European Market Open: European equity futures are mildly softer, French PM to present budget

Update: 2025-10-14

Description

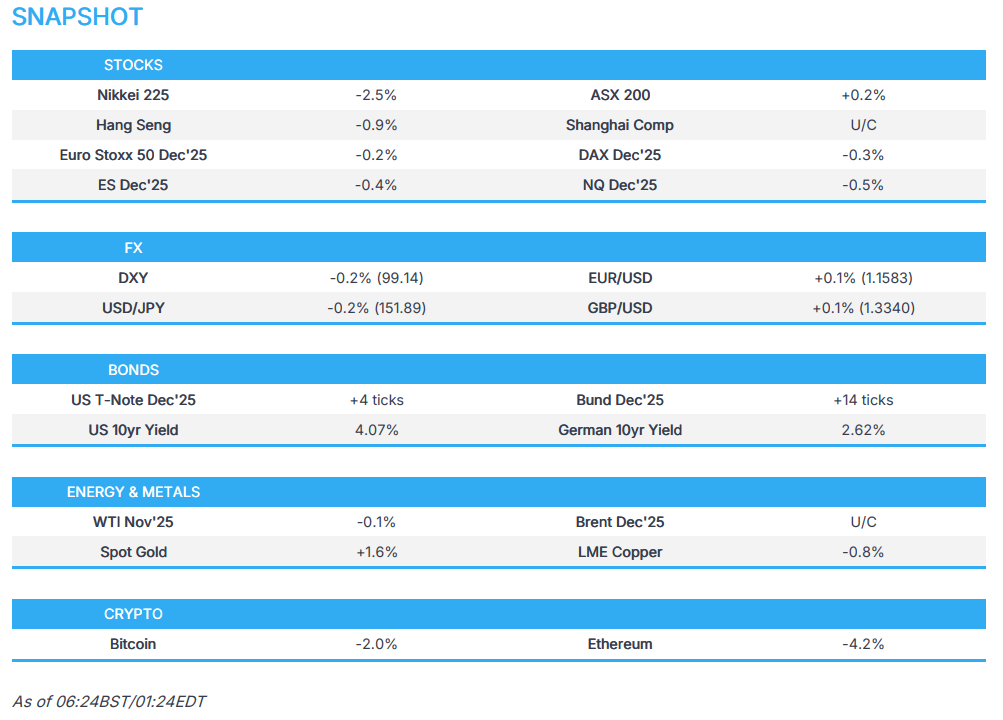

- APAC stocks were mixed following the rebound on Wall St; Japan underperformed on return from holiday/reacted to the ruling coalition split.

- China's MOFCOM announced that it is taking countermeasures against five US-linked firms; said the US cannot have talks while threatening new restrictions.

- European equity futures indicate a mildly lower cash market open with Euro Stoxx 50 futures down 0.2% after the cash market closed with gains of 0.7% on Monday.

- DXY is a touch softer, antipodeans lag, JPY picked up as the risk sentiment soured, EUR/USD is on the rise and eyeing 1.16.

- French PM Lecornu's government is to present a budget aiming to reduce the deficit to 4.7% by end-2026, according to La Tribune.

- Looking ahead, highlights include UK Unemployment/Wages (Aug), German ZEW (Oct), US NFIB (Sep), IEA OMR, Fed Discount Rate Minutes, ECB’s Cipollone & Villeroy, BoE’s Bailey & Taylor, Fed’s Powell, Waller, Collins & Bowman, BoC’s Rogers, RBA’s Hunter & Hauser, Supply from Netherlands, Italy & Germany

- Earnings from BlackRock, JPMorgan, Goldman Sachs, Citi, Wells Fargo, Johnson & Johnson, Bellway & LVMH.

SNAPSHOT

<figure class="image"> </figure>

</figure>US TRADE

EQUITIES

- US stocks rallied to recoup some of the downside seen on Friday that had been triggered by US President Trump's tariff offensive against China, with the rebound spurred by the softer rhetoric over the weekend by Trump who said everything will be "fine" with China, while Treasury Secretary Bessent also stated that 100% tariffs do not have to happen and that things are still in place for a Trump meeting with Chinese President Xi. The toning down of aggression on China trade from Trump had boosted sentiment and largely reversed a lot of the price action seen on Friday, while outperformance was seen in the Nasdaq and Russell, with tech gains buoying the former following a slew of deals, namely the OpenAI and Broadcom (AVGO) strategic partnership.

- SPX +1.55% at 6,654, NDX +2.18% at 24,750, DJI +1.30% at 46,073, RUT +2.62% at 2,457.

- Click here for a detailed summary.

TARIFFS/TRADE

- China officially began special port fees for US ships, while it was earlier reported that China issued implementation rules on port fees on US ships and exempted China-made ships owned by US companies from port fees, while it is to adjust special port fees on US ships as needed.

