European Market Open: Positive sentiment after Trump pours cold water on recent US-China tensions

Update: 2025-10-13

Description

- US President Trump announced on Friday that the US is to impose a tariff of 100% on China beginning on November 1st, which will be over and above any tariffs that they are currently paying, while US export controls on critical software will also start on November 1st.

- US President Trump posted on Sunday, “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!”

- APAC stocks began the week in the red as the region reacted to last Friday's Trump tariff threats and the subsequent Wall St sell-off, although US equity futures rebounded due to the softer tone from Trump over the weekend, while Japanese markets were shut for a holiday.

- European equity futures indicate a positive cash market open with Euro Stoxx 50 futures up 0.3% after the cash market closed with losses of 1.7% on Friday.

- US BLS said it will publish the September CPI report on Friday, 24th October 2025, at 08:30 EDT/13:30 BST.

- Looking ahead, highlights include German WPI (Sep), OPEC MOMR, Speakers including BoE’s Mann, Fed’s Paulson & RBA’s Hauser. Holidays: US Columbus Day (US bond market will be closed) & Canadian Thanksgiving.

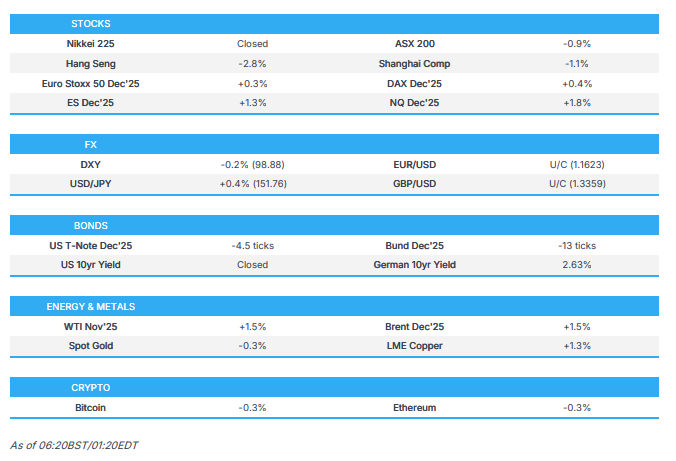

SNAPSHOT

<figure class="image"> </figure>

</figure>US TRADE

EQUITIES

- US stocks plummeted on Friday and havens rallied after US President Trump reignited trade concerns as he threatened massive tariffs on China in response to China's rare earth export controls and noted that other countermeasures are also under consideration. He also said there is seemingly no need for an in-person meeting with Chinese President Xi, given the escalations.

- The post on Truth hit global equities hard, with all indices in the red and sectors also whacked, aside from Consumer Staples. The dollar was sold on the news as it raises trade uncertainty and antipodes were hit the hardest, given their exposure to China, while the Yen and Swiss Franc outperformed. Furthermore, oil prices were sold in the risk-off trade, adding to the post-Gaza ceasefire downside.

- SPX -2.71% at 6,553, NDX -3.49% at 24,222, DJI -1.90% at 45,480, RUT -3.01% at 2,395.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump announced on Friday that the US is to impose a tariff of 100% on China beginning on November 1st, which will be over and above any tariffs that they are currently paying, while US export controls on critical software will also start on November 1st.

- US President Trump said on Friday that he has not cancelled the meeting with Chinese President Xi and assumes they might have it. Furthermore, Trump posted on Sunday “Don’t worry about China, it will all be fine! Highly respected President Xi just had a bad moment. He doesn’t want Depression for his country, and neither do I. The U.S.A. wants to help China, not hurt it!!!”

- US VP Vance called on Beijing to "choose the path of reason" amid escalating trade tensions with China and said President Trump has "far more cards" if an aggressive response is required.

