US Opening News: USD on the front foot, shutdown talks ongoing, geopols in focus

Update: 2025-10-07

Description

- Democrat and Republican bills to end the US government shutdown failed to secure sufficient votes for passage in the Senate, as expected.

- Senior Hamas official Mahmoud Al-Mardaw said "President Trump's plan is mainly an Israeli plan", but emphasises that Hamas wants to end the war.

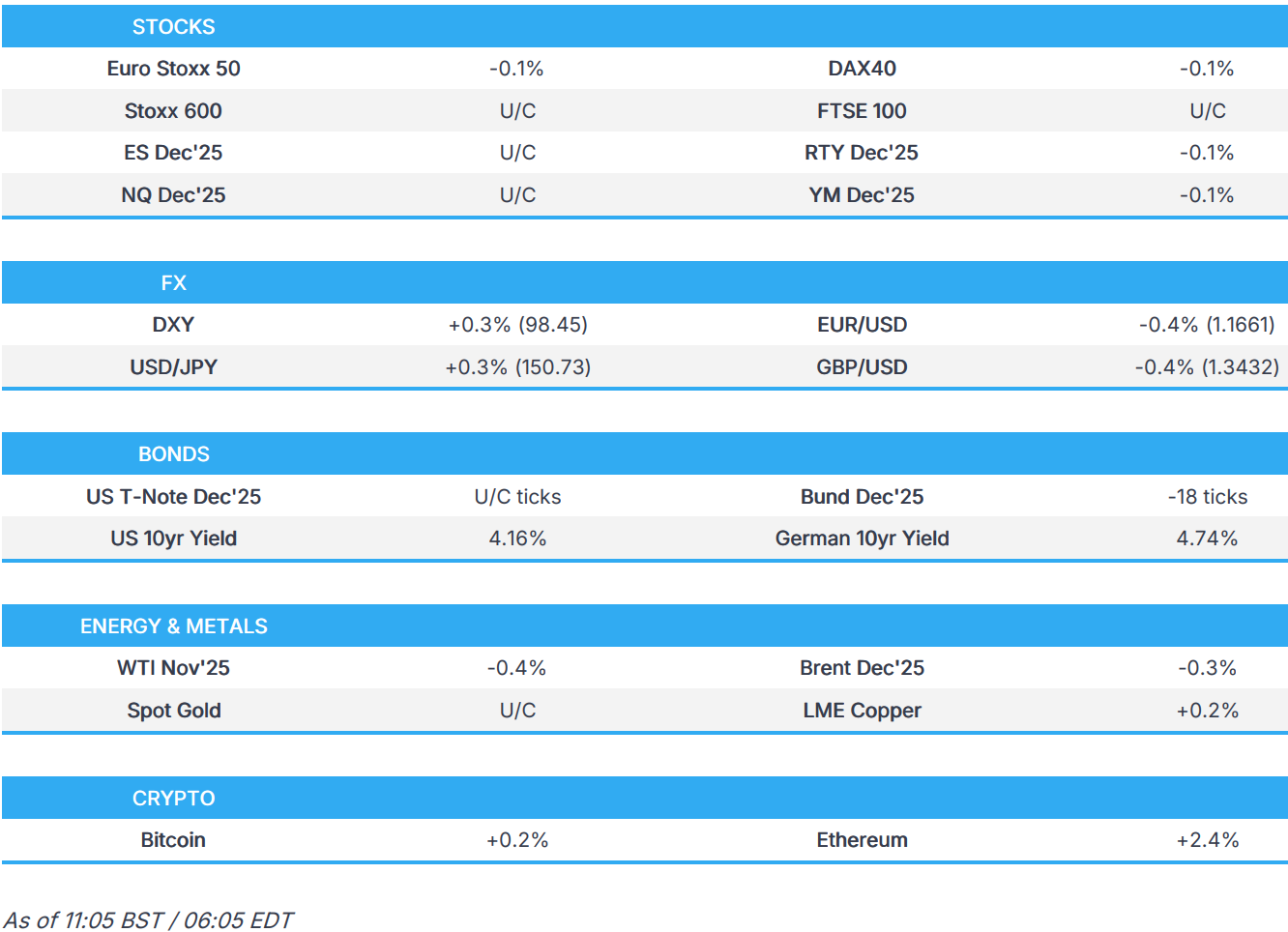

- European bourses are choppy, trading on either side of the unchanged mark; US equity futures are flat/lower.

- USD once again on the front foot despite ongoing impasse on Capitol Hill; Kiwi lags awaiting the RBNZ.

- Bearish trade across global paper, except for JGBs which are marginally firmer following supply.

- Gold prints fresh ATHs near USD 4,000/oz; crude subdued, eyeing geopolitical updates. On supply, Russian Deputy PM Novak says OPEC+ nations did not discuss increasing quotas by more than 137k BPD in November.

- Looking ahead, NY Fed SCE, Atlanta Fed GDP, Canadian Trade Balance (Aug), Ivey PMI (Sep), EIA STEO, Speakers including Fed’s Bostic, Bowman, Miran, Kashkari, ECB’s Lagarde & Nagel, Supply from the US, Earnings from McCormick & Company.

- Suspended Releases: US International Trade, Consumer Credit.

</figure>

</figure>TARIFFS/TRADE

- Japan's Chief Cabinet Secretary Hayashi said he is aware of US President Trump's comments on truck tariffs, while he added that they will assess the details once clarified and will respond appropriately.

- Trump will meet with Carney at 11.45EDT/16:45 BST on Tuesday.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 -0.2%) opened mostly lower, albeit with very marginal losses. Though, soon after the cash-open sentiment slipped a touch to display a more negative picture in Europe, but without a clear driver.

