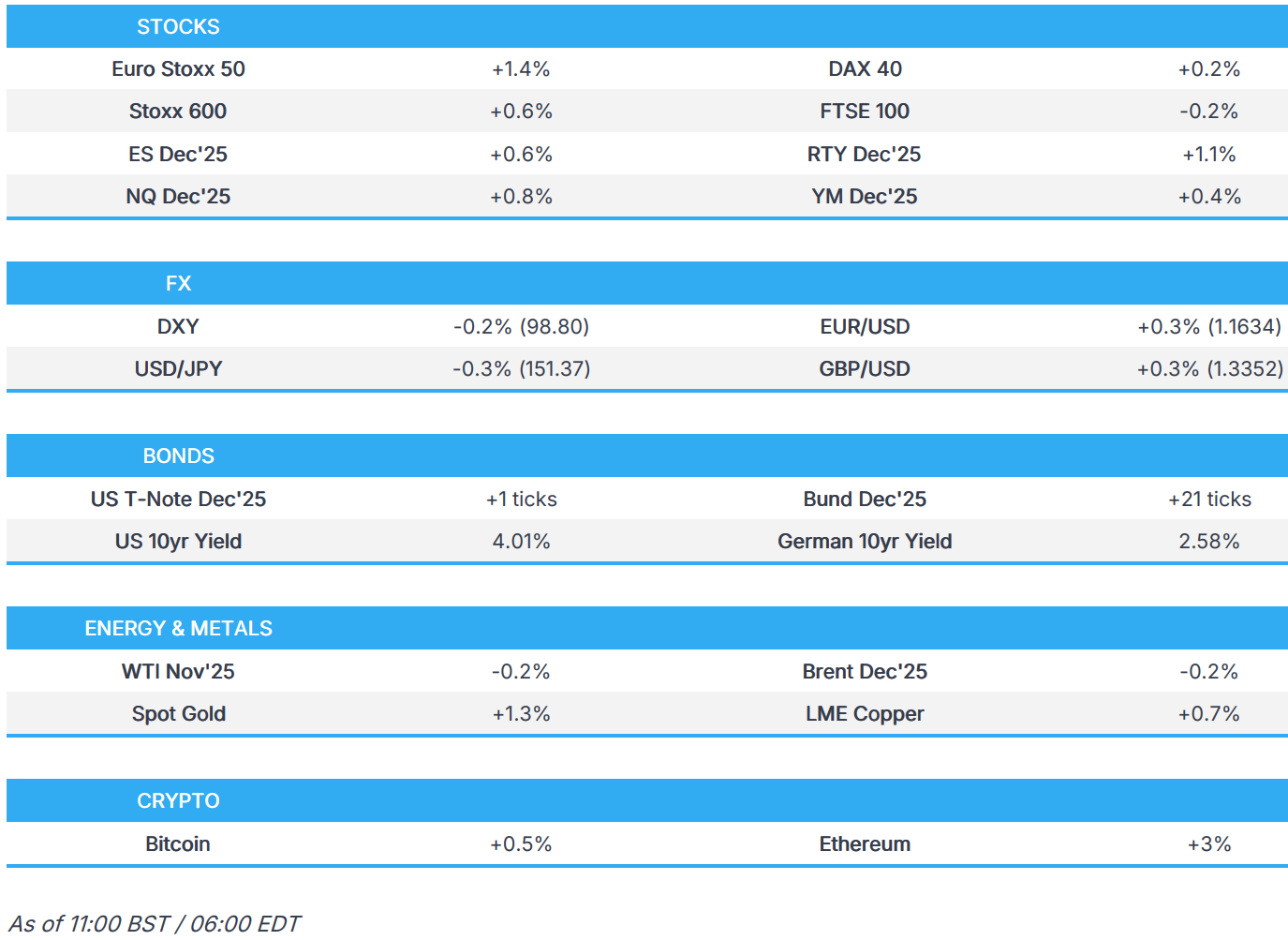

US Market Open: NQ boosted after ASML results; USTs firmer & USD slips ahead of Fed speak

Update: 2025-10-15

Description

- European bourses are in the green; LVMH +14% & ASML +3.6% both gain post-earnings; US equity futures also rise.

