Why the Old Utility Business Model Doesn’t Fit Anymore with Lynne Kiesling (Part 1)

Description

Over a hundred years ago, the monopoly business utility model emerged as the one that could attract sufficient capital to electrify everything.

The monopoly utility business was championed by Thomas Edison’s protégé and early leader of ComEd in Chicago, Sam Insull.

It worked. By mid-century, most Americans had power.

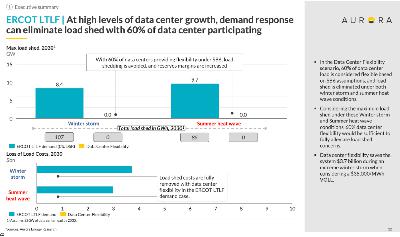

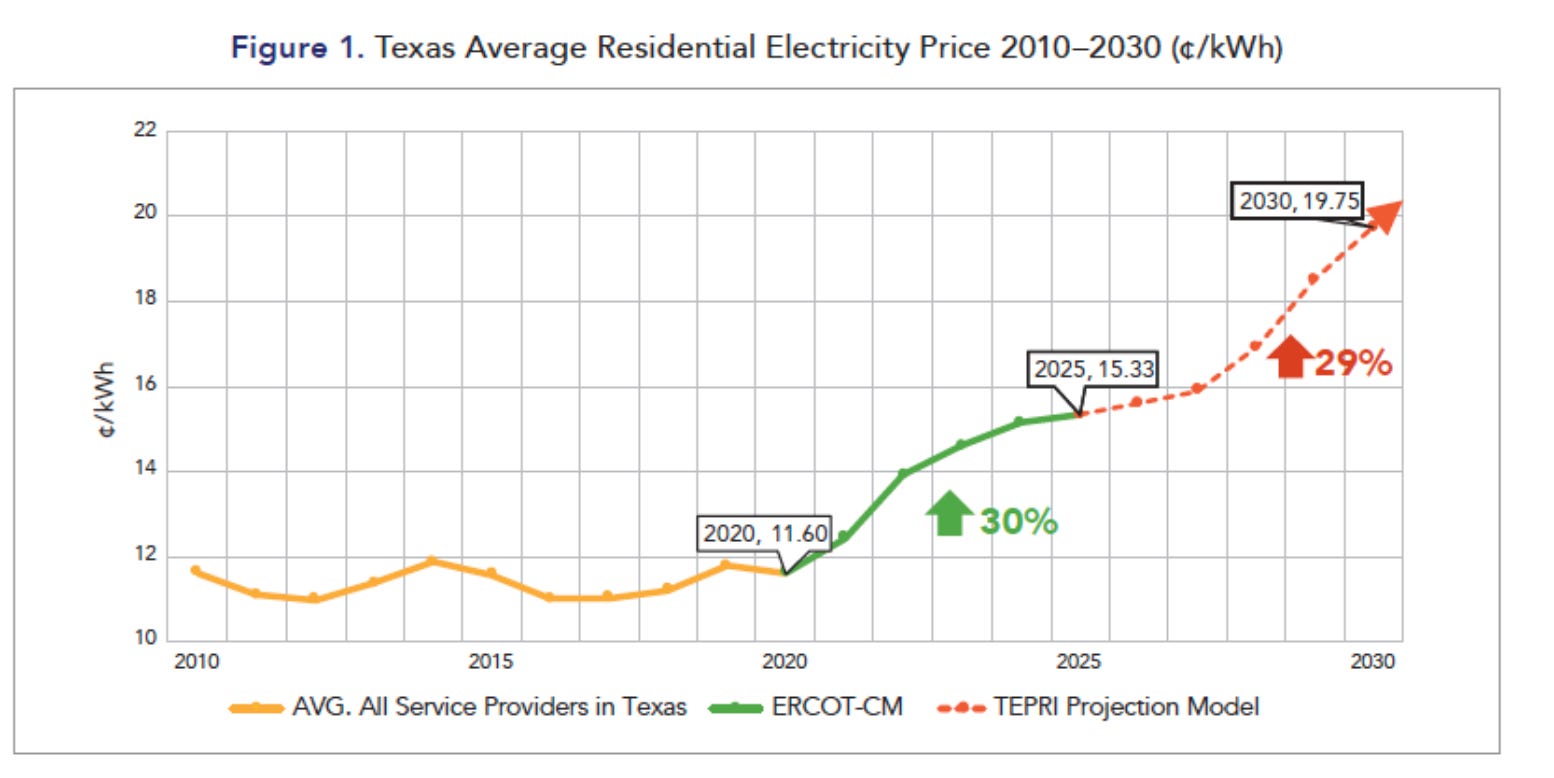

But today, competition for generation and retail have shown that monopolies are not necessary. Texas is a poster child for for competition but even Texas has little competition on the distribution side — and the cost of distribution is skyrocketing with no ability for competitors to offer alternatives that could save consumers money.

