Cautious Easing, Global Jitters

Description

This Week at a Glance

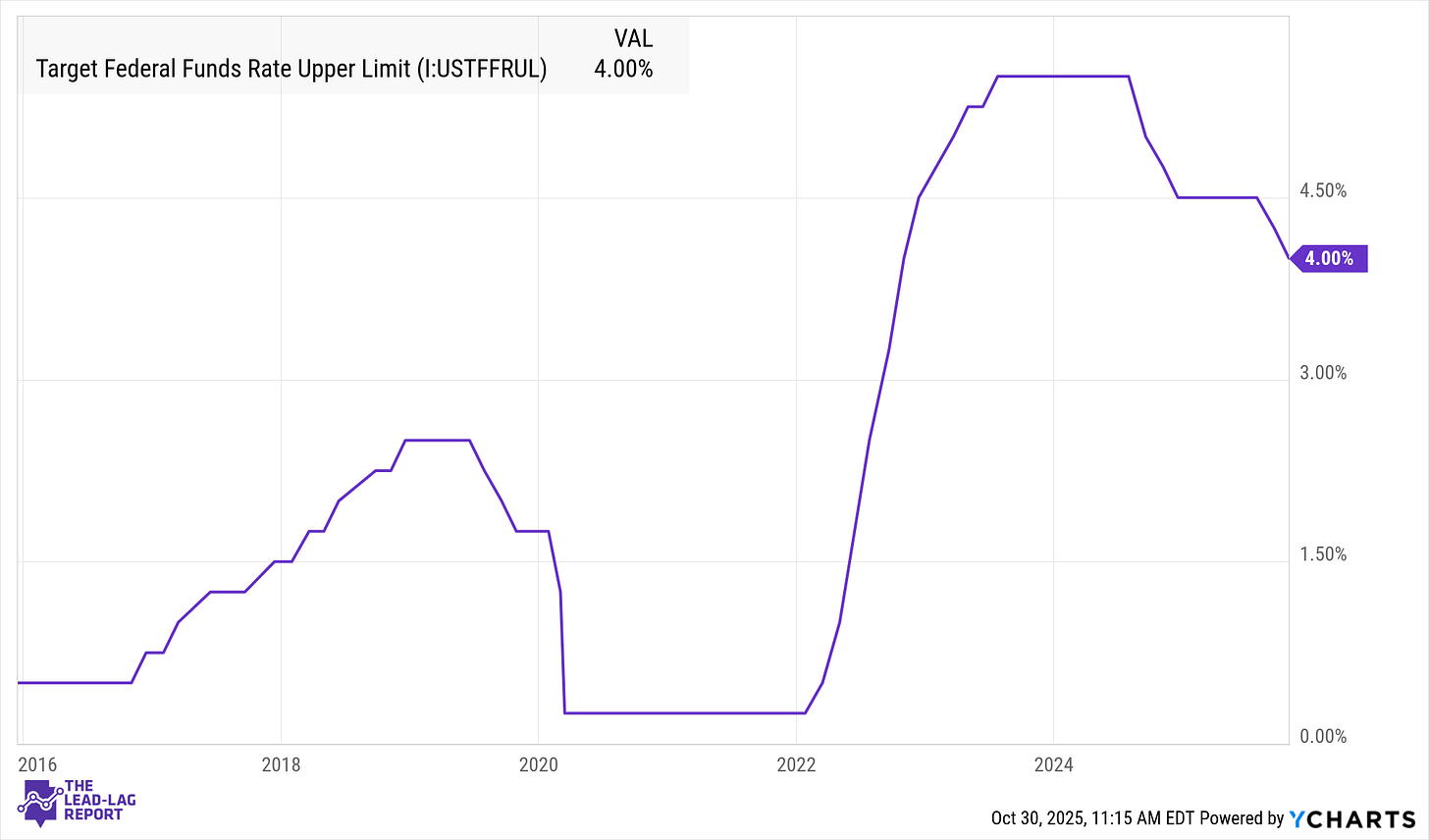

• U.S.: The Federal Reserve delivered a second straight rate cut, trimming the policy rate to 3.75–4.00%, while hinting at a pause amid a federal data blackout.

• International: A one-year U.S.-China trade truce was announced, easing tariff tensions even as Europe’s central bank held rates steady and Japan’s new leadership signaled continuity in ultra-easy policy.

• Markets: The S&P 500 pulled back slightly from record highs after Fed Chair Powell’s cautious tone, but is still poised for its longest streak of monthly gains in four years. Bond yields climbed alongside a surging U.S. dollar, and oil prices steadied, keeping cross-asset signals in focus.

The Federal Reserve delivered a second consecutive rate cut, trimming its policy rate to 3.75–4.00% while hinting at a pause amid limited economic data access due to the federal shutdown¹. Chair Jerome Powell’s cautious tone suggested that “driving in the fog” means the central bank will slow further easing until clarity returns². The split 10–2 decision reflected internal debate—one official favored a deeper cut, another no cut at all³.

Markets initially rallied but reversed as Powell downplayed the odds of another cut this year. The S&P 500 ended flat near record highs, Treasury yields rose, and volatility edged higher. The 2-year yield climbed above 4.3%, while the 10-year hovered near 4.7%, modestly re-steepening the yield curve⁴. With unemployment at 4.3% and core inflation at 2.7%⁵, the Fed appears to be balancing between easing too little and too much. The result: a “hawkish cut” that keeps markets guessing.

Developed Markets: Diverging Paths

Europe. The European Central Bank (ECB) held rates at 2.0%, enjoying a “Goldilocks” moment as inflation nears 2% and growth stabilizes⁹. President Christine Lagarde described policy as “in a good place,” though global trade frictions and soft manufacturing data linger¹⁰. With Germany flirting with recession, the ECB is expected to remain on hold through 2026, and the euro languishes near $1.05.

United Kingdom. The Bank of England kept its base rate at 4.0% as inflation remains stubborn at 3.8%, with core services running at 4.7%¹¹. While some policymakers argue the fight against inflation isn’t over¹², slowing growth suggests rate cuts may begin in early 2026¹³. For now, the pound holds steady near $1.22 amid policy stalemate.

Japan. Under new Prime Minister Sanae Takaichi, the Bank of Japan kept its benchmark rate at 0.50%¹⁴. Inflation has topped the 2% target for 41 straight months, yet the BoJ remains committed to ultra-easy policy, projecting moderation to 1.8% in 2026¹⁵. The yen slid to ¥153 per dollar—a multi-year low—while the Nikkei edged up, signaling confidence in policy continuity. Still, the Ministry of Finance may intervene if yen weakness deepens¹⁶.

Emerging Markets: China Slows, India Accelerates

China. Growth continues to falter. Q3 GDP rose 4.8% year-on-year, down from 5.2% in Q2¹⁷. Retail sales and property investment remain weak, though exports have held up thanks to aggressive discounting abroad¹⁸. Beijing responded with stimulus: mortgage-rate cuts, relaxed home-purchase rules, and liquidity injections. A temporary U.S.-China trade truce has eased tensions, helping stabilize the yuan near ¥7.10 per dollar¹⁹. Still, China’s rebound depends on sustained policy support.