- USD losses extend into a second session, EUR remains underpinned by French optimism.

- USTs incrementally firmer, OATs gain as traders digest the latest pension reform suspension.

- XAU breaks USD 4200/oz, crude benchmarks muted amid heightened trade tensions.

- Looking ahead, highlights include NY Fed Manufacturing (Oct), Cleveland Fed CPI (Sep), US Military Pay Date, Fed Beige Book, (Suspended Releases: US CPI), BoE’s Breeden, ECB’s Lane & Lagarde, Fed’s Miran, Bostic, Waller & Schmid, RBA’s Bullock & Kent.

- Earnings from Bank of America, Morgan Stanley, Dollar Tree & Progressive.

</figure>

</figure>TARIFFS/TRADE

- Chinese Foreign Ministry Spokesperson Lin says the US and China should engage in talks.

- China files complaint to WTO over India's EV and battery subsidies; vows resolute measures to protect domestic industry, says Indian measures hurt China's interests.

EUROPEAN TRADE

EQUITIES

- European equities opened higher, buoyed by strong updates from ASML and LVMH, with the CAC 40 (+2.4%) leading gains after LVMH (+13.4%) beat Q3 revenue forecasts and political stability improved in France.

- Most European sectors trade in the green, led by Consumer Products & Services (+5.9%) on strong luxury brand performance (LVMH, Kering, Hermes), while Healthcare (-0.3%) lags due to cyclical rotation; Media (+1.7%) and Technology (+1.6%) also firm, with ASML’s results and resilient Chinese demand underpinning sentiment.

- US futures point to a positive open (ES +0.5%, RTY +0.8%, NQ +0.7%) as dovish comments from Fed Chair Powell lift sentiment and ASML’s update supports tech, with focus now on US-China trade tensions, Fed speakers, and data including MBA mortgage applications, NY Fed manufacturing, Cleveland Fed CPI, and the Beige Book.

- Synchrony Financial (SYF) Q3 2025 (USD): EPS 2.86 (exp. 2.24), Revenue 3.82bln (exp. 4.73bln), NII 4.7bln.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

NOTABLE EUROPEAN EQUITY NEWS

- ASML (ASML NA) - Q3 2025 (EUR): Revenue 7.516bln (exp. 7.790bln), Net 2.13bln (exp. 2.08bln), Net order bookings 5.4bln (exp. 5.36bln); guides Q4 revenue between 9.2bln to 9.8bln (exp. 9.23bln/9.48bln); does not expect FY26 total net sales to be below FY25.Gross Margin 51.6% (exp. 51.4%). An interim dividend of EUR 1.60 per ordinary share will be made payable on November 6, 2025. Intend to announce a new share buyback program in January 2026. Weightings: 29.8% in Tech (largest), 4.76% in Euro Stoxx 50 (2nd largest), 2.28% in STOXX 600 (2nd largest).

- ASML (ASML NA) CFO says Co. is prepared for rare earth export controls, has all the materials needed for the coming months; number of customers in China is increasing; steel, aluminium tariffs do have "a bit" of impact on costs. Customer uncertainty around tariffs and trade war has partially receded since July. It's possible that the Chinese chip market may see some consolidation. The expected China sales decline is not due to previous stockpiling. ASML needs limited quantities of rare earth materials.

FX

- After starting the week on the front foot, DXY was knocked lower yesterday by a combination of a pick-up in the EUR, US-China trade tensions and dovish comments from Fed Chair Powell. On the latter, the key takeaway was the ongoing acknowledgement of the softness in the labour market by the Fed Chair. Something which could be aggravated by the ongoing US shutdown and expectations of mass federal layoffs. One potential source will be today's Fed Beige Book, which will provide anecdotal evidence on the performance of the US economy. ING argues that the Beige Book played a key role in the Fed’s 50bp cut in September 2024. Elsewhere, NY Fed Manufacturing and Cleveland CPI are due on deck, with the latter coming ahead of next week's delayed BLS release. DXY has delved as low as 98.73 with the next target coming via the 9th October trough at 98.69.

