How Data Centers Can Strengthen the Texas Grid with Camus Energy CEO Astrid Atkinson

Description

Watch the Conversation on YouTube

Headlines warn that data centers are straining the Texas grid. The reality is more interesting: data centers — through their own flexibility and by supporting distributed flexibility markets — can strengthen the grid.

I explored that topic and a lot more with Astrid Atkinson, CEO and co-founder of Camus Energy and former senior reliability engineer at Google. At Google, she led teams responsible for keeping the world’s search engine online, matching computing load to available capacity across continents. Her lessons from that experience translates well to the grid: reliability doesn’t come from scale alone.

Reliability comes from flexibility and orchestration.

Astrid calls it “grid orchestration” which means coordinating and optimizing both supply and demand in real time all the way down to homes and businesses, but starting with better data and better management of the distribution grid. We’re moving toward a more decentralized network of flexible resources: batteries, EVs, thermostats, and yes, data centers. We’re going to need a much smarter, much better orchestrated grid.

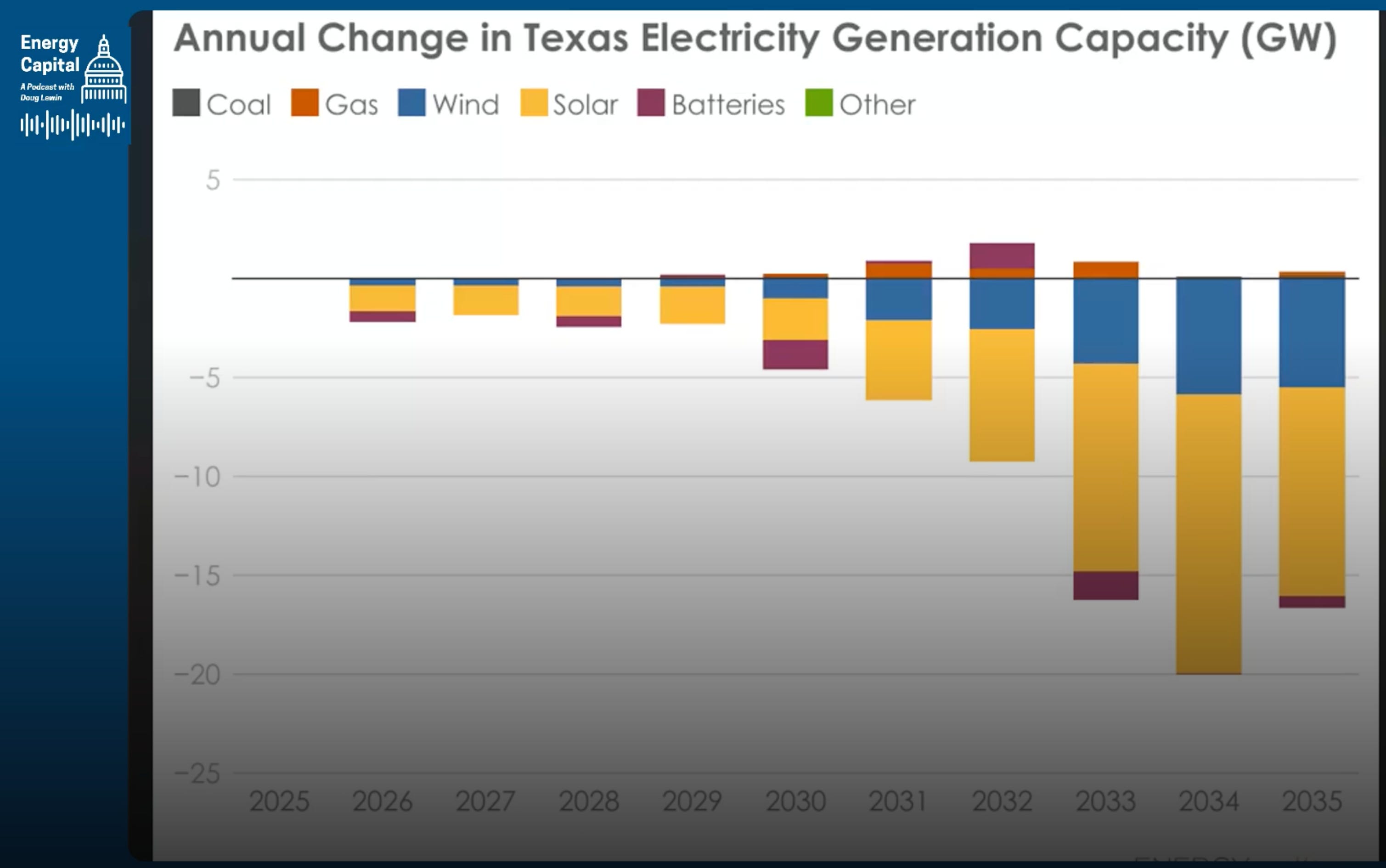

Texas already has the raw material for this shift.

