High Yield, Higher Risk: Is KBWY Worth the Ride?

Description

Key Takeaways

KBWY offers one of the highest yields in the ETF world (~9–10%), but that payout comes with real volatility and long-term capital erosion.

The fund is concentrated in small and micro-cap REITs — the riskiest corners of the real estate market — which fall harder in downturns and often recover more slowly.

Historical performance has been weak, with a decade of declining share prices despite strong income. The yield often masks underlying stress.

Dividends are paid monthly but fluctuate, reflecting the instability of high-risk REIT tenants, leverage, and cost of capital.

KBWY only makes sense as a tactical, high-octane income play, not a core holding — and only for investors who can handle deep drawdowns.

Introduction

If you’ve been around markets long enough, you know there’s always a catch hiding behind a high yield. And in real estate — a sector that’s taken more punches than Mike Tyson’s sparring gloves — that catch has been especially unforgiving.

Between rate hikes, remote work, and financing costs going vertical, REITs have struggled to get their footing. The Vanguard Real Estate ETF (VNQ) dropped a brutal -26% in 2022.¹ Even through late 2024, when the S&P 500 quietly marched higher, real estate kept lagging behind.²

Enter KBWY — a small-cap REIT ETF from Invesco that waves a near 10% yield in your face like a neon sign on the Vegas strip. Tempting? Absolutely. But as I always say: the higher the yield, the more likely you’re being paid to take pain.

And KBWY has delivered plenty of both.

What KBWY Owns — And Why It’s So Volatile

Most investors owning broad REIT ETFs are used to names like Prologis, American Tower, AvalonBay — giants with diversified tenants and deep pockets.

KBWY is the opposite.

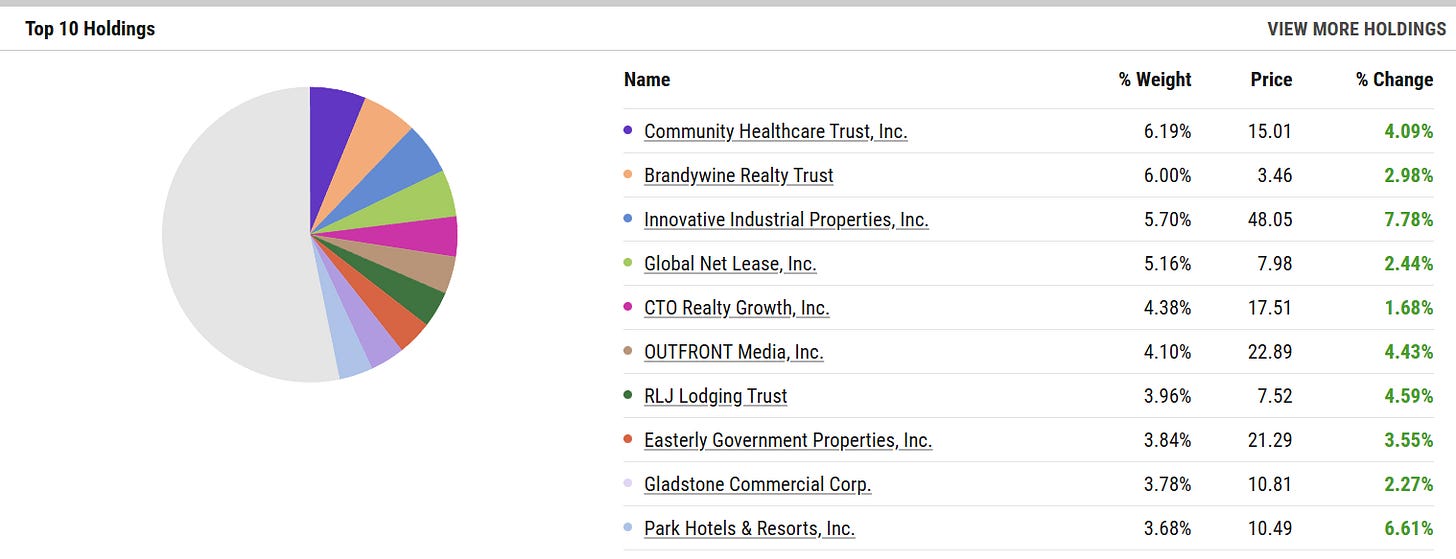

Its underlying index hunts for 25–40 of the highest-yielding equity REITs in the U.S.³ The result is a portfolio overwhelmingly made up of small and micro-cap landlords. Nearly 80% of the fund sits in micro-cap territory.⁴ These companies are the minnows of real estate: thinner liquidity, higher financing costs, and businesses that wobble when the macro picture turns cloudy.

Source: YCharts

The top holdings say everything you need to know: Brandywine Realty Trust (office exposure in a world that still can’t figure out hybrid work), Innovative Industrial Properties (cannabis-linked industrial real estate with tenant risk), Community Healthcare Trust, Park Hotels & Resorts, and Global Medical REIT.⁵

These names aren’t yielding 7–10% by accident. They’re yielding that much because they have to — investors demand a big risk premium to touch them. In a world where money markets pay over 5%, a high-yield REIT has to shout even louder.

