The mystery of usury (Highlights only)

Description

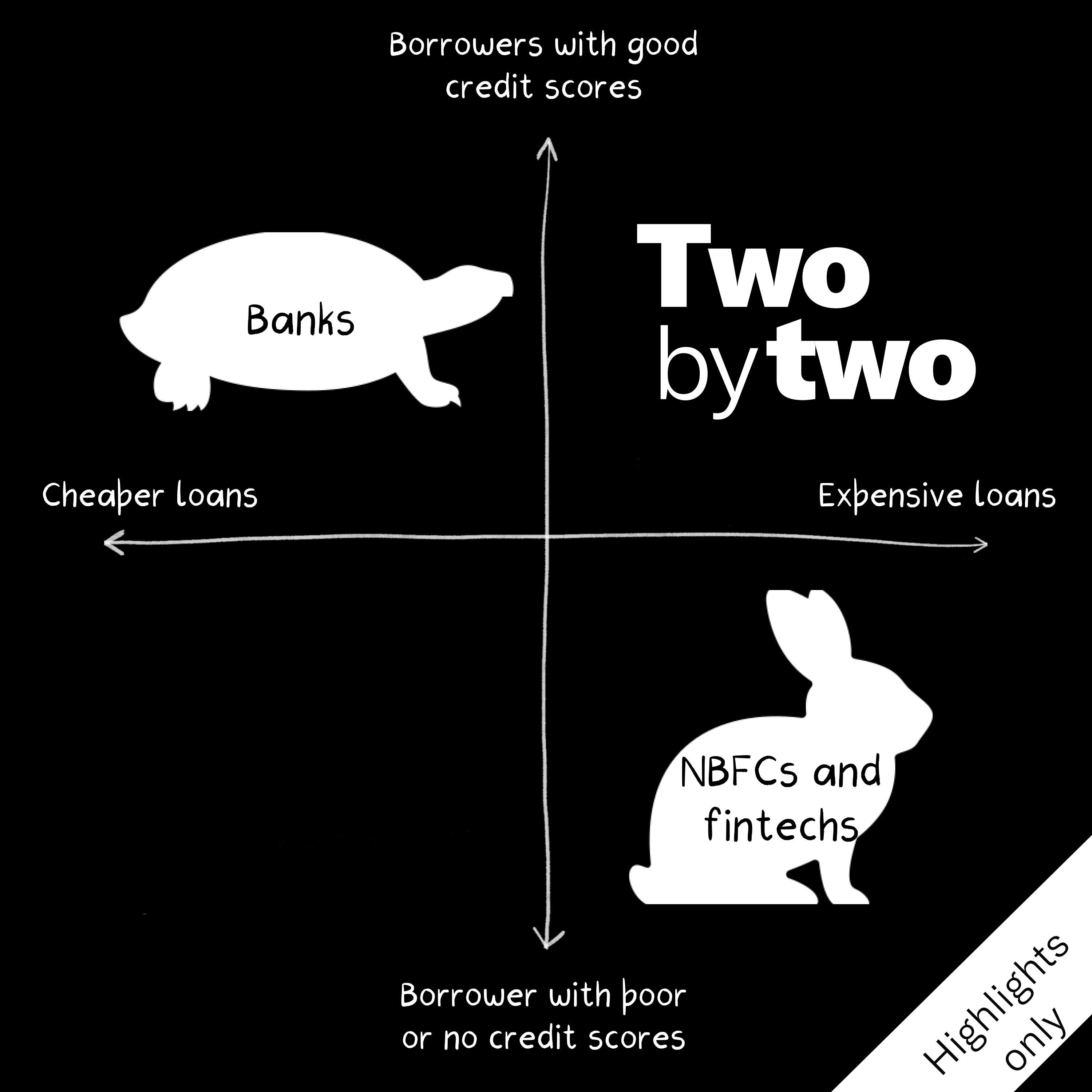

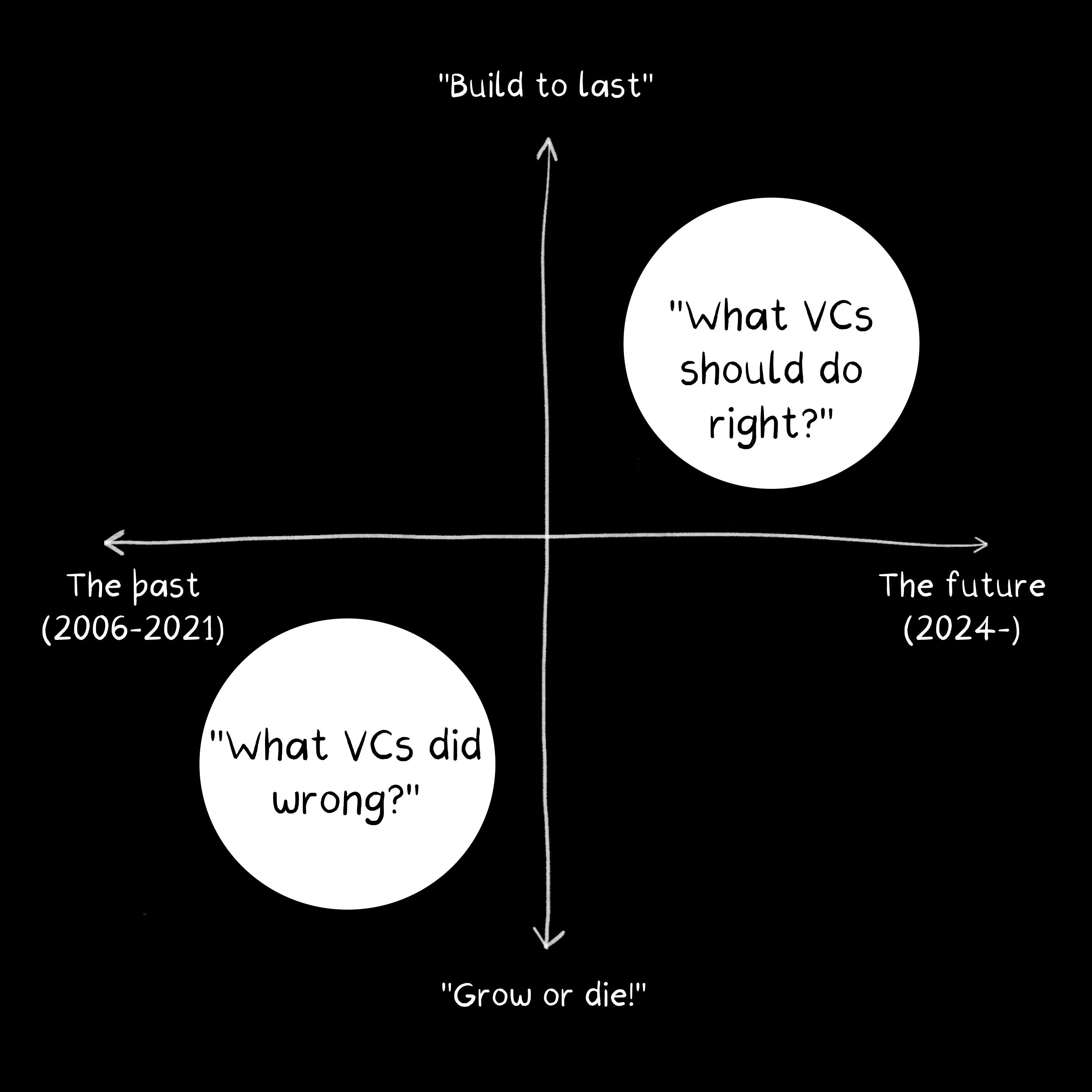

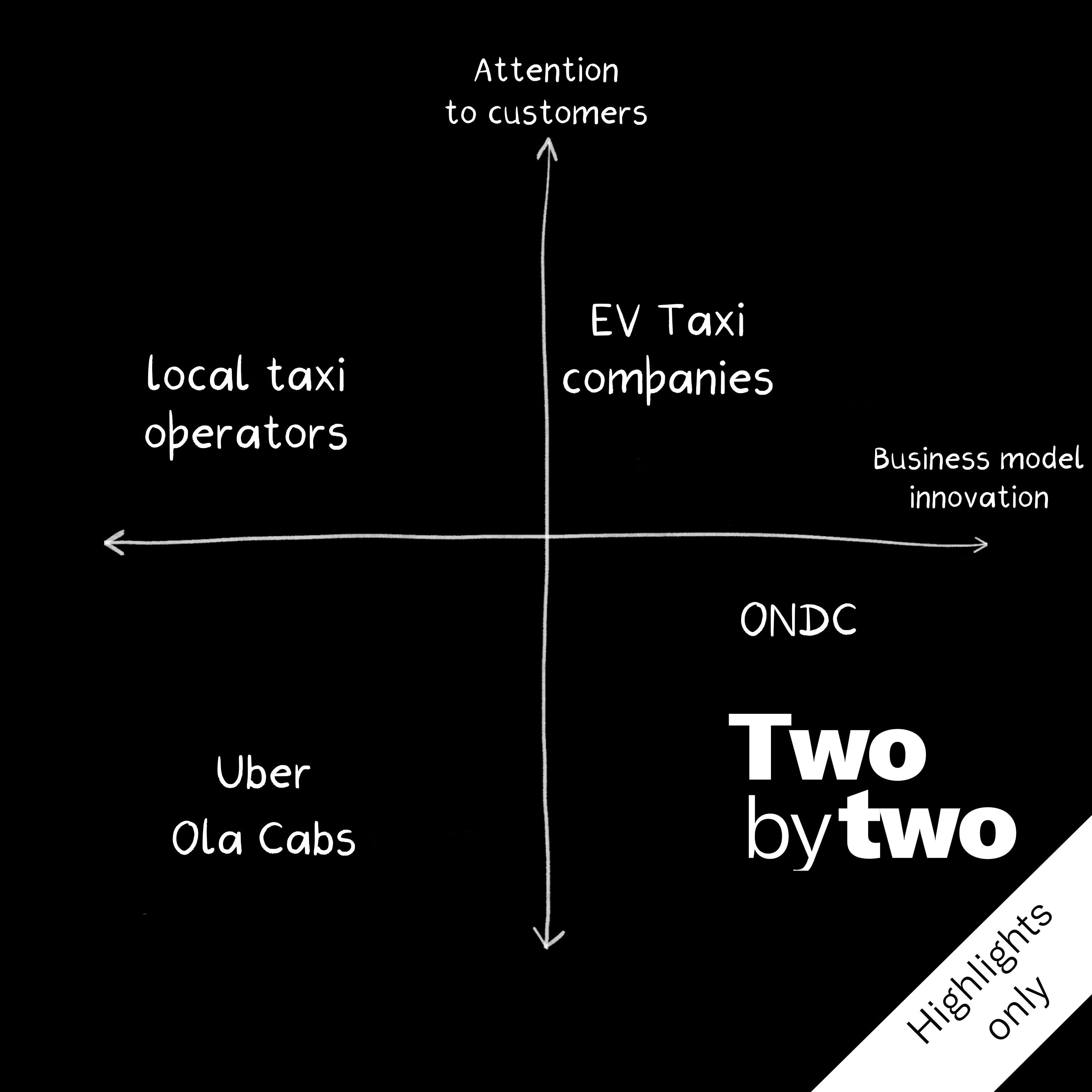

