Episode 31: How To Start A Private FM - Integrative Clinic with No Money|Funding Options

Description

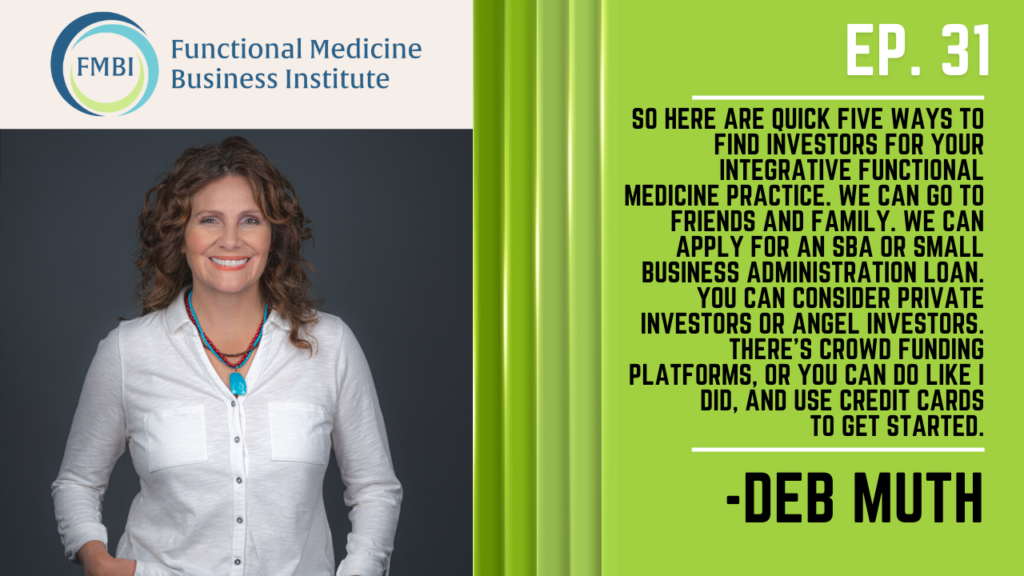

5 Key business investors for your functional-integrative medical practitioners.

How do I start an FM or Integrative medical practice with 0 money? Yup, I said 0 cash. It is possible and necessary. You can use investor cash, friends or family, SBA loans or Credit Cards to begin your practice today. It is easier than you think. There are people willing and ready to help you.

Do not miss these highlights:

02:17 In order to be successful, you have to think like an entrepreneur, you can't just think like an integrative practitioner.

04:19 When you ask friends and family to invest, make sure you outline the details before beginning and outline the responsibilities.

05:04 The SBA, Small Business Administration matches other agencies to find lenders that the SBA has already approved - guarantees certain loans, a generous repayment term with a lower interest rate for both parties.

05:24 Private investors can be either angel investors or venture capitalists in return for their investment, they will receive shares in the company or shares that are not publicly traded.

06:56 Crowdfunding platforms allows individuals and businesses to request funds online through a website that specialize in a specific form of funding.

10:35 Personal funding, life insurance policy that has some cash value, credit cards, or a loan could be a great way to start a small practice if there's not a lot of equipment involved that needs to be purchased.

Resources Mentioned

Join Us in the FMBI Mastermind Group on Facebook. You can find the Group at https://www.facebook.com/groups/5461914567153276/

<figure class="wp-block-image size-large">

</figure>

</figure>Transcript of Epsiode #31:

0:01

You're listening to the Functional Medicine Business Podcast featuring Dr. Deb, one of the most creative functional medicine business practitioners in her industry. She shares the wisdom and knowledge that she has gained over 25 years of functional medicine, a pioneer in functional medicine, scheduling, leadership and Practice Management. Dr. Deb has a wealth of knowledge and he's eager to share to help functional medicine become more productive, and for the practitioners and patients to live better lives. Our podcast shares the good and the bad of our industry because Dr. Deb knows the pain you live every day building a functional medicine practice with practical tools of how to manage money, taxes and patient care. She will discuss it all with you.

