The 7% Solution: Why DIVP Could Be the Smart Income Play for a Value-Starved Market

Description

For U.S. income investors, the Cullen Enhanced Equity Income ETF (DIVP) is a new player in the expanding global universe of “enhanced income” or “covered-call + dividend” ETFs. DIVP, which began trading March 6, 2024, is designed to provide current income and the potential for equity appreciation through exposure to dividend-paying stocks with an active covered call strategy overlay.

The Core Idea

DIVP is based on large-cap, dividend paying stocks with “value” characteristics. In other words: stable businesses, lower valuations and reliable dividends. That provides the fund with baseline income from cash dividends and the opportunity for capital appreciation.

DIVP layers a covered call strategy on roughly 25-40% of its stock holdings. In simple terms:

The fund owns a stock.

It sells a call option on that stock (i.e. provides someone else the right to buy it at some pre-set “strike price” up to expiration).

In exchange, the buyer pays a front-end premium (cash).

If the stock remains below that strike at expiration, the call expires worthless, and DIVP pockets the premium (booking even more income).

Should the stock go up beyond the strike, it might be called away/sold,

The call premium serves as a source of income. It’s a trade-off: You give up some upside in return for more consistent yield.

Cullen is aiming for a gross yield of ~7% (dividends + call premiums) for DIVP, in line with the historical performance of the enhanced equity income sleeve. The firm also notes that this structure can serve as an “alternative to bonds” — delivering yield but still having exposure in equity markets.

It’s worth noting you’re taking capped upside and keeping some equity risk. For a lot of income-oriented investors, however, that trade-off is just fine or even preferable.

