AI, Outage Risks, and Market Opportunities with Lynne Kiesling (Part 2)

Description

In Part 1 of my conversation with economist Lynne Kiesling, we traced how monopoly utilities and central planning helped electrify the country. That model worked. Economies of scale and guaranteed returns brought capital into the system, and within a few decades, nearly every home had electricity.

But the world has changed. Technologies are smaller, decentralized, and more flexible. Risks are more complex. Consumers expect more than just “the light turns on.” In some areas, the old model now creates perverse incentives: rewarding capital spending over performance, insulating utilities from risk, and slowing innovation.

So the question is: what comes next?

In Part 2, we explore how markets can evolve beyond wholesale and retail competition to tackle the next frontier: risk allocation, demand-side flexibility, and performance-based regulation. And we look at how AI-driven data centers are testing the limits of the old model while creating new opportunities for Texas to lead.

Markets as Error Correction

Markets don’t just allocate resources, they correct errors.

As Lynne explained:

“If someone has made an investment and… we’ve built too many gas power plants, and we’re not earning profits on that, that’s a signal to me that I need to take my money and put it somewhere else.”

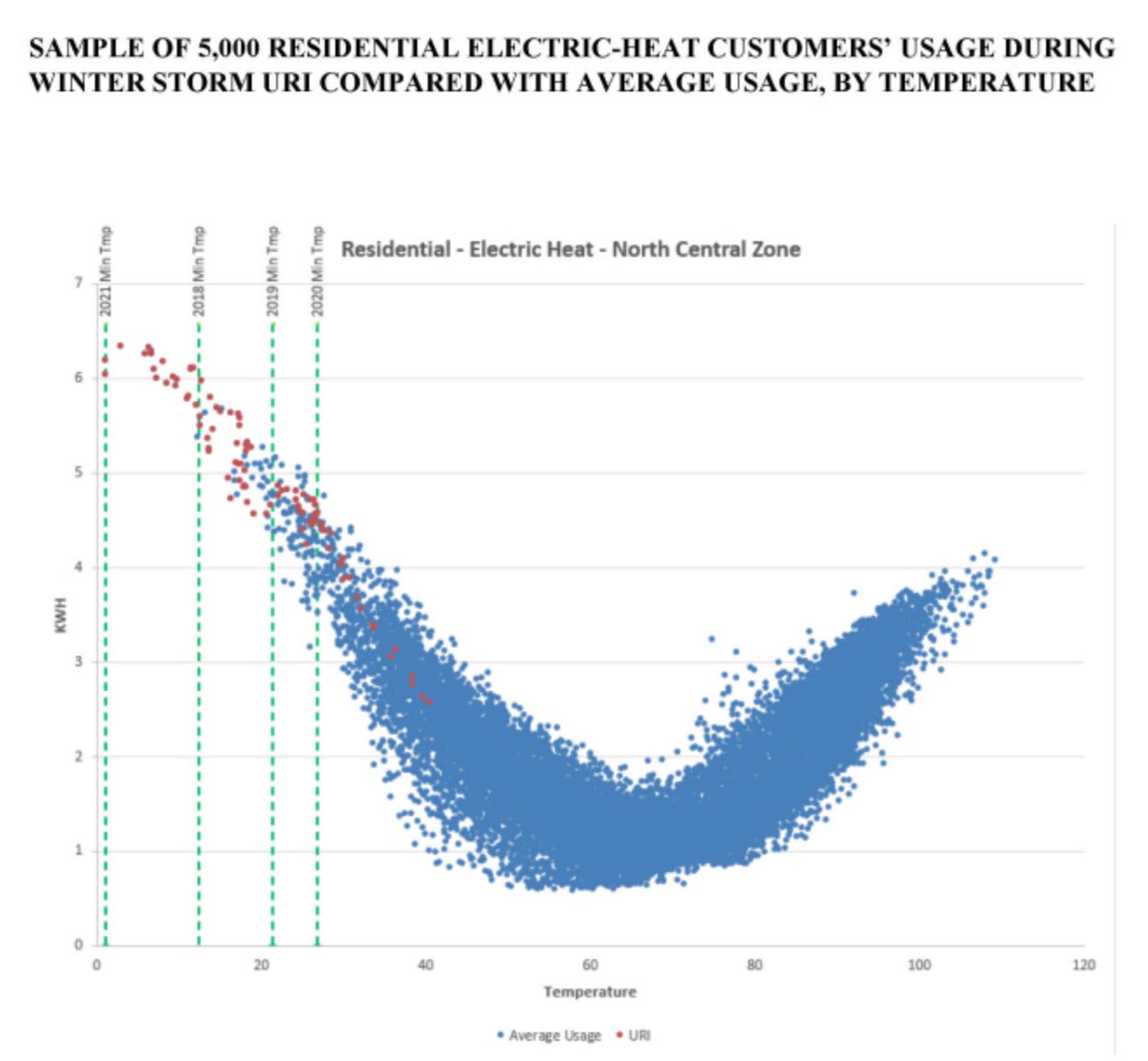

That’s how we avoid repeating mistakes. Yet in the utility model, many risks never reach shareholders. After Hurricane Beryl, for example, CenterPoint admitted its failures but still posted a billion dollars in profits. Consumers bore the outage costs, while investors stayed insulated.

The missing piece: markets for risk. Today, outage risk, rate risk, and weather risk aren’t fully priced or traded. Post-Uri, some generators took huge hits while others profited. That’s markets working. But for regulated utilities, risk rarely lands where it should.

