The death of D2C (Highlights only)

Description

It’s time for us to retire the term “Direct-to-Consumer” or D2C. The phase is, anyway, a bit long in the tooth, having been used since the days of the dot-com boom.

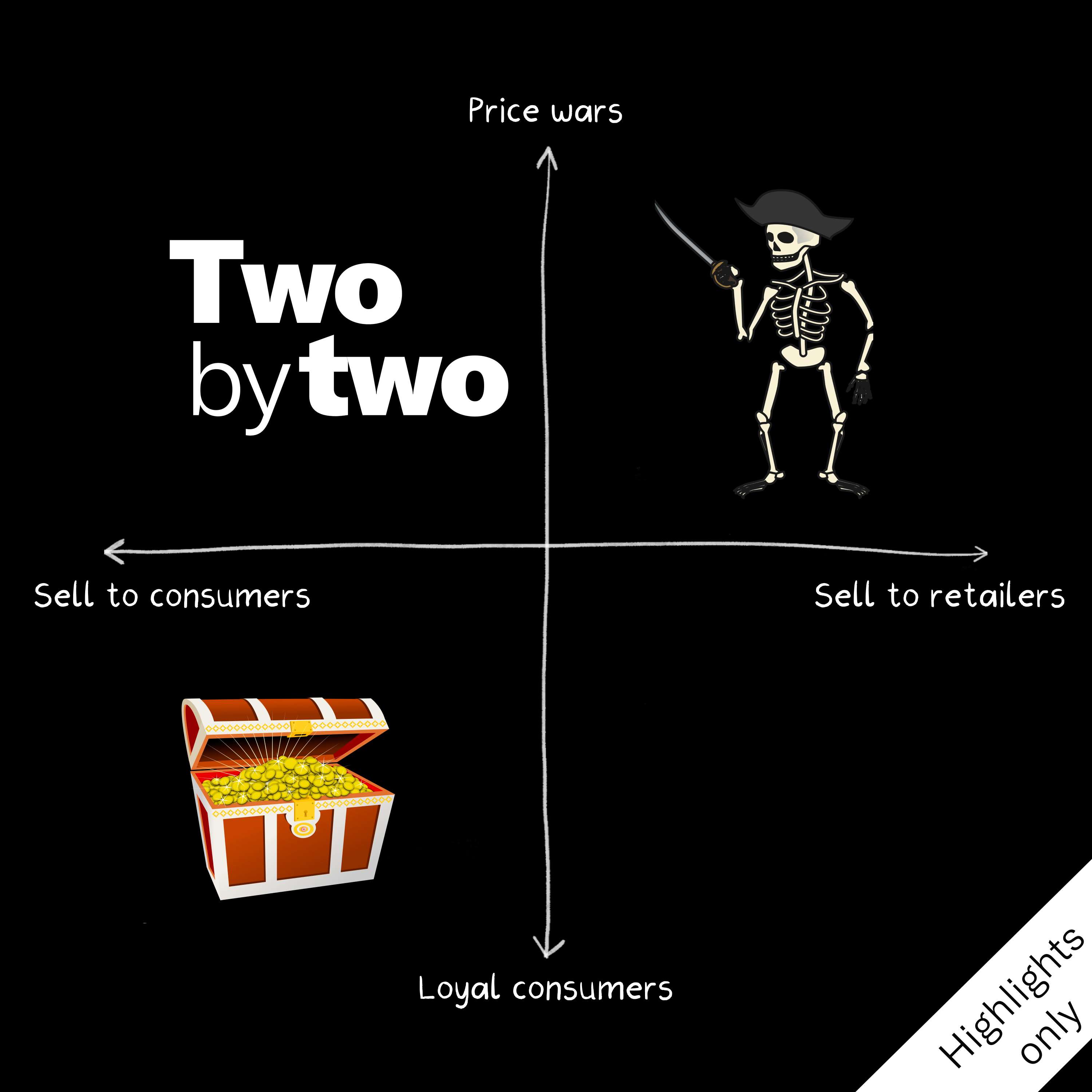

D2C used to mean selling directly to end customers, rather than selling through retailers or other middlemen. In theory, selling directly to consumers would allow a company to offer both lower prices and maintain higher margins (since it didn’t have to pay commissions to middlemen), having better products sustained through a faster innovation cycle and the ability to sell products through evolving brand stories instead of merely price.

