$JOJO: Fundraising Fatigue = Risk Creep

Description

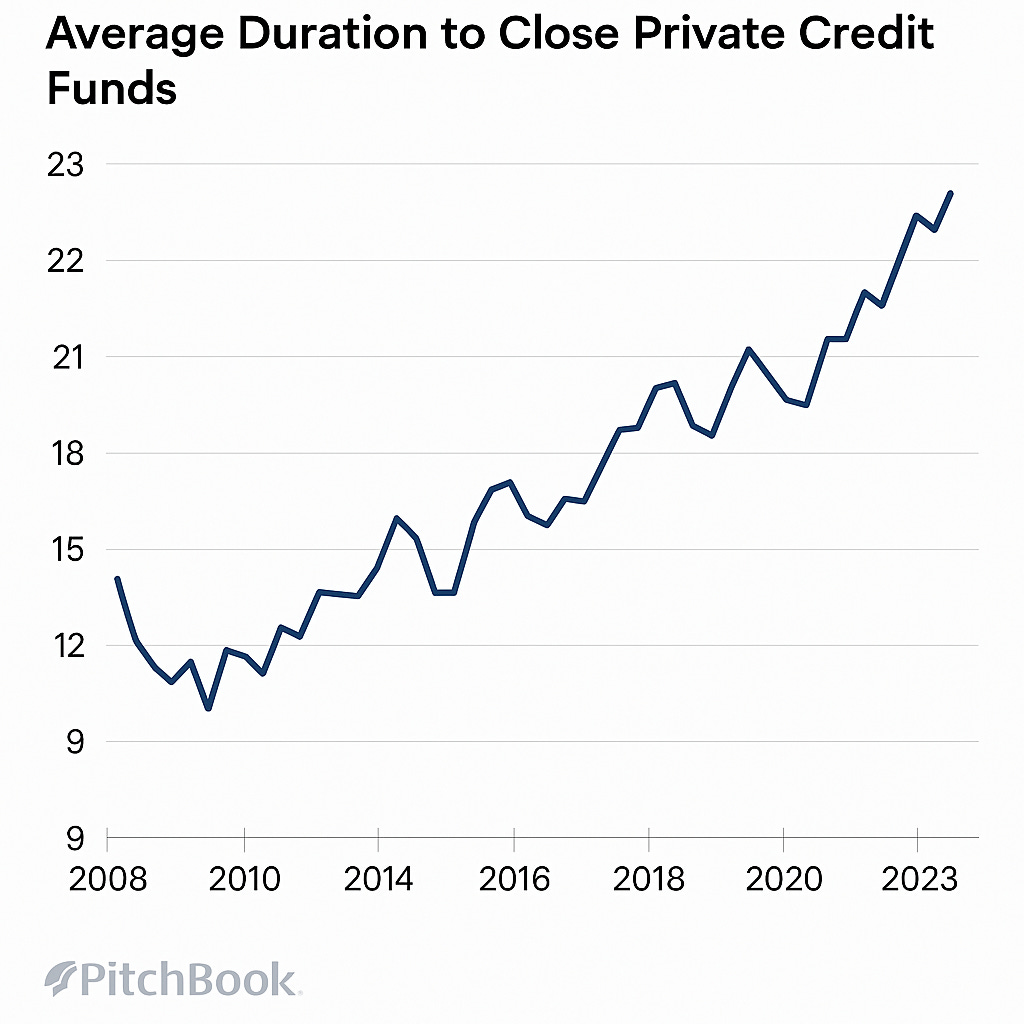

In credit markets these days, raising new funds feels like running a marathon, not a sprint. According to PitchBook, private credit funds now take nearly two years to close—roughly double the pace from just a few years ago¹. Major managers are feeling the strain and are turning to new sources of capital to bridge the gap. Bloomberg reports that insurers and wealthy individuals have become a growing focus for alternative asset managers seeking fresh inflows². Even firms like Apollo are structuring new vehicles aimed at insurers, as traditional pension and endowment checks become harder to secure³.

As capital dries up, a new risk emerges: looser lending. Bloomberg notes that direct lenders are offering borrowers higher leverage—allowing companies to take on more debt—to get deals done⁴. JPMorgan CEO Jamie Dimon recently warned that the current environment is showing signs of excess, including “opaque ratings, aggressive leverage, looser covenants and illiquid vehicles”⁵. Meanwhile, business development companies (BDCs)—publicly traded firms that hold baskets of private loans—have seen investors grow more cautious, reflecting concerns about rising credit risk⁶.

These shifts suggest that risk is creeping in through the side door. When capital becomes scarce, standards often bend. If defaults begin rising, many bondholders may realize they were undercompensated for the risk they took. That’s why active, tactical strategies might make more sense today than set-it-and-forget-it bond allocations.