The monopoly model literally rewards utilities for spending more capital, even when smarter, cheaper options exist.

In my conversation with economist Lynne Kiesling, we traced the arc from Insull’s vision to today, and talked about where the system is showing serious signs of distress. And we discussed how that could change…

How We Got Here: Edison’s Machine

Edison designed complete systems, from generators to the lamp in JP Morgan’s house. Insull scaled that model in Chicago, betting on economies of scale (bigger plants) and scope (serving factoreis, homes and electric trolleys together to increase system utilization and load factors).

That became the vertically integrated monopoly: a single company, fully integrated, would keep costs low. Legislatures around the country formalized it, spreading the monopoly-utility model far and wide.

It was the right model for the time. America needed electrification, and investors needed stable returns.

“Economies of scale and scope… that’s your natural monopoly right there.” - Lynne Kiesling

Why It Worked Then and Why It Doesn’t Now

The framework assumed three things:

* Bigger plants are always cheaper.

* Vertical integration and central planning are essential.

* Utilities should earn guaranteed returns on new capital.

That fit a world that wasn’t yet electrified and needed massive centralized power plants. But two revolutions were disruptive to the monopoly model:

* Gas turbines: By the 1980s, combined-cycle plants made smaller, flexible generation competitive and lower cost than bigger centralized plants. The “dash to gas” in the 2000s proved it.

* Digitalization: Sensors, controls, and standards cut transaction costs. Coordination no longer required vertical integration.