- EUR remains buoyed following Tuesday's French-induced bounce, which saw EUR/USD reclaim 1.16 to the upside. Markets took solace in the announcement by PM Lecornu to suspend pension reform. Whilst this itself is not seen as economically prudent, the move has been met with a positive response from the Socialists, who will not support any motion to censure the government. Elsewhere, the slew of ECB speak over the past 24 hours has failed to shift the dial for market pricing and that will likely remain the case with Villeroy, de Guindos, Lane & Lagarde due to give remarks. EUR/USD has ventured as high as 1.1644.

- The Yen's gains vs. the USD have extended into a second session with the former underpinned by a broad haven appeal alongside US-China trade tensions. That being said, the domestic story remains a tricky one with political tensions front and centre. Following the recent collapse of the ruling coalition, opposition parties are scrambling to see if they can present a credible candidate as an alternative to Takaichi. Accordingly, Japan's Parliamentary Committee failed to agree on holding an election to choose the next PM on October 21st, as proposed by the LDP. Comments from the DPFP leader suggested that there is still some distance with the CDP in talks, but if issues can be resolved, there could be another meeting on October 20th. USD/JPY briefly made its way onto a 150 handle, delving as low as 150.91 before reclaiming 151 status.

- After the Pound's brief wobble vs. the USD yesterday in the wake of a dovish labour market report, the pound has since stabilised and briefly hit a new high for the week at 1.3373. Yesterday's jobs report was followed up by remarks from BoE Governor Bailey, who noted that the data support his view of a softening labour market. Additionally, Taylor also stated that he now sees a "bumpy" landing as more likely than a soft landing. Additionally, the November 26th budget is a great source of uncertainty for the MPC. On which, in an interview today, UK Chancellor Reeves says she is looking at both tax rises and spending for next month. The next upside target for Cable comes via the 1.34 mark.

- Antipodeans are both on the front foot vs. the USD, albeit the AUD is slightly outperforming its antipodean peer following a strong Yuan fix by the PBoC and hawkish comments from RBA Assistant Governor Hunter, who said recent data has been a little stronger than expected and inflation is likely to be stronger than forecast in Q3.

- Click for a detailed summary

FIXED INCOME

- USTs are marginally firmer (+1 tick at 113-14), extending Tuesday’s gains amid lingering haven demand and cautious sentiment following renewed US-China trade tensions after Trump threatened to end cooking oil business with China; support also comes from dovish Fed commentary, with Powell signalling rising job market risks, nearing the end of balance sheet runoff, and justification for a September rate cut, while today’s focus turns to Fed speakers and the Beige Book.

- Bunds trade higher (+17 ticks at 129.85) within a 129.68–129.95 range, supported by dovish ECB comments from Villeroy suggesting the next move is more likely a cut. A relatively poor 2050/2056 Bund auction sparked little move on price action. Elsewhere, OATs outperform after France’s Socialist Party backed PM Lecornu’s temporary pension reform suspension, tightening the OAT-Bund spread to 78.32 from Tuesday's peak of 84.50.

- Gilts outperform global peers (+36 ticks at 92.31), holding near highs of 92.39 with potential to retest early-August levels (92.66), supported by reports that Chancellor Reeves may halve the annual tax-free ISA allowance to boost UK equity investment, while broader budget discussions point to potential tax rises and spending cuts ahead of remarks from BoE’s Breeden.

- UK sells GBP 1.5bln 0.125% 2031 I/L Gilt: b/c 3.49x, real yield 0.889%.

- Germany sells EUR 0.757bln vs exp. EUR 1bln 0.0% 2050 and EUR 1.182bln vs exp. EUR 1.5bln 2.90% 2056 Bund.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks trade rangebound, oscillating in a c. USD 0.50/bbl band. WTI and Brent remain below USD 59/bbl and USD 62.50/bbl, respectively, as markets wait for delayed weekly Private Inventor

Comments

In Channel