Information Is Infrastructure with Nat Bullard (Part 1)

Description

This is Part 1 of my conversation with Nat. Part 2 will be out next Wednesday. The Video is Live on YouTube

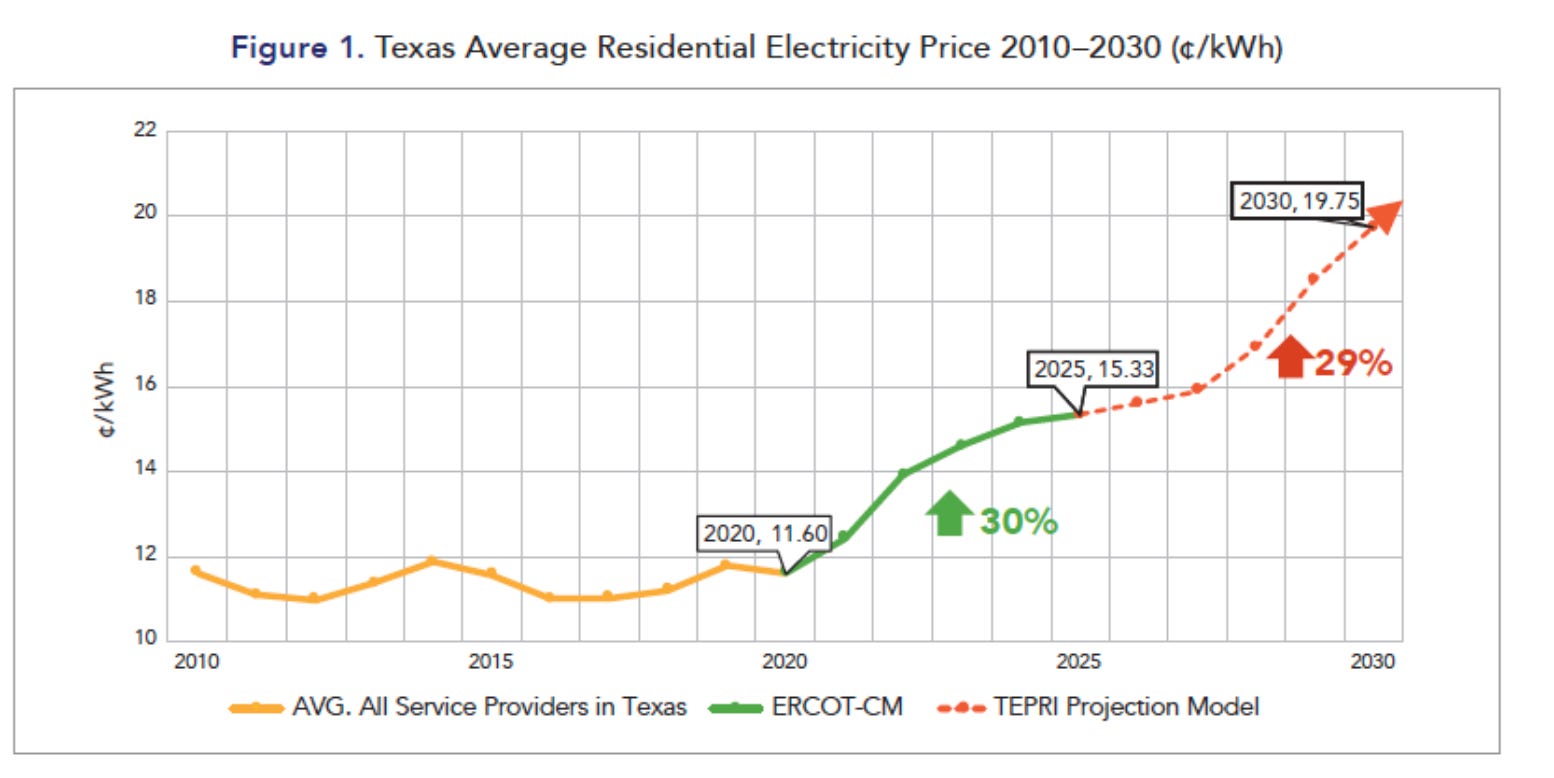

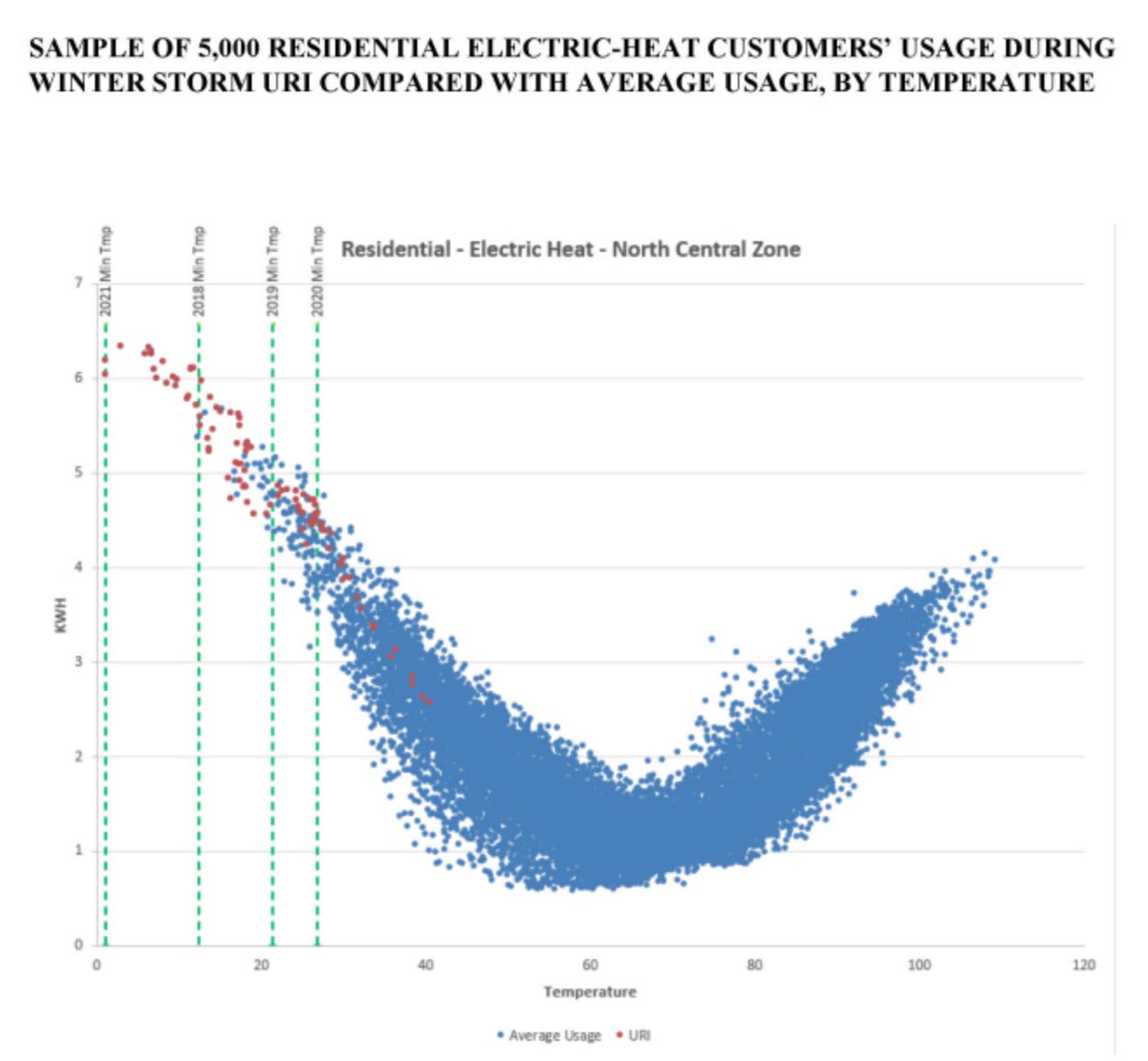

Texas has plenty of energy stories. The harder part is finding the signal through the noise of endless filings. That is why Nat Bullard’s new venture, Halcyon, matters. It turns piles of ERCOT and PUC dockets into something manageable. It’s AI that makes dense regulatory filings sortable and understandable.

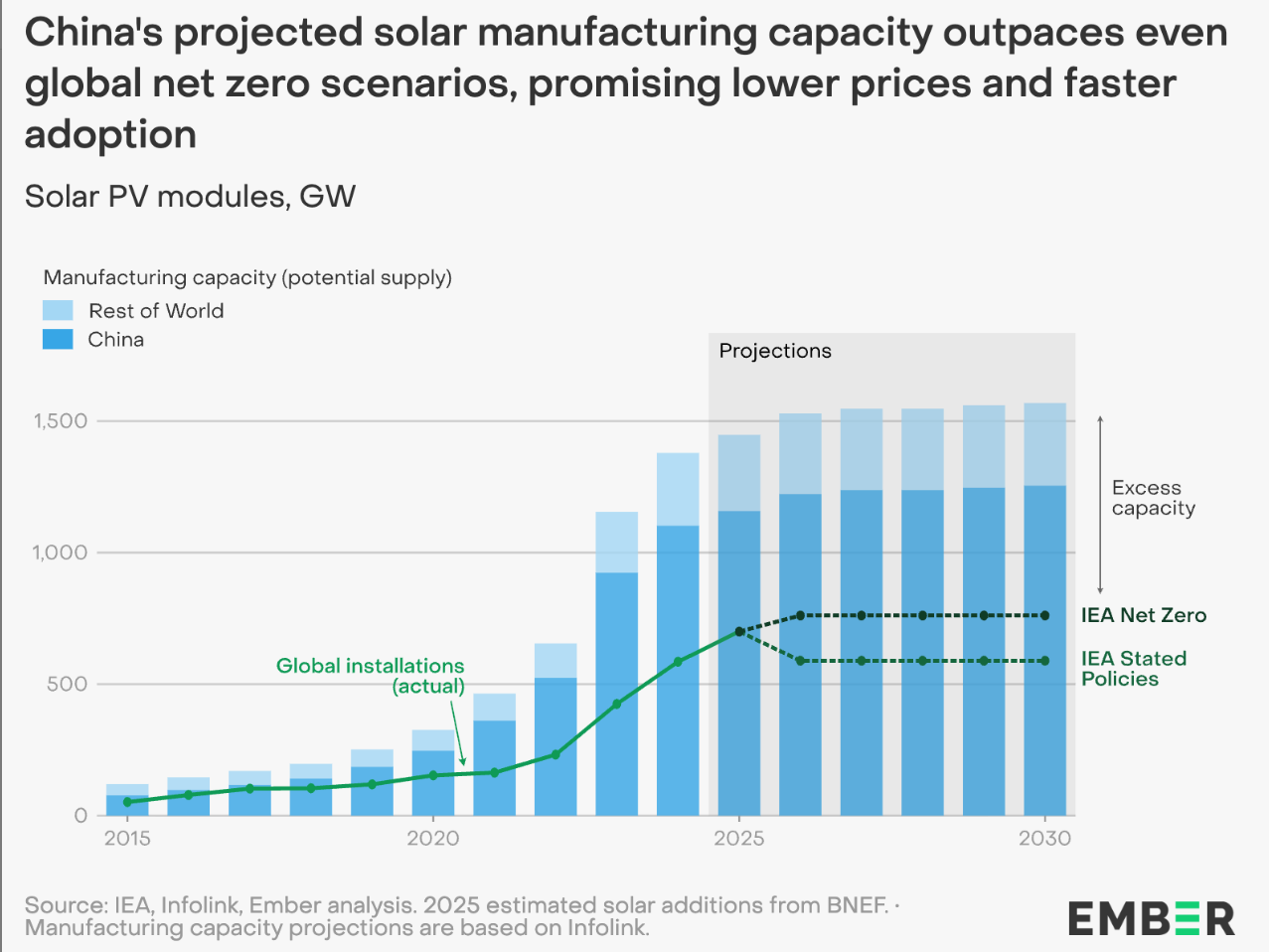

Meanwhile, Nat’s annual presentation has become must-read material for anyone trying to understand what’s happening in the world of energy: the market forces, capital shifts, and technologies driving global change. He looks at macro trends like EV adoption, clean-tech capital flows, global cost curves.

We talked about one of the main takeaways from this year’s edition: China’s dominance in EV manufacturing and exports

The Texas Energy and Power Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

We also talked a lot about a recent study Halcyon did with GridLab to quantify the rapidly escalating costs of gas turbines. I asked what his biggest takeaway from compiling that research:

“The biggest one for me being at a $2,500 a kilowatt cost for a combined cycle gas plant. What other competing options are there for providing power?”

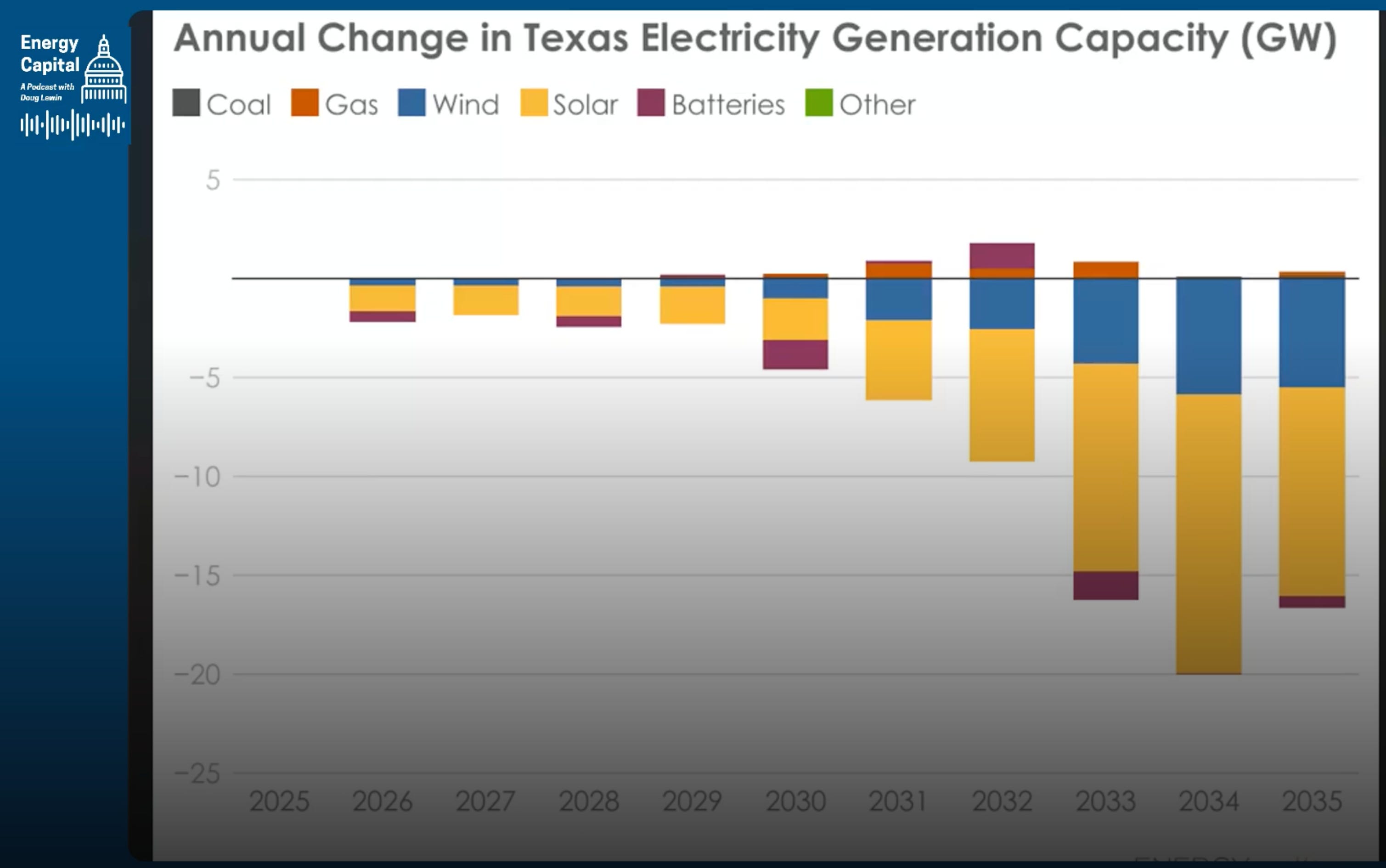

At that cost, there are many better options, including re-using older turbines as many of the data center developers are doing. Storage that can be sited quickly. Demand flexibility can meet much of the need. Solar is still going onto the grid at about a gigawatt per month. Targeted wires upgrades and fast local capacity can bridge the gap while long-lead assets work their way through the process.

I left this conversation thinking about how information itself is infrastructure. If we can see what’s changing — if the opaque can become more transparent — we can make better, more informed decisions.

Please share this episode with someone who will get something out of it and subscribe to keep the conversation going.

Timestamps:

* 00:00 – Introduction

* 02:00 – Guest welcome, Nat Bullard

* 03:00 – How Halcyon can find needles in large regulatory haystacks

* 06:00 – Relevance to the Oncor rate case

* 09:00 – Tracking changes in gas plant costs and across filings

* 10:00 – ERCOT vs. utility load growth projections

* 14:00 – Queue reality vs capacity

* 16:00 – Regulators’ role to align incentives and process

* 18:30 – Nat’s annual presentation

* 20:00 – How Nat builds his presentation

* 23:30 – China is the dominant EV manufacturer

* 26:00 – Will America ever import Chinese EVs?

* 27:00 – American manufacturing partnerships

* 31:00 – Can Tesla keep up?

* 33:00 – Permeability between EVs and power sector

* 34:30 – Gas turbine supply limitations and costs

* 38:51 – Closing note, turbine ask

Resources:

Guest & Company

* Halcyon - Company Website + LinkedIn

* Nat Bullard’s Famous 200-Slide Presentation

* Nat’s NY Climate Week Presentation (From Disparity to Data)

* GridLab White Paper with Halcyon on Natural Gas Turbines

Industry News & Podcasts

Studies & Policy Documents

* PUC Load Forecasting Docket 58480

* PUC Financial Assurance Docket 58481

Doug’s Platforms

* YouTube

Transcript:

Doug Lewin (00:05 .42)

Welcome to the Energy Capital podcast. I’m your host, Doug Lewin. My guest this week is Nat Bullard. Nat is and has been for a long time one of the smartest guys on energy issues. I know I have been reading his stuff long before I knew him. He does a now famous slideshow, highly anticipated by folks in the energy space that comes out every January. The last one, as many of the ones before, 200 slides long. We talked a little bit about his process for pulling all that together. He was at New Energy Finance before it was acquired by Bloomberg, wrote a newsletter that was read by hundreds of thousands of folks. He is more currently the co-founder of Halcyon, an AI-assisted research and information platform focused on energy transition. I have started using it a lot. It is great for those of us that are tracking regulatory dockets, sometimes with their many hundreds or even thousands of filings within a single docket. It is a great way to quickly summarize some of those documents. Highly recommend folks check that out. We will have a link to that as well as his famous slideshow presentation in the show notes.

This conversation did go long. I love talking to Nat. And so we split this one into two. In this first one, you’ll hear a whole lot of discussion of China. He’s based in Singapore, including a whole lot on EVs and the future of the automotive industry, a whole lot more. I think you’re really going to enjoy this and then come back next week to listen to the other one. Also, please don’t forget to give us a five-star review wherever you listen to the podcast and also to subscribe to the Texas Energy and Power newsletter and to the Energy Capital podcast. This is a free episode. It is not free to produce. Becoming a paid member at Substack really helps support our activity. So please do that today if you haven’t already. And with nothing further, please enjoy the Energy Capital podcast with Nat.

Nat Bullard (02:05 .634)

Doug Lewin, thank you for having me. What a treat. I was just listening to you on the treadmill yesterday, and here we are in the flesh, so to speak.

Doug Lewin (02:14 .868)

It is, I can’t tell you Nat how gratifying it was to get an email from you. I can’t remember when you sent it a couple months ago, six months ago or something saying, really enjoying the newsletter. I said to my wife, I’m like, I got a note from Nat Bullard today. Of course she’s not in the energy world. So she’s like, who? And I told her, you’re a big deal. She needs to know who you are. Nat, for anybody in the audience that doesn’t know, Nat does this, I think everybody probably will, but this amazing annual presentation. I’m sometimes asked by people, Hey, you seem to know a thing or two. Like what are some of the sources you learn from? And you’re one I always name, especially for folks that kind of want to get a global perspective. So we’re going to talk about that. What you’re doing with the presentation, some of the major takeaways, what you’re looking at for next year. But first you’ve got this new venture, which sounds super exciting to me as somebody who spends a lot of time reading regulatory filings and trying to dig through regulatory filings, ERCOT, NPRRs and all that kind of stuff. Let everybody know what you’re up to with Halcyon before we jump into the rest.

Nat Bullard (03:19 .662)

With pleasure, Doug. So I spent a long time in the energy and the decarbonization research business. I was 15 years at the startup and then a company that got acquired by Bloomberg, New Energy Finance that became Bloomberg New Energy Finance became BNEF. And when I finished and took some time out on my own, I realized that I still have a real yen for the information business and the information in and around energy and changes in the system. And I also realized that it was a moment where technology allows us to do things that are different. And there are teams of people that are willing to deploy it and interested in building something new around it that viewed all of the stuff that you just described, you know, ERCOT, NPRR, or thousands of large generator interconnection agreements as a feature input for large language model and AI-driven capabilities, as opposed to a bug of people having to just read stuff by hand, so to speak, over and over and over again. And so about two years ago now, my lead investor, Andrew Beebe at Obvious Ve