Discover Energy Capital Podcast

Energy Capital Podcast

Energy Capital Podcast

Author: Doug Lewin

Subscribed: 28Played: 667Subscribe

Share

© Texas Energy and Power Newsletter

Description

The Energy Capital podcast focuses on Texas energy and power grid issues, featuring interviews with energy professionals, academics, policymakers, and advocates.

www.douglewin.com

www.douglewin.com

85 Episodes

Reverse

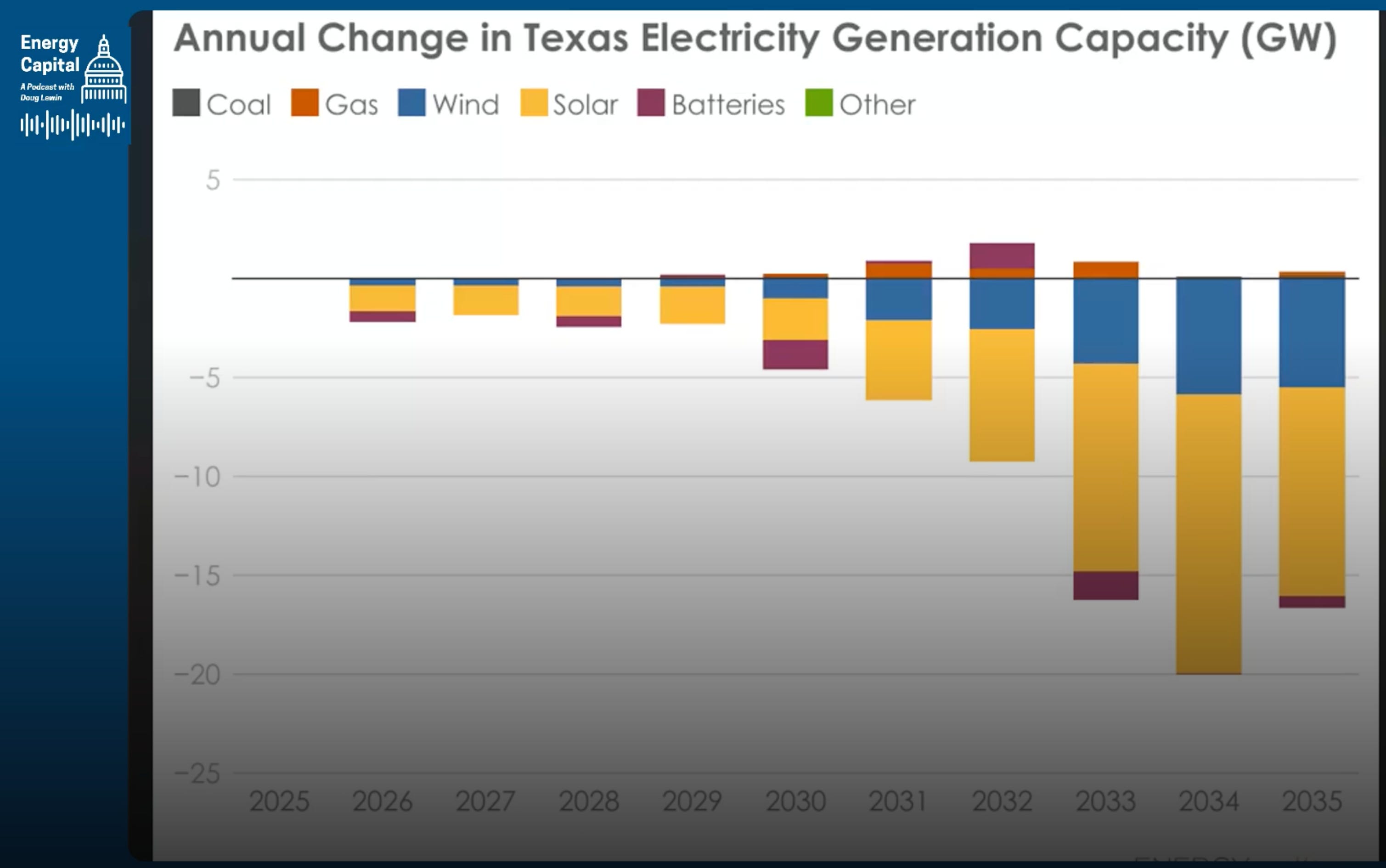

This episode is a little different. As I wrote on Friday: this is both a transition and an expansion. Several folks will be stepping up to use this platform and I couldn’t be more excited to hear what comes next.A platform, now with more places to standArchimedes said: “Give me a place to stand and I will move the Earth.” This podcast will become a platform for more people to stand.The podcast is moving into a multi-host format, and one of those new voices is Matt Boms, Executive Director of the Texas Advanced Energy Business Alliance (TAEBA). Matt has been a leader on some of the most important energy work in Texas: distributed energy resources, affordability, energy waste reduction, grid flexibility, and much more.How I got “bit by the bug”Matt asked how I got into energy. The real answer is, slowly and then all at once.My early work in energy policy was at the Texas Legislature, in a stretch (2005 to 2009) when a lot was happening and the instincts to build and expand were strong. That period mattered because it shaped a belief I still hold today: Texas works best when we put pragmatism above ideology. Texas is a place to build and do big things.The next frontier is the grid edgeOne of the big themes in this conversation with Matt is that the “cheap electrons” story is true on the generation side, but bills keep climbing because transmission and distribution costs keep rising.So if we’re serious about affordability, we have to talk about the distribution grid, and the tools that can help us defer (or avoid) some of the costs associated with building out the grid. We’re still going to spend a lot but can we avoid some of it?That’s where distributed energy resources (DERs) come in, and where Texas has a real opportunity to lead.Matt and TAEBA recently looked at what DERs could do in Oncor’s territory. The numbers are big, but here’s the one that sticks: about $279 per family per year in savings. If you want a sense of how big a difference that would make for many Texans, check out my discussion with Margo Weisz of the Texas Energy Poverty Research Institute:There are two core value buckets behind these savings:* Wholesale market value (DERs competing through aggregation, the work ERCOT is already moving through)* Transmission and distribution deferral or avoidance (often the larger, currently under-valued piece)If we get the policy design right, DERs can help lower system costs, enable load growth, and reduce the pressure that shows up on people’s bills.Final ThoughtsIf you’ve been listening for a while, let the new team (more announcements on that soon) know what topics you want them to cover next. The next chapter is going to be great. I can’t wait to listen!Timestamps* 00:00 – Introduction* 02:30 – Matt asks his first question!* 04:00 – Doug’s first energy experiences* 05:30 – * Beginner’s mind ** 07:00 – Politicization of energy, what brings us together, * 10:00 – The need to look for similarities first* 14:00 – How do we meet Texas’ rapid demand growth? (Here’s the slide I was referring to:)* 16:00 – How do we continue to grow the economy and electric demand?* 18:00 – Distributed energy resources * 20:00 – Matt’s work on demand side * 23:00 – Distributed batteries can last a lot longer than an hour or two!* 25:00 – The TAEBA study showing $2,000 savings per family in DFW from DERs. More on T&D cost avoidance and deferral here:* 29:00 – The potential for Texas leadership* 32:00 – What does Matt want to cover next?* 32:00 – The under-discussed part of the Texas Energy Fund: the Texas Backup Power Package Program for critical facilities* 36:00 – Matt’s thank you, Doug’s excitement to stop talking and start listening!ResourcesGuest & Company* Matt Boms - LinkedIn* Texas Advanced Energy Business Alliance (TAEBA) - LinkedInCompany & Industry News* The Value of Integrating Distributed Energy Resources in Texas’ Oncor Territory* New Study Finds Oncor Customers Could Save $8.5 Billion With DERs* Texas Energy Fund, Backup Power Package ProgramTranscriptDoug Lewin (00:04.526)Welcome back to the Energy Capital podcast. I’m your host, Doug Lewin. Today’s episode is a little different. The platform is expanding into a multi-host format. I’m really excited about these changes. I cannot wait to be a listener to this podcast and hear where it’s going. I’ve been working with your new hosts and there are several on the issues and topics and speakers they’re going to be inviting and I could not be more excited. Doug Lewin (00:33.504)about where this is gonna go. I put out a post this morning at the Texas Energy and Power newsletter called It’s a Transition and an Expansion. And that is exactly what it is. Change can be hard, but change can also be really good. And this is an opportunity for a lot