- European sectors are showing a slightly more negative picture vs initially opening mixed. Food Beverage & Tobacco takes the top spot, boosted by a couple of reasons. Firstly, Imperial Brands (+3%) helps to prop up the sector after the Co. announced a GBP 1.45bln share buyback and confirmed its FY25 guidance. Secondly, alcohol names opened higher in a read-across following strong Q2 metrics from US-listed Constellation Brands (+3.2% pre-market); the Co. beat on its top- and bottom-lines, where it cited continued demand for its beer portfolio. The likes of Diageo (+1%) and AB InBev (+0.7%) both move higher. Energy and Telecoms complete the top three; the former is helped by Shell (+1.7%) after the Co. said it expects “significantly higher” gas trading in Q3, with its outlook for that quarter also positive.

- US equity futures (ES U/C NQ U/C RTY -0.1%) are modestly lower across the board, following a similar theme seen in the European morning.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is extending on Monday's upside that was triggered by JPY and to a lesser extent, EUR weakness. The government shutdown continues to grip the US macro narrative but is failing to weigh on the USD at the start of the week. This view may be re-appraised in the event that it drags on and has a more tangible impact on the US economy. The shutdown still shows no signs of being resolved after Democrat and Republican bills to end the shutdown failed to secure sufficient votes for passage in the Senate. As such, it is looking increasingly likely that mass layoffs of Federal workers are on the cards. For today's docket, given that trade and consumer metrics will not be published, markets will instead focus on US RCM/TIPP Economic Optimism, NY Fed SCE, Atlanta Fed GDP metrics and a slew of Fed speakers. DXY has ventured as high as 98.47.

- EUR remains on the backfoot vs. the USD with EUR/USD returning to a 1.16 handle as French political risks remain front and centre. In terms of the latest, outgoing PM Lecornu has been instructed by Macron to hold final discussion with political parties to see if there is a way forward. There are three paths the current crisis could take: 1) a new PM, which would appease opposition parties. 2) Fresh legislative elections. 3) An early Presidential election. France aside, German industrial orders disappointed this morning but failed to generate any traction in EUR. EUR/USD has delved as low as 1.1661.

- JPY is once again lagging vs. the USD but to a lesser extent than most G10 peers. Focus remains on the fallout from Saturday's LDP leadership election in which, Abe-protégé Takaichi was declared the victor. However, it remains to be seen how much sway the incoming PM will have on policy at the BoJ. Accordingly, investors look to scheduled speeches from multiple BoJ officials ahead of the October meeting; however, Wednesday's appearance by Governor Ueda has been cancelled. USD/JPY has been as high as 150.70 with the next upside target coming via the 1st August peak at 150.91. Note, Finance Minister Kato attempted to jawbone the currency overnight but it had little impact on JPY.

- GBP is softer vs. the USD but steady vs. the EUR. It remains the case that in the absence of any tier 1 data, focus in the UK is on the ongoing angst in the run-up to the November 26th budget. Ahead of which, Bloomberg reports that Chancellor Reeves is set to receive an unexpected GBP 5bln boost to her budget plans from inflation, which raises the taxable value of incomes, profits, and prices. The gain offsets higher debt servicing costs, helping narrow the UK’s projected GBP 20-30bln budget shortfall ahead of the budget. Cable sits towards the lower end of Monday's 1.3417-90 range.

- Antipodeans are both are at the foot of the G10 leader board with NZD lagging its antipodean peer in the run up to tomorrow's RBNZ rate decision, which is set to see a reduction in the OCR. The scale of easing remains in debate, with a Reuters poll finding that 15 of 26 economists expect a 25bp cut to 2.75%, while 11 look for a larger 50bp move.

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are flat. Specifics for the most part are light owing to the ongoing shutdown and the subsequent lack of US data. Several Fed speakers due, but in the absence of fresh data points it remains to be seen what they can add beyond recent remarks to the narrative. On the shutdown, there are some glimmers of progress. President Trump commented that he is willing to look at and make a deal on ACA subsidies, but the government must reopen first. From the Democrats, Senate Minority Leader Schumer said Trump is not yet negotiating with them, but progress on the shutdown is being made. Currently, USTs find themselves in a thin 112-11 to 112-15+ band.

- JGBs picked up overnight following a strong 30yr JGB auction. Supply was in more focus than usual given the move seen in JGBs and particularly the long-end driven steepening that occurred after the weekend’s LDP election. Auction aside, potentially the most pertinent update has been BoJ Governor Ueda cancelling his speech on October 8th. As it stands, that was Ueda’s last scheduled appearance before the end-October BoJ; though, several other officials are scheduled before then. More recently, Takaichi met with the Komeito leader. A meeting of particular pertinence amid concern that Komeito could lead the alliance. However, the meeting was positive overall with agreements shared on two out of three points and talks set to continue on the third; the officials reportedly shared an understanding on history and foreigners.

- OATs are lower. On Monday, Takaichi met with the Komeito leader. A meeting of particular pertinence amid concern that Komeito could lead the alliance. However, the meeting was positive overall with agreements shared on two out of three points and talks set to continue on the third; the officials reportedly shared an understanding on history and foreigners. Thus far, the OAT-Bund 10yr yield spread is contained within yesterday’s parameters, been as high as 86.7bps but shy of the 88.2bps YTD peak that printed on Monday. As a reminder, the 2024 high resides at 90bps.

- Bunds are softer than USTs but foreign better than OATs thus far. For Germany, the main update was another soft industrial orders print for August, a series that is even worse if large orders are excluded. A German Bobl auction was exceptionally weak, but had little impact on price action. Now we await ECB's Lagarde and Nagel.

- Gilts are also in the red, trading a

Comments

In Channel