Why Warren Buffett Is Sitting on Record Cash — and What That Says About the Market

Description

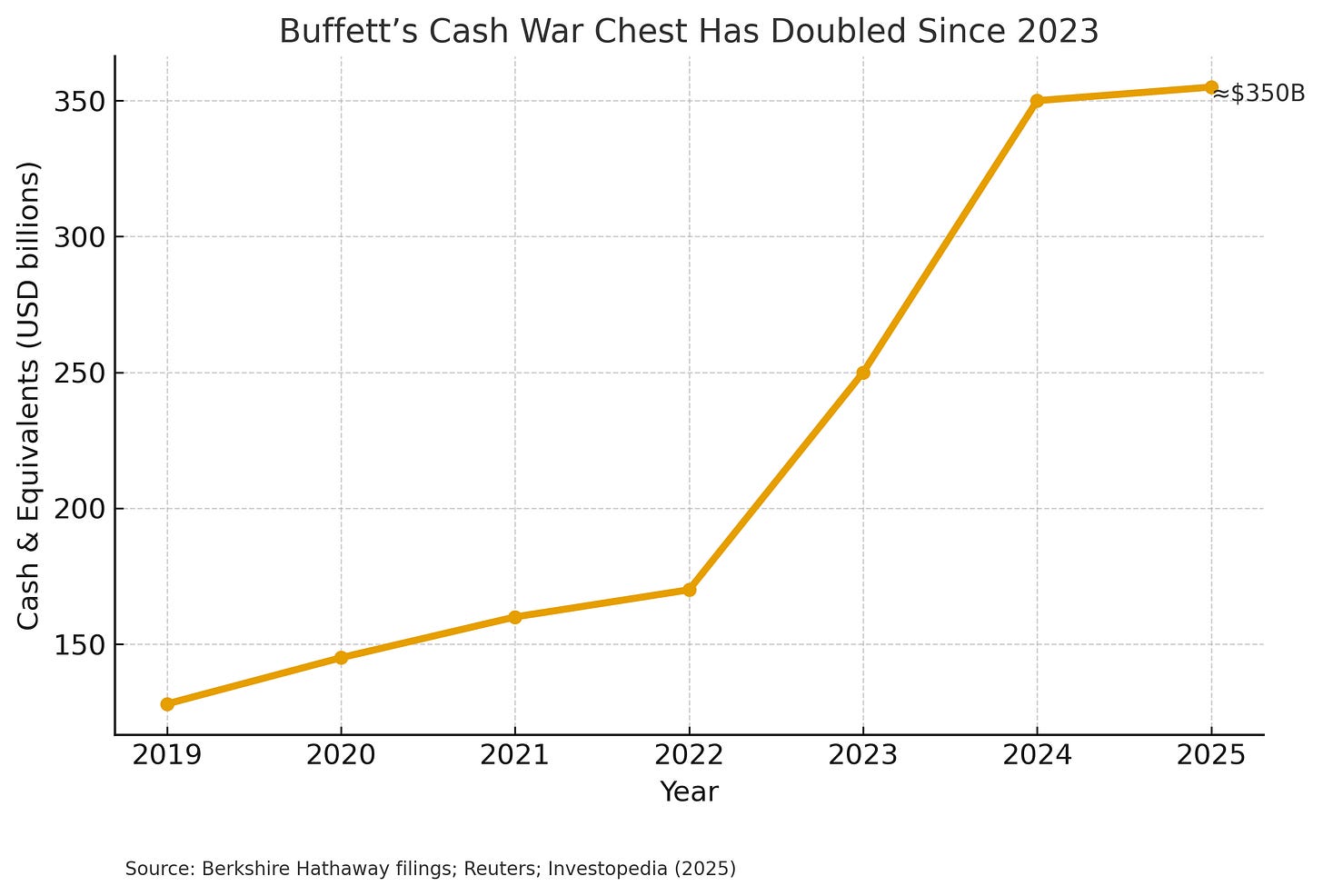

When Warren Buffett—famed for spotting undervalued stocks—is reluctant to buy, investors take notice. His firm, Berkshire Hathaway, is holding nearly $350 billion in cash and short-term Treasuries—the largest hoard ever amassed by a public company, even exceeding the combined liquid reserves of Apple, Microsoft, Alphabet, Amazon, and Nvidia¹. This war chest has doubled in just over a year², built as Berkshire sold far more stock than it bought. Why is the “Oracle of Omaha” waiting on the sidelines—and what might that signal about today’s market?