of folks to use the platform that I have helped to build. There’s a famous quote from Archimedes where he says, give me a place to stand and I’ll move the earth. Doug Lewin (01:03.768)You all, dear listener, come on, it’s the Energy Capital podcast. Y’all, dear listeners, have given me a place to stand, given me a voice, and I’m deeply, deeply grateful for that. Now, other folks are gonna have this place to stand to move the Earth. Stand with them, help them through this transition and expansion, and I know you’re gonna be really excited to hear what comes next. So today, again, this is a little different. Doug Lewin (01:31.2)and thrilled to introduce one of the new voices who will be carrying this work forward. That’s Matt Bombs. Matt is the executive director of the Texas Advanced Energy Business Alliance, TABAA for short. They do some great work in Texas and Matt has done some great work, particularly around distributed energy resources. He was part of that aggregated distributed energy resource task force that has had a lot of success in Texas. He’s also part of the advisory committee on the backup power package program I talk a lot about. He was instrumental Doug Lewin (02:00.138)in getting the Texas Energy Waste Advisory Committee established here in Texas. So he’s done a lot of great work. He is an expert in his own right. He is very interested and curious about all this stuff, just like I am. And I’m thrilled that he’s one of the people that is going to be stepping onto this platform. So what you’re here today is me interviewing Matt and Matt interviewing me. A little bit of a retrospective looking back. I hope you enjoy this episode and I hope you enjoy all the episodes going forward. Doug Lewin (02:28.364)I can’t wait to listen myself and I know you’re gonna like what comes next. So with that, thanks for listening and let’s jump in. Matt Boms (02:43.352)Hi everybody, I’m Matt Bombs and I’m here with Doug Lewin on the Energy Capital podcast. Doug, it’s great to have you here on the podcast that you built. And now that I’m hosting the podcast with a few of my very talented and brilliant colleagues, it’s just a great opportunity to pick your brain and to hear more from you. I really do want to hear more about your story and how you first got into energy. What was the key factor that really brought you into this industry and how did you first get started? Doug Lewin (03:11.522)Yeah, Matt, before I jump into that, just want to say how thrilled I am to be able to take this platform that I think really is reaching a lot of people that are really interested in Texas energy. Texas is such a dynamic place and you’re such an important part of that ecosystem. And I’m thrilled that you’re excited to step into this role, like you mentioned with some others. So, you know, we, often joke in the energy world about energy transition and energy expansion. This is both, it’s going to be an energy transition and an expansion. Doug Lewin (03:41.154)You know, with, new hosts coming in and there’ll be multiple of them that’ll allow more exploration. And I’m just so thrilled you’re in that mix. So thanks, Matt. So to answer your question, it’s something I’ve talked about a little bit on the pod over the years, but not a lot. And yeah, look, I can’t even like tell you like, Hey, there was this moment or this, you know, day or week or month or year where it would like all clicked and like, this is what, like what I want to do with my professional life. It kind of happened over time. Matt Boms (03:49.59)Awesome. Thanks so much Doug. Doug Lewin (04:09.614)Certainly some of my first experiences with energy policy were at the legislature. And it was a time at the legislature, there was a really good time to be there. It 2005 to 2009. It was just a very different time over there, particularly related to energy policy. So like a lot of things were happening, right? 2005 Senate bill 20, which had an expansion of global portfolio standard, the big expansion of the transmission system commonly known as CREZ, but really that enabled a lot of the economic growth Texas had over the last 20 years. Doug Lewin (04:39.758)You know, that was passed in 05, 07, there was a major efficiency bill that was passed then. I had the privilege to work on that. That was with Representative Strauss before he was Speaker Strauss. And then, you know, 2000, when 2008, right, people forget this, but you had both Republican and Democratic candidates running on platforms that were extremely pro clean energy, climate action, all that kind of stuff. And obviously 2009, you had... Doug Lewin (05:05.166)President Obama and there was like RF funds and all that kind of stuff. So like, it was just kind of a fascinating time to be in there. Add to that, that like 2005, six Al Gore puts out inconvenient truth and Rick Perry fast tracked 11 coal plants. Now Perry was like, you know, pro wind and solar and pro transmission and pro coal. He’s got to like pro everything, but you know, 11 coal plants, right in the middle of that context of like this dawning awareness around climate change. It was just kind of, it was just a fascinating time. Doug Lewin (05:33.932)to be in it and I’ve always foun

