Markets Are Betting on Rate Cuts — But Are They Ignoring a Bigger Threat?

Description

Key Takeaways

Markets Rally on Fed Pivot Hopes: Softer U.S. inflation strengthened expectations of rate cuts, pushing the S&P 500 to within reach of record highs.

Global Growth Diverges: The Eurozone surprised with its strongest PMI in 17 months, while China’s economy slowed, raising pressure for targeted stimulus.

Sector Rotation Emerging: Investors are broadening exposure beyond mega-cap tech, with small-caps and cyclicals showing signs of revival as yields fall.

Policy Split Across Economies: The Fed readies to ease, the ECB and BoE are on hold, and Japan’s BoJ remains ultra-cautious under new political leadership.

Cautious Optimism Prevails: Liquidity tailwinds support risk assets for now, but uneven data and central bank divergence could test the rally’s durability.Markets surged worldwide this week as investors cheered prospects of Federal Reserve easing. Softer U.S. inflation bolstered expectations for rate cuts, sending the S&P 500 toward record highs while Treasury yields eased¹². Abroad, Eurozone growth surprised to the upside even as China slowed, hinting at fresh stimulus³⁴.

The theme was clear: central banks may soon be entering different phases of policy, creating both opportunities and uncertainty.

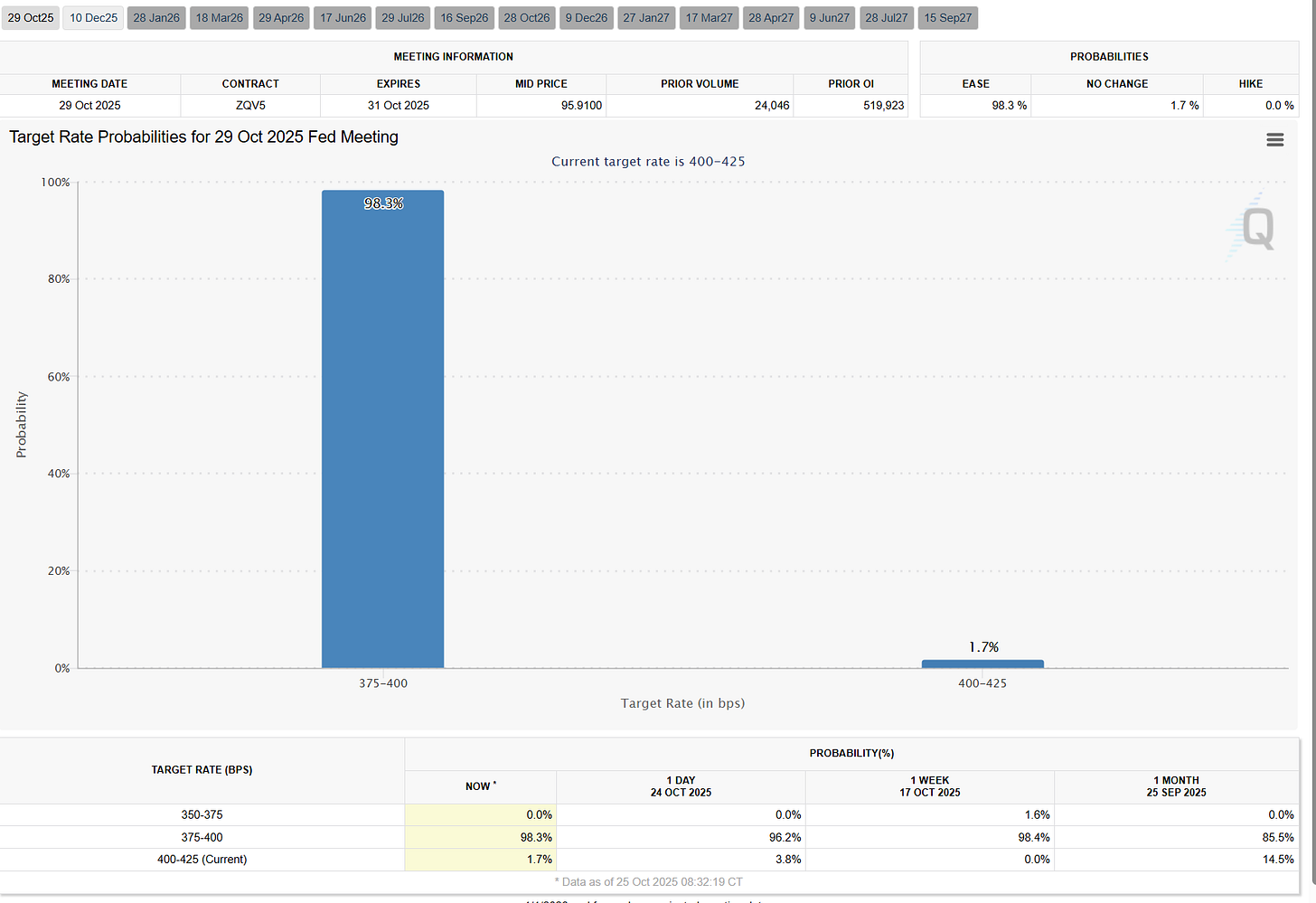

U.S. Markets: The Fed Pivot Narrative

A cooler-than-expected inflation print was the spark. The Consumer Price Index rose just 3.0% year-on-year in September, slightly above August’s 2.9% but below forecasts¹. Fed officials took comfort that price pressures are moderating, reinforcing the case for a 0.25% rate cut at the October 28–29 meeting—the second of 2025⁵⁶⁷. Futures now imply three consecutive quarter-point cuts, lowering the policy rate toward 3.75% by early 2026¹⁷.