Price Discovery: The Linchpin

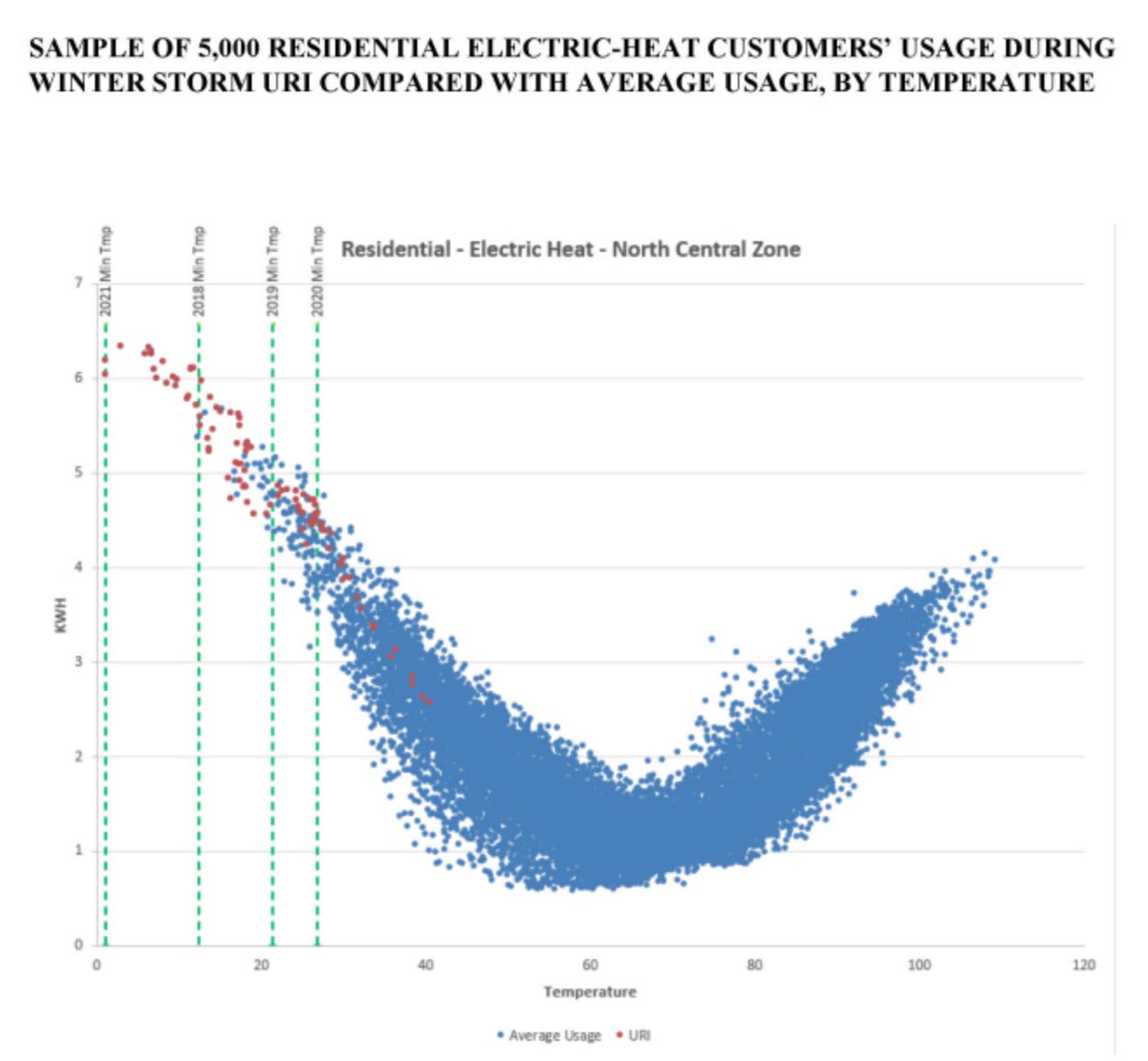

Economist Friedrich Hayek described prices as a “system of telecommunications.” ERCOT proves it daily. When scarcity prices spike, batteries discharge, generators ramp up, demand response kicks in. Investors see those signals and commit capital for more resources.

“Markets are a discovery procedure… trial and error with your own capital is how we get the most benefit.” - Lynne Kiesling