KBWY listens to that shout. And investors get the volatility that comes with it.

The Real Problem: Price Erosion Over Time

Here’s where KBWY’s story gets tough.

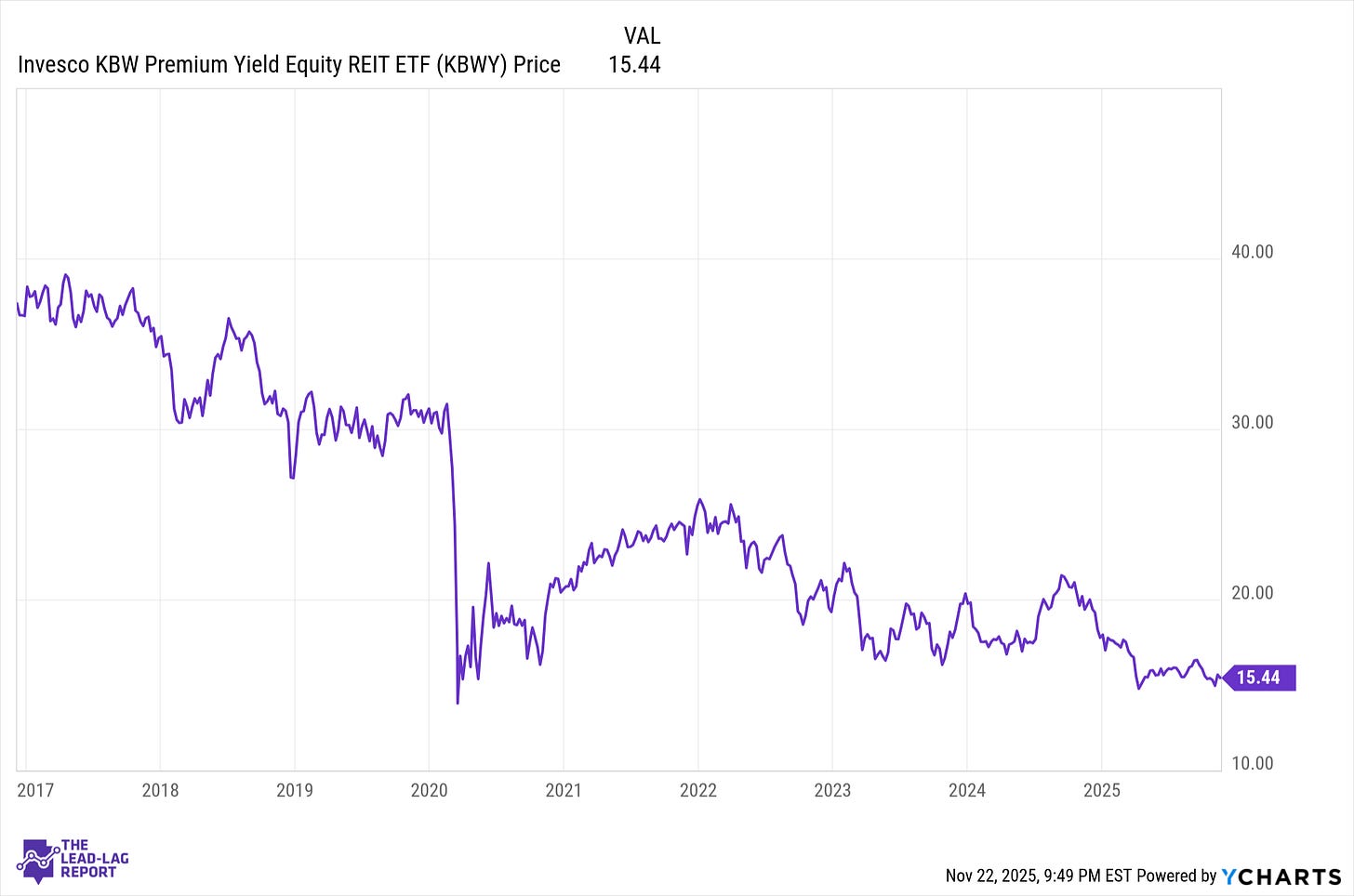

Since launching in 2010, the fund’s NAV has barely budged — up roughly 4% over 15 years.⁶ That’s not a typo. Nearly all of the return investors have earned came from dividends, not appreciation.

Even worse: KBWY’s price has fallen almost 50% over the last decade.⁷ VNQ? Positive. The S&P 500? Don’t even ask.

And during real stress, KBWY doesn’t bend — it breaks.

In 2020, KBWY fell -33.6%.⁹

In 2021, it rallied — but still underperformed a roaring VNQ.¹⁰

In 2025 (through October), it was down about -9% YTD while VNQ was slightly positive.¹¹

If you plotted the last ten years, the chart would look like a slow-moving ski slope. Dividends helped cushion the blow, but they didn’t change the direction of travel.

This is what I call the yield trap illusion: big payouts masking capital erosion.

The Yield: Big, Real, and Very Much at Risk

KBWY pays investors extremely well — no denying that. Over the past year, it threw off about $1.51 per share, translating to a trailing yield close to 10%.¹² And you get it monthly, which income-driven investors love.

But that yield has a history of shrinking when markets get tight.