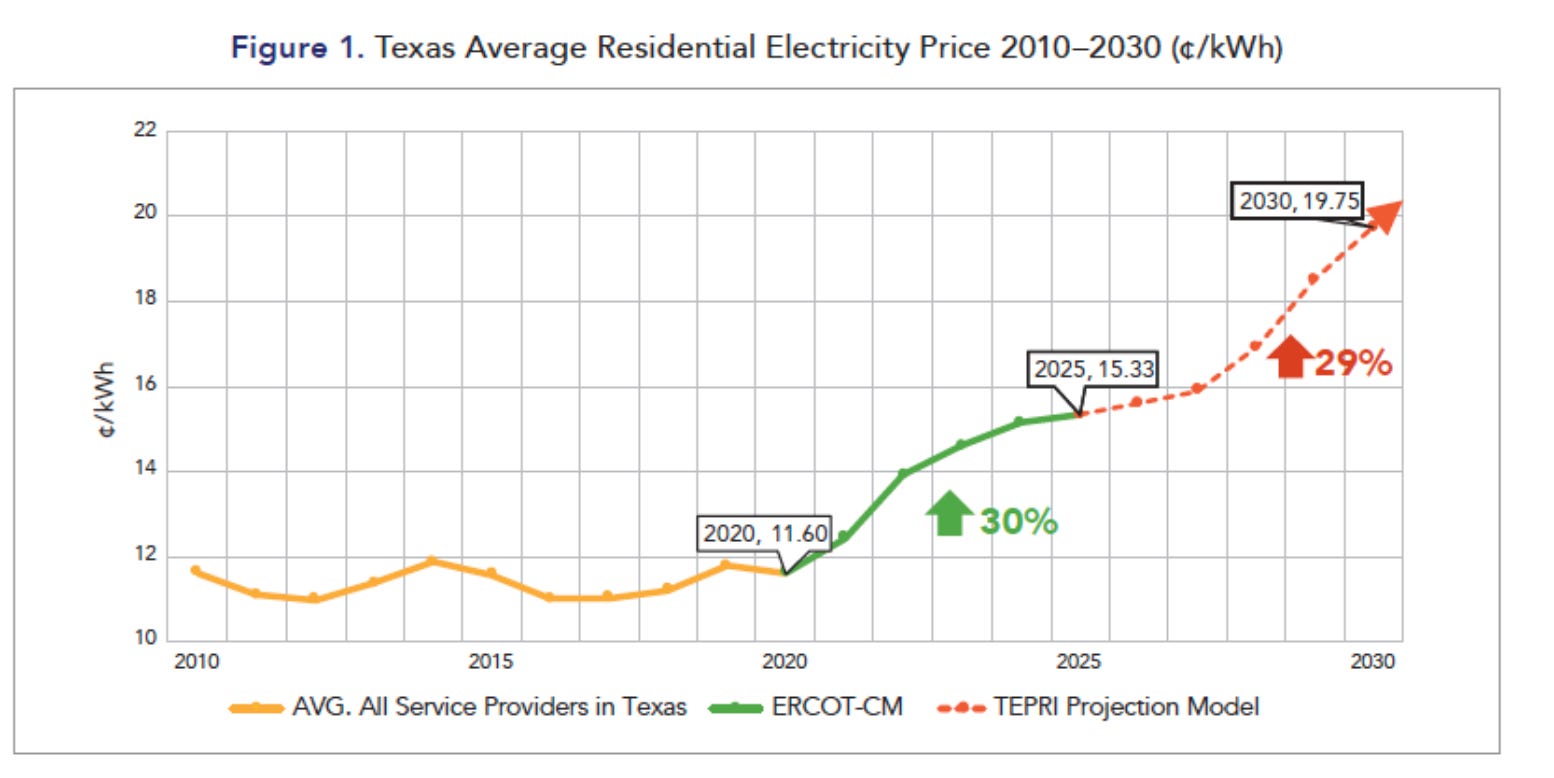

Everyone’s talking about the cost of power lately. But the Texas Energy Poverty Research Institute has been studying, talking, writing, and working to do something about it, for over a decade. In recent research, TEPRI found that 65 percent of low and moderate income Texans are cutting back on essential energy use, often turning off AC in extreme heat. But their demand reductions aren’t necessarily saving them much money or supporting the grid. Affordability is now a very high salience issue and there’s no one better to help us understand than TEPRI Executive Director, Margo Weisz. She talked about energy burden and affordability in Texas and the clearest paths to ratepayer relief.TEPRI’s latest research shows bills increasing sharply over the last five years and again in the next five years: TEPRI Releases ERCOT Electricity Affordability Outlook: Forecasting Residential Electricity Prices and Burdens (2025-2030)Energy burden is rising sharplyEnergy burden is the share of income spent on electricity. In Texas:* ~4.5 million households are low or moderate income.* Their average electricity burden for a low income Texan is nearing 7% — that is, they pay 7% of their income for their power costs alone — and expected to be 9% by 2030.* TEPRI’s modeling shows about a 29 percent increase in the cost of power over the last five years, with another 29 percent projected for the next 5 years.* The biggest increases are coming from transmission and distribution utilities.Wages are not keeping pace, leaving an average affordability gap of roughly $850 per year.Because of this, households are taking risky steps — or getting shut offAs TEPRI’s survey shows, they are turning off or limiting AC in dangerous heat, skipping essentials to pay the bill, and accumulating arrears until shutoff notices arrive. And 12% were actually shut off. But Texas does not track disconnects so we don’t know if this survey matches actual shut-offs.These actions point to system-level strain. They increase health risks and make reconnection more expensive for everyone.Efficiency and distributed energy are long term solutionsEfficiency is the fastest, cheapest way to cut bills and peak demand. Weatherization and efficient HVAC could reduce load and permanently lower costs for the households who feel the most pain.Distributed energy goes one step further. Community solar, batteries, and virtual power plants at homes and apartments can lower bills, reduce peak load and improve resilience. Final ThoughtsEnergy burden is the lived reality of the Texas grid. Millions of Texans are paying nearly 9 percent of their income for electricity, and many are already taking unsafe steps to stay connected.But we have real options. Smarter enrollment for bill help. Scalable efficiency. Community solar and virtual power plants that lower costs and support ERCOT.If this work matters to you, share it with someone who cares about Texas energy, and consider subscribing so we can keep tracking what works and where Texas can lead.Timestamps* 00:00 – Intro and why energy burden matters* 02:00 – Margo’s background and TEPRI’s mission* 04:00 – “energy limiting behaviors” often aren’t saving much money* 05:00 – Community Voices Energy Survey and behaviors* 06:30 – How Bandera Electric Co-op is helping their customers* 08:30 – Texas does not track disconnect data* 10:00 – “Sexy energy efficiency” and heat pumps; the split incentive problem* 12:00 – TEPRI’s approach to applied research* 13:30 – Defining and measuring energy burden* 17:00 – the potential for energy abundance and what that means for low-income Texans * 19:00 – Texas rates are lower but rising faster than the national average. Why?* 22:00 – How do we allocate costs for socialized grid upgrades and storm recovery? (SB 6 implementation)* 27:00 – What’s going to happen to bills in the next 5 years?* 30:00 – Where some downward pressure for prices could come from* 32:00 – What do we do about all this?* 35:00 – Bill assistance and the future of LIHEAP* 36:00 – Scaling efficiency and demand response in Texas* 39:00 – Virtual power plants in low-income communities* 41:00 – Enlightened self interest: helping those in need helps everyone* 43:00 – Margo’s closing thoughtsResourcesGuest & Company* Margo Weisz – LinkedIn* Texas Energy Poverty Research Institute (TEPRI) - LinkedIn Company & Industry News* TEPRI New Report: “ERCOT Electricity Forecast Outlook”* TEPRI Receives Outstanding Non-Profit Award at Texas Energy Summit* TEPRI 10-Year Anniversary Celebration and Future of Energy in Texas * Community Voices Energy Survey* E4-TX Geo-Eligibility Tool* Low Income Energy Assistance Program on TX System Benefits ChargeRelated Podcasts by Doug* Why Your Utility Bill Keeps Rising YouTube* Creating a Distributed Battery Network with Zach Dell YouTube* How Data Centers Can Strengthen the Texas Grid with Astrid Atkinson YouTubeRelated Substack Posts by Doug* The Affordability Crisis Deepens: Reading & Podcast Picks, August 31, 2025 * An Expensive and Unnecessary Capacity Market* Energy Inflation* Texas Has Never Had a Summer Blackout — Here’s Why That May ChangeTranscriptDoug Lewin (00:05.548)Welcome to the Energy Capital Podcast. I’m your host, Doug Lewin. And my guest this week is Margo Weisz. She is the executive director of the Texas Energy Poverty Research Institute or TEPRI. Everybody these days is talking about affordability, and rightfully so. Affordability played a very important role in the recent elections in New Jersey, Virginia, and Georgia. And we are seeing increasing numbers of Americans and of Texans that are struggling to pay their bills, that are making that terrible choice between food, medicine, and their power bills. As high as 30 and sometimes 40% of Texans making those choices. TEPRI has done incredible work with their Community Energy Voices survey, where they surveyed 6,500 low-income Texans and found that more than 60% of them were engaged in energy-limiting behaviors. Translation of energy-limiting behaviors is, in some cases, particularly with medically vulnerable populations, extremely medically risky. This is a problem we’ve got to solve together. And as I talked about with Margo, who’s just a fantastic leader in this space in Texas, the solutions actually can help across the grid. One of the things TEPRI is working on is distributed energy resources at multifamily facilities. And one of the things we talked about there is how all of us benefit from implementing those kinds of solutions. It’s what I’ve referred to—I didn’t come up with this term; I’ve heard it in a lot of different places—but enlightened self-interest. If we are getting solar and storage and energy efficiency out widely, particularly to low-income Texans, that strengthens the grid for all of us while it lowers their energy bills. So looking for those win-win-wins is what Margo and TEPRI are all about. I hope you enjoyed this episode and, as always, if you did, please share it with a friend, family member, or colleague and please leave us a five-star review wherever you listen. And with that, here’s my conversation with Margo Weisz.Margo Weisz, welcome to the Energy Capital Podcast.Margo Weisz (02:11.64)Thank you, Doug. It is awesome to be here with you. Yeah.Doug Lewin (02:15.662)We’ve been talking about this for a while, but this is timely because you guys have a really important paper coming out that we’re going to talk through a little bit. But before we get into all that, can you just share with the audience a little bit about the Texas Energy Poverty Research Institute? What do you guys do? What’s it all about?Margo Weisz (02:29.486)Right, we’re a statewide nonprofit and we address the acute energy needs of people with low incomes. And we do it in a variety of different ways. As our name says, we do some research and we’re going to talk a little bit about that today. And the cornerstone of our research is a survey of low-income households throughout the state. And I know we’re going to get to that. We also do some pilot projects. So we take what we learn in that research and then we try to figure out some strategies to solve some of the challenges that low-income households face by doing a variety of different pilot projects on the ground. We also have some web-based tools that we use, that we’ve created, and we do a little bit of education as well.Doug Lewin (03:09.134)Great. Thanks for that. We’ll have information on the organization in the show notes. So folks that want to learn more about TEPRI, I encourage you to go check out their website. You just mentioned the Community Voices Energy Survey. You all surveyed 6,500 Texans who are low or moderate income. Can you talk a little bit about what are some of the key takeaways from that for you? What a fantastic exercise. Yeah. So what did you guys learn?Margo Weisz (03:32.626)Right. I mean, it’s so important for us to really have our work guided very much by the experience and the priorities of the people that we serve. So we focus on affordability, reliability, and clean energy. What are their behaviors around it? What are their priorities? What are their concerns? So that’s kind of—we just ask a whole variety of questions about their experience in a day-to-day environment with energy. It’s very illuminating for us.Doug Lewin (03:59.756)Yeah, and one of the things that really stuck out to me out of that was 65% of the low and moderate income Texans you surveyed said they engage in, quote unquote, energy-limiting behaviors. I mean, that to me was sort of an eye-popping figure. Can you talk about why that’s so important?Margo Weisz (04:16.649)Yes. So I think these are the ways that people try to lower their bills. So they think to themselves, “How can I lower my bills? I can turn off my air conditioning when it’s, you know, a hundred degrees outside, because it’s probably really expensive if it’s a hundred degrees outside,” or “I can turn off my heat or turn down my heat.” You kno