Equities rallied as “bad news” became “good news.” Year-to-date, the S&P 500 index is up roughly 17%, as investors price in a soft landing⁸. Even a 20+-day government shutdown—the third-longest on record—failed to derail optimism.

Earnings also played a role: Apple’s strong product demand lifted tech sentiment⁹. Meanwhile, short-term yields dropped as markets priced in cuts, and the yield curve steepened, hinting at early signs of policy normalization.

Shifting Market Leadership

While large-cap tech still dominates, breadth is improving. The Nasdaq Composite is up nearly 19% in 2025¹⁰, but small-caps and cyclicals are catching up. The Russell 2000 surged 2% in a single session last week¹¹, signaling revived risk appetite.

Yet not all was smooth. A midweek pullback saw technology and industrials fall 1.3%¹³¹⁴ while **consumer staples gained 0.8%**¹⁵. Still, the week ended with growth and cyclicals back in charge. Historically, when the Fed turns dovish, lagging groups like small-caps tend to outperform—a pattern worth watching if liquidity tailwinds strengthen.

Europe: Resilient Expansion

The Eurozone Composite PMI jumped to 52.2 in October, its highest in 17 months³. Germany’s services strength offset France’s contraction¹⁷. Inflation hovered near the ECB’s target—2.2% in September—prompting policymakers to pause after cutting rates by 200 basis points since mid-2024²⁰²¹.

Markets expect no change at the October 30 ECB meeting, and most economists now believe cuts are done until 2027²²²³. Europe’s outlook, while modest, has stabilized, buoyed by steady fiscal policy and improving confidence.

