Underperforming but Undervalued: Can Healthcare’s 2025 Slump Reverse?

Description

Summary

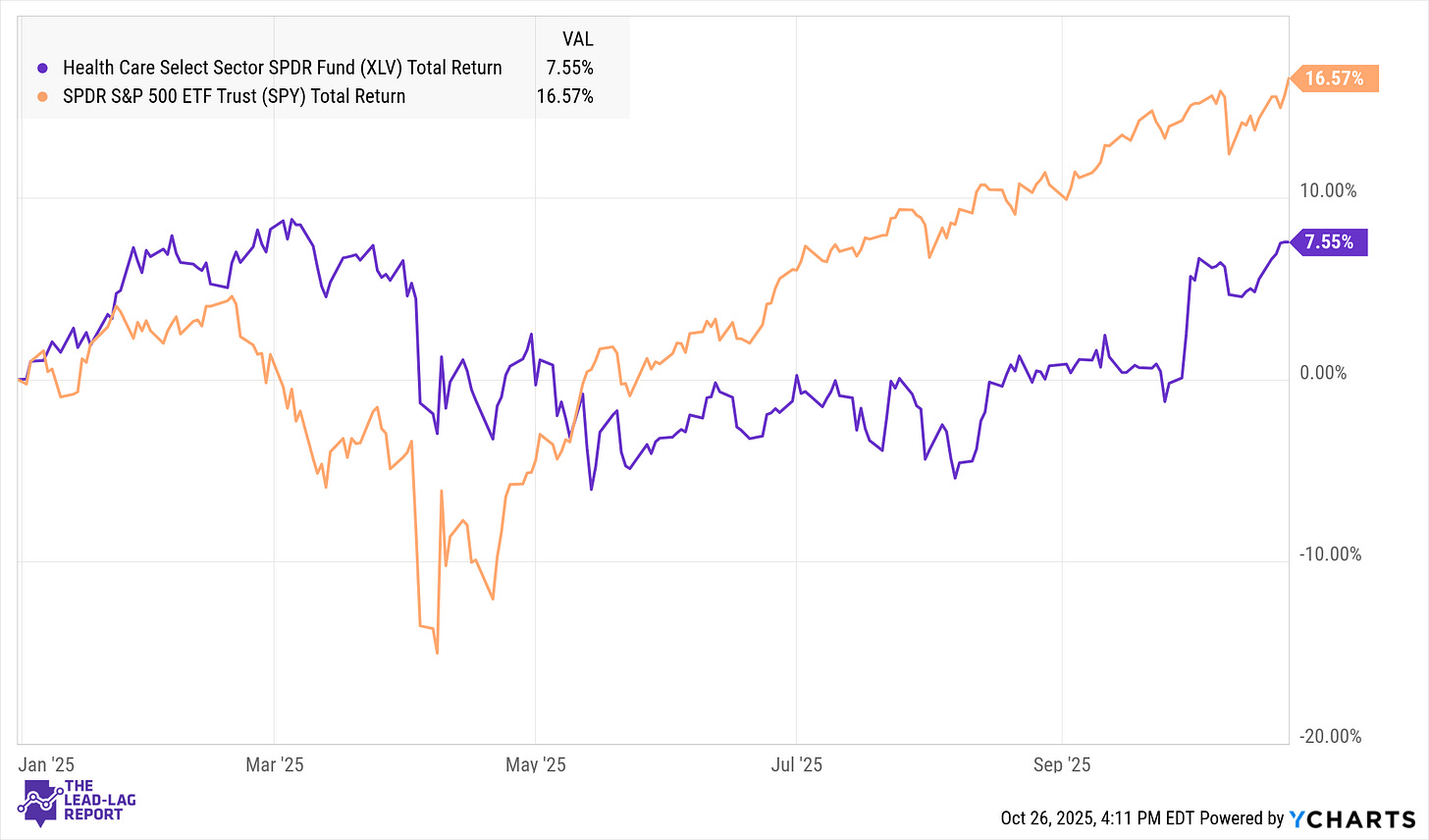

Healthcare has lagged the S&P 500 by hundreds of basis points year-to-date, extending a multi-year stretch of underperformance.

Political pressure, patent expirations, and investor rotations into AI and tech have weighed heavily on the sector.

Valuations are now at multi-decade lows, with large-cap names like Merck, Bristol Myers, Pfizer, and J&J trading at steep discounts.

Easing rate policy, normalization of healthcare costs, and clearer regulation could trigger a rebound in 2026.

Value-oriented investors are beginning to return, signaling a potential mean-reversion opportunity.