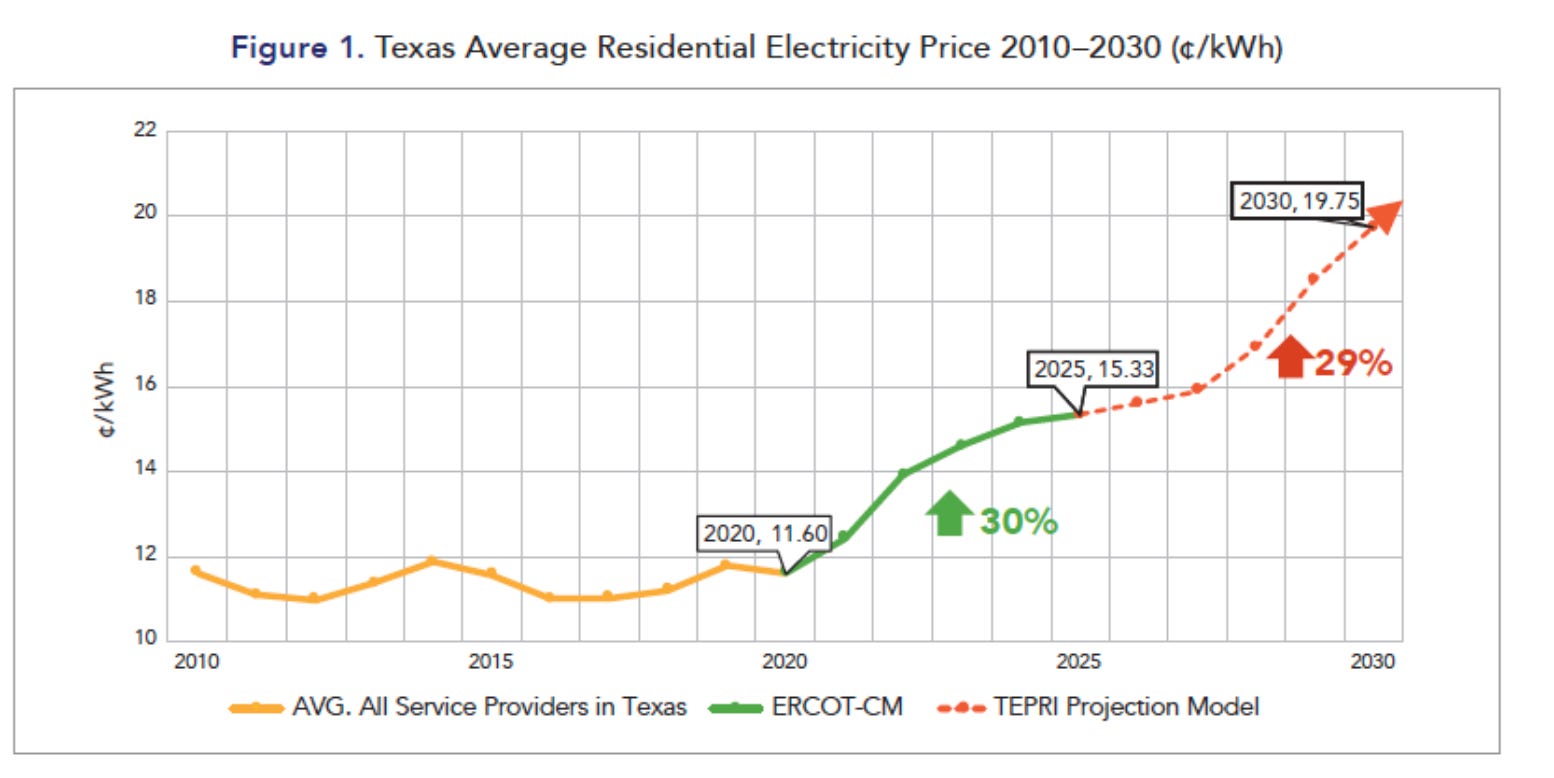

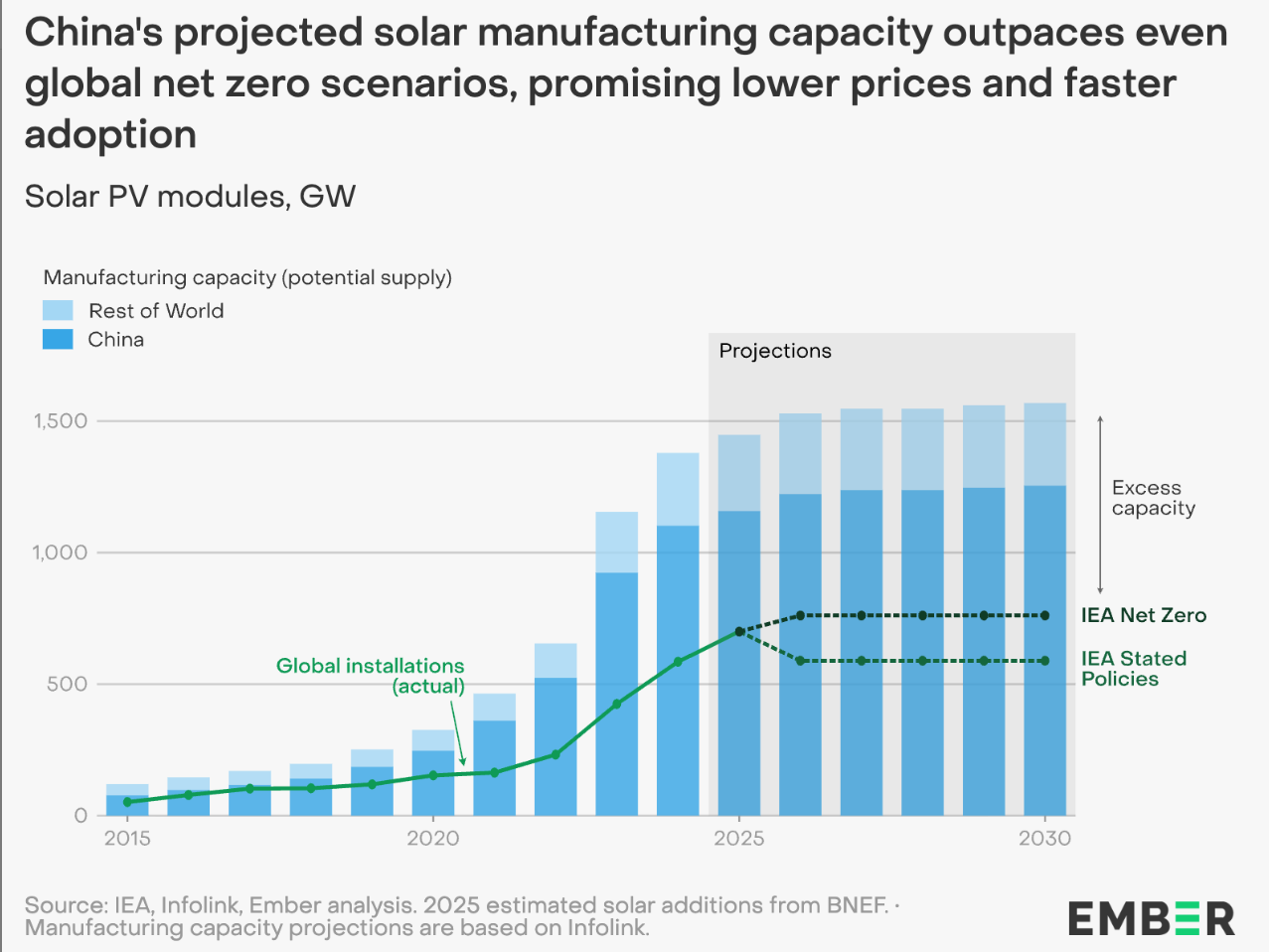

Rooftop solar, batteries, and EVs are scaling faster than ever. We now have over 6 gigawatts of distributed resources in ERCOT, roughly the size of six large power plants.

But they’re not well coordinated and that disorganized integration means we’re leaving cost savings and reliability benefits on the table. Part of the problem is that market signals aren’t flowing to distributed resources at a level near their actual value.

