Reaching for Yield or Reaching for Trouble? Understanding PDI’s Credit Mix

Description

Investors hungry for income often find themselves drawn to the PIMCO Dynamic Income Fund (PDI)—a closed-end vehicle that promises steady cash flow in a world where safe yields have rarely satisfied. The question is what lies behind that income stream, and whether the trade-off between risk and reward is as comfortable as it appears.

What “Dynamic Income” Really Means

PDI’s prospectus gives its managers near-total freedom. The fund can buy bonds “of any type and any quality worldwide,” including corporate, mortgage-backed, or emerging-market debt.¹ This flexibility defines the “dynamic” part of its name. In practice, it lets PIMCO’s team move quickly between asset classes when credit spreads or global yields shift. A 2025 update shows the fund overweighting U.S. agency mortgage-backed securities while trimming duration in developed markets like Australia.²

That latitude can be powerful in uncertain markets. It allows PDI to hunt for yield wherever it still exists. Yet it also means the portfolio may look very different from a standard bond index. Where a benchmark like the Bloomberg U.S. Aggregate Bond Index tilts toward high-grade Treasuries and investment-grade corporates, PDI leans heavily into riskier corners of the credit spectrum.

Inside the Portfolio

PIMCO’s filings reveal that only a small fraction of PDI’s holdings are investment-grade. Most of its corporate exposure sits in the BB or B range, with minimal AAA or AA paper.³ The fund explicitly permits up to 20 percent of its assets in deeply distressed CCC-rated or lower debt.⁴ It can also invest without limit in mortgage- or asset-backed securities, regardless of credit rating.⁴

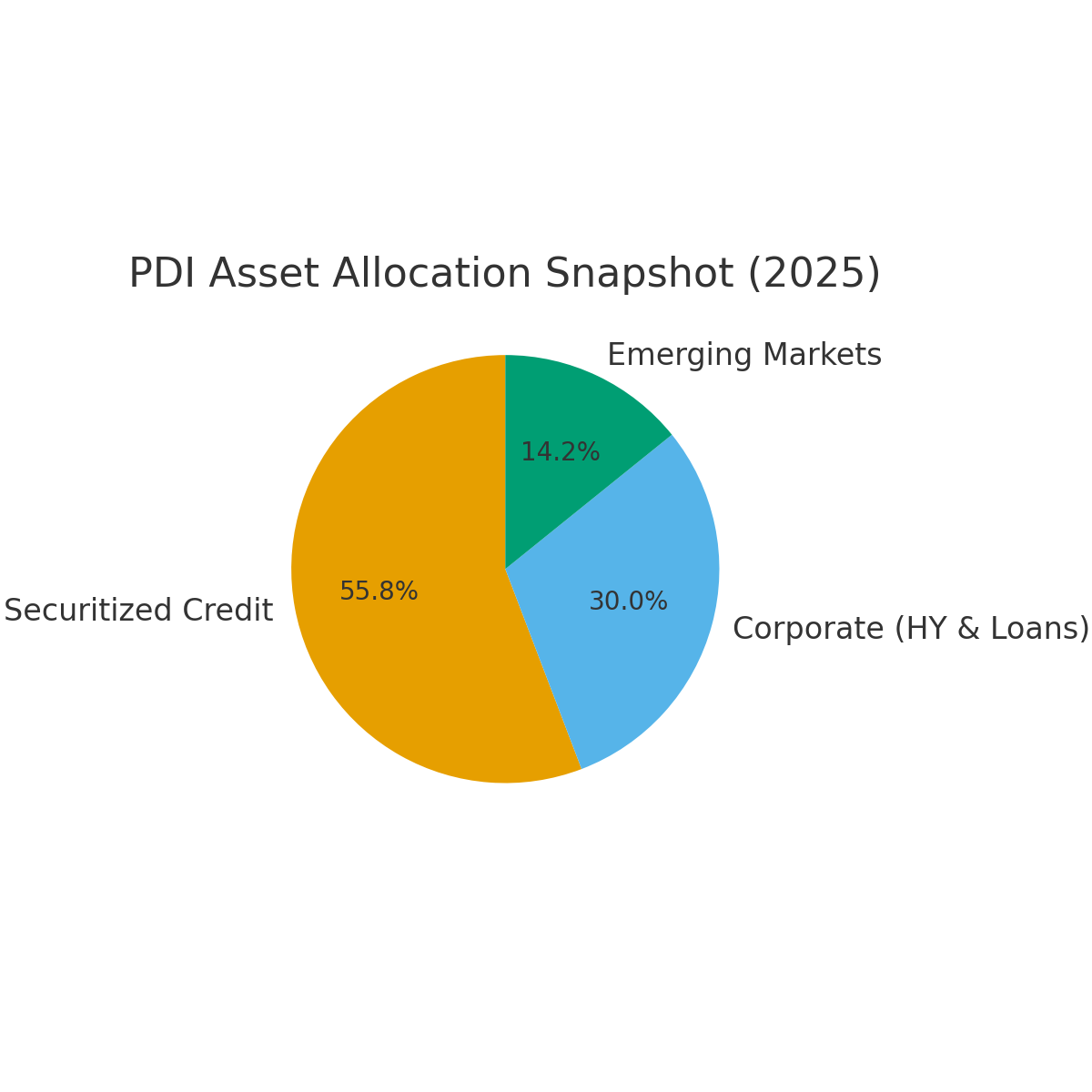

In reality, the bulk of the portfolio clusters around three pillars: high-yield corporate bonds, non-agency mortgage-backed securities (MBS), and emerging-market debt. Securitized assets—residential, commercial, and consumer loan pools—make up roughly half the mix in recent reports.⁵ PDI must keep at least one-quarter of assets in mortgage-related instruments at all times.⁶ Those securities, not guaranteed by the government, can generate attractive coupons but carry credit and prepayment risks.

High-yield corporate credit provides another big chunk of income. These are bonds from companies a notch or two below investment-grade, which compensate investors with higher coupons for taking more default risk. PIMCO’s analysts scour that space for mispriced names and often hold floating-rate loans alongside fixed-rate debt to manage interest-rate exposure.

Then there is emerging-market debt—sovereign and corporate issues from Latin America, Asia, and frontier economies. PDI can allocate as much as 40 percent of assets there.⁶ This sleeve broadens diversification but introduces new hazards: currency swings, political instability, and sudden outflows when global risk appetite fades.

The Leverage Factor

PDI is not just diversified; it is leveraged. The fund routinely borrows to amplify income, with borrowed capital accounting for roughly one-third of total assets in 2025.⁷ When credit spreads tighten or rates fall, that leverage supercharges returns. When conditions reverse, losses magnify just as quickly.