- China’s Commerce Ministry said the October 9th rare earth export control measures are legitimate and designed to better safeguard world peace and regional stability, while it added that rare earth export control measures do not constitute a ban on exports, and applications that meet the requirements will be granted licences. MOFCOM said the US announcement of 100% tariffs on China represents a classic case of double standards, and since the US-China talks in Madrid, the US has continuously introduced a series of new restrictions against China. It also stated that China’s position on tariff wars has been consistent, whereby they do not want to fight but are not afraid to fight. Furthermore, China urged the US to promptly correct its erroneous practices and warned that should the US persist in its course, China will resolutely take corresponding measures to safeguard its legitimate rights and interests, as well as noted that the US decision to impose port fees on relevant Chinese vessels meant China “had no choice but to take countermeasures”, and that China’s decision to impose a special port fee on US-related vessels are necessary defensive actions.

- China Customs spokesperson said US measures on shipping fees are a typical show of unilateralism and protectionism, while the spokesperson added that China’s countermeasures are necessary and are defensive actions. Furthermore, it was stated that China’s measures aim to safeguard the legitimate rights of Chinese industries and firms, while they hope the US can face up to its own 'mistakes' and that the US gets back to the correct track of communication and negotiations.

- USTR Greer said the US reached out for a call with China after the export controls announcement, but Beijing deferred. It was also reported that Greer said significant progress was made in trade talks with Cambodia that will allow more export opportunities for US farmers.

- US said it is taking action to defend America from the UN’s first global carbon tax and that the administration unequivocally rejects this proposal, while the US is considering actions against nations that support this global carbon tax on American consumers. Furthermore, the US said possible actions include probes, visa restrictions, commercial penalties, additional port fees and sanctions on officials.

- Canadian Industry Minister Joly said the government is working on a new industrial strategy that seeks to open new markets for exporters and prioritise domestic procurement in the face of US tariffs, which have hurt steel, aluminium, forestry and automotive companies. It was also reported that Canadian Trade Minister Sidhu spoke with India’s Commerce Minister Goyal.

- Switzerland and China will accelerate trade discussions on upgrading their free-trade agreement, following a meeting between Swiss Foreign Minister Cassis and Chinese counterpart Wang on Friday.

NOTABLE HEADLINES

- Fed's Musalem (2025 voter) said on Friday that the Fed’s goals are in tension, inflation is running high and the labour market is showing signs of potential weakness. Musalem said a balanced approach to monetary policy only works if inflation expectations are anchored, and they are less able to respond to short-term labour market fluctuations if inflation expectations become unanchored. Furthermore, he is open-minded on a potential further rate cut as further insurance and believes they should tread with caution, as well as noted limited room for further easing before policy gets overly accommodative.

- Federal Reserve said on Friday that Industrial Production data will not be released on October 17th because it relies on other government data that is not available.

- US BLS said it will publish the September CPI report on Friday, 24th October 2025, at 08:30 EDT/13:30 BST.

- US President Trump said on Friday that layoffs will be Democrat-oriented and it will be a lot of people. Trump separately commented that he is using his authority to direct the defence secretary to use all available funds to get troops paid on October 15th, while he added they identified funds to do this and Secretary Hegseth will use them to pay troops.

- US VP Vance said they have to lay off some federal workers to preserve essential benefits, while he responded that the ‘President is looking at all his options’ when asked if Trump is considering invoking the Insurrection Act. Furthermore, he said that the Justice Department is not acting on orders by President Trump to prosecute his political opponents.

- White House official said on Friday that federal layoffs will be in the thousands. It was also reported that the Trump administration laid off dozens of CDC officials, according to NYT.

- New research suggested that the upcoming easing of capital rules could unlock USD 2.6tln in lending capacity for US banks and increase pressure on regulators elsewhere to follow suit, according to FT.

APAC TRADE

EQUITIES

- APAC stocks began the week in the red as the region reacted to last Friday's Trump tariff threats and the subsequent Wall St sell-off, although US equity futures rebounded due to the softer tone from Trump over the weekend, while Japanese markets were shut for a holiday.

- ASX 200 was dragged lower by underperformance in tech, energy, telecoms and defensives, while gold miners are at the other end of the spectrum after prices rebounded back above the USD 4,000/oz level to touch fresh record highs.

- KOSPI retreated amid tech weakness, and with index heavywe

Comments

In Channel