa #scholarship #grants #financialaid #collegecosts ♬ original sound - The College Investor

<script async="" src="https://www.tiktok.com/embed.js"></script>Find Free Money For College With Federal Grants

What is a grant? A federal grant is a form of federal financial assistance where the U.S government redistributes its resources to eligible recipients who demonstrate financial need.

Below, we’ve got you covered for Federal grants, State Grants, College Grants, and other grants in special situations. Just follow these steps, and you’ll have a higher chance of uncovering grants that are the perfect fit for you.

Find this infographic useful? You can download the full version here.

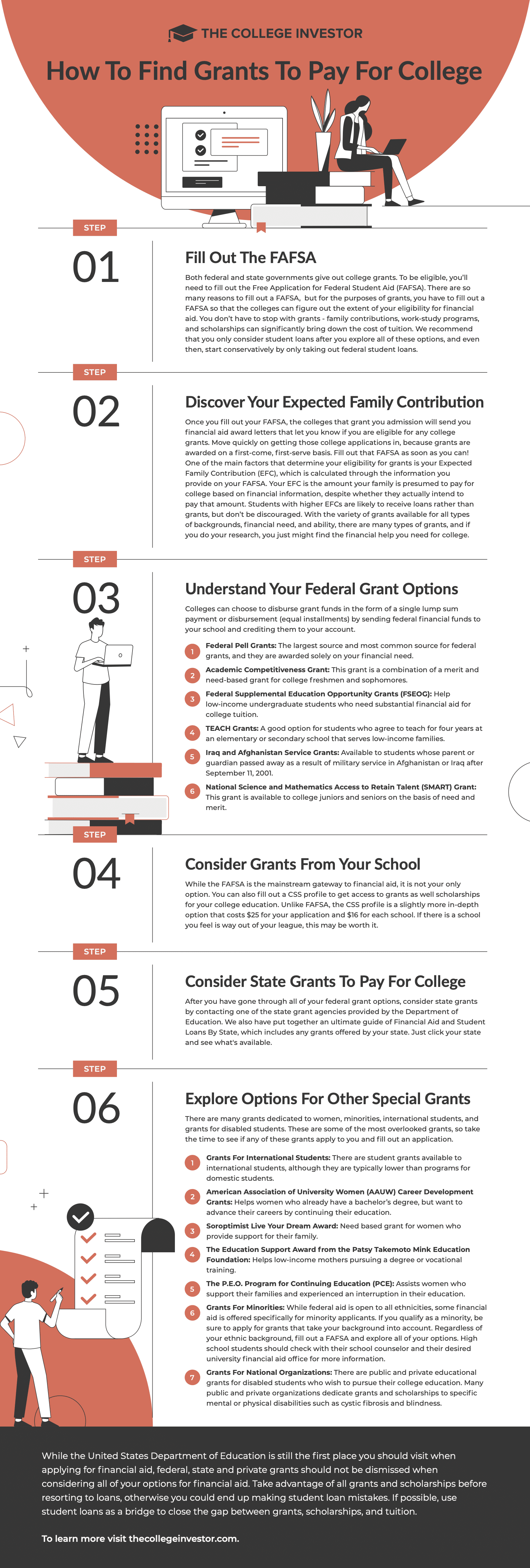

Step 1: Fill Out The FAFSA

Both federal and state governments give out college grants. To be eligible, you’ll need to fill out the Free Application for Federal Student Aid (FAFSA).

There are so many reasons to fill out a FAFSA, but for the purposes of grants, you have to fill out a FAFSA so that the colleges can figure out the extent of your eligibility for financial aid.

You don’t have to stop with grants - family contributions, work-study programs, and scholarships can significantly bring down the cost of tuition. We recommend that you only consider student loans after you explore all of these options, and even then, start conservatively by only taking out federal student loans.

Learn why federal student loans are the best kind of student loan you can take out (if you need to take out a loan at all).

Step 2: Discover Your Student Aid Index

Once you fill out your FAFSA, the colleges that grant you admission will send you financial aid award letters that let you know if you are eligible for any college grants.

Move quickly on getting those college applications in, because grants are awarded on a first-come, first-serve basis. Fill out that FAFSA as soon as you can!

One of the main factors that determine your eligibility for grants is your Student Aid Index. This is a new metric that replaces the Expected Family Contribution.

Your SAI is amount your family is presumed to pay for college based on financial information, despite whether they actually intend to pay that amount. Students with higher SAIs are likely to receive loans rather than grants, but don’t be discouraged.

With the <a href="https://thecollegei