Thanksgiving Week RepostThis episode originally aired in June 2024. We’re resurfacing it because the core idea discussed here were timely then and even more timely now.We’ve also refreshed the audio, with improved mixing and mastering for a clearer, smoother listen.Crusoe has scaled dramatically since this conversation, including major new funding and new projects in Texas. With so much energy news focused on problems, it felt right this week to highlight solutions in action.When most people see flares in the Permian, they wonder why all that energy is being wasted. Crusoe’s co-founders figured out how to put that wasted energy to good use. They started with cryptocurrency mining and have steadily moved to AI data centers. Over the last few years, they have found themselves perfectly positioned to grow as the AI boom took hold. They’ve recently completed the 8th building at Stargate in Abilene for Open AI and Oracle. They’re also building facilities for Google near Amarillo. In this conversation from May 2024, Crusoe Co-Founder, President, and COO Cully Cavness and I talked about the rapidly growing size of data centers, the flexibility of different kinds of data centers, and how large loads can increase grid reliability. This was one of the earlier podcasts on these topics and I think it holds up really well. For those looking for more on the topic, here are some other Energy Capital Podcasts covering similar ground:What Has Changed Since ThenWhen this episode first aired in mid-2024, Crusoe was already shifting from “flare mitigation plus computing” to a broader energy-first AI infrastructure model.In the time since:* Crusoe has become one of the most aggressive builders of AI data centers in the country. It is now described as an “AI factory company” with a vertically integrated cloud platform built around stranded and low-cost energy.* Abilene, Texas moved from concept to centerpiece. Crusoe is building a 1.2 gigawatt data center at the Lancium Clean Campus outside Abilene — Stargate — as the first phase of a planned 5 GW campus. * The company’s capital and pipeline exploded. Since 2024, Crusoe has raised hundreds of millions of dollars to scale “clean energy data centers,” then a further $1.3 billion in Series E financing, bringing total funding close to $4 billion and valuing the company around $10 billion.In other words, the approach Cully describes in this episode has scaled — rapidly. Why The Core Idea Still Matters For TexasThe heart of the episode is simple:* Methane mitigation is still some of the lowest-hanging fruit in climate policy. Crusoe’s digital flare mitigation aims for 99 percent plus combustion efficiency, cutting the climate impact of flaring while turning waste into power.* Curtailment and congestion are still big problems in West Texas. A “go to the energy” model lets data centers soak up low-priced or stranded wind and solar instead of forcing renewable operators to shut down when prices go negative.* AI loads can be designed to help rather than hurt the grid. Some training workloads can be paused or shifted toward hours when renewables are plentiful. That kind of flexibility is exactly what ERCOT needs as large loads and renewables grow together.Texas sits at the center of all three issues. We flare and vent more than we should. We waste clean power when transmission is full. We are a magnet for AI and industrial loads.Crusoe’s solutions help with all of these challenges. Final ThoughtsThis episode is worth revisiting because it offers a concrete picture of one possible future for Texas: fewer wasted molecules, less wasted renewable power, and more large loads designed with the grid in mind.If you listen again with today’s headlines in mind, I would be interested to hear what stands out for you. If you know someone working in oil and gas, renewables, or AI infrastructure in Texas, feel free to share it with them.We will not get every siting decision right. But we do have choices about whether AI growth deepens our problems or helps solve them.Timestamps* 00:00 – Introduction* 01:30 – Cully’s background and the origin story of Crusoe* 08:00 – How digital flare mitigation works and why it cuts methane emissions* 15:00 – Digital renewables optimization, negative pricing, & stranded wind power* 21:00 – Data center and AI demand growth and what it means for the grid* 28:00– Flexibility of AI workloads and how data centers can act as flexible loads* 38:00 – Efficiency gains in AI chips and power density in modern racks* 41:00 – Location-based versus market-based carbon accounting* 43:00 – “Tally’s Law” and what it tells us about the energy transition* 50:00 – Policy and regulatory changes that could accelerate this kind of solutionShow NotesHost, Guest, & Company• Cully Cavness - LinkedIn, Twitter/X• Crusoe Energy - Crusoe Careers Page - LinkedIn, Twitter/X• Doug Lewin - LinkedIn, Twitter(X), Bluesky, & YouTubeMentions in the Podcast:• Tally’s Law and the Energy Transition by Cully Cavness• The Extraction State by Charles Blanchard (book)• AI, Data Centers & Energy, Interview w/ Michael Terrell - Redefining Energy Podcast• AI is poised to drive 160% increase in data center power demand - Report from Goldman Sachs• Nuclear? Perhaps! - Interview with Jigar Shah on the Volts Podcast• Texas Advanced Nuclear Reactor Working Group at the Texas Public Utility CommissionRelated Energy Capital Podcast episodes:• The Energy Capital Podcast with Former PUC Commissioner Will McAdams• “The Name of the Game is Flexibility,” a Conversation with ERCOT’s Pablo VegasTranscriptDoug LewinCully Cavness, welcome to the Energy Capital Podcast.Cully CavnessThank you so much for having me.Doug LewinReally looking forward to this conversation. Crusoe is really a fascinating company. You guys are doing some really innovative, interesting, and different things. So why don’t we start with you, Cully? Tell us a little bit about your background and about Crusoe. Explain to the audience a little bit who you guys are as a company, if you would.Cully CavnessGreat. I’m excited to be here and share a little bit about what we’re doing at Crusoe, where we came from, where we’re going. In terms of my personal background, I grew up in Denver, Colorado. I went to Middlebury College in Vermont to study and I studied geology and economics thinking I was gonna go into oil and gas. But at Middlebury, anybody who’s familiar with the school will know that the climate conversation was a huge theme and a huge focus in that student body. And it made a big impact on me.And so I actually, right after I graduated from college, I was awarded a Thomas Watson Fellowship, which is a program where you’re sort of banished from your home country for a year and you get to go study whatever subject you really want to study for that year. And I wanted to think about this sort of morality of energy and the balance between energy and the economy and the environment. And so I was really fortunate to be able to go to Iceland where I worked with a lot of geothermal power and hydro producers. I went to China where I was much closer to coal. And then I went to Spain. I worked with wind and solar developers for the CFO of a large renewables group there. And then I went to Argentina and I worked with a hydroelectric engineer.And I got to really see a pretty broad survey of the global energy system, everything from finance to project development and management to engineering and operations. I saw power plants that had broken and were in stages of repair and learned a lot from that experience.And from that, I ended up going into the geothermal energy industry. I had a mentor who was the CEO of a company called Global Geothermal, and he took me under his wing. And for the first few years of my career, I was developing geothermal power plants, mostly internationally. And then sort of long story short, I ended up doing an MBA over at Oxford in England and came back to an oil and gas focused investment bank here in Denver. It was sort of the one energy focused investment banking role in Denver, primarily oil and gas clients. And that brought me back into the oil industry. I ended up being a Vice President of Finance for a private equity backed oil and gas company after that. And we were drilling some exploratory oil and gas wells in Eastern Colorado. That was sort of a step out from the core shale play, the Niobrara. We were miles away from the core of the activity. We drilled some wells that ended up being good oil wells, but there was no natural gas pipeline infrastructure in that area. And so the default then is, at least at the time was, all right, if you can’t get the gas into a pipe, you put the oil into a truck and you send the truck to the refinery. That’s how you sell the oil. And you can’t do that with the gas, so you just light it on fire and you burn it. It’s called a flare. And I thought that was pretty insane. And I was frankly, I was embarrassed about it. You know, just considering the path that I’d gone through and that I had really wrestled with that intersection of climate and environment on one side, but then the economic and human benefits of energy access on the other.Wasting the energy the uncombusted methane emissions. I had a big problem with that and I’ve been you know, I’ve been playing around with mining Bitcoin as a hobby in my basement and my wife was observing that you know, the there’s like hot wind coming out of the basement and our power bill had dribbled and that’s also a commercial problem related to energy and an environmental problem related to energy. And the insight was basically maybe one of these problems can solve the other. What if we could package a modular data center that could go to the oil field, actually sit on pad next to a flaring well site, capture that gas that was being flared, turn it into electricity, use the electricity to power the modular data center and basically new way to, we called it the digital pipel