That’s where data centers could potentially come in.If data center developers fund load flexibility, they could potentially put money into consumers’ pockets and increase their speed to interconnection.

[D]ata centers fundamentally are not really budget constrained for getting these things built. They’re really time constrained. And so, I think in there is the opportunity to start thinking about off-market or kind of secondary market opportunities to get value for flexibility, both from the site itself, but also from you, me, batteries [and other DERs]…

Astrid’s experience offers two key lessons for Texas:

* Automation must be simple and local. The best systems don’t depend on constant central control.

* The biggest savings aren’t in wholesale prices, they’re in avoided infrastructure. Flexible demand can defer costly upgrades to poles and wires, easing pressure on bills.

We’re seeing movement in the right direction, ERCOT’s efforts to integrate distributed energy resources, electric cooperatives piloting new demand response tools, and increasing talk of creating distribution-level markets where buyers and sellers can trade flexibility directly.

Texas has always led by embracing what’s next before anyone else believed it could work. This is the next frontier: flexibility, orchestration, and coordination of DERs.

“There’s never been a more exciting time to work in this industry,” Astrid said.

She’s right. We have the tools, the data, and the entrepreneurial spirit. What we need now is the will to connect them.

The path forward isn’t about choosing between growth, affordability, and reliability. If we build smart, Texas can have it all.

If this perspective resonates, share it with someone who cares about where Texas energy goes next and subscribe to stay part of that conversation.

Watch the Interview Here:

Timestamps:

* 00:00 – Intro

* 02:30 – Astrid’s background and Camus

* 05:00 – Google reliability lessons

* 06:30 – Texas load growth reality

* 11:00 – Contracting flexibility, framing the problem

* 12:30 – Internet-scale orchestration parallels

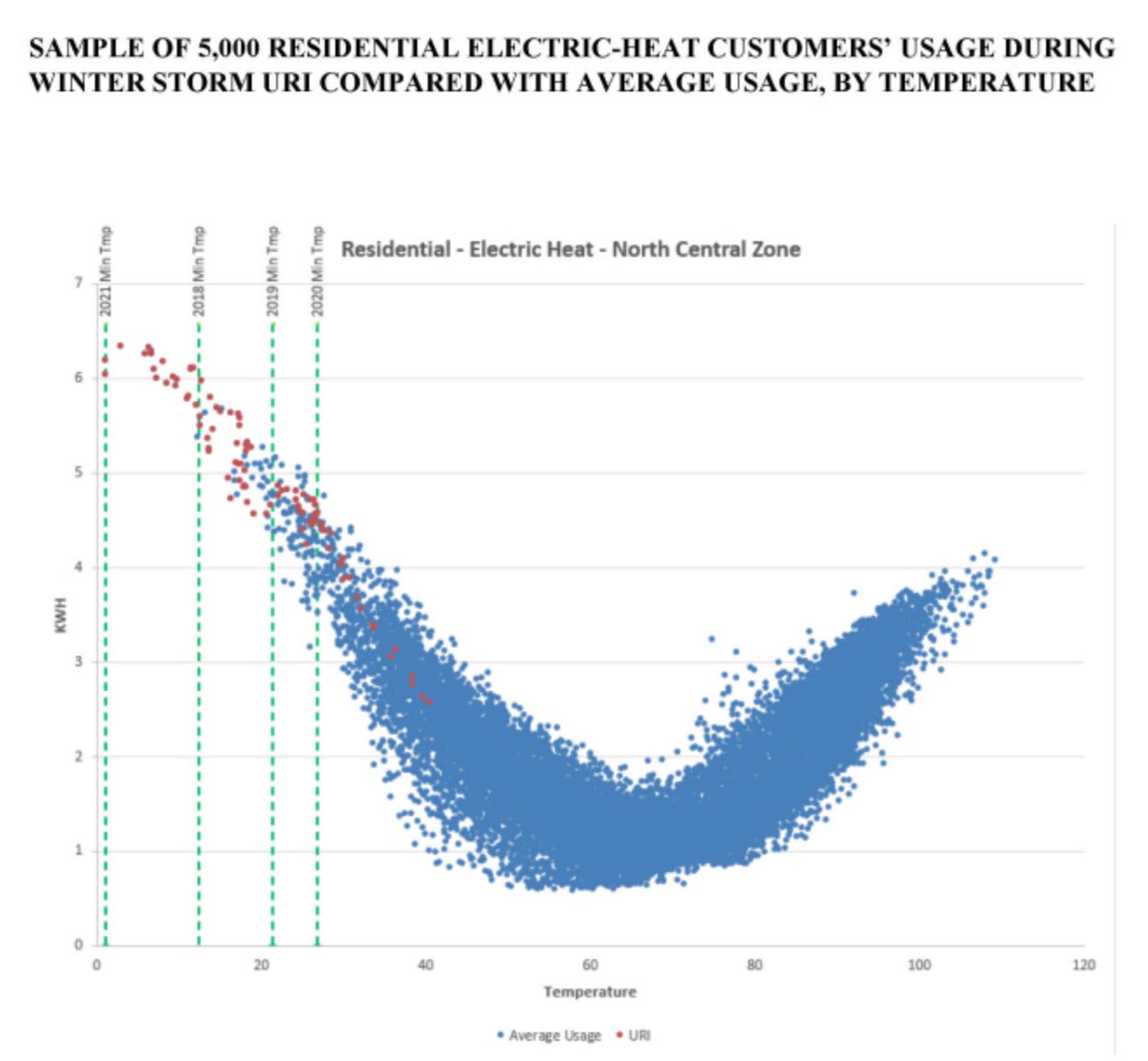

* 14:30 – Major reliability event takeaways

* 18:00 – What a flexible grid requires

* 20:00 – Paying Texans for household flexibility

* 27:30 – Visibility before control (DSO layer)

* 31:30 – Intelligent automation, local control

* 34:00 – Value is in avoided T&D spend

* 38:00 – Co-ops and munis as testbeds

* 46:30 – Edge markets and price signals

* 56:30 – Bills down, capacity up, resilience

* 58:30 – Closing thoughts

Resources:

Guest & Company

* Astrid Atkinson (LinkedIn)

* Camus Energy, (LinkedIn)

Company & Industry News

* “So What Does Camus Do Exactly?” (Camus Energy blog)

* Camus wins Innovation Challenge Award at Data Center World (Camus Energy)

* Access “Getting ahead of the EV tipping point” AES and Camus White Paper (Camus Energy)

* Voltus “Bring Your Own Capacity” Announcement (Voltus)

* ERCOT Selects GE Vernova to Help Drive Innovation in DERs Announcement (ERCOT)

* ERCOT Grid Research, Innovation, and Transformation Announcement (ERCOT)

* Community pressure mounts against CPS disconnection policy, rate structures (San Antonio Express News)

* National Energy Assistance Directors Association. Energy Hardship Report.

* Google’s new plan to keep its data centers from stressing the grid (Canary Media)

* Texas law gives ERCOT authority to disconnect data centers in emergencies (Utility Dive)

* Texas data center buildout, stranded-cost risks and planning challenges (Utility Dive)

* MIT: Data center flexibility can cut costs, emissions vary by region (Utility Dive)

Related Podcasts by Doug

* How Load Flexibility Could Unlock Energy Abundance (with Tyler Norris)

* Why the Old Utility Business Model Doesn’t Fit Anymore with Lynne Kiesling (Part 1)

* AI, Outage Risks, and Market Opportunities with Lynne Kiesling (Part 2)

* YouTube clip — Texas Grid Growth Depends on Data Center Flexibility:

Related Substack Posts:

* ERCOT and Texas Need a Different Kind of Growth

* Demand-Side Resources Could Enable Load Growth

* March 4, 2025: Data Centers, Nukes, VPPs, and More

Transcript:

Doug Lewin (00:05 .356)

Welcome to the Energy Capital Podcast. I’m your host, Doug Lewin. My guest this week is Astrid Atkinson. She is the CEO and co-founder of Camu Energy. The conversation was a really great one. We got into one of my favorite topics these days, which is how can data centers coming onto the grid actually increase the reliability of the grid and improve affordability for customers? So we talked a lot about data centers potentially actually creating funds to get demand reductions and demand flexibility in people’s homes and businesses that would put money back into their pockets while strengthening the grid, giving data centers speed to power. We talked about particularly the DSO model, distribution system operator model, and what that might mean in the United States. These are common in other parts of the world, but we really don’t have designated entities in the US that are DSOs. We talked about intelligent automation and how processes being automated can actually make it easier for human operators. The economics of DERs, distributed energy resources, so much of the value of DERs is the potential reduction in cost in the distribution system. Transmission distribution utilities have so many different investment opportunities, but how