The How, What, and Why of VP's Asset Allocation Engine

Description

This video was originally shared with VP clients on September 23, 2024. Link to original video here. To gain access to more of our research, contact us here.

Speakers: Tian Yang (CEO & Head of Research) and Scott Freeman (Director of Asset Allocation)

There are 2 key decisions to get right for asset allocation:

* How much to allocate to risk assets (stock vs. bond vs. cash allocation).

* How to gain exposure to outperforming sectors while avoiding underperforming ones.

We address these two problems in a repeatable way, using the best frameworks we have developed over the 15 year history of Variant Perception.

* Our leading indicators help us understand the business cycle.

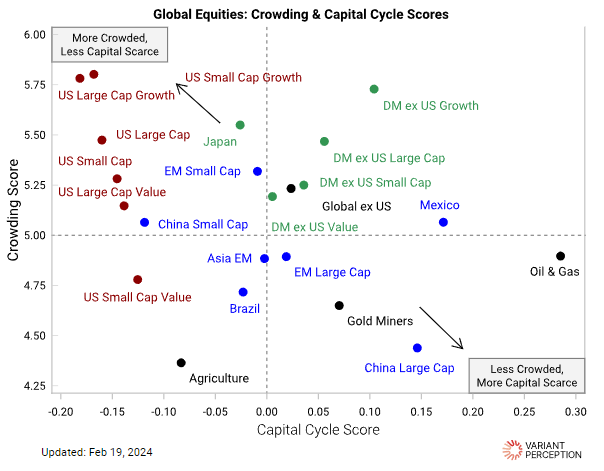

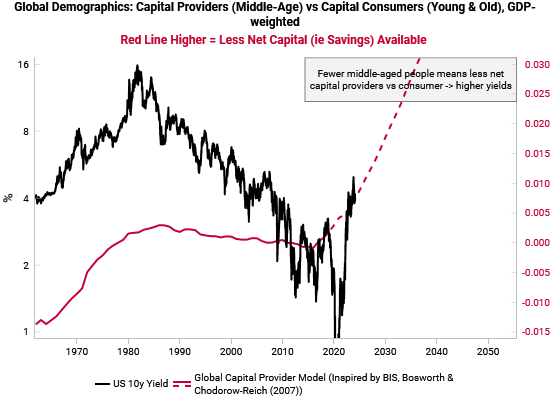

* Our capital cycle models help us understand long-term profitability trends across industries.

* Our crowding indicators help us understand market positioning and herding behavior.

These 3 key models can be synthesized into modular and customizable portfolios that:

* Maximize upside capture & minimize downside capture vs. standard benchmarks.

* Do NOT take undue risk with leverage or hero calls.

* Have reasonable trading turnover.

This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit blog.variantperception.com