European Opening News: US gov't shuts down & OPEC rejects 500k reports

Update: 2025-10-01

Description

- APAC stocks traded mixed following modest gains on Wall Street, with focus on the length of the US government shutdown after the Senate rejected the House-passed CR, whilst Chinese participants were away for Golden Week.

- The Senate has rejected the House-passed CR (as expected), cementing a shutdown, while House and Senate GOP leaders will hold a 10 a.m. (15:00 BST) news conference Wednesday, according to Politico, citing sources.

- BoJ Tankan Survey came in mixed and not strong enough to trigger hawkish repricing. Pricing tilted incrementally dovish as the dust settled, with a BoJ official noting firms were divided on the impact of US tariffs.

- The OPEC Secretariat firmly rejected media reports alleging that the OPEC-8 countries are planning to increase production by 500k bpd, calling the claims wholly inaccurate and misleading.

- Looking ahead, highlights include EZ & UK Final Manufacturing PMI (Sep), EZ Flash HICP (Sep), US ADP (Sep), ISM Manufacturing (Sep), Atlanta Fed GDP, BoC Minutes, Fed’s Barkin, ECB’s Elderson, de Guindos, Rehn, BoC’s Rogers, supply from UK and Germany.

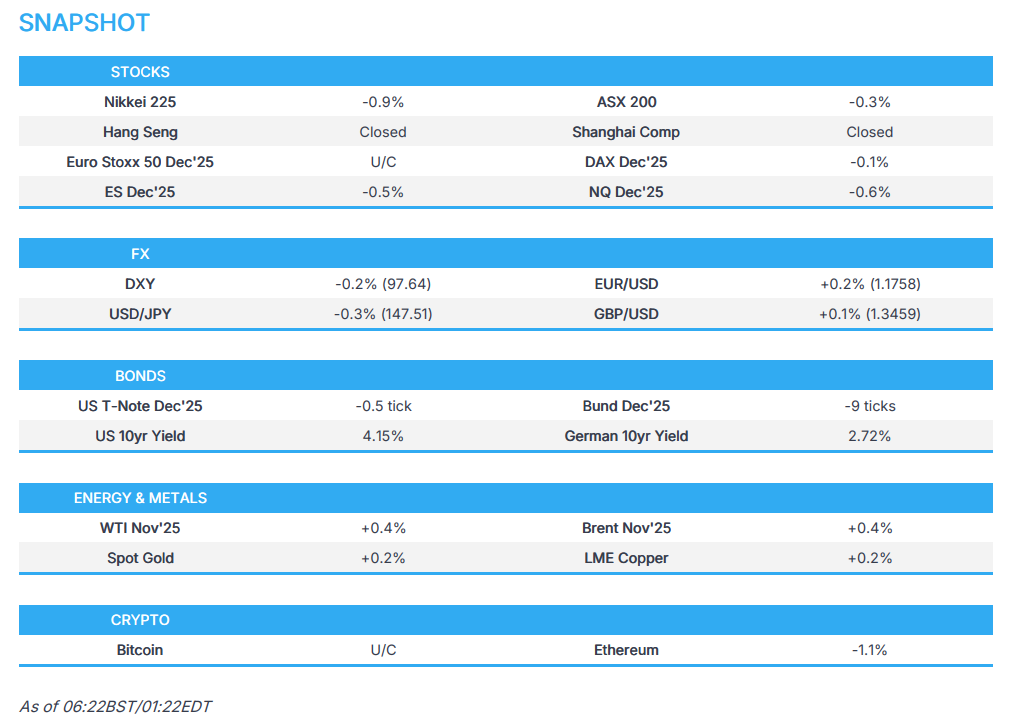

SNAPSHOT

<figure class="image"> </figure>

</figure>US TRADE

EQUITIES

- US stocks finished near session highs, finding strength through the afternoon and into month/quarter-end, though the Russell 2000 still closed flat. The late recovery came without a clear headline catalyst.

- Sectors ended mixed with a slight positive bias: Energy lagged, weighed by lower oil prices, while Health led gains, supported by Pfizer (+6.5%) following a series of Trump-related announcements. Meanwhile, spot gold reversed earlier losses, extended its climb, and printed a fresh all-time high.

- SPX +0.41% at 6,688, NDX +0.28% at 24,680, DJI +0.18% at 46,398, RUT +0.05% at 2,436

- Click here for a detailed summary.

US GOVERNMENT SHUTDOWN

- The US government officially went into shutdown, with a majority of operations halted after no funding deal was reached in the Senate, marking the first shutdown since 2018.

- The Senate has rejected the House-passed CR (as expected), cementing a shutdown, while House and Senate GOP leaders will hold a 10 a.m. (15:00 BST) news conference Wednesday, according to Politico, citing sources.

- US President Trump said on government spending that they are going to see what happens, noting he had a good discussion with Schumer and Jeffries. On a potential government shutdown, he said “we’ll probably have one,” adding that Democrats are taking a risk and that during a shutdown, the government can cut benefits and take medical actions that are irreversible, according to Reuters.

- US Senate Democrats urged colleagues to resist President Trump’s stance on government funding during a private caucus meeting on Tuesday, according to Axios sources. A US government shutdown looms within hours amid a lack of compromise from lawmakers, with Democratic opposition strengthening, according to Reuters.