The U.S. Healthcare sector has sharply lagged the broader market in 2025. Healthcare’s total market cap (~$4.8 trillion) is now barely larger than a single company, NVIDIA (~$4.3 trillion)², underscoring its dramatic relative decline.

This weakness has been broad-based across pharmaceuticals, biotech, insurers, and device makers. Defensive healthcare names, typically resilient, failed to keep pace even amid volatility. As a result, valuations across the sector have compressed to multi-decade lows — levels that contrarian investors increasingly view as potential entry points.

Why Healthcare Has Struggled

Policy headwinds have weighed heavily. The administration’s push to benchmark U.S. drug prices to international levels, combined with proposed Medicaid and research funding cuts, created persistent uncertainty³. Fears of “most-favored-nation” pricing and Medicare negotiations depressed multiples.

Fundamental pressures added to the pain. Blockbuster patent expirations for companies such as Merck and Bristol Myers Squibb (BMY) threaten future revenue streams, while post-COVID normalization hit profits at Pfizer and Moderna⁴. Providers faced rising labor costs, eroding margins. Altogether, healthcare was one of the few S&P 500 sectors with declining 2025 earnings⁵.

Investor sentiment turned sharply negative. Healthcare ETFs suffered twelve straight months of outflows totaling $11.5 billion through July — the worst of any sector⁶. Fund managers favored tech’s cleaner growth narrative, reinforcing healthcare’s underperformance. By late 2025, pessimism had reached extremes, setting up conditions where even modestly positive surprises could trigger a reversal.

Valuations Near Historical Extremes

The sector’s valuation discount versus the S&P 500 is among the widest in 30 years. The forward P/E for healthcare (~16×) sits far below the market’s 22× multiple⁷. Relative to the S&P 500, healthcare trades roughly 30% cheaper than average — after touching a 38% discount earlier in 2025⁸. The sector’s price-to-book and EV/EBITDA multiples hover near multi-decade lows, comparable to consumer staples⁹.

Major names reflect this deep value: Merck (MRK) trades at ~9× forward earnings vs a historical 14–15× average; BMY around 7× vs ~15×; and Pfizer (PFE) at 9–10× after its pandemic unwind¹⁰. Johnson & Johnson (JNJ) sits near 16× — below its long-term premium valuation¹¹. Bad news is more than priced in¹².

Catalysts for a Reversal

1. Monetary Policy Shift. If the Federal Reserve continues to cut rates, healthcare could regain favor as investors rotate from overextended growth stocks into defensive value plays. Lower yields make dividends relatively more attractive and reduce financing costs. Historically, healthcare has outperformed when markets grow risk-averse or macro conditions tighten¹³.

2. Defensive Rotation. Rising volatility or economic slowdown tends to favor healthcare’s stable cash flows. The sector typically leads during “difficult markets”¹⁴. With cyclical sectors stretched, any equity correction could channel flows back into undervalued defensives such as pharma and managed care.

3. Earnings Inflection. Margin pressures are easing as labor markets normalize. Hospitals and providers are renegotiating contracts at higher rates, while staffing shortages subside¹⁵. Insurers like UnitedHealth are adjusting premiums to offset higher utilization. Pharma is approaching the end of its patent-cliff cycle, and innovation remains robust — from obesity and gene therapies to AI-driven diagnostics. Notably, 87% of healthcare firms beat EPS estimates in Q3 2025¹⁶, hinting at improving fundamentals.

4. Valuation Mean-Reversion. Simply narrowing the valuation gap from 30% to its historical 18% would imply major relative upside⁸. Deep-value managers are re-entering the space, and M&A activity is likely to accelerate as large players seek growth through acquisitions of discounted biotechs and medtechs¹⁷.

5. Policy Clarity. Policy fears are easing. Pfizer’s recent Medicaid drug-pricing deal — which averted broader tariffs — may serve as a template for other firms, suggesting targeted reforms instead of sweeping price controls¹⁸. As 2026 election clarity emerges, reduced uncertainty could help re-rate the sector. Demographic tailwinds (aging population) and technological efficiency gains (AI, telehealth, precision medicine) reinforce the long-term case¹⁹.

Selected Stocks Poised for Recovery

Merck & Co. (MRK) – A leader in oncology and vaccines, Merck trades at ~9× forward earnings — half its norm. Keytruda’s future patent loss is a concern, yet the company’s pipeline in oncology, HIV, and cardio-metabolic drugs supports renewed growth. With A-range credit ratings and robust cash flow, even a re-rating to 12–13× could yield meaningful upside²⁰.