“Everyone hates data centers.”That was the subject line on the email newsletter from Heatmap Daily the day before I sat down with Dr. Varun Sivaram, co-founder and CEO of Emerald AI. Communities see huge new loads coming onto the grid, hear about billions in new infrastructure, and worry that their bills will go up.It doesn’t have to work that way.Varun argues there are two paths. On the villain path, AI data centers drive up power bills and increase the likelihood of outages. On the hero path, they become flexible grid assets that help us use existing capacity better, absorb much of the cost of new grid infrastructure, and help residential and small commercial customers pay for distributed batteries, heat pumps, and more.Texas and ERCOT are at that fork in the road.Two futures for AI data centersVarun calls this a “critical juncture.” If ratepayers have to pay more and grid reliability takes a hit, communities start pushing projects away and the U.S. falls behind in the global AI raceThe alternative is the hero path, where data centers show up as flexible partners:Data centers in this hero path are going to contribute to grid reliability and help us to avoid rolling blackouts. I think we can get there, but we’re not on that path right now and folks are right to worry. And this is the moment where we switch from the villain to the hero.Texas has a chance to innovate — both technologically and with policy. Regulatory innovation is as important as technological innovation — maybe more so.Turning AI load into flexibilityEmerald AI is a software layer that makes AI workloads flexible. Varun breaks it down into four kinds of flexibility:* Temporal. Once you know what can move, you can shift it in time. Training a big model at 6 p.m., when ERCOT is tight, is very different than running it at 2 a.m. when prices are low and resources are abundant.* Spatial. Many jobs can move across locations. If a Texas node is stressed and another region is fine, traffic can be shifted without changing the user experience.* Resource. Some tasks truly need instant answers, others can wait minutes, hours, or days. Emerald deploys and optimizes onsite resources when necessary.* Adjacent. Data centers can purchase flexibility — putting money into the pockets of residential and small commercial customers — from distributed batteries, HVAC systems, and other controllable equipment. Put together, these layers make a data center behave less like a rigid block of demand and more like a flexible grid asset when conditions require it.The Energy Capital Podcast is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.ERCOT’s stakes and the Texas choiceVarun shared a conversation with ERCOT CEO Pablo Vegas. Vegas said he did not just want a tool that jumps in during emergencies. He wanted something that keeps the grid from getting to an emergency. Don’t want for the flashing red lights; have data centers contribute flexibility when the lights are flashing yellow.That is the heart of the hero path.ERCOT was already dealing with intense load growth from industrial projects, crypto-miners, traditional data centers, increasing population, hotter temperatures, and now AI data centers. Texans will not accept anything less than high reliability and lower bills. If the PUC and ERCOT treat AI as inflexible, we will need to build a lot more capacity and infrastructure than we might otherwise need.If we require and reward flexibility, we can serve more load at lower cost, then add new infrastructure when truly needed.Final ThoughtsThe hardware and software inside AI data centers means they are already some of the most controllable loads connected to the system. With the right tools, incentives, and market structures, AI factories can act as shock absorbers instead of stress multipliers.Texas leads on gas. Texas leads on wind. Texas leads on solar and storage. We can also lead on making AI an ally to the grid, not a villain. That will take work but it is possible. It’s a choice we can make.If you enjoyed this podcast, please share it with a friend or colleague or family member or neighbor. The more Texans engage with these decisions, the better chance we have for a grid that is reliable, affordable, and cleaner for everyone.Timestamps:* 00:00 – Intro, Varun bio, Emerald AI* 02:15 – The villain and hero paths for AI data centers* 05:30 – Phoenix pilot as a tangible example of the hero path* 09:00 – California simulation of 2020 outages* 10:00 – Possibility of doing a pilot in ERCOT, Pablo Vegas’s comments* 12:00 – What exactly does EmeraldAI do?* 14:00 – Breaking down four flexibilities: temporal, spatial, onsite resource flexibility, adjacent* 20:00 – Emerald AI’s focus is on onsite flexibility* 24:00 – Real-world stress test results* 27:00 – What excites Varun about AI* 32:00 – How AI can help lower power bills: the central tenet of the hero path* 36:00 – Why ERCOT is potentially the global model for speed to power* 40:00 – Connect-and-manage for loads* 43:00 – A reference design for AI factories from a pilot in Virginia* 46:30 – The hero and villain path for AI and emissions* 49:00 – Optimizing the system to buy time until nuclear, geothermal, etc. are ready* 51:30 – Getting a win-win-win: on affordability, on AI innovation, and sustainable, reliable systems* 52:30 – Final thoughts: the Emerald AI teamResources:Host, Guest & Company• Varun Sivaram - Linkedin • EmeraldAI - LinkedIn• Doug Lewin - LinkedIn, Twitter(X), Bluesky, & YouTubeCompany News• Sharing Our Seed Extension - Press Release• National Grid and Emerald AI announce strategic partnership - Press Release• How AI Factories Can Help Relieve Grid Stress - Press Release Books & Articles •The Worlds I See: Curiosity, Exploration, and Discovery at the Dawn of AI by Dr. Fei-Fei Li•The Country’s Biggest Grid Has a Plan to Manage Data Centers’ Power Use. Everyone Hates It. - Heatmap News •The mechanics of data center flexibility - Catalyst Podcast (Latitude Media) •How the world’s first flexible AI factory will work in tandem with the grid by Arushi Sharma Frank in Latitude MediaPolicy & Reports • Report on disorganized integration of data centers - Texas Reliability Entity • 2025 State of Reliability - NERC• The Worlds I See - Dr. Fei-Fei Li• Arushi Sharma Frank’s ERCOT Planning Guide Revision Request• Retail Electricity Price and Cost Trends: 2024 - Lawrence Berkeley Labs• Rethinking Load Growth - Tyler Norris and Duke University• ANOPR on Large Load Interconnection - FERC• Emerald AI: presentation to ERCOT Large Flexible Load Task Force • PGGR 135: Large Load Interconnection Queue Process RevisionRelated Podcasts by Doug• How Data centers Strengthen the Grid - Astrid Atkinson• Texas’ Load Growth Challenges – And Opportunities, with Arushi Sharma Frank• How Load Flexibility Could Unlock Energy Abundance with Tyler NorrisRelated Substack Posts by Doug• AI Data Centers Aren’t Causing Higher Prices • Demand Side Resources Could Enable Load Growth• Can AI Data Centers Lower Costs for Residential Consumers?Transcript:Doug Lewin (00:05.154)Welcome to the Energy Capital Podcast. I’m your host, Doug Lewin. My guest this week is Dr. Varun Sivaram. Varun is one of the most interesting guests I’ve had in the three years now I’ve been doing podcasts, both the Energy Capital Podcast and going back to the Texas Power Podcast. He is the founder of Emerald AI, a company which is transforming energy-intensive data centers into grid assets and grid allies. We talked about all the different ways that data centers, if integrated right... The Texas reliability entity brought this up in a report: the possible disorganized integration of data centers into the grid is one of the biggest reliability risks. I would argue, and clearly Dr. Sivaram argues, the counter is true as well. The organized integration of data centers can actually make grids more reliable and spread costs out to more customers.We got into all of that. Just a couple of notes on Varun: He was formerly the chief strategy and innovation officer at Ørsted. He was the chief technology officer of India’s largest clean energy company, ReNew Power. He was a diplomat at the US State Department. He is currently a senior fellow at the Council on Foreign Relations. He was named as one of Time Magazine’s Time 100 Next for the next 100 most influential people in the world. MIT Technology Review named him one of the top 35 innovators under 35. You get the idea. He also has a PhD in condensed matter physics from Oxford. This bio is kind of ridiculous. Clearly one of the smartest people out there in this space, and this company, Emerald AI, is really doing some super innovative things with some really high-level partners, including NVIDIA and others. I think you’ll enjoy this conversation as much as I did. Please leave us a five-star review wherever you listen.And most importantly, if you are not already a subscriber at douglewin.com, please go there and become a subscriber today. Your support for the podcast really makes it possible. And with that, here is my conversation with Dr. Varun Sivaram.Varun Sivaram, welcome to the Energy Capital Podcast.Varun Sivaram (02:19.256)Thanks so much for having me. It’s an honor.Doug Lewin (02:21.514)Hey, it’s great to talk with you. I have been reading article after article about Emerald AI. I saw your presentation to the large load task force a couple of months ago in Texas and have been meaning to do this for a while. So thanks so much for taking the time. We’re going to obviously talk about Emerald AI. We’re going to talk about Texas and data center growth. We’re going to talk about all of these things, but I just want to start from a very high level, Varun. We are recording here on November 7th. Yesterday, Heatmap News had a very provocative headline: “Everyone hates data centers.” I don’t know that that’s actually true, but I know what they’re trying to say. Th