- The Office of Management and Budget issued official guidance that the government will shut down at about midnight, according to FBN’s Lawrence.

NOTABLE HEADLINES

- Fed’s Goolsbee (2025 voter) said the US seems to be headed into a new wave of tariffs, while the labour market remains pretty steady, according to Reuters.

- Fed’s Collins (2025 voter) said gradual rate cuts are likely if the economy meets expectations, but warned that aggressive cuts risk fuelling inflation. She noted the economic outlook aligns with Fed forecasts, said supportive financial conditions give space to watch data, and emphasised the Fed must continue managing inflation risks, according to Reuters.

- Fed’s Logan (2026 voter) said the Fed will be cautious in any further reductions and that the US may need additional labour market slack to reach the 2% inflation target. She noted resilient consumption and business investment show policy is only modestly restrictive, adding that inflation expectations cannot be taken for granted and that financial conditions are now a tailwind, further evidence that policy is modestly restrictive. Logan said it is unclear how much further the Fed can cut before hitting neutral and warned that even excluding tariff impacts, inflation may be as high as 2.4%, driven by non-housing services, according to Reuters.

TRADE/TARIFFS

- US President Trump said Eli Lilly (LLY) has been fantastic, warning that pharma companies will face an extra 5–8% tariff if no deals are made. He said drug pricing will have a huge impact on the mid-term elections and that on Pfizer (PFE), drug price lowering will be immediate, according to Reuters.

- US President Trump said Pfizer (PFE) agreed to offer discounts, with the US paying the lowest price, 50–100% off and in some cases more. He added that all US medications will be sold at most favoured nation prices and that Pfizer will offer all of its prescription medications to Medicaid at MFN prices, according to Reuters.

- US FDA Chief said that if drugmakers equalise their prices, their applications will go to the front of the line, and if they build in the US, they will also move to the front of the line, according to Reuters.

- USTR Greer said President Trump’s pharmaceutical tariff is aimed at ensuring that the most innovative drugs are produced in the US, according to the Economic Club of New York.

- US Commerce Secretary Lutnick, on 232 investigations, said that while negotiations are ongoing, they are going to let it play out, according to Reuters.

- USTR Greer said the US will always trade with China but needs to find a place where both countries are comfortable, adding that China’s reliance on exports is not sustainable and that trade should become more balanced. He said China’s “wolf warrior” ethos has leaked into US-China economic relations, noted that the average tariff of 55% on Chinese imports is the status quo, and added that the USTR will be fully functioning in the event of a government shutdown. He said US tariff revenues could reach USD 600bln to USD 1tln per year, according to Reuters.

- US President Trump said other drugmakers will commit in the coming weeks to sell at most favoured nation prices, which will help bring Medicaid costs down. He added that medicines will be available for direct purchase on a US government website, according to Reuters.

- US Deputy Secretary of State encouraged investment from South Korea, with the US and South Korea holding a working group on visas for South Korean businesses investing in the US, according to a statement.

- South Korea and the US released a joint statement on a foreign exchange policy agreement, pledging to avoid manipulating exchange rates to gain an unfair competitive advantage. The statement did not mention a bilateral currency swap or South Korea’s state-run pension fund. Both sides agreed that FX market intervention should be reserved for combating excessive volatility and would be considered for both disorderly depreciation and appreciation. They also agreed to exchange FX intervention operations on a monthly basis and said any macroprudential or capital flow measures will not target exchange rates, according to Reuters.

- Taiwan rejected a US request to produce half of its chips locally, according to Bloomberg.

- Japanese Economy Minister Akazawa said they will operate a USD 550bln US-bound investment without causing FX impact, suggesting USD 550bln is the range where there is no FX impact, according to Reuters.

NOTABLE US EQUITY NEWS

- USTR Greer, when asked whether the Trump administration has discussed taking a stake in NVIDIA (NVDA), said US President Trump would love a stake in every company that is doing well, according to Reuters.

- Nike Inc (NKE) Q1 2026 (USD): EPS 0.49 (exp. 0.27), Revenue 11.72bln (exp. 11.00bln). Gross margin decreased 320bps to 42.2%, primarily due to lower average selling price, reflecting higher discounts and channel mix, as well as higher tariffs in North America. CFO said tariffs will cost approximately USD 1.5bln, higher than the prior estimate of around USD 1bln, and expects Q2 revenue to fall by low single digits versus estimates of a 3.1% decline, according to Reuters. Shares rose 4.5% after hours.

- Fed to ease Morgan Stanley's (MS) capital requirements following a review, according to Bloomberg.

- US Energy Secretary said the US government is taking an equity stake in Lithium Americas (LAC), via Bloomberg TV; US DoE to take a 5% stake in Lithium Americas (LAC), according to Reuters sources.

- Berkshire Hathaway (BRK.B) is reportedly in talks to buy Occidental Petroleum’s (OXY) chemical unit for USD 10bln, via WSJ.

- BlackRock’s (BLK) GIP is said to be nearing USD 38bln takeover of utility AES (AES), according to FT sources

APAC TRADE

EQUITIES

- <li

Comments

In Channel