Number of holdings & allocation

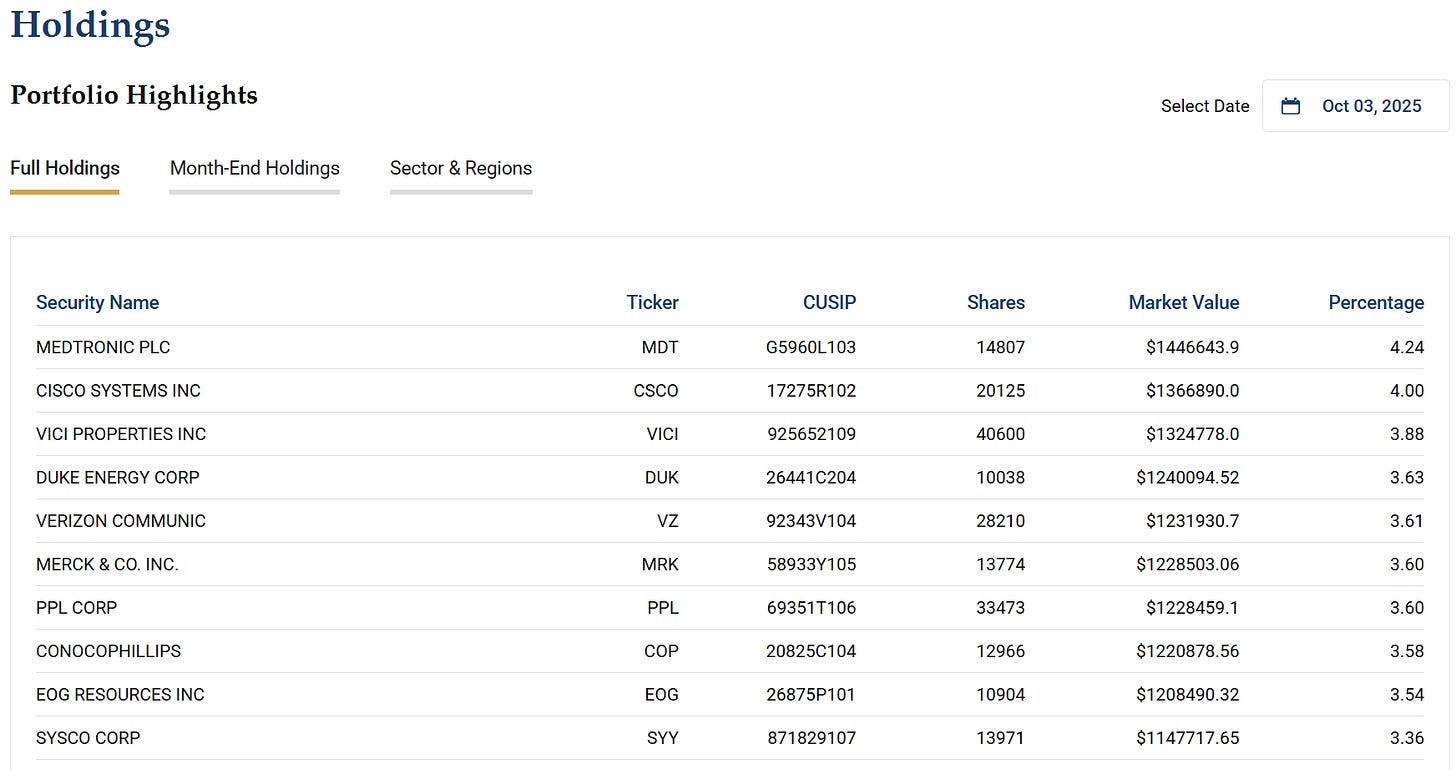

DIVP still typically maintains 30-40 equity positions—a semi-concentrated, actively managed portfolio. Its top 10 holdings represent ~35-40% of its total assets, suggesting moderate concentration.

According to recent filings, these are the biggest holdings:

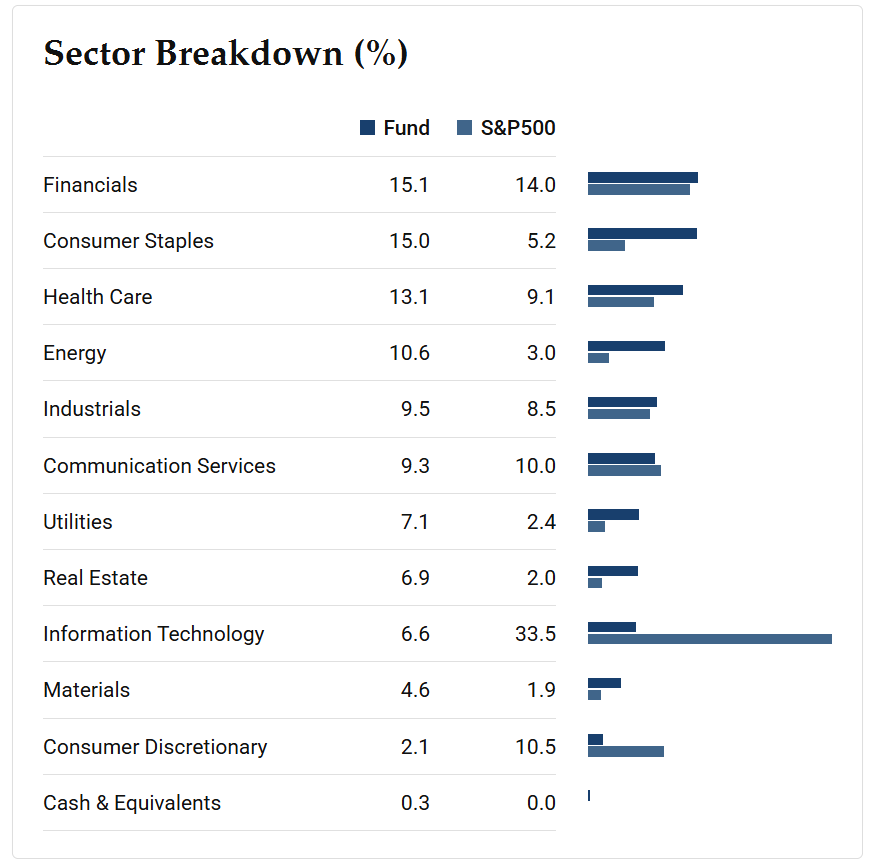

On the sector front, DIVP is underweight technology and expensive growth areas and is favoring more traditional, stable sectors (utilities, and energy).

Distributions & yield

DIVP pays monthly dividends. In December 2024, for example, it distributed $0.32 per share (a larger end-of-year distribution)¹². In January 2025, it paid about $0.14 per share, corresponding to a trailing yield in the ~7.15% range given its trading price (~$25).