In reality though, few brands are even remotely D2C. For instance, 82% of Boat’s sales come via Amazon and Flipkart, with only 2% selling directly to consumers. The dependence on kiranas, distributors and modern retail has merely been replaced with a dependence on Amazon, Flipkart or Quick Commerce companies.

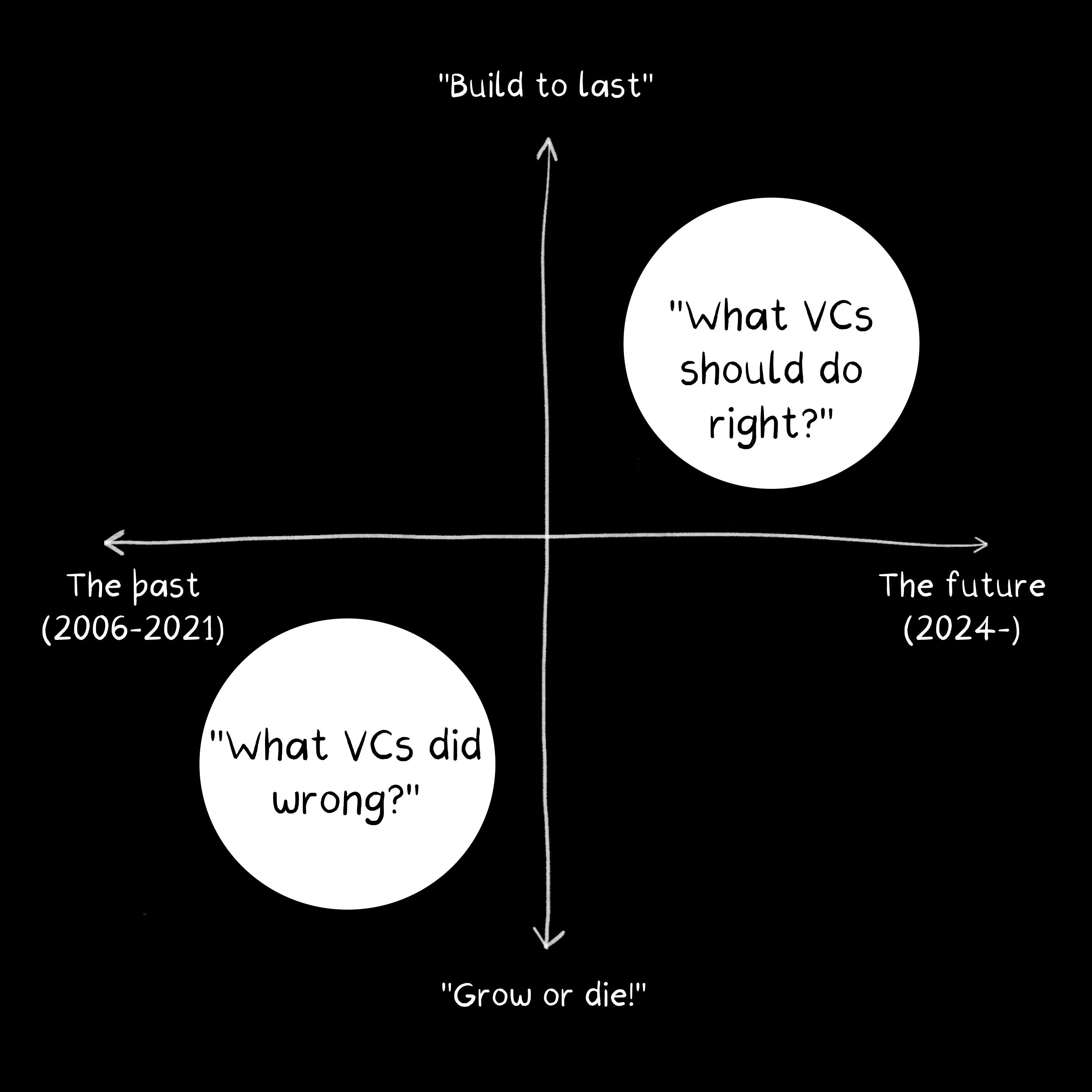

Large and “traditional” FMCG companies, which were once acquirers of D2C startups, have sobered up. Their acquisitions haven’t really scaled up well, even as they’ve figured out how to compete with D2Cs. As a result, the acquisition premium for D2C startups has plummeted from the peak during the post-pandemic days. In some cases even a 50% discount from the peak isn’t leading to deals.