Buffett’s Record Cash Pile

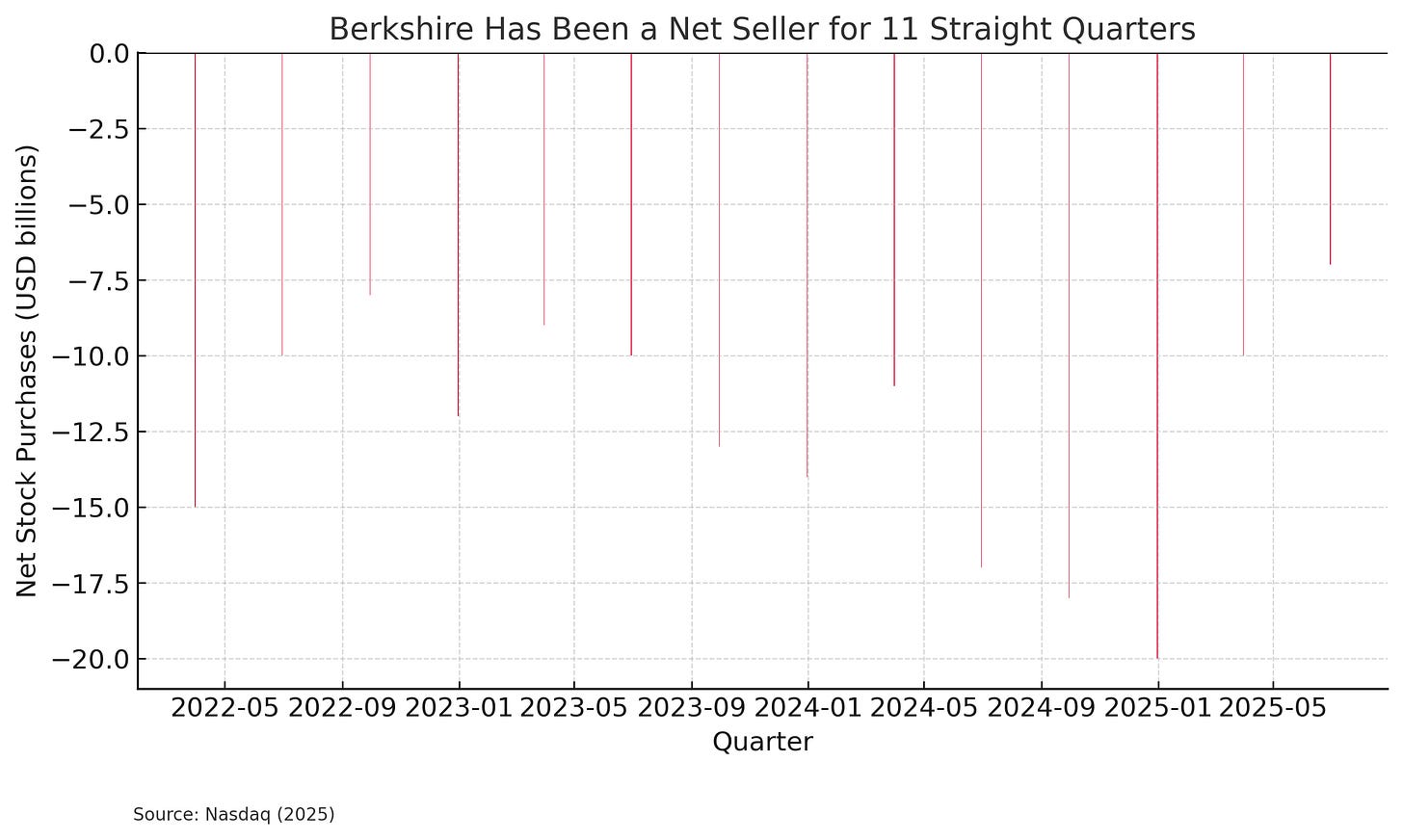

Berkshire’s cash position reflects Buffett’s caution amid few attractive opportunities. The firm has been a net seller for 11 consecutive quarters, unloading roughly $177 billion more in stocks than it purchased since 2022³. Even long-time favorites such as Apple and Bank of America were trimmed; Berkshire cut its Apple stake by roughly two-thirds⁴. Buffett has long preached: “Be fearful when others are greedy.” Today, he admits it is difficult to find value in a historically expensive market⁵.

Rather than chase momentum, Buffett is content to hold cash and earn billions in risk-free interest income while waiting for better entry points⁶. With policy rates at multi-decade highs, even idle cash now pays—a stark contrast to the zero-rate era when “cash was trash.” Size also limits his options: few acquisitions can “move the needle” for a $1 trillion conglomerate⁷. Berkshire’s recent $10 billion chemicals acquisition, its largest in years, barely dented reserves⁸.