Of course, markets don’t solve everything on their own. Consumers need protection against fraud and market manipulation, and regulators still have a vital role in setting guardrails. The goal isn’t to remove oversight, but to let markets do what they do best, deliver solutions faster than central planning.

Demand Flexibility

For decades, demand seemed inelastic. People flipped a switch, the light came on, and rates averaged out costs. But digital automation has changed the game. Devices from EV chargers to air conditioners to fridges can now respond to prices automatically.

“We could find that there is a lot more latent flexibility on the demand side that would not inconvenience or discomfort consumers.” - Lynne Kiesling

Imagine refrigerators with backup batteries. When the grid is stressed, those batteries could keep food cold without drawing power, creating resilience for the household and flexibility for the grid.

Markets can unlock this value. Today, no one pays you for your fridge’s flexibility. But if performance-based regulation and transactive energy systems take hold, millions of small, automated actions could add up to major resilience.

Performance Over Spending

Rate-of-return regulation rewards utilities for spending capital, not necessarily for delivering better outcomes. Lynne contrasted that with price-cap or performance-based systems:

* Rate-of-return: utilities get a guaranteed return, no matter the outcome.

* Price-cap: utilities must meet quality requirements under a certain cost

* Performance-based regulation: rewards improvements in reliability, efficiency, or customer service, usually removes incentives for capital spending and removes disincentives for operational expenses

“If I were rewriting utility regulation, there would be a penalty structure on your ROE depending on your [reliability] scores.”- Lynne Kiesling

Aligning incentives with performance instead of capital spending could drive innovation from transmission and distribution utilities.