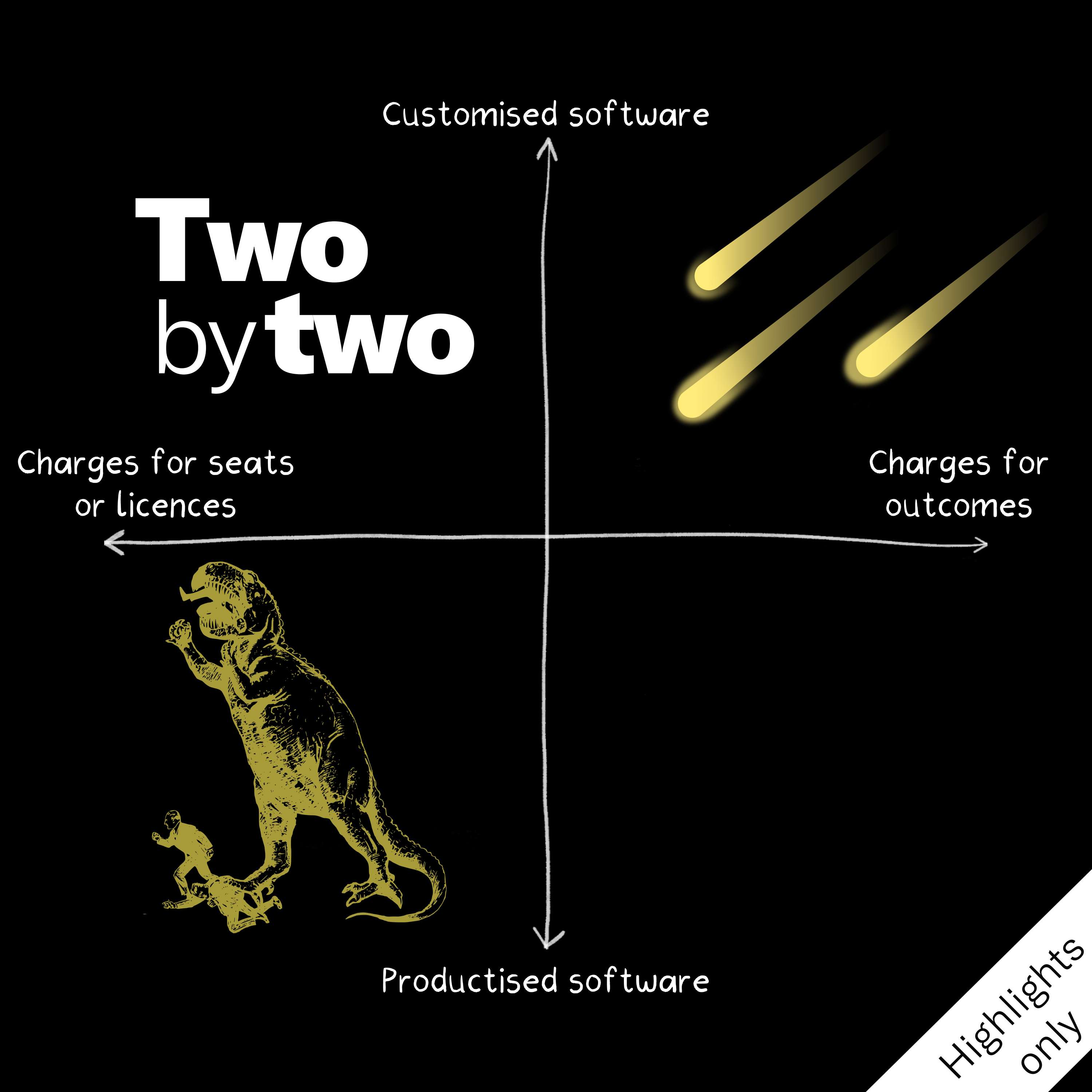

In terms of categories, electronics has scale, but profits have plummeted. In skincare, there is also a downward spiral of competition and price pressure. A good example is Mamaearth, which is now paying the price on the stock markets.

In terms of competition, the likes of Meesho, Fire-Boltt, Boult, Noise etc., are pushing prices dramatically lower. What is a differentiating factor? It’s hard to say right now. The entire category looks like a turnstile with a 2-3 year cycle.