This “rainy-day fund” gives Buffett flexibility to strike when prices fall. It also signals that, in his view, most assets are priced without a margin of safety. He would rather underperform in euphoric periods than overpay—a stance consistent with his mantra of “extreme fiscal conservatism.”⁹

Valuations Near Historical Extremes

To grasp Buffett’s restraint, consider market valuations. The S&P 500 trades near 23 times forward earnings, well above its 10-year average and approaching levels last seen in the late-1990s tech bubble¹⁰. On trailing earnings, the multiple exceeds 30—roughly 67 percent above the long-term norm¹¹.

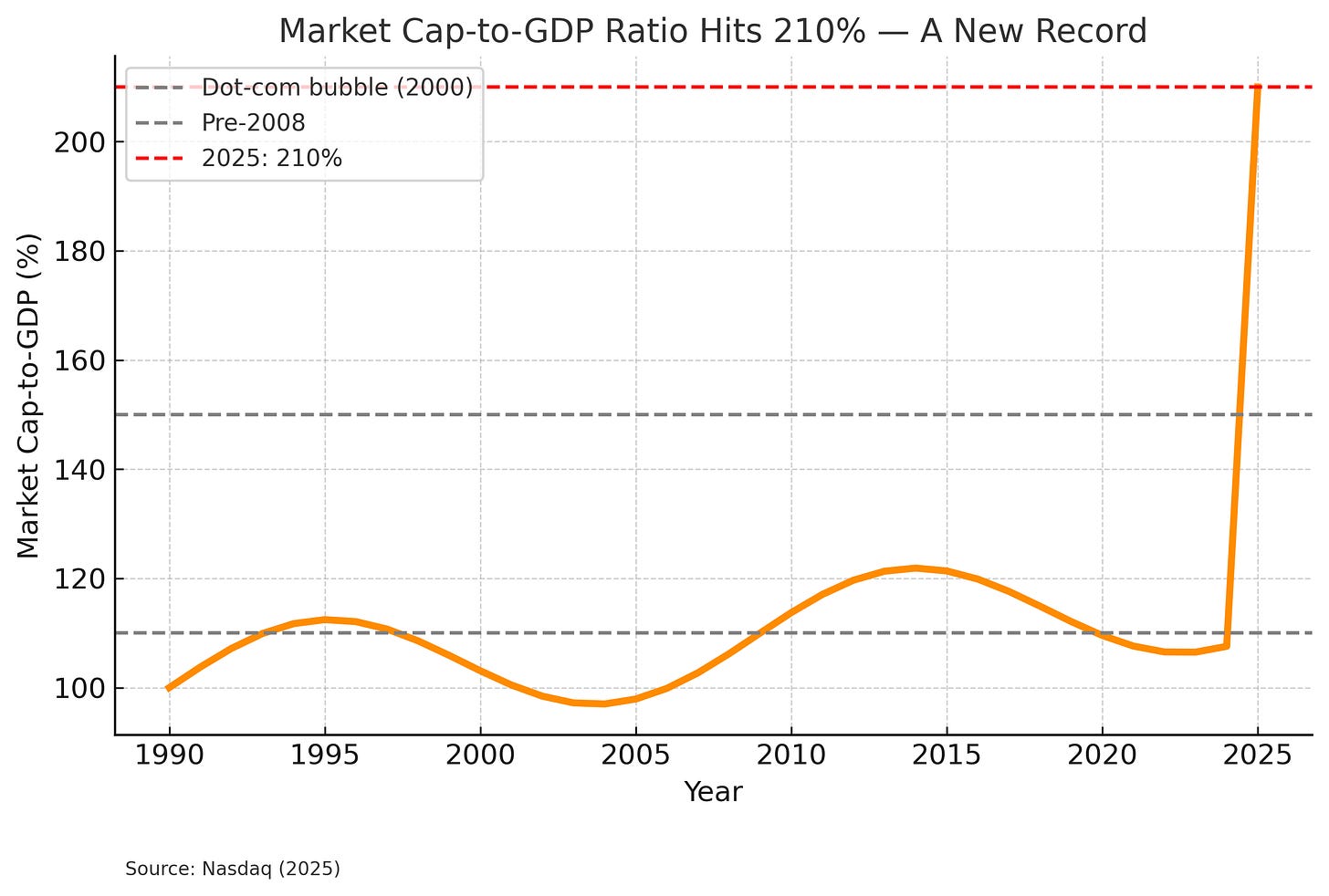

