Inside the Data: What Shapes Startup Deal Sizes in Africa

Description

This story was originally published on HackerNoon at: https://hackernoon.com/inside-the-data-what-shapes-startup-deal-sizes-in-africa.

Data-driven study uses machine learning to reveal the key factors influencing African startup deal amounts and investment outcomes.

Check more stories related to tech-stories at: https://hackernoon.com/c/tech-stories.

You can also check exclusive content about #african-startups, #startup-funding-africa, #venture-capital-africa, #african-entrepreneurship, #startup-investment-data, #startup-policy-africa, #african-startup-ecosystem, #venture-capital-research, and more.

This story was written by: @exitstrategy. Learn more about this writer by checking @exitstrategy's about page,

and for more stories, please visit hackernoon.com.

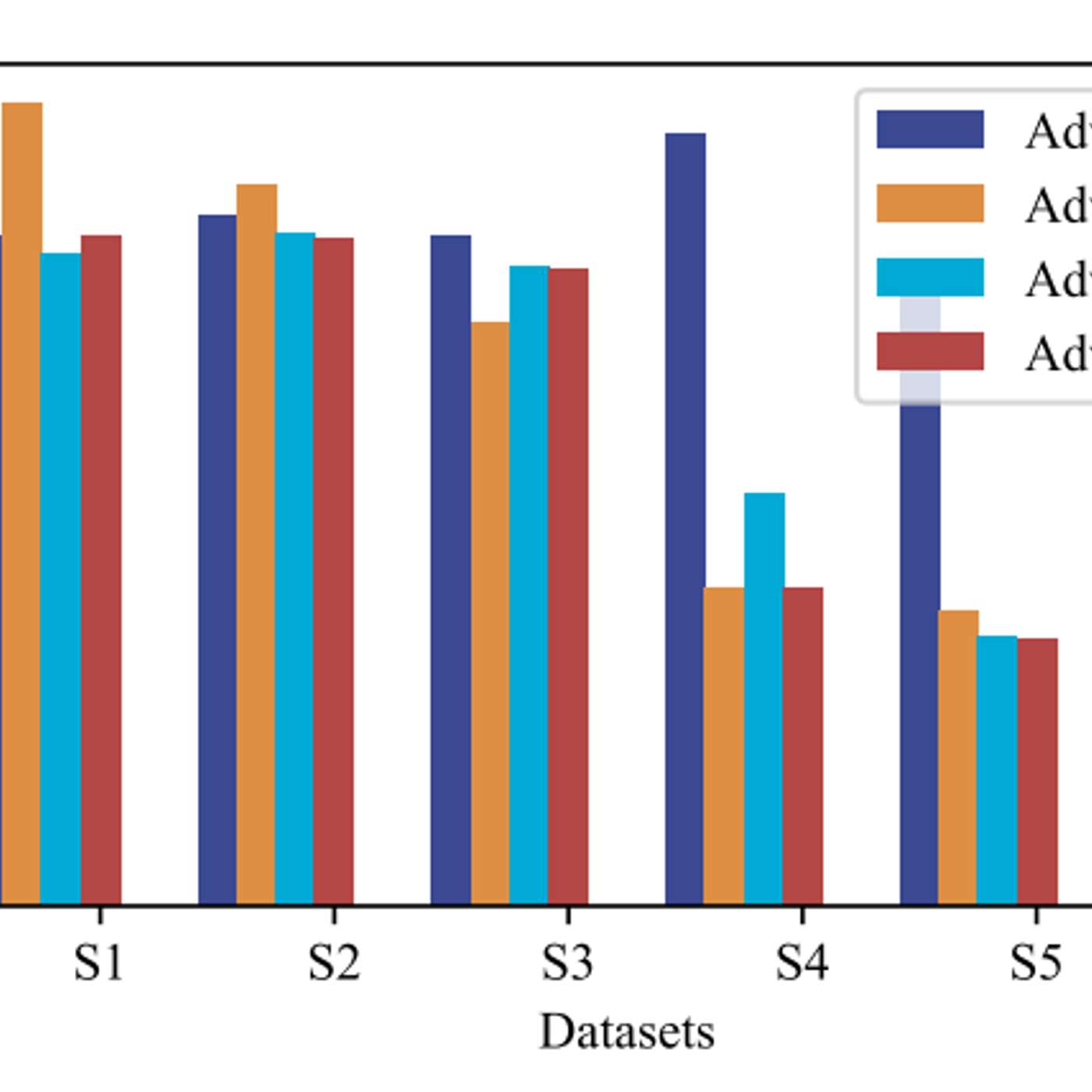

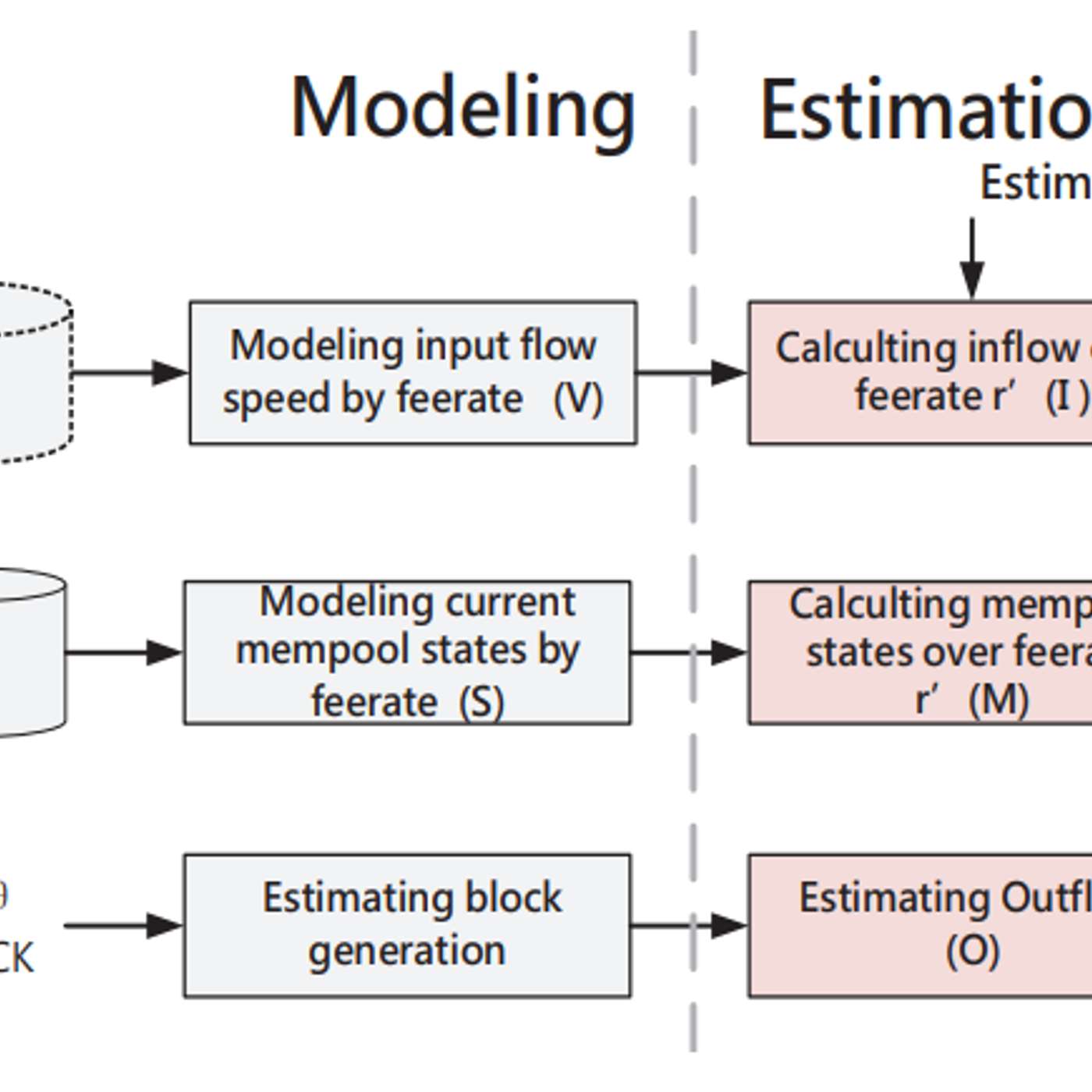

This study analyzes over 2,500 publicly disclosed African startup deals to uncover what drives investment sizes. By cleaning, merging, and engineering data from africathebigdeal.com, features were grouped into founding-team, company, and investment categories. Exploratory Data Analysis and four machine learning models — Linear Regression, SVR, Random Forest, and Gradient Boosting — were used to predict deal amounts. The best-performing model, validated via cross-validation, forms the basis for data-backed insights and policy recommendations aimed at strengthening Africa’s startup funding ecosystem.