- China's MOFCOM responded to the US saying it has proposed talks with China after rare earth restrictions, in which MOFCOM stated the US cannot have talks while threatening to intimidate and introduce new restrictions, which is not the right way to get along with China, while it urged the US to correct its “wrong practices” as soon as possible and show sincerity in talks with China. It also stated that export curbs are not an export ban and do not prohibit exports. Furthermore, it said they held working-level talks on Monday and noted that both sides have maintained communication under the framework of the China-US economic and trade consultation mechanism. However, MOFCOM later announced that it is taking countermeasures against five US-linked firms.

- China Transport Ministry said it opened an investigation into the impact of US 301 tariffs on China's shipping industry.

NOTABLE HEADLINES

- Fed's Paulson (2026 voter) said she favours a gradual path of rate cuts over this year and into next, as well as noted that monetary policy should be focused on balancing risks to maximum employment and price stability. Paulson said gradual rate cuts should keep the job market close to full employment, and it is unclear what the neutral rate is, while she argued for caution in the rate cut pace and said the September Fed rate cut size made sense. Paulson said she sees policy as modestly restrictive and views easing along the lines of the median Summary of Economic Projections policy path as appropriate.

- US House Republicans are holding a conference call on Tuesday at 11:30 EDT/16:30 BST, according to Punchbowl's Weiss citing sources.

APAC TRADE

EQUITIES

- APAC stocks were mixed following the rebound on Wall St and with underperformance in Japanese markets as they reopened from the extended weekend and reacted to the recent US-China tariff tensions, as well as the Japanese ruling coalition split.

- ASX 200 struggled for direction as weakness in the financial and consumer-related sectors offset the gains in materials and miners, with the latter helped by the recent upside in metal prices and with Rio Tinto gaining following its quarterly activity update.

- Nikkei 225 underperformed as participants returned from the holiday closure and reacted to the recent US-China trade frictions and political uncertainty in Japan, while there were late headwinds after reports of China trade-related actions against the US.

- Hang Seng and Shanghai Comp are lower amid the backdrop of the tumultuous trade/tariff related headlines in which the recent softening in tone by the US on China was followed by reports overnight that China's MOFCOM is taking countermeasures against five US-linked firms and that China's Transport Ministry opened an investigation into US 301 tariffs impact on China shipping industry.

- US equity futures (ES -0.4%, NQ -0.5%) were mildly pressured following the US-China headlines, while markets also await the start of earnings season.

- European equity futures indicate a mildly lower cash market open with Euro Stoxx 50 futures down 0.2% after the cash market closed with gains of 0.7% on Monday.

FX

- DXY was uneventful for most of the session after ultimately strengthening on US President Trump's softer rhetoric on China, which Treasury Secretary Bessent followed on from and stated that 100% tariffs do not have to happen and that Trump is on track to meet with Chinese President Xi in Korea. There were some comments from Fed’s Paulson (2026 voter), who spoke for the first time since becoming President of the Philly Fed, in which she ultimately took a dovish/neutral tone and stated that she is aligned with the median dot plot for the rate view by year-end and called for gradual rate cuts over this year and into next. However, the DXY later weakened on reports that China's MOFCOM is taking countermeasures against five US-linked firms and that China's Transport Ministry opened an investigation into the impact of US 301 tariffs on China's shipping industry.

- EUR/USD rebounded from the prior day's lows but with the recovery limited as attention also remains on French politics with the government to present a budget aiming to cut costs by EUR 31bln, which would cut EUR 17bln in spending and aims to reduce the deficit to 4.7% by end-2026.

- GBP/USD traded rangebound in the absence of any notable drivers and with participants awaiting UK employment and average earnings data.

- USD/JPY ultimately declined as risk sentiment deteriorated late in the session following China's trade measures against the US.

- Antipodeans price action was little changed for the majority of Asia-Pac trade with a lack of fireworks from the RBA September meeting minutes, which stated that the Board agreed no need for immediate reduction in the cash rate, and that future policy decisions are to be cautious and data dependent. However, there were slight headwinds later in the session following the latest US-China trade-related headlines.

FIXED INCOME

- 10yr UST futures were choppy following the recent lull owing to the closure of the US bond market on Monday for Columbus Day, but later gained as risk appetite soured following some negative US-China trade-related headlines.

- Bund futures edged higher but with the upside capped ahead of German ZEW data and this week's supply.

- 10yr JGB futures held on to most of Friday's spoils on return from the extended weekend with prices underpinned by US-China trade frictions.

COMMODITIES

- Crude futures kept afloat after gaining yesterday alongside the rebound in risk appetite, although upside was capped with the latest OPEC MOMR maintaining 2025 and 2026 global oil demand growth forecasts unchanged from the prior month’s assessment, while there were some recent comments from Saudi Aramco's CEO that oil demand is resilient and there is large growth potential, but also noted that they can sustain oil production at a maximum capacity of 12mln bpd for a year without additional investments.

- Spot gold extended its ongoing rally and printed a fresh record high after breaching above USD 4150/oz.

- Copper futures marginally pulled back from yesterday's peak amid the somewhat mixed overnight risk appetite.

CRYPTO

- Bitcoin steadily declined throughout the session with prices reverting to beneath the USD 114k level.

NOTABLE ASIA-PAC HEA

Comments

In Channel