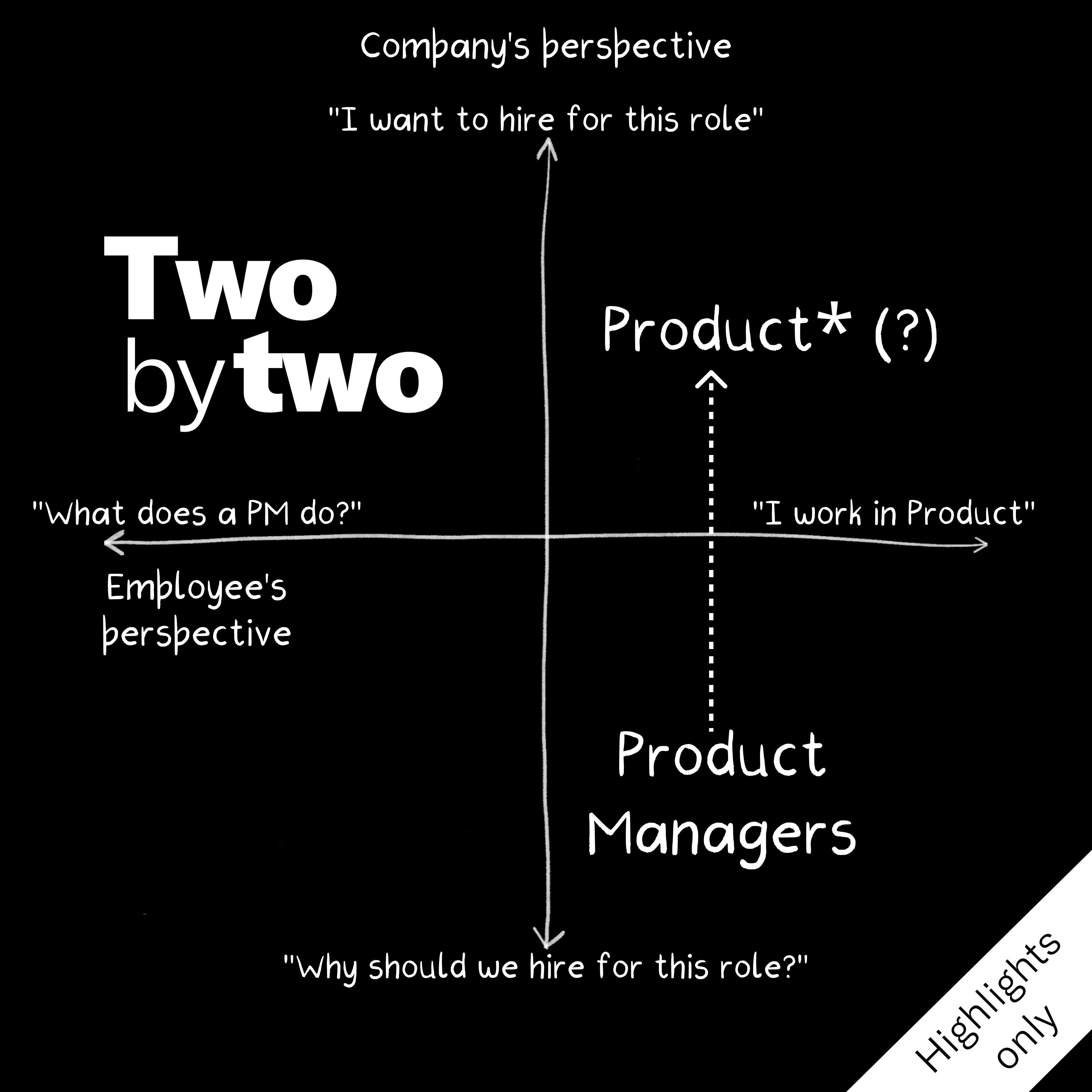

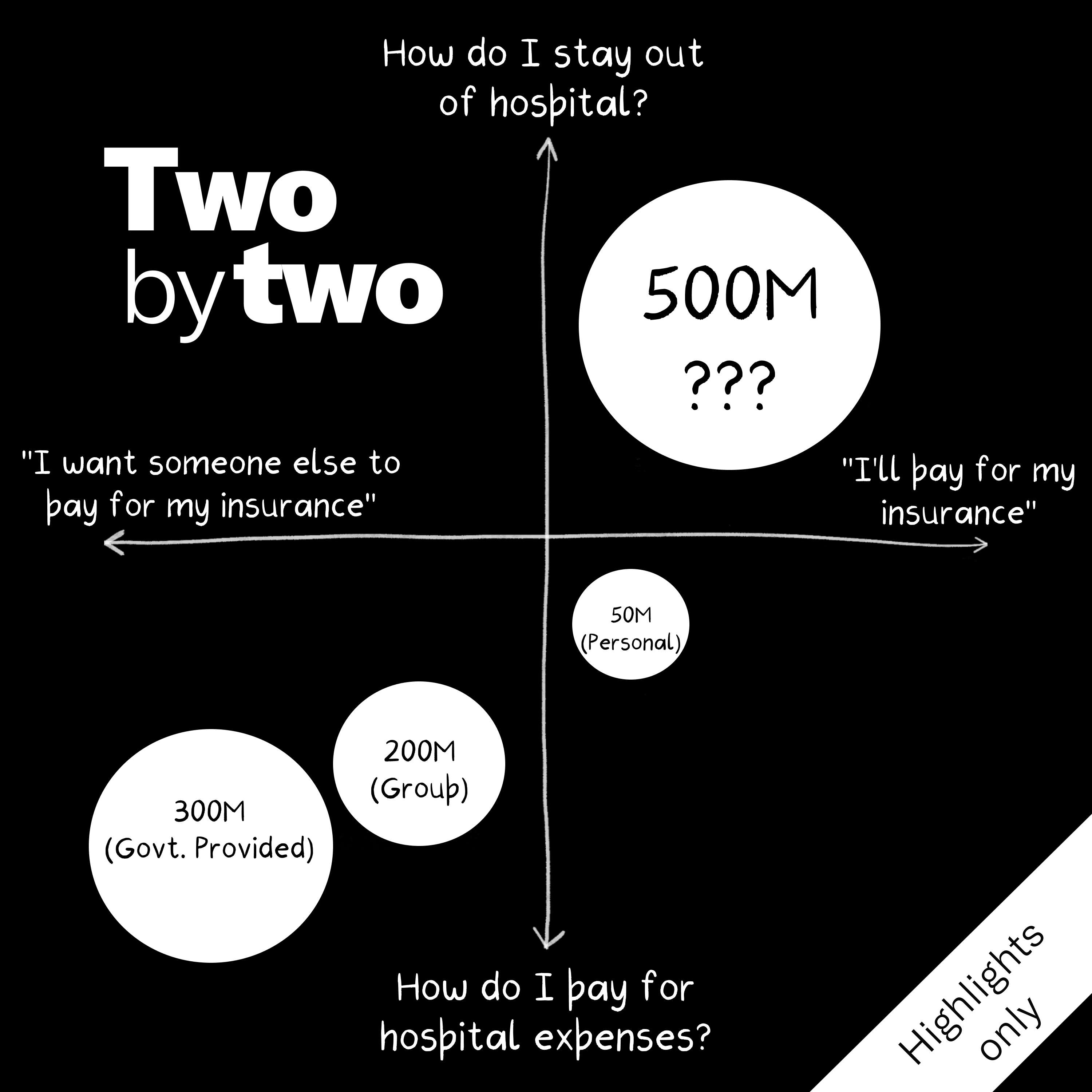

Fintech lending was supposed to be the bridge that would enable entrepreneurs, small businesses and even individuals across the country to get access to much-needed credit to build businesses. For millions of small and medium businesses, and even individuals seeking a personal loan, who’d otherwise not qualify for them (usually unsecured ones) from banks, these new-age financial institutions were the great hope and sources of credit.