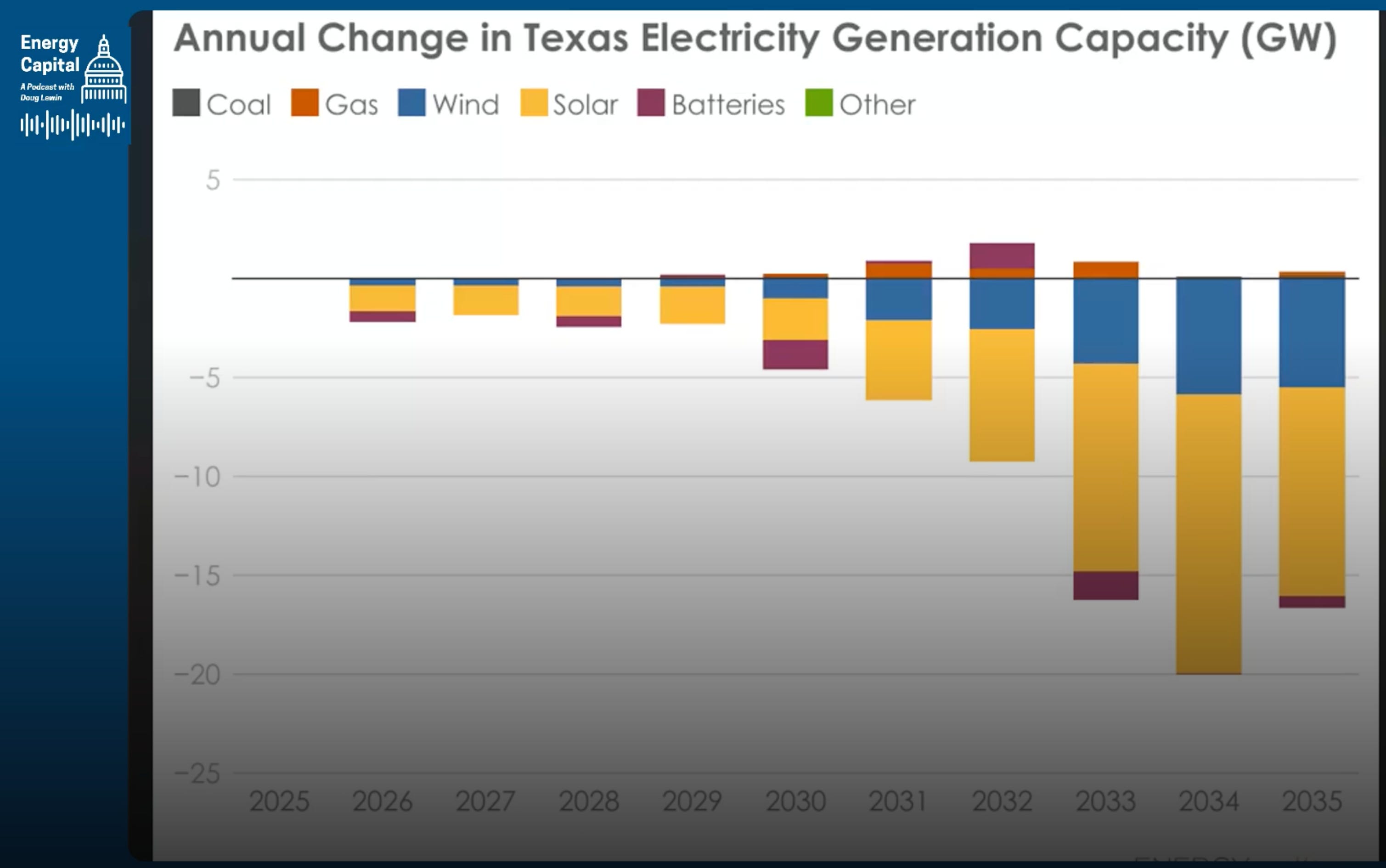

Every bet on future conditions shapes tomorrow’s incentives. That’s why Texas leads in storage growth, retail innovation, and is attracting new gas peaker plants, too.

But here’s the catch: we don’t allow price discovery work at the distribution level.

The Last Monopoly Mile

Transmission and distribution remain monopoly domains. Under today’s rules, utilities earn more by spending more. Propose a $50 million substation, get it approved, earn a return. But what if a portfolio of distributed resources (e.g. batteries, EV charging, demand response) solved the same problem for half the cost?

In most states, including Texas, that option isn’t tested. Regulators just green-light the $50 million.

That’s why Lynne calls for “quarantining the monopoly”: keep exclusive rights to the poles and wires, but open competition for solutions at the grid edge.

Final Thoughts

Texas already showed the world that wholesale competition works. Volatility spurs investment, spreads risk to investors, and drives down long-term costs.

The next frontier is distribution. If we quarantine the monopoly to the wires while opening structured competition for everything else, we’ll see faster innovation, more reliability per dollar, and lower bills.

That’s the Texas way: pragmatic, innovative, and willing to lead.