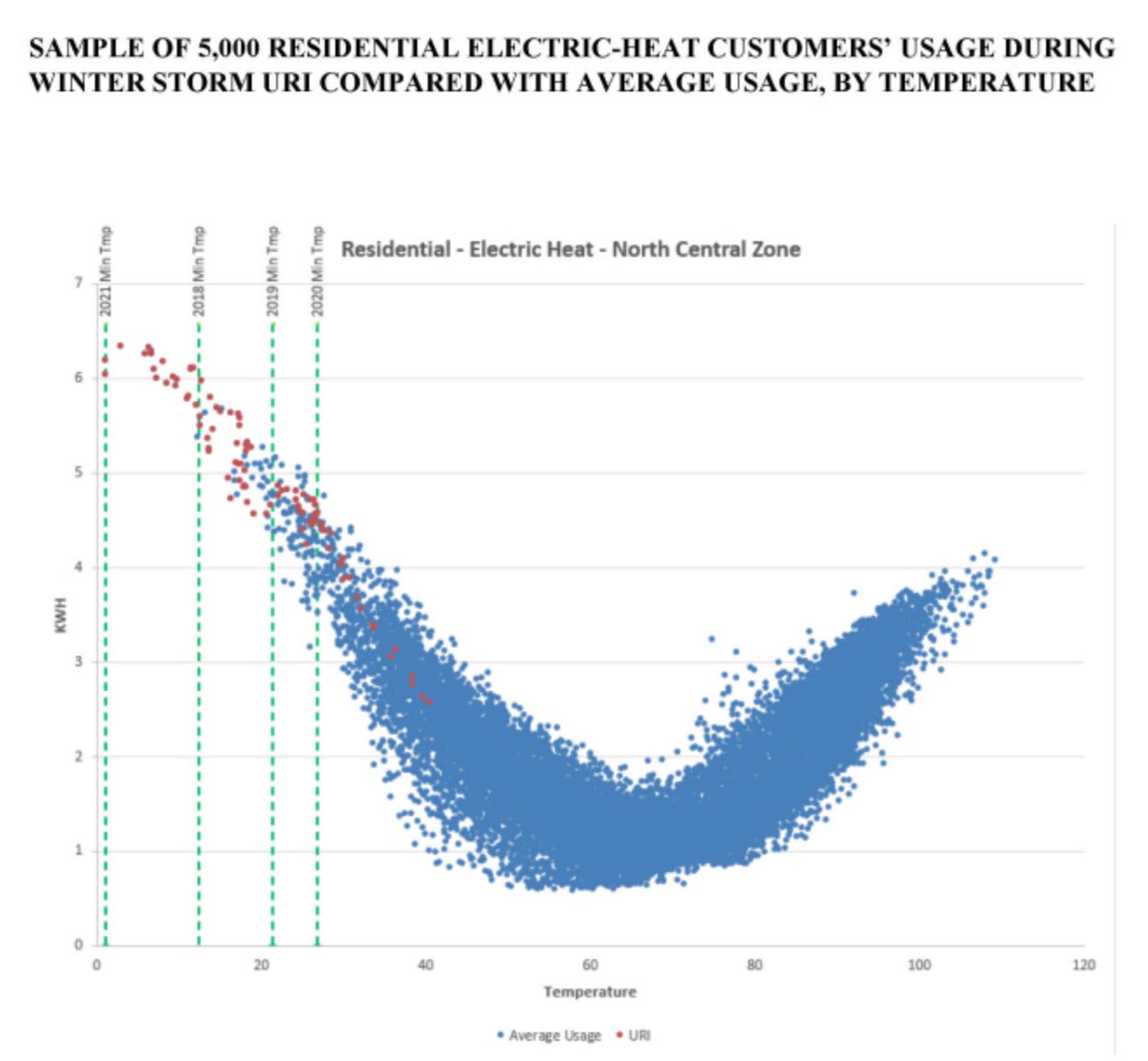

This is part 2 of my conversation with Nat Bullard. Check out Part 1 here:We talk a lot about the grid of the future. The truth is, that future is already showing up in Texas.Batteries are being built at record pace, data centers are chasing cheap and reliable power, and Texans are adding gigawatts worth of backup systems in homes, schools, and factories.I sat down with energy analyst Nat Bullard to ask a simple question: if we look at what is actually being built — not the rhetorical arguments happening online, but what is actually happening around the world — where are energy systems headed?We started with a comparison of batteries and gas peakers. Batteries respond in milliseconds, don’t rely on fuel deliveries during a freeze, and can make money all day providing grid services between scarcity events. Increasingly, duration is less of an issue as prices fall. As Nat reminded us, during Winter Storm Uri it was “largely things in the thermal fleet” that failed. Winterizing batteries is likely much less onerous and complicated than winterizing gas plants.Behind-the-meter systems are also booming. One- to ten-megawatt batteries can turn schools or factories into mini-resilience hubs. If Texas keeps adding storage at this pace, we could end up with the equivalent of dozens of peaker plants—only more responsive and decentralized. Nat concluded with a description of his family as a mix of, a ground source heat heat pump, a mini split, and a Franklin stove. A small hybrid system built to ride out different conditions. That is a good picture of where ERCOT is headed: a mix of gas and batteries, large wires and local resources, data centers and smart devices. The question is whether we design structures to speed up that hybrid grid on purpose or stumble along and end up there eventually anyway. The first path costs a lot less. The more we learn from what’s actually happening — the focus of Nat’s excellent annual decarbonization presentation — the more cost effective our decisions will be for Texas.Timestamps:* 00:00 – Introduction* 01:30 – Price and attributes of batteries compared to gas peakers* 03:45 – The optimal generation stack; a portfolio approach* 07:00 – “Ruthlessly practical” developers* 09:00 – Distributed batteries and community resilience* 12:00 – Australia’s rapid installation of distributed storage* 15:00 – Texas Energy Fund’s viability* 16:30 – Global solar scale and trends* 21:00 – Electrifying countries without electricity * 23:00 – The absurdity of arguments against distributed energy* 25:00 – Automated flexible demand; using buildings as thermal batteries* 30:00 – Winter problems in ERCOT* 31:30 – Primary energy is a deeply flawed metric* 35:00 – Looking ahead to Nat’s 2026 Decarbonization slideshowResources:Guest & Company* Nat Bullard - LinkedIn* Halcyon - Company Website + LinkedIn* Nat Bullard’s Famous 200-Slide Presentation* Nat’s NY Climate Week Presentation (From Disparity to Data)Referenced in this Episode:* Energy Capital Podcast with Bill McKibben* The Energy Capital Podcast with Zach Dell* The Energy Capital Podcast with Bret Biggart:* The more recent podcast with Zach Dell et al. Studies & Policy Documents* GridStrategies Report on Data Center Demand* International Energy Agency Solar ProjectionsDoug’s Platforms* LinkedIn* YouTube* X (Twitter)Transcript:Doug Lewin (00:06.422)Welcome to the Energy Capital podcast. I’m your host, Doug Lewin, and welcome to part two of my conversation with Nat Bullard. Nat, as you heard last week, is the co-founder of Halcyon. He is also the one who puts together a fantastic energy transition and decarbonization presentation that comes out every January, which we talked about in this podcast. All around, one of the great experts on all things energy transition and decarbonization. I learned a ton from talking to Nat. I couldn’t let him go after the usual 45 to 50 minutes. We ended up going long, so we split it into two parts. This is part two.As usual, please go to douglewin.com and subscribe. Please become a paid subscriber if you are not already. This is a free episode, but it is not free to produce, and your support is extremely important to us. And you’ll get all kinds of benefits: access to the entire archives, grid roundups, reading and podcast picks, special episodes of the Energy Capital podcast that are paid only, like those with John Arnold and Dan Barcelo from T1, Rudy Garza from CPS Energy, et cetera. And please leave us a five-star review wherever you listen to your podcasts. Please enjoy part two with Nat Bullard. Thanks for listening.So that kind of leads me to where I wanted to go next. You obviously do a whole lot of tracking of batteries. We’ve been talking about electric vehicles a lot. Obviously batteries first started their performance improvement and cost declines because of their use in computers and phones. But now we’re seeing them go into cars on a mass scale and now onto the grid in a really mass scale. I mean, how do you think about that as far as the price comparisons for batteries, particularly gas peakers? Combined cycle, I would almost put in a little bit of a different category because you’re talking more about something that’s going to have a much higher utilization. These days, I think there weren’t a lot being built. There were very few being built, particularly in Texas, but I think just about anywhere with data centers, I think we’ll see some more built.But still in Texas, for instance, in the Texas Energy Fund—this is obviously the subsidy program the Texas legislature put in place a couple of years ago, $7.2 billion in subsidies for gas plants—something like 80% of the projects that applied and were chosen, I think it actually is closer to 85%, were peaker plants. And that’s because we do have an energy-only market. Like you said, in a market, people respond to incentives. The incentives are for short bursts of very high prices. And when you start to stack the peakers up against batteries, and of course the old thing was, you can only go an hour or two, an hour or two is enough for 90, 95% of the high prices in the market. And for the rest, now we’re starting to get to where batteries are going to four or five, six, even longer hour durations. So how do you think about both the price comparison and then the attributes? How do you think differently about the attributes of a peaker versus a battery? Are they really doing the same thing?Nat Bullard (03:13.294)What’s so funny—we had this four-hour standard, more or less. And what’s fascinating about that to me is that is largely an artifact of regulation, not of anything technical. In California back in the day, all you would get paid for was four hours worth of storage. So guess what? Everybody optimizes around this artificially binding constraint that I think we’re starting to see people move past. Again, energy-only market—if there was any place that is going to be ready to do more, or for that matter, to do less, it would be Texas. And also to combine things. When I talk to the biggest of the developers, what their view is, is to meet, let’s say a 500-megawatt load for a data center, the quickest path, the critical path is probably going to be mostly renewable electrons. And within that almost entirely, probably solar, a bunch of batteries. And then you have a combustion turbine to serve the rest of the purpose, but it comes in kind of after the purpose served, obviously, by the generation, but also by the storage.And that kind of stack is the one that seems to be moving the quickest, probably at the lowest cost, and probably the best fit for anybody who’s out there operating. It’s also the one in the future that, if you want to think about future-proofing it, you’re not talking about having to rip out 600 megawatts of solar and 3,000 megawatt-hours of batteries or whatever you might be doing. You’re talking about keeping those, improving them with software, with new hardware, and then altering the final step at the end. If you were to make this a zero-carbon or zero-net-emissions in the long run, maybe the combustion turbine is running on hydrogen. Maybe you’re doing some kind of durable binding, verified carbon removal to cover the cost of the emissions that are there.So I guess my way of thinking is to be a bit more ecumenical about all of this and also watch what the smartest people who build stuff are already doing, watch how they’re going about it and thinking about doing this and viewing these things as generally part of a portfolio approach as opposed to either “if this then that” or an “either/or” approach. Not like if I’m doing this I therefore have to do that, but I’m doing that because it makes the most sense and not I’m doing this or I’m doing only that. Now there are constraints elsewhere. Again, Texas is a unique market where if you have the land and the wherewithal to go build a 500-megawatt data center, you probably can locate the land and have the wherewithal to do a similar amount of power generation. It is less the case in, say, Pennsylvania or in Maryland. So it’s going to be different elsewhere, but you all have a unique market down there for this kind of thing.Doug Lewin (05:51.948)Yeah, it’s incredibly challenging here too, but I think it is more doable than in those other places. I also think that there is too much kind of either/or. I think there’s actually benefits to having both on the system—gas peakers and batteries. Obviously batteries, whatever the duration is, they are duration-limited at some point. They’re going to run out. Now the sun will come back up and charge them or wind blows and charges them or turn the gas plant on and charge them, if you have enough power to do that. And we also get times when the gas plants aren’t working, particularly in extreme cold. We’ve had severe problems with that. Having a battery that can operate while you’re getting people to the site to figure out what’s going on with the gas plant to get i