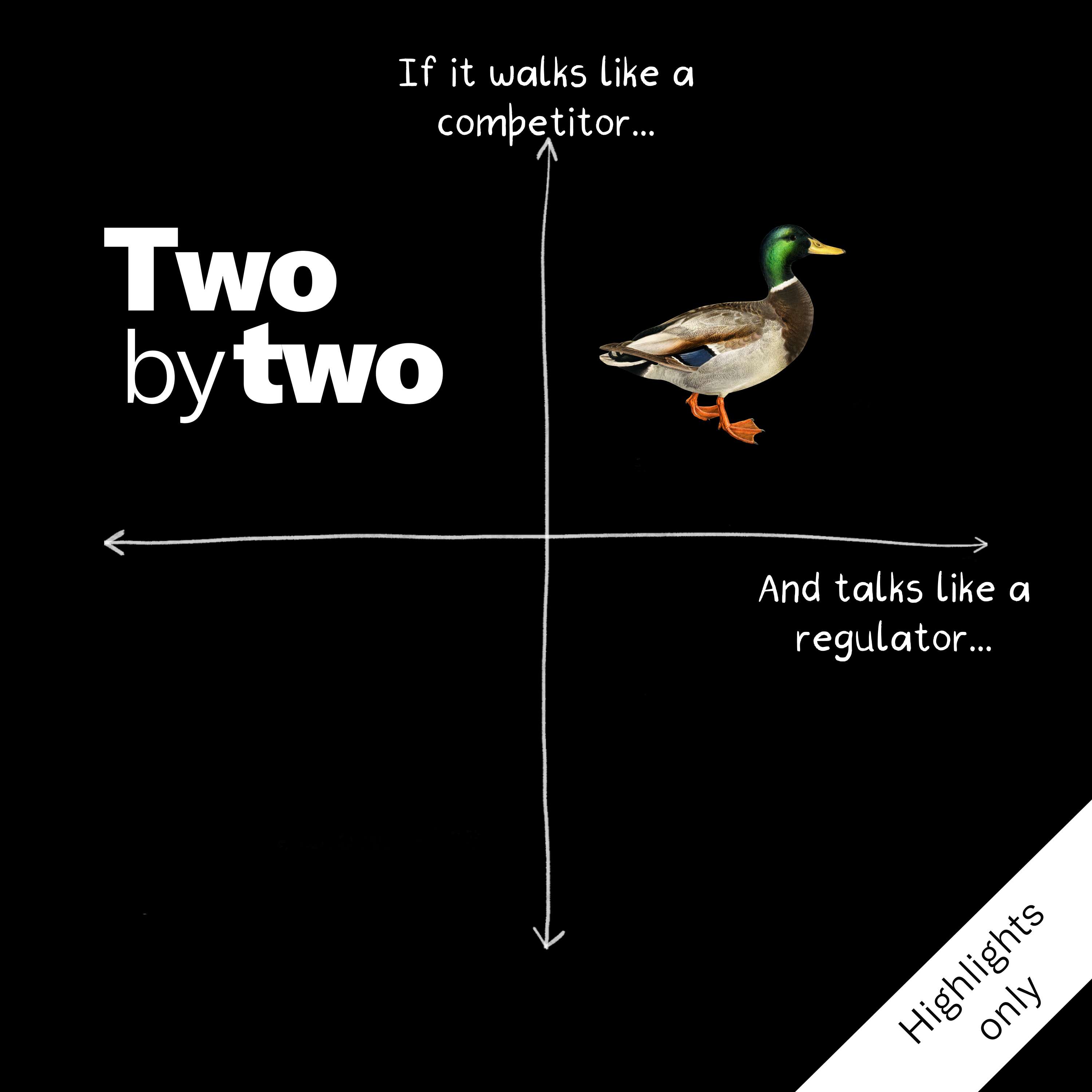

Then in October this year, the RBI, like it usually seems to do these days, suddenly swept in and took action. It halted the loan disbursement activities of four NBFCs: Asirvad Micro Finance Limited, Arohan Financial Services Limited, DMI Finance Private Limited, and Navi Finserv Limited. In fact, between the time we recorded this episode to when we released it, the RBI had lifted restrictions from one of these companies - Navi Finserv.

But why did the RBI do this?

Here are some hints as to why. Here are two quotes from the RBI about why they did this:

“Deviations were also observed in respect of Income Recognition & Asset Classification norms, resulting in evergreening of loans, conduct of gold loan portfolio, mandated disclosure requirements on interest rates and fees, outsourcing of core financial services, etc.”

And here’s the most interesting one:

“...unfair and usurious practices continued to be seen during the course of onsite examinations as well as from the data collected and analysed offsite”

That’s what the RBI said.

But what did it not say?

Joining hosts Rohin Dharmakumar and Praveen Gopal Krishnan for the discussion are guests Ateesh Tankha and Mithun Sundar. Ateesh Tankha is the founder of Alsowise Content Solutions and a keen observer and critic of the financial services space, and Mithun Sundar is the chief Partner Officer at Microsoft India and a former CEO of Lendingkart.