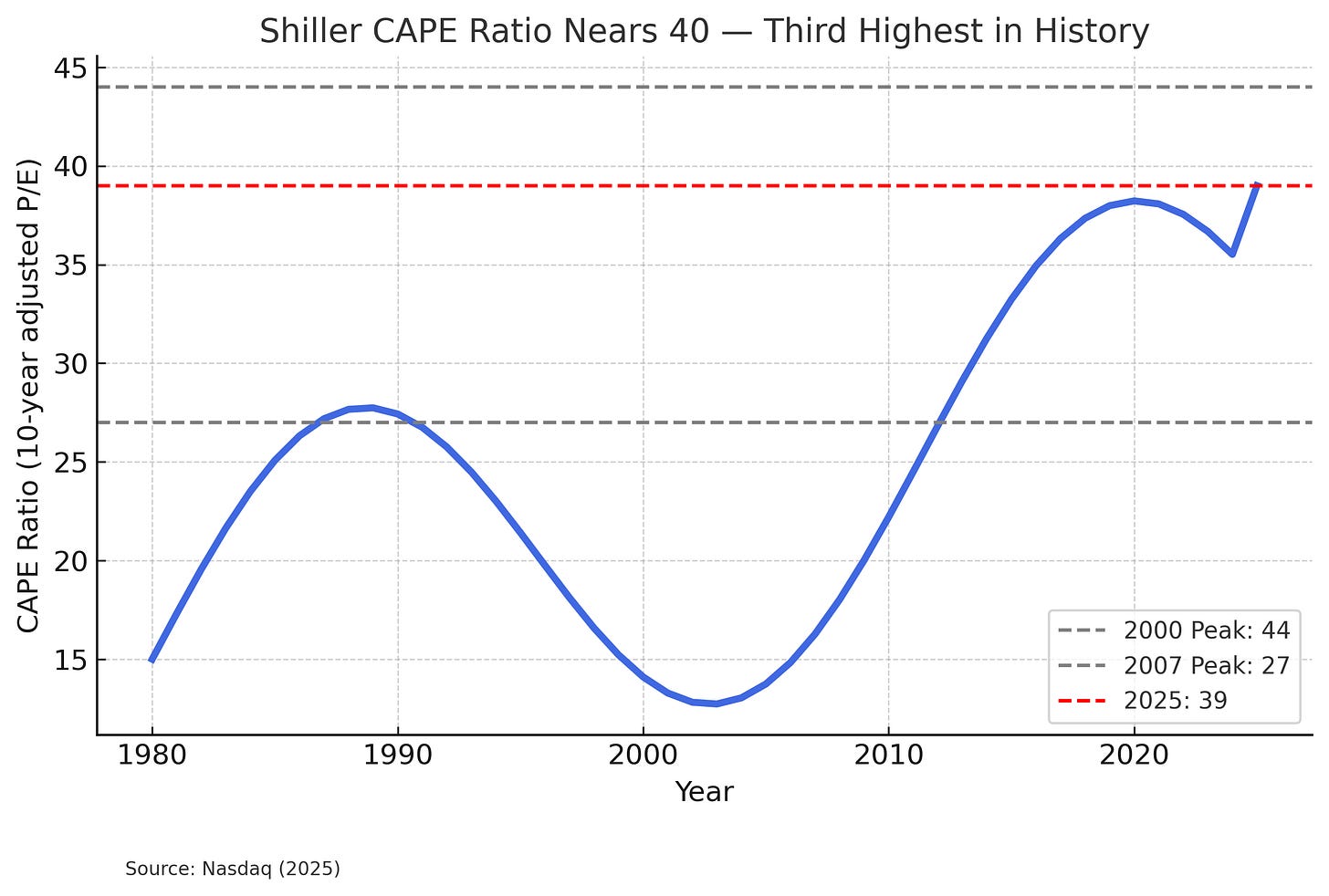

Buffett’s own yardstick, the “Buffett Indicator” (total U.S. market capitalization divided by GDP), recently topped 210 percent, an all-time high¹². That means the market’s value is more than double the size of the economy—a ratio surpassing even the dot-com mania. Another measure, the Shiller CAPE, hovers around 39, versus a 20th-century average near 17¹³. The only prior periods above 30—the late 1990s and mid-2000s—were followed by steep declines¹⁴.

No indicator can time a crash, but such extremes suggest future returns may be modest and risks elevated. Buffett’s discipline leads him to wait rather than chase. “De