This is Part 1 of my conversation with Nat. Part 2 will be out next Wednesday. The Video is Live on YouTubeTexas has plenty of energy stories. The harder part is finding the signal through the noise of endless filings. That is why Nat Bullard’s new venture, Halcyon, matters. It turns piles of ERCOT and PUC dockets into something manageable. It’s AI that makes dense regulatory filings sortable and understandable.Meanwhile, Nat’s annual presentation has become must-read material for anyone trying to understand what’s happening in the world of energy: the market forces, capital shifts, and technologies driving global change. He looks at macro trends like EV adoption, clean-tech capital flows, global cost curves. We talked about one of the main takeaways from this year’s edition: China’s dominance in EV manufacturing and exports The Texas Energy and Power Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.We also talked a lot about a recent study Halcyon did with GridLab to quantify the rapidly escalating costs of gas turbines. I asked what his biggest takeaway from compiling that research:“The biggest one for me being at a $2,500 a kilowatt cost for a combined cycle gas plant. What other competing options are there for providing power?”At that cost, there are many better options, including re-using older turbines as many of the data center developers are doing. Storage that can be sited quickly. Demand flexibility can meet much of the need. Solar is still going onto the grid at about a gigawatt per month. Targeted wires upgrades and fast local capacity can bridge the gap while long-lead assets work their way through the process.I left this conversation thinking about how information itself is infrastructure. If we can see what’s changing — if the opaque can become more transparent — we can make better, more informed decisions. Please share this episode with someone who will get something out of it and subscribe to keep the conversation going.Timestamps:* 00:00 – Introduction* 02:00 – Guest welcome, Nat Bullard* 03:00 – How Halcyon can find needles in large regulatory haystacks* 06:00 – Relevance to the Oncor rate case* 09:00 – Tracking changes in gas plant costs and across filings* 10:00 – ERCOT vs. utility load growth projections* 14:00 – Queue reality vs capacity* 16:00 – Regulators’ role to align incentives and process* 18:30 – Nat’s annual presentation* 20:00 – How Nat builds his presentation* 23:30 – China is the dominant EV manufacturer* 26:00 – Will America ever import Chinese EVs?* 27:00 – American manufacturing partnerships* 31:00 – Can Tesla keep up?* 33:00 – Permeability between EVs and power sector* 34:30 – Gas turbine supply limitations and costs* 38:51 – Closing note, turbine askResources:Guest & Company* Nat Bullard - LinkedIn* Halcyon - Company Website + LinkedIn* Nat Bullard’s Famous 200-Slide Presentation* Nat’s NY Climate Week Presentation (From Disparity to Data) * GridLab White Paper with Halcyon on Natural Gas TurbinesIndustry News & Podcasts* Oncor Rate Case* Odd Lots Stargate PodcastStudies & Policy Documents * Texas Senate Bill 6* PUC Load Forecasting Docket 58480 * PUC Financial Assurance Docket 58481Doug’s Platforms* LinkedIn* YouTube* X (Twitter)Transcript:Doug Lewin (00:05.42)Welcome to the Energy Capital podcast. I’m your host, Doug Lewin. My guest this week is Nat Bullard. Nat is and has been for a long time one of the smartest guys on energy issues. I know I have been reading his stuff long before I knew him. He does a now famous slideshow, highly anticipated by folks in the energy space that comes out every January. The last one, as many of the ones before, 200 slides long. We talked a little bit about his process for pulling all that together. He was at New Energy Finance before it was acquired by Bloomberg, wrote a newsletter that was read by hundreds of thousands of folks. He is more currently the co-founder of Halcyon, an AI-assisted research and information platform focused on energy transition. I have started using it a lot. It is great for those of us that are tracking regulatory dockets, sometimes with their many hundreds or even thousands of filings within a single docket. It is a great way to quickly summarize some of those documents. Highly recommend folks check that out. We will have a link to that as well as his famous slideshow presentation in the show notes. This conversation did go long. I love talking to Nat. And so we split this one into two. In this first one, you’ll hear a whole lot of discussion of China. He’s based in Singapore, including a whole lot on EVs and the future of the automotive industry, a whole lot more. I think you’re really going to enjoy this and then come back next week to listen to the other one. Also, please don’t forget to give us a five-star review wherever you listen to the podcast and also to subscribe to the Texas Energy and Power newsletter and to the Energy Capital podcast. This is a free episode. It is not free to produce. Becoming a paid member at Substack really helps support our activity. So please do that today if you haven’t already. And with nothing further, please enjoy the Energy Capital podcast with Nat.Nat Bullard (02:05.634)Doug Lewin, thank you for having me. What a treat. I was just listening to you on the treadmill yesterday, and here we are in the flesh, so to speak.Doug Lewin (02:14.868)It is, I can’t tell you Nat how gratifying it was to get an email from you. I can’t remember when you sent it a couple months ago, six months ago or something saying, really enjoying the newsletter. I said to my wife, I’m like, I got a note from Nat Bullard today. Of course she’s not in the energy world. So she’s like, who? And I told her, you’re a big deal. She needs to know who you are. Nat, for anybody in the audience that doesn’t know, Nat does this, I think everybody probably will, but this amazing annual presentation. I’m sometimes asked by people, Hey, you seem to know a thing or two. Like what are some of the sources you learn from? And you’re one I always name, especially for folks that kind of want to get a global perspective. So we’re going to talk about that. What you’re doing with the presentation, some of the major takeaways, what you’re looking at for next year. But first you’ve got this new venture, which sounds super exciting to me as somebody who spends a lot of time reading regulatory filings and trying to dig through regulatory filings, ERCOT, NPRRs and all that kind of stuff. Let everybody know what you’re up to with Halcyon before we jump into the rest.Nat Bullard (03:19.662)With pleasure, Doug. So I spent a long time in the energy and the decarbonization research business. I was 15 years at the startup and then a company that got acquired by Bloomberg, New Energy Finance that became Bloomberg New Energy Finance became BNEF. And when I finished and took some time out on my own, I realized that I still have a real yen for the information business and the information in and around energy and changes in the system. And I also realized that it was a moment where technology allows us to do things that are different. And there are teams of people that are willing to deploy it and interested in building something new around it that viewed all of the stuff that you just described, you know, ERCOT, NPRR, or thousands of large generator interconnection agreements as a feature input for large language model and AI-driven capabilities, as opposed to a bug of people having to just read stuff by hand, so to speak, over and over and over again. And so about two years ago now, my lead investor, Andrew Beebe at Obvious Ventures, connected me with my co-founders, Bruce Falk and Alex Shuris, who are both veterans of building and operating companies and information systems at real scale, like really, really big. Billion dollar company revenue lines. Who only knows how big an information system in terms of that size, but real platforms. And we said to each other, like, what can we do with today’s new technology to answer questions and solve information challenges that we know exist? And what we settled on is that actually it’s all of that stuff. It’s everything that exists in an unstructured, as the saying would go, fashion that is all text, that is all public, at least at the initial phases, but is, as we joke about internally, a denial of service attack on getting your work done. You want to read everything in ERCOT? It’s public. Go for it. Here you go. Here’s a fire hose of tens of thousands of pages a week per institution. And there’s 50 of them plus one if you include the District of Columbia. Start including all the other things you need to include. The federal layers, the other state layers. We’re talking about on the order of probably hundreds of thousands of pages a week of information. And within those hills, there’s gold. It’s just that it’s not often conveyed in a way that is readable by machine in our old classical way of thinking about it. But with today’s technology, with AI in particular, you know, we move from computers that can compute, that can add and subtract and multiply to machines that can read and can allow us to start extracting information that we really need. If you want to find the price of something, if you want to find a change to a forecast, if you want to find how did this number turn into that number. It often exists. It’s just that you would find it in say the third response to a request for information in this part of a proceeding in that state without any change log.Doug Lewin (06:22.048)Nat, I am so into that right now. So Oncor is in the middle of its rate case and there’s exactly that going on. Environmental Defense Fund and Google and a coalition of cities in their third and fourth requests for information. And within those long questions and long replies, there’s so much good information, but man, it is hard to

