Europe Market Open: European bourses set to open lower, China reportedly launched crackdown on NVIDIA AI chips

Update: 2025-10-10

Description

- APAC stocks were mostly lower following the negative handover from Wall Street.

- China reportedly launched a customs crackdown on NVIDIA (NVDA) AI chips, according to FT; US President Trump said maybe they will have to stop importing massive amounts from China.

- BLS is preparing to release a September US CPI report despite the shutdown, according to the NYT. Bloomberg sources suggested staff have been recalled for the preparation of the publication by the end of the month.

- Japanese Finance Minister Kato said they are recently seeing one-sided, rapid moves, and it is important for currencies to move in a stable manner reflecting fundamentals.

- European equity futures indicate an uneventful/subdued cash market open with Euro Stoxx 50 futures -0.1% after the cash market closed with losses of 0.4% on Thursday.

- Looking ahead, highlights include Norwegian CPI (Aug), Canadian Employment Report (Sep), US Uni. of Michigan Prelim. (Oct), Chinese M2/New Yuan Loans (Sep), Speakers including Fed’s Daly, Goolsbee & Musalem.

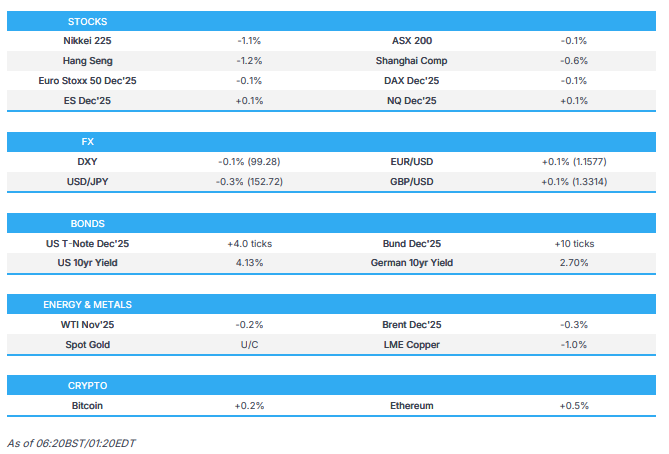

SNAPSHOT

<figure class="image"> </figure>

</figure>US TRADE

EQUITIES

- US stocks declined, which appeared to be a retracement of some of the moves seen in recent weeks, with stocks and precious metals selling off from record high territory, while the Dollar saw notable upside - there wasn't a specific headline for the driver, but likely profit taking or extended positioning/over crowded positions. US/China relations saw a knock, with China implementing rare earth export controls, and Trump implied "maybe" they will have to stop importing massive amounts from China.

- The weakness in stocks was broad-based, with the majority of sectors in the red, and the equal-weighted S&P lagged. Conversely, the Nasdaq "outperformed" thanks to continued gains in NVIDIA (NVDA), which hit highs of USD 195/shr.

- SPX -0.28% at 6,735, NDX -0.15% at 25,098, DJI -0.52% at 46,358, RUT -0.61% at 2,469.

- Click here for a detailed summary.

TARIFFS/TRADE

- China reportedly launched a customs crackdown on NVIDIA (NVDA) AI chips, according to FT, which reported that China stepped up enforcement of its controls on chip imports, as Beijing seeks to wean the country’s tech companies away from US products such as NVIDIA's AI processors.

- US President Trump said maybe they will have to stop importing massive amounts from China, and he wants to discuss soybeans with Chinese President Xi, while he said regarding China export controls, that Commerce Secretary Lutnick and Treasury Secretary Bessent will sort out.

- US President Trump said tariffs are only good if you want your country to be rich, influential, and powerful, while he added that if you want your country to be a third-world country, you should vote against tariffs.

- US Treasury Secretary Bessent said he believes the Chinese will come back at the end of the season and buy soybeans, while Bessent said India is going to start rebalancing over the next few weeks and months, in favour of US oil and will buy less Russian oil.

- US President Trump's administration said the US and Saudi Arabia are making progress on an agreement to allow US chip companies to export semiconductors to Saudi Arabia and could finalise a deal soon, according to WSJ.