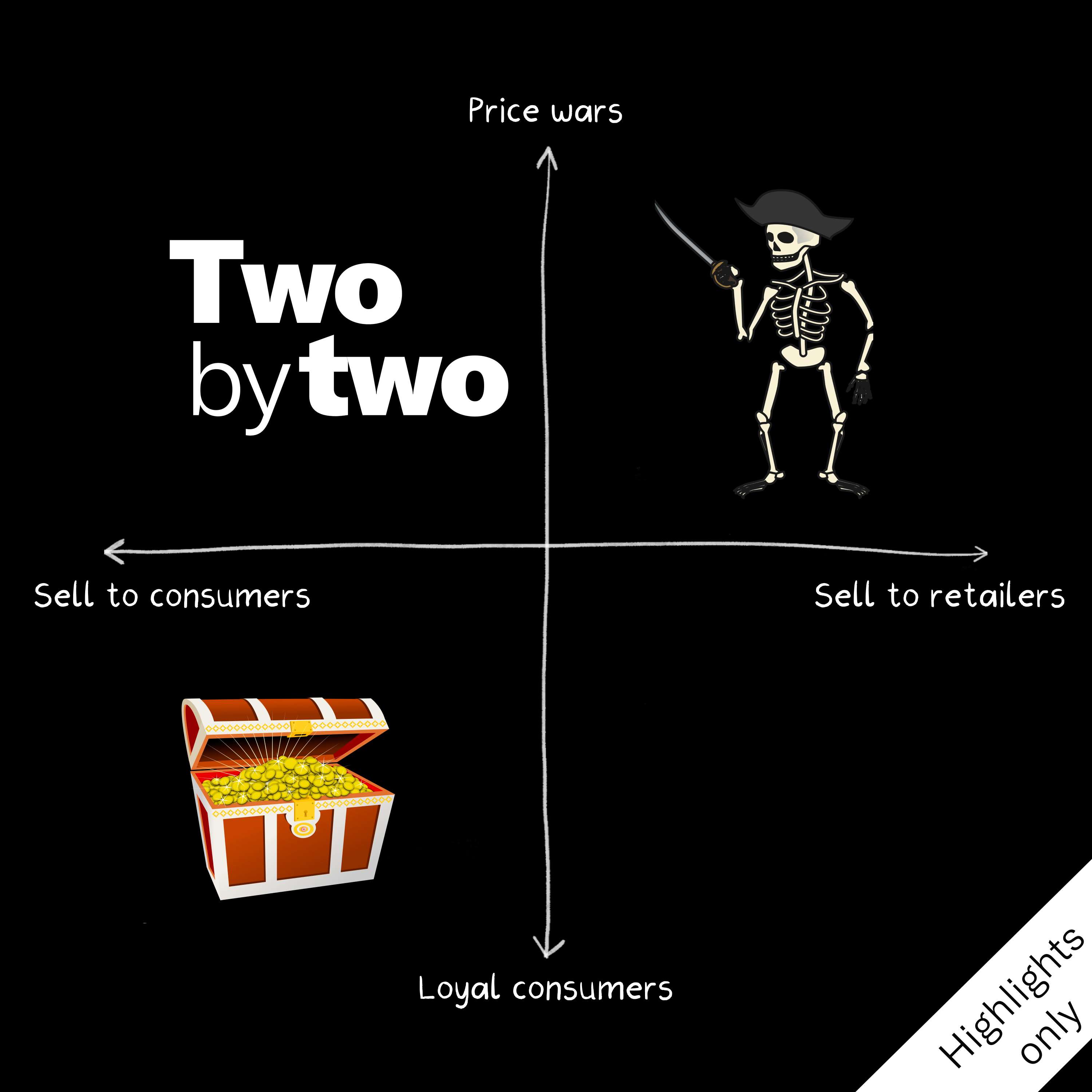

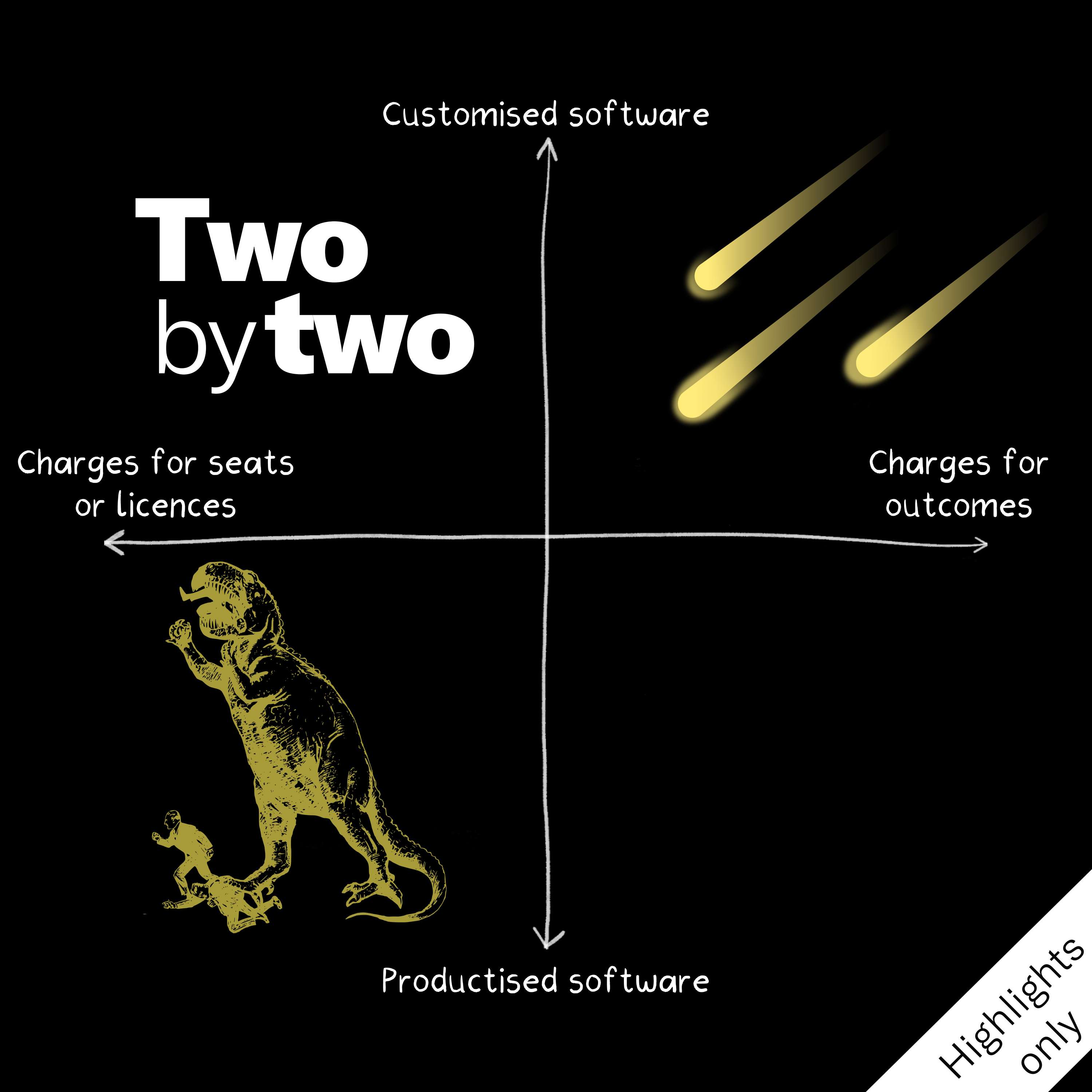

Throughout our conversation, both Mithun and Ateesh took the time to explain how digital lending works, why private banks are hesitant to enter the ring and play the game themselves, what’s up with the sky-high interest rates charged on these loans, and, of course, why credit is so important for our country's growth and where we’re falling short.