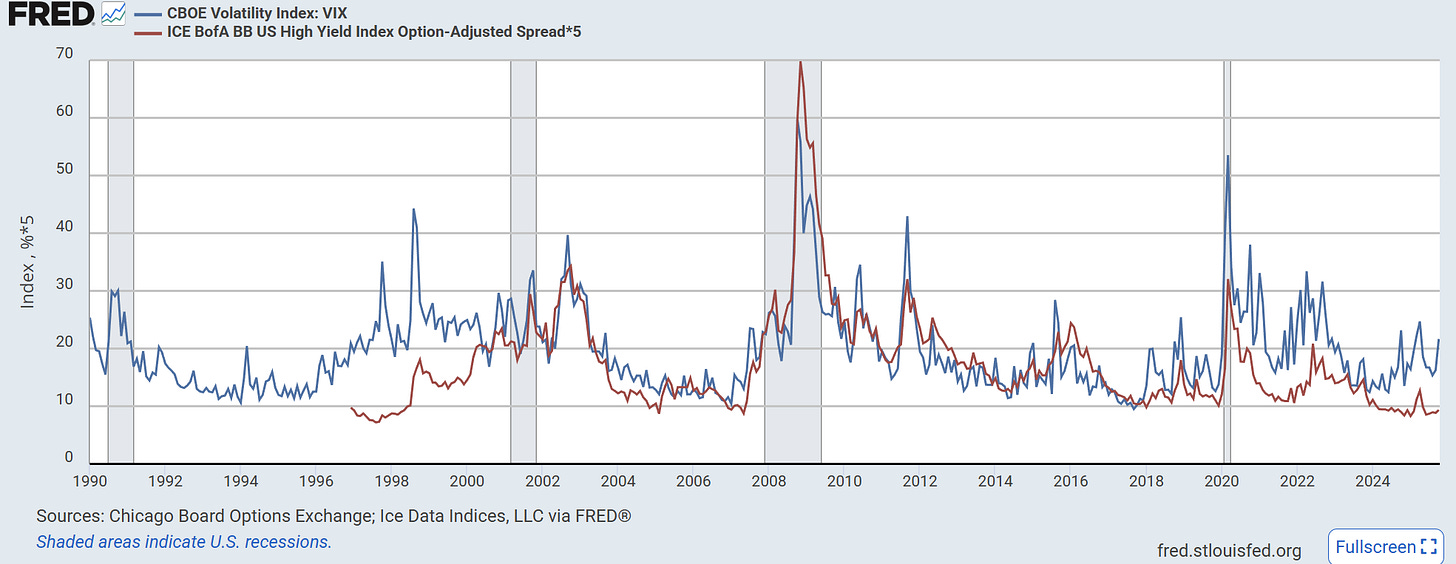

One such strategy is a fund I launched - the ATAC Credit Rotation ETF (Ticker: JOJO). The fund rotates between long-duration U.S. Treasuries and high-yield corporate bonds based on a rules-based model that reacts to changing risk conditions⁷. In calm markets, JOJO leans into high-yield credit; when volatility spikes, it shifts toward Treasuries. This rotation is designed to help manage credit cycle swings and potentially mitigate drawdowns in periods of stress.

If the pressure on fundraising continues, and credit standards keep slipping, flexible bond strategies may become more relevant. Tactical funds like JOJO offer a potential way to step out of harm’s way—or lean back into opportunity—based on systematic risk cues. In a market where the balance between risk and reward keeps shifting, being able to adjust quickly might not just be smart. It might be necessary.

Consider $JOJO. I believe in it. I wouldn’t have launched the fund if I didn’t.

Footnotes

PitchBook, “Fundraising Timeline Hits Record Lengths,” accessed October 2025.

Bloomberg, “Private Credit Funds Stretch Fundraising Timelines,” accessed October 2025.

Bloomberg, “Apollo Targets Insurers in $10 Billion Private Credit Vehicle,” accessed October 2025.

Bloomberg, “Direct Lenders Offer Higher Leverage to Compete,” accessed October 2025.

Bloomberg, “Jamie Dimon Warns of Private Credit Risks,” accessed October 2025.

Morningstar, “Investor Flows Show Strain in BDC Market,” accessed October 2025.

ATAC Funds, “ATAC Credit Rotation ETF (JOJO) Overview and Strategy,” accessed October 2025.

Junk debt, also known as high-yield bonds or speculative-grade debt, refers to fixed-income securities issued by companies or governments with lower credit ratings, offering higher interest rates to compensate investors for the elevated risk of default.

Duration measures a bond’s sensitivity to interest rate changes, representing the weighted average time it takes to receive all cash flows from the bond.

The VIX index, often called the "fear gauge" of Wall Street, is a real-time market index that measures the market's expectation of 30-day forward-looking volatility derived from S&P 500 index options prices, serving as a key barometer of investor sentiment and market risk.

The ICE BofA BB US High Yield Index Option-Adjusted Spread measures the yield differential between BB-rated corporate bonds and a spot Treasury curve, quantifying the risk premium for below-investment-grade debt with a BB rating in the US market.

As with all ETFs, Fund shares may be bought and sold in the secondary market at market prices. The market price normally should approximate the Fund’s net asset value per share (NAV), but the market price sometimes may be higher or lower than the NAV. The Fund is new with a limited operating history. There are a limited number of financial institutions authorized to buy and sell shares directly with the Fund, and there may be a limited number of other liquidity providers in the marketplace. There is no assurance that Fund shar