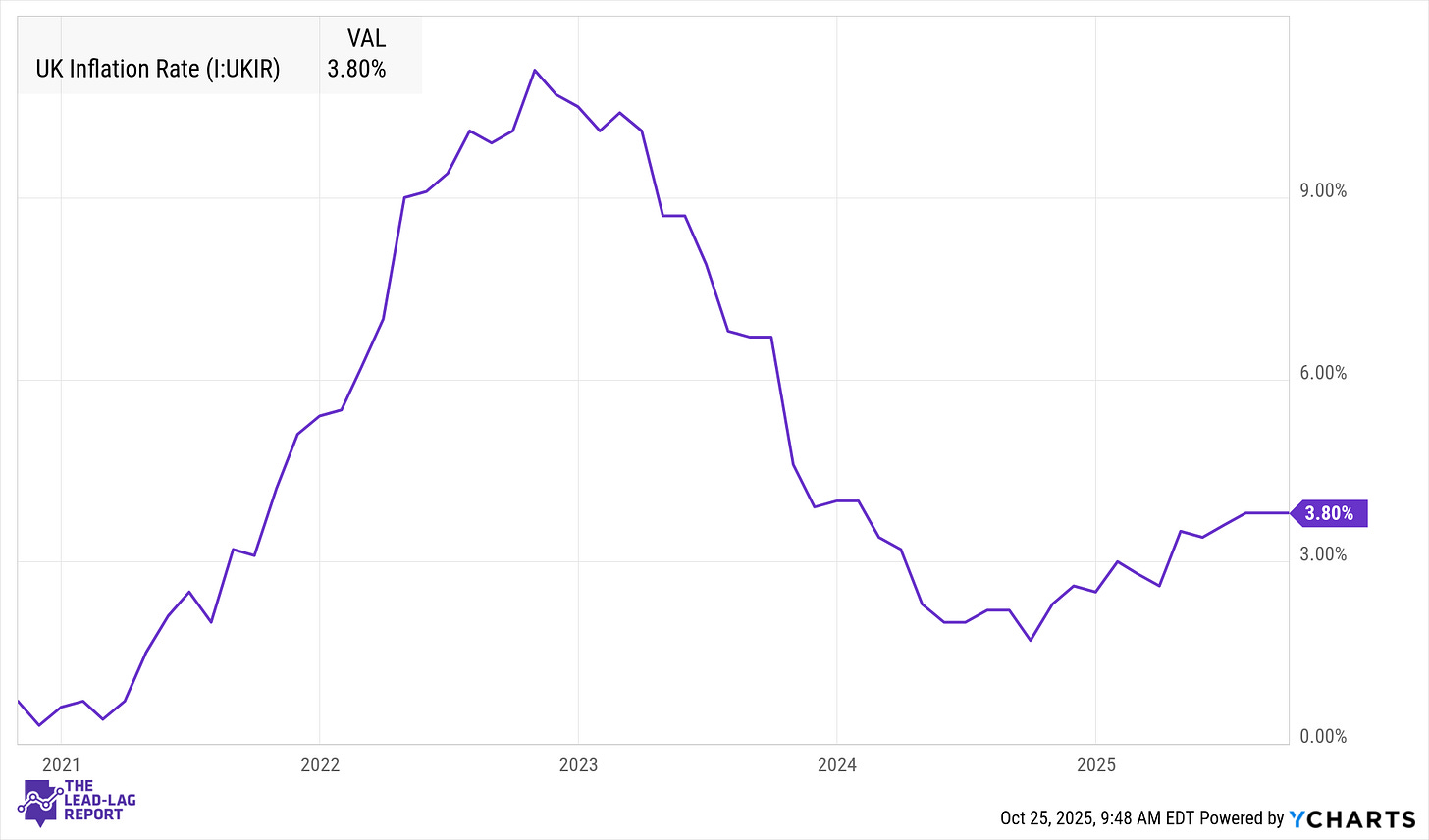

United Kingdom: Inflation’s Plateau

British inflation stayed at 3.8% in September, below expectations of a renewed rise²⁴²⁵²⁶. The news sent sterling lower as traders advanced bets on a December rate cut, now seen as a 75% probability²⁷. With the Bank Rate at 4.00%, the BoE has paused its hiking cycle²⁸, and two members already favor cuts.

Despite stagnation risks, officials remain cautious: easing will be gradual until inflation—still the highest among G7 nations—returns to target²⁹. The policy divergence from the Fed, which is easing sooner, briefly boosted the pound earlier this month³⁰³¹ but that advantage has faded.

Japan: A Balancing Act

Japan’s export sector showed its first growth in five months—up 4.2% year-on-year in September³²³³—thanks to a weak yen. Shipments to China rose 5.8%, but exports to the U.S. fell 13.3%, hurt by tariffs³⁴³⁵. A new U.S.–Japan trade deal trimmed auto tariffs from 27.5% to 15%,