- US Commerce Department reportedly probes Singapore company Megaspeed over chip export rules to see if it helped China companies avoid chip rules, according to NYT, which noted that Megaspeed is set to purchase USD 2bln of NVIDIA (NVDA) AI technology in the next year.

- Japan's government said tariff negotiator Akazawa spoke with US Commerce Secretary Lutnick by phone, and they confirmed to smooth the implementation of the trade agreement to further strengthen ties.

- Indian PM Modi said he spoke with US President Trump and reviewed the good progress achieved in trade negotiations, while they agreed to stay in close touch over the coming weeks.

NOTABLE HEADLINES

- Fed Governor Barr (voter) said uncertainty about both inflation and jobs warrants a cautious approach to any further interest rate cut, while he added that the rate cut in September was appropriate, but current policy rates are still modestly restrictive. Furthermore, he said the current outlook poses challenges for judging the stance of monetary policy and deciding the right path forward.

- Fed Governor Barr (voter) said he does not think there is a generalised spillover of tariffs into services inflation, and some components of services inflation stem from higher stock prices. Barr added there's a lot of resilience in the US economy and that the effects of AI in the short term are likely smaller than anticipated, while AI is likely to have profound effects on the economy in the medium and long term.

- Fed's Kashkari (2026 voter) said he "basically agrees" with everything that Fed's Barr said.

- Fed's Daly (2027 voter) said inflation has come in much less than had feared and the labour market is to a point where softening looks like it could be more worrisome if they don't risk manage it, while she added that policy is still modestly restrictive after the September rate cut and the Fed is also projecting more cuts, part of risk management.

- Federal Reserve Board announces expanded operating days of two large-value payments services, Fedwire® Funds Service and the National Settlement Service (NSS), to include Sundays and weekday holidays.

- US Treasury Secretary Bessent is finalising the first round of interviews for the next Fed Chair this week, according to FBN citing sources. It was also reported that Former Fed governor Larry Lindsey withdraws name from consideration for US Fed Chair position, according to CNBC.

- US President Trump said some Democrats are calling him to reopen the government, and he will be making permanent cuts to Democratic programmes in the shutdown.

- US House Speaker Johnson said the House remains on a 48-hour notice to return to Washington, according to Punchbowl, while it was noted that "This is a sign that the House does not plan to come back next week -- as of now".

- US Bureau of Labor Statistics is preparing to release a September CPI report despite the shutdown, according to NYT. Bloomberg sources suggested staff have been recalled for the preparation of the publication of the report by the end of the month. US CPI was scheduled to be released on October 15th.

- New York Attorney General Letitia James was indicted by the US Department of Justice, while she stated that the indictment is nothing more than a continuation of the President's desperate weaponisation of the justice system, and she will fight these baseless charges aggressively.

- US President Trump said they made pharmaceutical deals with numerous companies and the US is winning disputes with countries on drug pricing.

- US President Trump will make an announcement in the Oval Office from 17:00 EDT/22:00 BST on Friday.

- US Agriculture Secretary Rollins said once the shutdown is over, they will be able to roll out the programme for farmers.

APAC TRADE

EQUITIES

- APAC stocks were mostly lower following the negative handover from Wall Street, where the stock market and gold prices pulled back from record levels, while the KOSPI outperformed against its regional counterparts on return from its extended holiday.

- ASX 200 lacked direction amid quiet catalysts and as weakness in the mining and materials sectors offset the strength in tech and financials.

- Nikkei 225 retreated following the firmer-than-expected PPI data, although participants also digested earnings updates, including from index heavyweight Fast Retailing, which was the biggest gainer after it reported a double-digit percentage increase in 6-month net.

- Hang Seng and Shanghai Comp conformed to the downbeat mood as trade frictions resurfaced following China's announcement of export controls on rare earth and items related to lithium batteries, while US President Trump commented that maybe they will have to stop importing massive amounts from China.

- US equity futures eked marginal gains in a frail attempt to nurse some of the prior day's losses.

- European equity futures indicate an uneventful/subdued cash market open with Euro Stoxx 50 futures -0.1% after the cash market closed with losses of 0.4% on Thursday.

FX

- DXY traded flat overnight and took a pause from the recent strengthening trend, with comments from Fed officials doing little to spur price acti

Comments

In Channel