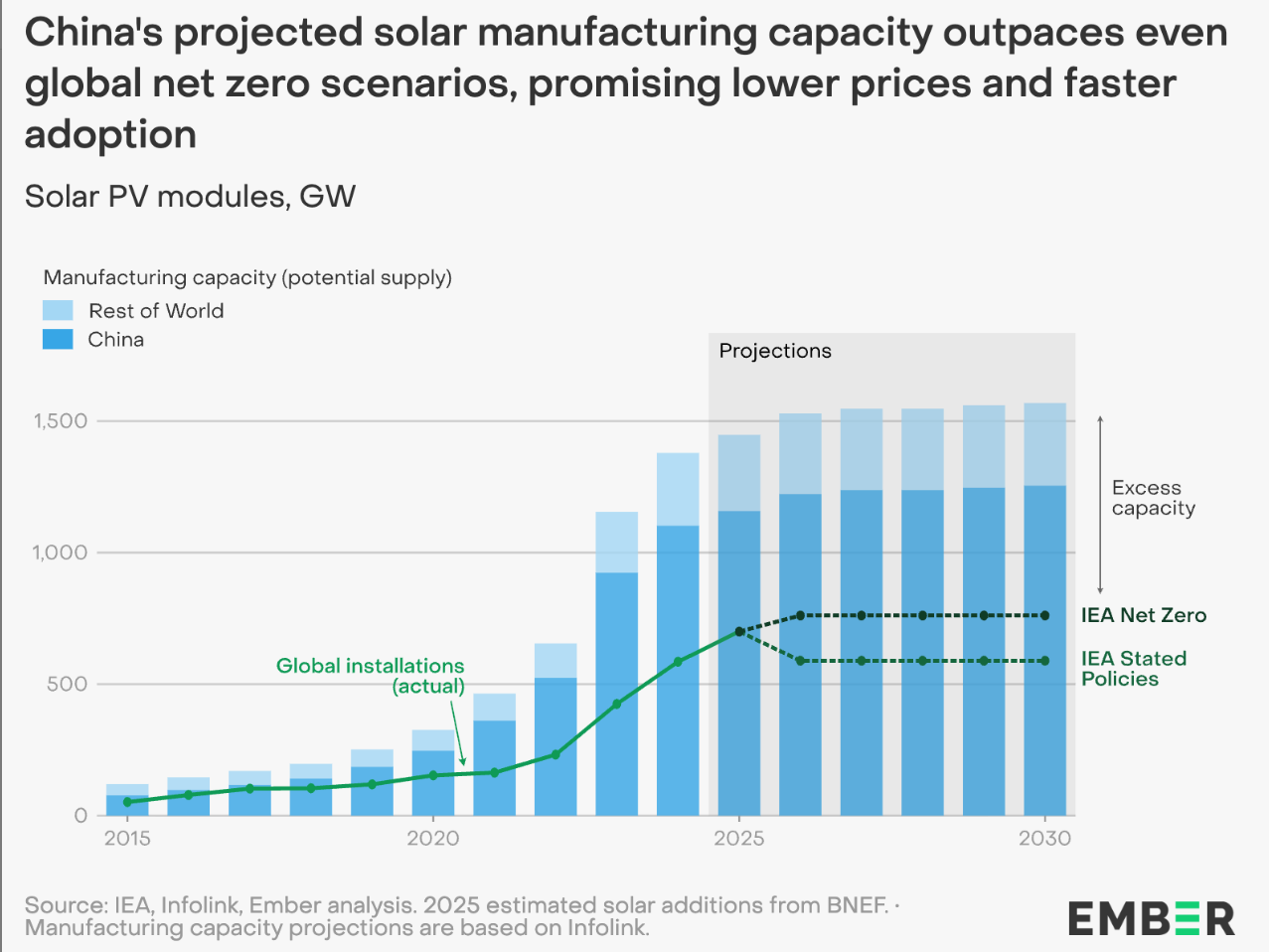

This is just Part 1 of my conversation with Lynne Kiesling. Next week in Part 2, we’ll dive into data centers, AI demand, and why risk allocation will define the grid’s future.

Timestamps

* 00:00 – Introduction

* 02:30 – Why history matters today

* 05:00 – Edison’s vision for a fully integrated electric system

* 07:30 – Insull’s bargain: regulate us but grant a monopoly & don’t municipalize

* 10:30 – Was monopoly the right solution then?

* 16:30 – Natural monopolies: economies of scale and scope

* 20:00 – Outdated assumptions, Texas competition

* 22:00 – Rate-of-return regulation, capital bias, and technology innovation

* 26:30 – The changes brought by combined-cycle gas plants and digitalization

* 30:00 – Quarantine the monopoly, price signals

* 31:30 – Do conservatives still support competitive markets?

* 33:00 – How and why arbitrage lower prices

* 34:30 – Distribution system efficiency and utility incentives

* 37:00 – “Markets are a discovery procedure”

* 40:00 – Let volatility speak, Texas choices

* 42:00 – What’s the next frontier of competition

Resources

Guest & Company• Knowledge Problem (Lynne’s Substack) • Lynne Kiesling (Northwestern, Personal site, Santa Fe Institute,

Books & Articles Discussed• The Merchant of Power: Sam Insull, Thomas Edison, and the Creation of the Modern Metropolis• Power Loss: The Origins of Deregulation and Restructuring in the American Electric Utility System by Richard F. Hirsh• Hayek: A Life, 1899-1950 by Caldwell and Klausinger• Competition as a Discovery Procedure, F. A. Hayek (QJAE translation)

Related Substack Posts by Doug•Why Are Energy Bills Rising So Fast? A Conversation with Charles Hua • Creating a Distributed Battery Network with Zach Dell• The Energy Capital Podcast, Episode 1 with Will McAdams• Texas’ Load Growth Challenges and Opportunities, with Arushi Sharma Frank

The Texas Energy and Power Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a paid subscriber.

Doug’s Platforms• LinkedIn• YouTube• X (Twitter)

Transcript

Doug Lewin (00:05 .356)

Welcome to the Energy Capital Podcast. I'm your host, Doug Lewin. My guest this week is Lynn Kiesling. There are few people in the electric industry I like reading and listening to more than Lynn. I'm kind of ashamed it took me this long to have her on the podcast, but better late than never. She is the director of the Institute for Regulatory Law and Economics at Northwestern University. She is a non-resident senior fellow at AEI, the American Enterprise Institute.

The reason I wanted to have her on the podcast is I think she is sort of the academic expert par excellence on markets. She really understands markets inside and out. She has been as influential talking about transactive energy, talking about distributed energy resources and how they can participate in markets. She's been talking about these things more than just about anybody, talking about them eloquently.

and really kind of pushing the envelope on what needs to happen in electric grids and electric markets for innovation. Obviously, with a focus on Texas and the electric market there, we split this into two parts. In the second part, which you'll hear next week, we got into all kinds of different stuff about data centers and their impact on electric grids, what they'll mean for competition. This was a ton of fun and a very wonky, deep conversation that I think you're going to enjoy. And more importantly,

learn a lot from. Lynn is just a fantastic teacher and it was great to spend this 90 minutes with her. So you'll have 45 minutes today, another 45 next week as we go deep into the roots of electric competition and what it means for energy transition, affordability, reliabili