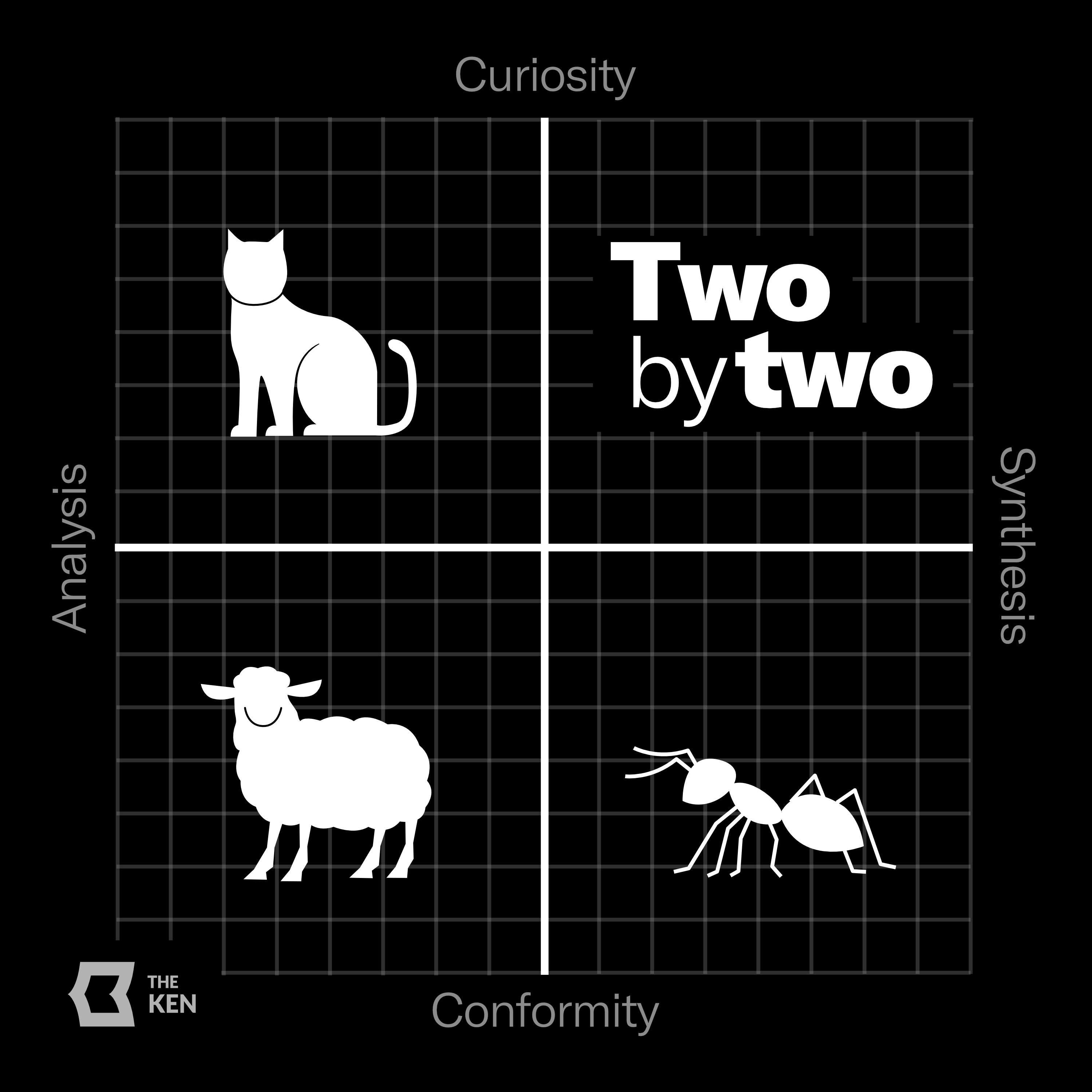

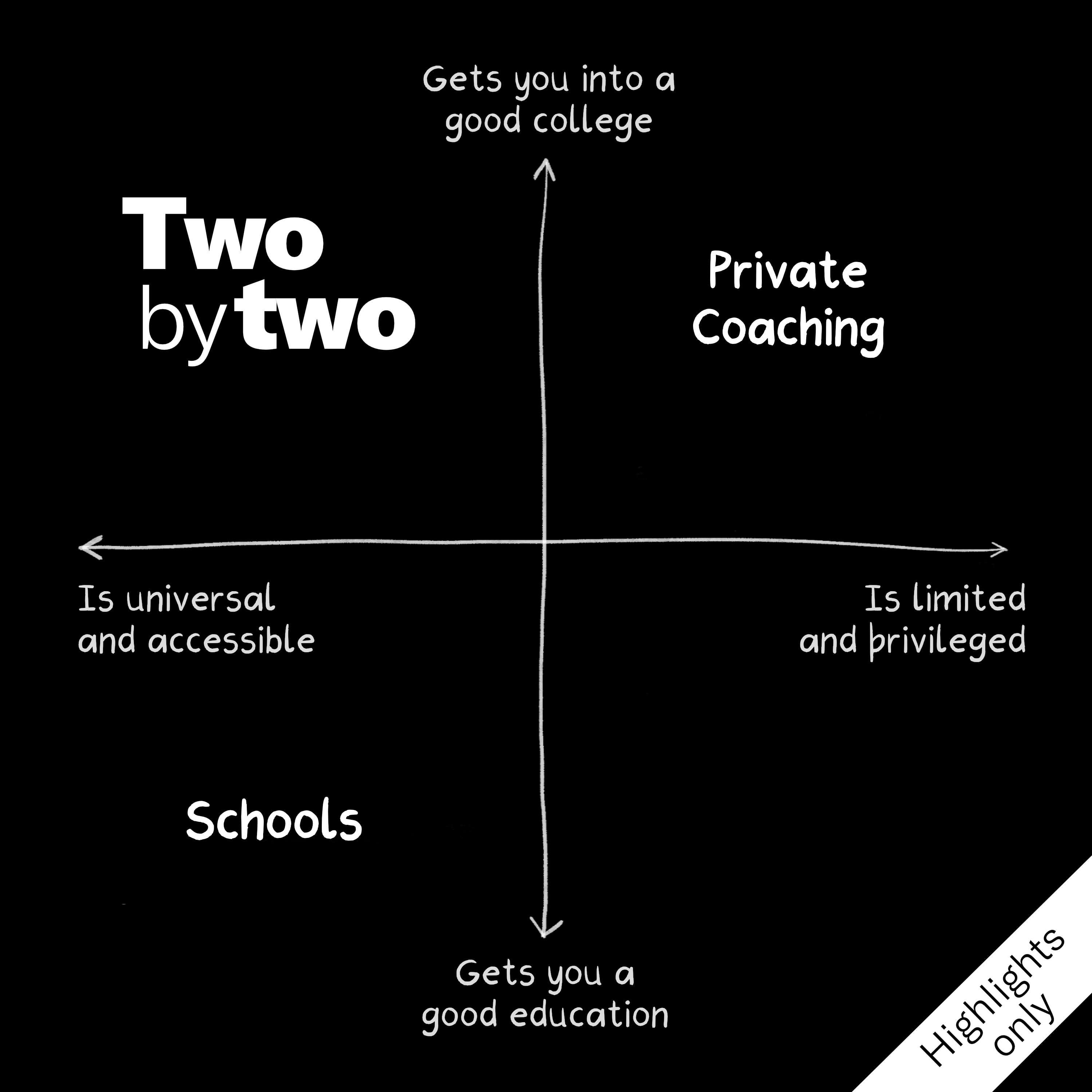

Welcome to episode 20 of Two by Two.

Additional reading:

RBI had better explain why Navi and DMI Finance are locked out of the loan market

For fintechs, RBI is the boy who cries wolf

---------

This is a shorter 'highlights only' episode. If you want to listen and get early access to the full episode, consider becoming a Premium subscriber to The Ken, which in addition to Two by Two, will also give you access to our long-form stories, Premiums newsletters and visual stories. Or if you just want to listen to Two by Two for now, for iOS users, we have enabled Premium subscription on Apple Podcasts.

You can sign up for The Two by Two newsletter here—it's free!

This episode was produced by Hari Krishna. Mixing and mastering for this episode is done by Rajiv CN. Write to us about what you thought of the episode at twobytwo@the-ken.com.