0:54

Welcome back to the functional MBI Podcast. Today we're going to talk about how to start a private functional medicine or integrative medicine clinic with no money. What are your funding options? I started my clinic with $0 outlaid out of my pocket and grew to a $4 million evaluation in less than 10 short years. There are lots of ways that we can get funding to start a Functional Medicine or Integrative Medical Practice, I'm going to share with you some of the five quickest ways to find investors to help you grow your idea of a functional medicine practice.

1:34

Now you have an idea and you want to start a functional or integrative medical practice, you have an idea that will impact the world in a very large way. Your idea is creative. It's different than anyone else that has set forth a functional medicine practice today. This makes you an entrepreneur, welcome to the family. You're not just a medical practitioner anymore with these big ideas, you're visionary, you're creating an idea to change the lives of many people in your practice. But in order to be successful, you have to think like an entrepreneur. You can't just think like an integrative practitioner. You're not just looking to create a business and health and wellness, you're looking to create a legacy for your family. You're looking to do something that you're passionate about, that brings you joy brings you happiness, and on top of it helps other people have an amazing life that they've been looking for. You have the idea. But how do you make this a reality. If it's a small business where you're just starting out with just yourself, it can be easily financed with credit cards or small business loan. But if it's a bigger idea, and you can't get this clinic off the ground with yourself, you need some investment help. If you're trying to put multiple providers under one roof, and you're trying to have different options in your clinic than what's offered in your local area. Like maybe you want to connect it to an organic food store. Or maybe you want it to be connected to a gym or a regenerative medicine practice. Or you want therapists and other disciplines under the same roof as you. Well, this can be a little bit more expensive to get off the ground. And it can take more planning on your part. And you may need to develop a little bit more of a team. To get this going. You need some help from somebody who's been successful before. So here are quick five ways to find investors for your integrative functional medicine practice. We can go to friends and family. We can apply for an SBA or Small Business Administration loan. You can consider private investors or angel investors. There's crowd funding platforms, or you can do like I did, and use credit cards to get started. When you ask friends and family to invest, you need to make sure your relationship is such that you can handle the good and the bad of this business. Treat it like any other loan and pay them back. Maybe there'll be a partner in your business with this family creates a unique situation and can come with its own set of complications. So make sure you outline the details before beginning. Make sure you outline the responsibilities, how they're going to get paid, when they're going to get paid and how they can expect their money to get a return on its invest submit, not just get it paid back

5:04

The SBA, so the Small Business Administration or SBA matches other agencies to find lenders that the SBA has already approved. The SBA also guarantees certain loans, meaning a generous repayment term with a lower interest rate for both parties. Private investors can be either angel investors or venture capitalists in return for their investment, they will receive shares in the company, or shares that are not publicly traded. Angel investors are high net worth individuals who have the money and the resources along with the knowledge and connections to make your practice successful. If an angel investor comes on board, it's likely you will not need any other investors. However, the angel investors expect a high return on their investment. They are very particular on what they invest in, and your business plans need to be solid. It was an angel investor who helped get Amazon and Apple off the ground. Angel investors usually want to have a voice in the day to day operations of the business and where the business is going. Venture capitalists are needed when a business is expanding, and perhaps leading into riskier ventures. Venture capitalists do not use their own money. They set up a fund that's used by others to buy shares in a company. They can help with startup, but typically, they come into an established business that has a solid management team in place and a proven track record. Venture capitalists usually require more return on investment than any other investor. Now there's crowdfunding platforms as well. And this allows individuals and businesses to request funds online through a website that specialize in a specific form of funding. This is where many people will put small amounts of money into a fund a business idea. The platform's best known for this is Kickstarter and Indigogo. There's also donation based crowdfunding. This is where money is contributed, and nothing is expected in return. And often this is helped. This is done to help other people who are in need. Now with a traditional Kickstarter or Indiegogo platform, usually people will provide money with a return have something in mind, like maybe they get the first product that you're developing, or they get a service or they get a plaque with their name, they get something that shows that they invested in your business.

7:55

Now there's also peer to peer lending or debt based crowdfunding. This is where similar businesses will find loans that match the person or the business with investors, applicants fill out an online form. And the peer to peer lending facility provides a credit score to a potential investor who then decides to lend out money or not. Investors received their money back plus interest. Equity crowdfunding is where investors taken ownership in the company, typically through shares, and the original investment is not paid back. But they'll receive shares of their profits in the company. If the company does well. If the company doesn't