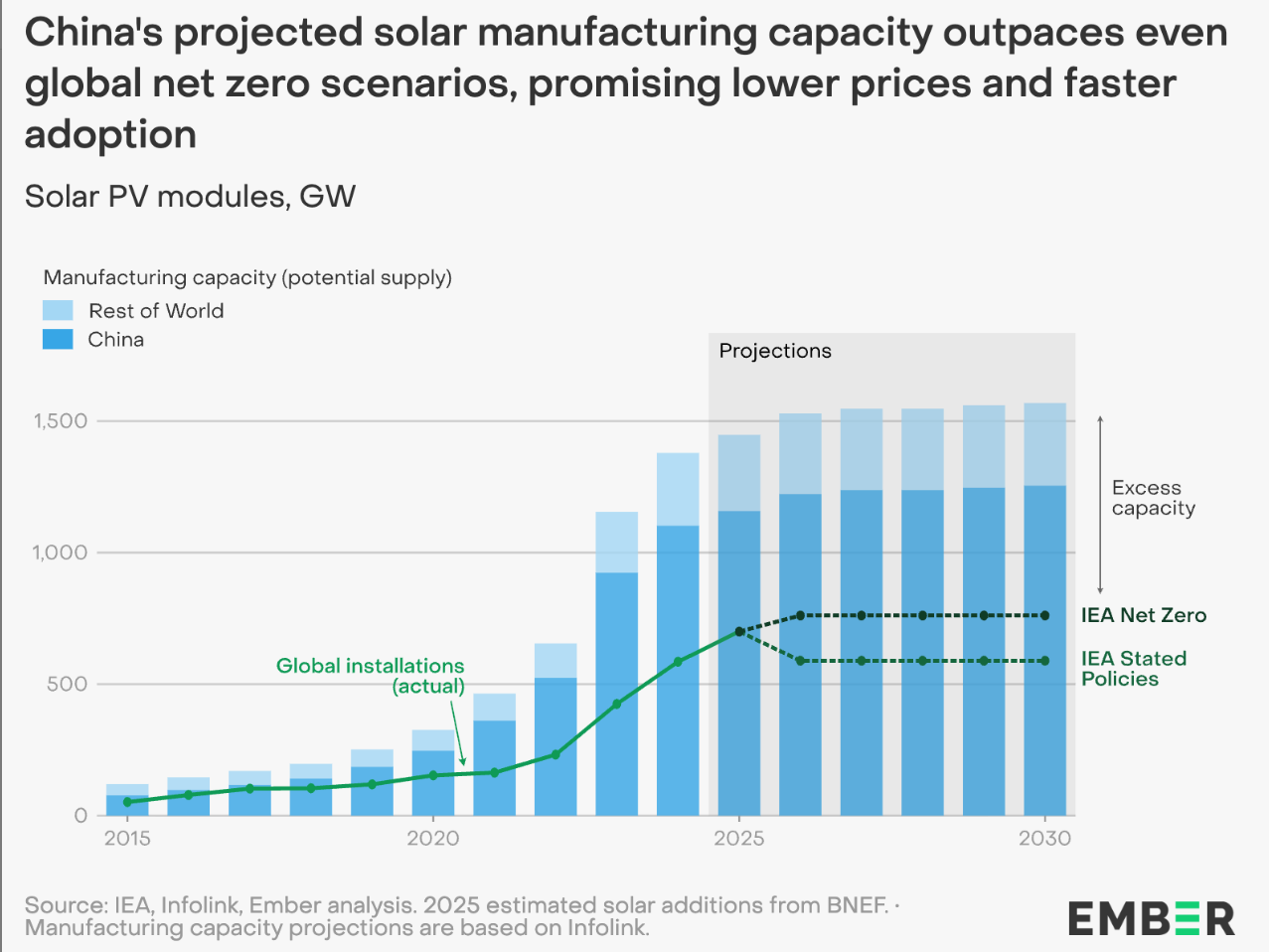

This is a free preview of a paid episode. To hear more, visit www.douglewin.comMost solar panels are imported from China which now has the ability to manufacture over a terawatt (1,000 gigawatts) of solar modules every year — roughly equal to the entire installed base of generation in the US inclusive from every energy source.America makes less than 1/20 of that amount and even less when it comes to the more difficult task of manufacturing cells. But Texas is known for manufacturing and T1 — short for Type 1 civilization — is building solar manufacturing in Texas that could change the game. This is about energy abundance that is reliable, local, and affordable. As T1 CEO Daniel Barcelo told me:“I’ve been working in oil and gas and I am an old oil and gas guy who has run oil and gas companies globally. At the end of the day, it’s really about providing the lowest cost energy in whatever form it is and delivering that energy at a cost-competitive basis to the customer. That drives the philosophy at T1.”T1’s plan is straightforward and ambitious: a multi-site Texas footprint that connects a domestic solar manufacturing chain from materials to finished modules. The company has a module assembly plant in Wilmer in the Dallas area, and is developing cell manufacturing in Rockdale in Central Texas. Upstream, they’ve lined up domestic polysilicon supply from Corning to feed those lines.While T1 scales up supply, demand for power is surging. Texas electricity use is rising rapidly, driven mostly by oil and gas demand, cryptocurrency mining, industrial electrification, and data centers. Texas demand is up 23% in the last four years; most of that new demand is being met by solar power. When more of the equipment is made here, projects move faster and carry less supply-chain risk. And solar can be scaled very quickly to meet near-term needs.“AI needs energy. Data centers need energy. They need it now. It’s great to build nuclear plants in 2030. That’s awesome. But the world’s not waiting. And the big tech companies are not waiting. And right now, solar and storage can deliver it.”This is not either-or. Texas has long succeeded by adding the next tool that works. Solar plus storage are tools for growth and we should use them. Domestic manufacturing creates jobs and strengthens our energy security and global competitiveness.Texas has never waited for someone else to build our future. If companies like T1 can stand up the full stack here, we get more than panels. We get speed, security, control, and the ability to match ERCOT’s needs with Texas-made solutions.If you found this episode useful, share it with a colleague. If you want more Texas-first, reality-based energy coverage, subscribe and join the conversation.The Texas Energy and Power Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.Timestamps* 00:00 – Introduction * 02:00 – T1’s Texas footprint overview* 04:00 – U.S. solar chain, Corning partnership* 05:30 – Jobs and polysilicon-to-module flow* 07:00 – Building U.S. cell capacity* 09:00 – Timelines and receptivity of Texas political leaders* 11:00 – Demand growth requires gigawatts per month* 13:00 – Competitive advantages of building in Texas* 15:30 – Oil and gas demand growth met by solar and wind, saving $1/barrel* 20:30 – When King Coal tried to kill natural gas and why gas won* 23:00 – Political economy of varying energy sources* 25:30 – Can the US build enough solar to meet domestic need and export?* 31:00 – Solar trade investigations, tariffs, anti-dumping rules, FEOC* 35:00 – Solar and manufacturing tax credits under OBBBA, “stackability”* 38:00 – How and why tax policy benefits all energy, including oil and gas* 42:00 – Will Texas continue to blaze trails and attract new energy companies?* 45:00 – Distributed power is “sovereign energy”ResourcesGuest & Company• Daniel Barcelo — LinkedIn • T1 Energy — Company Website + LinkedInCompany & Industry News• Reuters: T1 Energy and Corning agree to fully U.S.-made solar supply chain• PV Tech: T1 Energy–Corning “landmark” U.S.-made poly/wafer/cell deal• Manufacturing Dive: T1 to establish $850M solar cell facility in Texas• T1 Energy IR: Corning deal accelerates ‘Made in America’ solar • T1 Energy IR: Strategic investment in Talon PV Related Articles & Podcasts• How Batteries Are Reshaping the Texas Grid (with Suzanne Leta) • Beyond the Tax Credit Cliff (with Freedom Solar CEO Bret Biggart) • Creating a Distributed Battery Network (with Zach Dell)• The End of Solar & Battery Manufacturing in America? Studies & Policy Documents

• S&P Platts 2022 Study On Electrification of the Permian Basin

• Rystad Study on $/barrel savings

• FERC Order 636

• Section 232 Investigations

• Foreign Entity of Concern Guidance | Dept. of EnergyDoug’s Platforms• LinkedIn • YouTube• X (Twitter)TranscriptDoug Lewin (00:05.25)Welcome to the Energy Capital Podcast. I’m your host, Doug Lewin. My guest this week was Daniel Barcelo, the CEO and chairman of the board of T1 Energy. We talked about how they got their name in this episode. I think you’ll enjoy that. This is a fascinating company, headquartered in Texas. They are building out a full end-to-end manufacturing of solar in Texas. They started with the acquisition of a manufacturing plant, five gigawatts of solar module assembly in Wilmer, Texas, just south of Dallas. They are currently building in Rockdale, Texas, about 60 miles north of Austin, a cell manufacturing facility. So obviously cells are much more complicated to manufacture, much more complex than the module manufacturing. They are also in partnership with Owens Corning to get the raw materials actually sourced here in America. So that when they are done with that process in a year or two, they will have end-to-end American solar manufacturing. So we talked a lot about the potential for American manufacturing of solar, how big it is now, what its potential is to maybe counterbalance China, which is really dominating electricity supply chains throughout a whole number of different components, including all parts of the solar supply chain. They’re dominating that globally. Can America be a counterbalance? One of the things I really enjoyed about this conversation is Daniel has a great perspective, having worked in oil and gas for much of his career, really at the broad spectrum of energy. So I think that really comes through in the interview. I think you’re going to enjoy that. This is a paid episode. If you’re not already a paid subscriber, please become one today. You’ll get access to all sorts of things, roundups, reading your podcast picks, other paid episodes of the Energy Capital Podcast. Most importantly, you will be supporting the work of this podcast, the Texas Energy and Power Newsletter. They are not cheap to produce, and your six bucks a month or five bucks a month if you do an annual subscription is incredibly important, deeply appreciated. With that, let’s jump into the episode with Daniel Barcelo of T1.Daniel Barcelo, welcome to the Energy Capital Podcast. I am very excited to talk to you. T1 is making a whole lot of waves, people in Texas talking about the company a lot. Why don’t we just start from the beginning. What is T1 and tell us about the Texas operations you guys are standing up.Dan Barcelo (02:31.8)Great. First of all, Doug, thank you very much for having us. We’re always excited to talk about the T1 story, something we’re really passionate about as energy operators, managers, investors, historically. T1 Energy is building a domestic solar and battery supply chain that we want to invigorate America with clean, scalable, reliable, and low-cost energy. This is all about advanced manufacturing. This is about how do we bring advanced manufacturing capacity to unlock the most scalable resources we have. That’s what we’re doing. We’re doing this with our core foundational assets. We own and operate our five-gigawatt solar module plant just south of Dallas. That’s called G1 Dallas. And we are also building our five-gigawatt solar cell plant north of Austin called G2 Austin. Those two assets are foundational. The other part of the investments we’ve made is we also own a supply chain of polysilicon from Hemlock. Coupling that polysilicon supply chain coupled with the cell plant, coupled with the module side, we have a tremendous capacity to unlock what we think is a very scalable, renewable power asset we have available right now.Doug Lewin (03:42.39)Yeah, it’s pretty exciting because I see the vision of what you’re trying to do here, right? Because what we have in the United States right now, if I’m not mistaken, and you correct me on any of this I get wrong. This is your world. But my understanding is we’ve got something like 50 to 60 gigawatts of capacity of solar module manufacturing. So that’s sort of the last phase where you’re bringing the assembly, kind of bringing it all together. But you guys are going way upstream to raw materials. And you mentioned something just there. I’m not sure I heard what you said, but I do want to get more into this. I think you guys announced a deal with Corning, right? For some of the raw materials. Not sure if that goes through to the wafers, but I do kind of want to break that down a little bit, Dan, because I think the audience will really appreciate it. It’s very important. I think it’s very important that the United States have the full end-to-end capability for manufacturing. And it looks to me like you guys are doing that with the partnership of Corning upstream, then actually making the cells, correct, in Rockdale, which is what you’re calling the G2 Austin plant, close enough, like 50 miles or so from Austin. I believe near the old Alcoa site, we could talk some about that. And then putting it together in Wilmer, south of Dallas. So you’re really kind of doing that like soup to nuts end-to-end, full supply chain, no?Dan Barcelo (05:04.