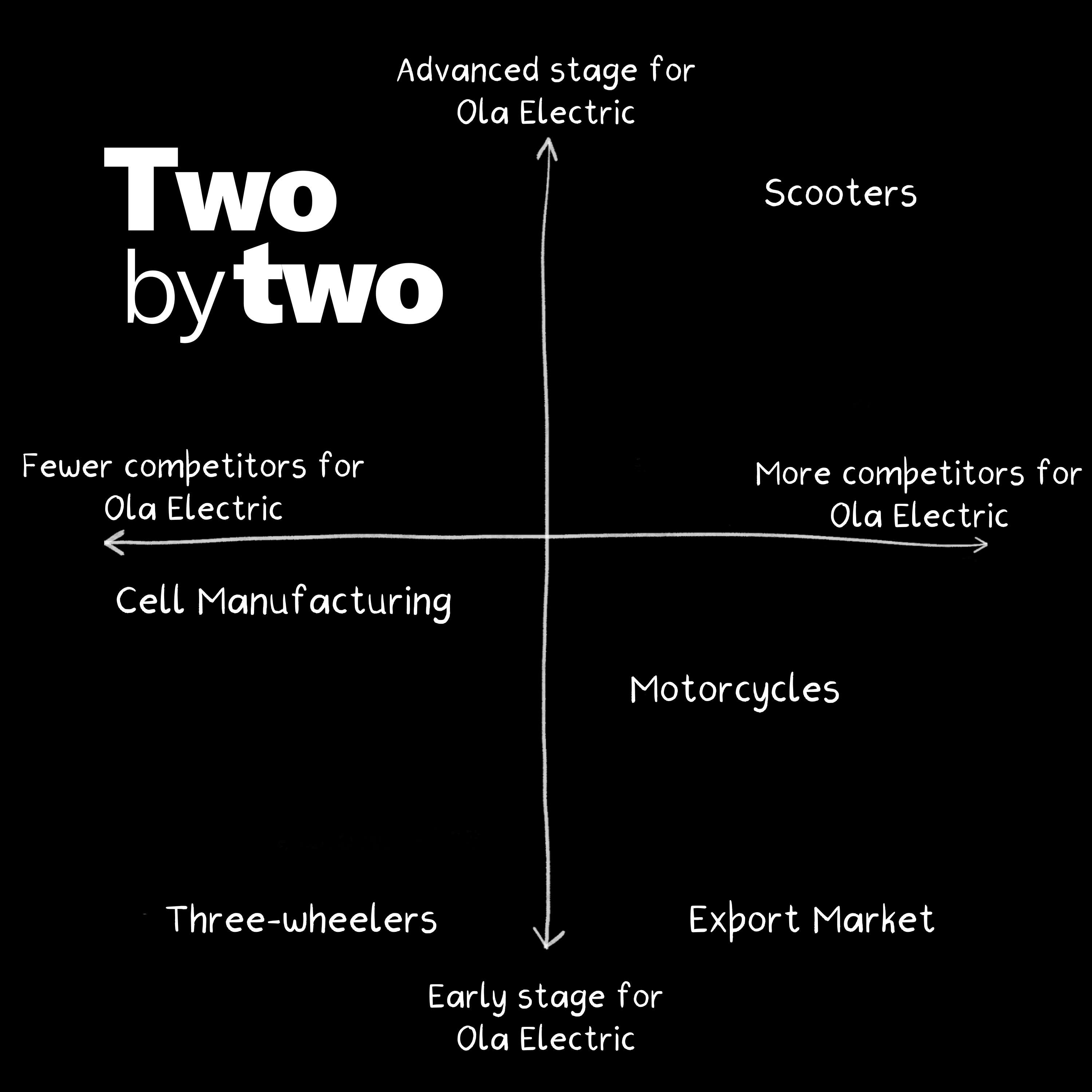

What is the way out? What should modern brands do to build lasting and sustainable brands? How should they cultivate consumer loyalty and connections? What should they even be called?