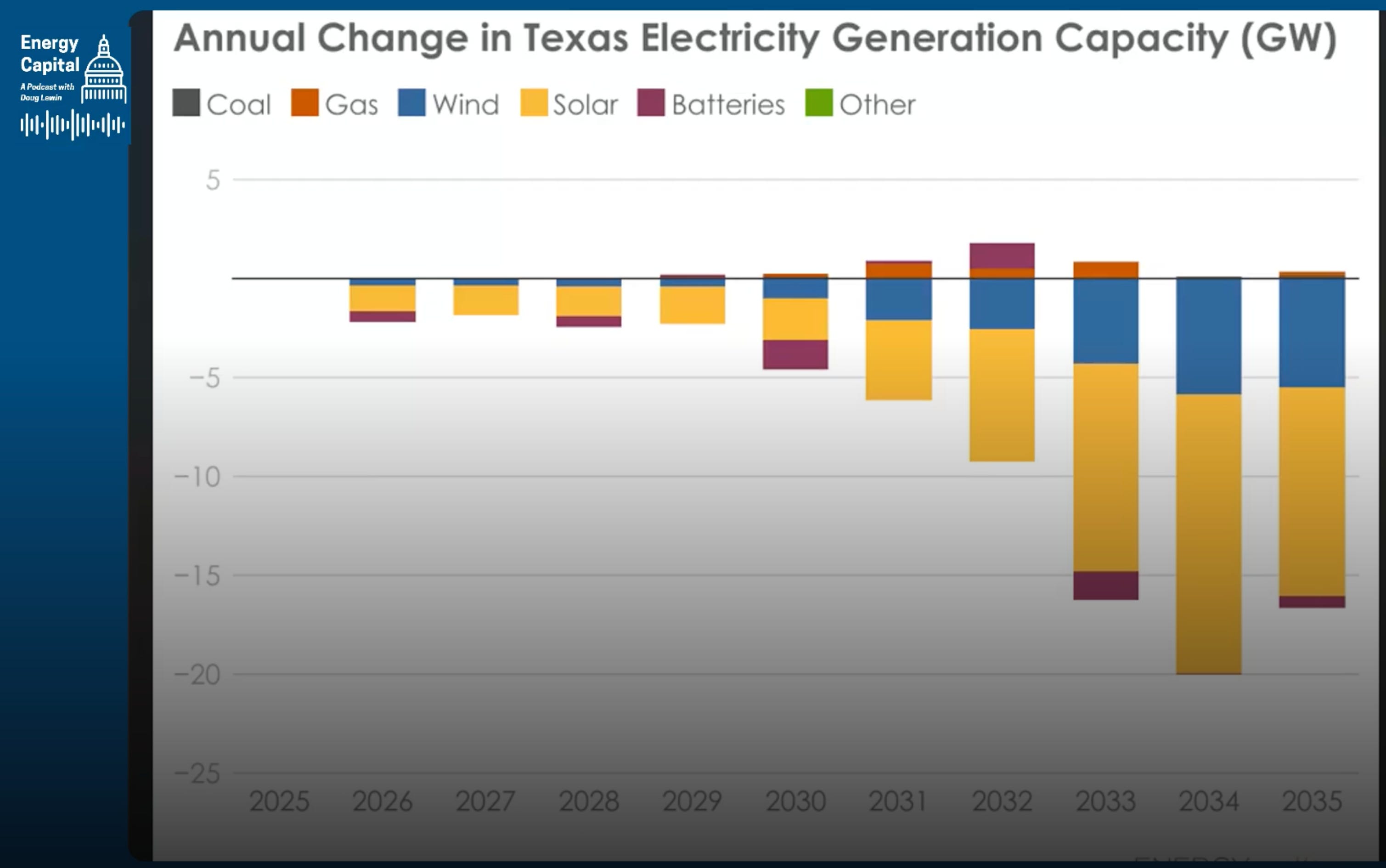

AI and Data Centers: The Demand Tsunami

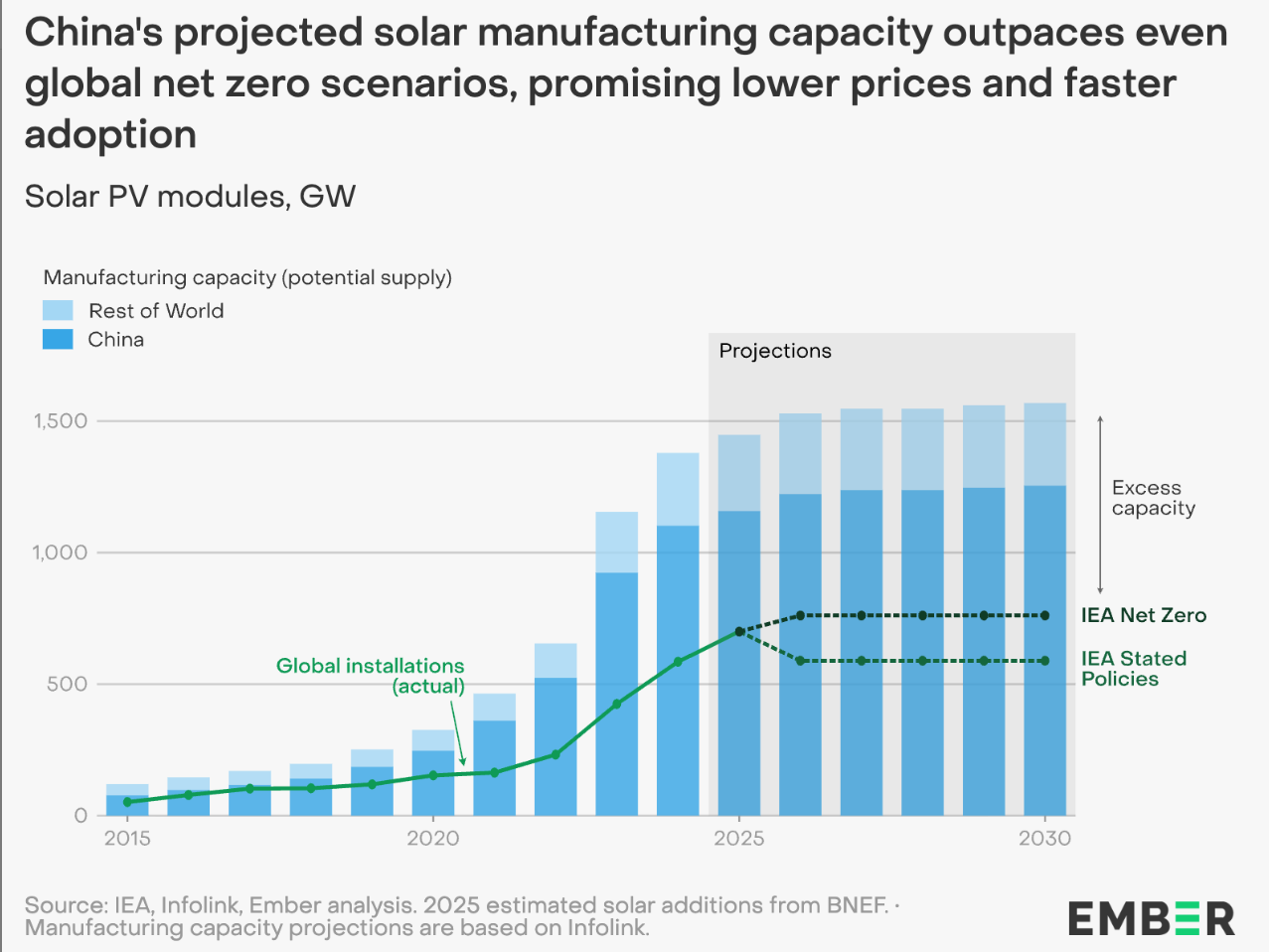

Perhaps the most urgent shift is the rise of AI and hyperscale data centers. The International Energy Agency projects global data center demand will double by 2030.

In the U.S., McKinsey forecasts a 23% compound annual growth rate through 2030, adding 400 terawatt hours of new demand, the equivalent of adding another Texas in just a few years.

Utilities, designed for less dramatic acceleration, can’t match that pace. Data centers are already seeking alternatives: onsite solar + storage, natural gas peakers, geothermal pilots, and even small modular reactors.

Texas has a leg up. In many states, large customers are captive even for their generating resources to the monopoly utility. In ERCOT, they can contract directly with generators. That flexibility is why AI companies are flocking here and why Texas can continue to lead.

The Texas Energy and Power Newsletter is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

From Capacity to Capabilities

The old system was built on capacity: how many megawatts you could generate or consume at peak. But AI and automation are shifting the paradigm.

Most data centers won’t run at full tilt 24/7. Their true value — and the value of generation — lies in capabilities, how much load (or supply) they can flex, when, and where.

“Capability and flexibility, with that intersection with time and location, that is kind of everything going forward.” - Doug Lewin

Texas must evolve its mindset. It’s not just about building more capacity. It’s about enabling capabilities: flexibility, automation, and responsiveness that can balance reliability and cost in real time.

Final Thoughts

Texas built a world-class wholesale market by letting price signals communicate. The next step is to let that principle flow into risk markets, demand-side markets, and distribution markets.

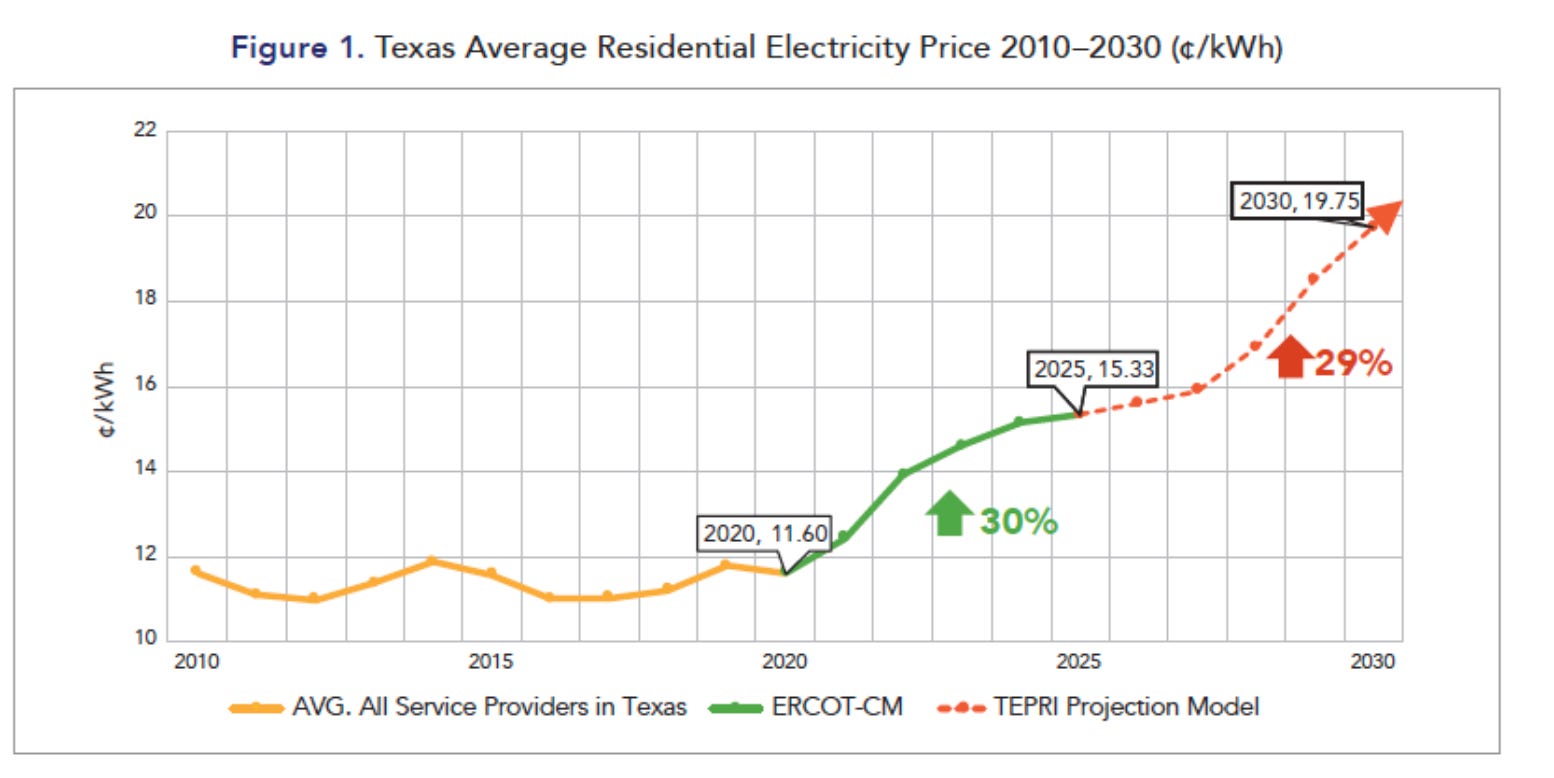

Markets, as Lynne Kiesling reminded us, are a discovery process. If we reward performance, enable innovation, and let capabilities speak louder than capacity, Texas can not only handle the AI and data center surge — we can do so while increasing reliability and lowering costs for residential and small commercial customers.

That’s how we keep build out the grid and meet the challenges of the 21st century.

If this resonated, share it with a colleague who cares about Texas energy. And if you haven’t yet, subscribe for more conversations and insights on the future of the grid.

Sponsored by Aurora Energy ResearchAurora Energy Research provides leading analysis of global electricity markets. Explore their insights on the Energy Unplugged podcast and join their Energy Transition Forum in New York on October 21. Details at auroraer.com

Timestamps

* 00:00 – Welcome and Part 2 overview

* 01:30 – Why central planning doesn’t work; next frontier: demand side

* 04:30 – Markets as error correction, markets for risk including for fully regulated monopoly utilities

* 08:30 – Demand flexibility via automation vs. customer actions

* 12:00 – Transactive energy and user-friendly customer interfaces

* 14:00 – Price cap regulation and performance-based regulation

* 17:00 – Metrics for price cap and performance-based regulation

* 20:30 – Sponsor: Aurora Energy Transition Forum

* 22:30 – How AI data centers are reshaping demand

* 25:30 – Make-or-buy decisions for AI infrastructure companies

* 30:00 – Contracting for power in Texas

* 32:00 – Crusoe, flare gas to power

* 34:00 – