Defensive, Discounted, and About to Dominate: 5 Stocks Hiding in Plain Sight

Description

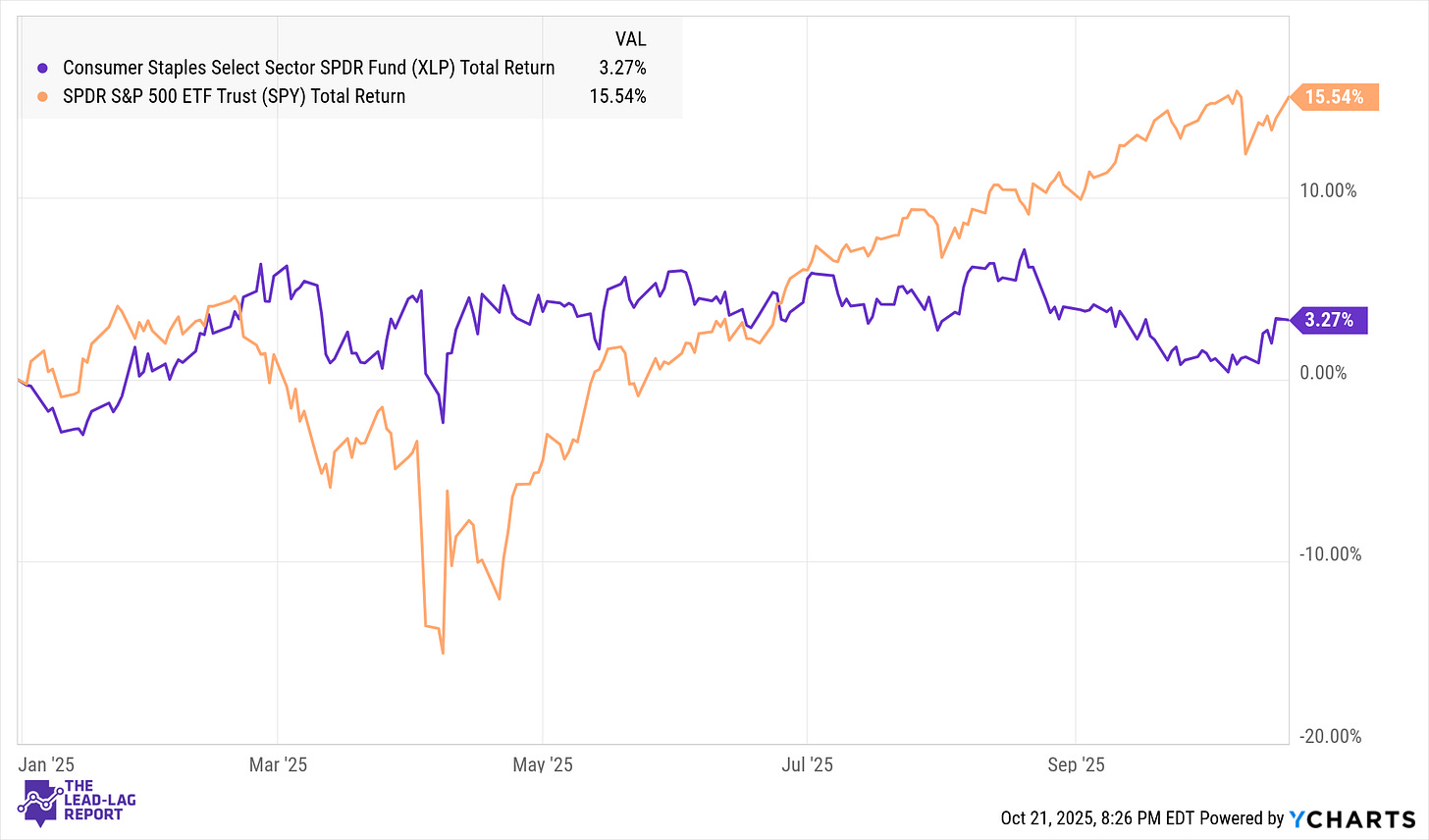

The Consumer Staples sector—traditionally a safe haven—has lagged sharply in 2025. Year-to-date, staples have gained barely 3 percent versus more than 15 percent for the S&P 500, making them among the weakest major sector of the stock market. Investors have chased high-growth tech and cyclical names while overlooking “boring” defensives.

Valuations and the Contrarian Setup

Staples entered 2025 with high valuations—about 21× earnings—leaving little margin for error⁵. After months of underperformance, multiples have compressed to roughly 22×, closer to the five-year average⁶. As expectations sink, the setup looks increasingly contrarian. Historically, staples outperform when optimism fades. If growth or AI exuberance cools, money could rotate back toward defensive names.

Why the Sector May Be Near a Relative Bottom

Three forces could revive interest in staples:

Resilience in volatility: During past pullbacks—like 2022—staples fell far less than cyclical sectors⁷.

Cooling costs: Commodity and freight inflation are easing, giving firms room to rebuild margins.

Better value: Dividend yields of 2½–3 percent now can outshine cash in a falling interest rate environment

Not all companies are equal, however. The best opportunities lie in firms with strong brands, cost discipline, and consistent cash flow. The following five U.S. names exemplify that mix.