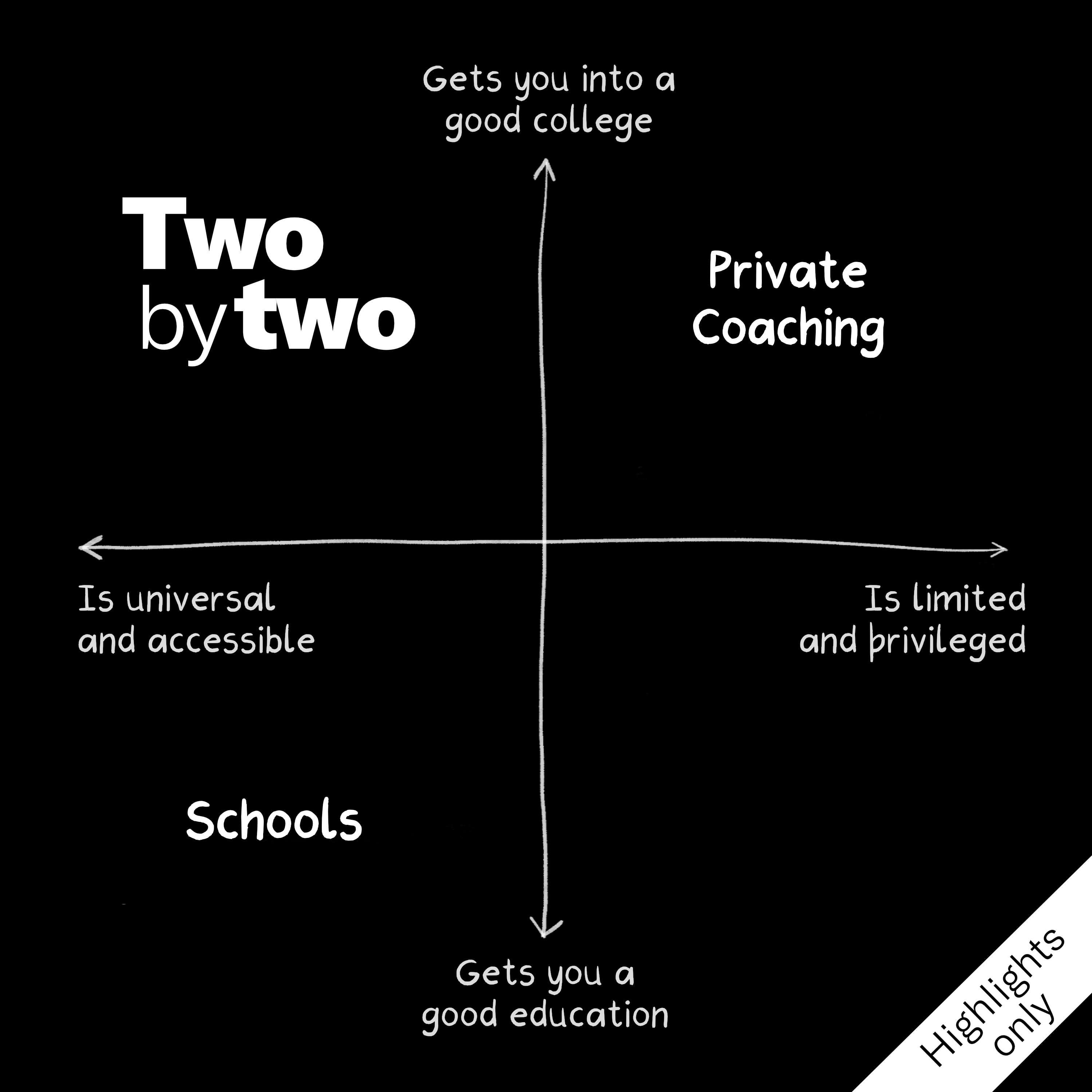

Welcome to episode 22 of Two by Two.

In this episode, hosts Rohin Dharmakumar and Praveen Gopal Krishnan are joined by Deepak Shahdadpuri, managing director and founder of DSG Consumer Partners–India and Southeast Asia's first consumer-focused venture capital fund. We also had Ajai Thandi, co-founder of Sleepy Owl Coffee and Seetharaman G, deputy editor at The Ken and resident expert on all things retail joining in for the discussion.

This is a short excerpt from a more than hour-long episode.

The full episode is exclusively available on The Ken app with a Premium subscription and on Apple Podcasts via a separate standalone subscription.

There is also a free Two by Two newsletter. You can sign up for it here.

------

Additional reading:

Boat, Noise unleashed cheap smartwatches on India. Rivals hurt them with dirt-cheap ones

Mamaearth sold investors on its FMCG dreams. Consumers had other plans

------

If you’ve been a regular listener of Two by Two, consider following the show wherever you get your podcasts and leave us a rating too. You can also write to us at twobytwo@the-ken.com.

This episode of Two by Two was produced by Hari Krishna. Rajiv CN did the mixing and mastering for this episode.

We’ll be back next Thursday with a new episode. See you then.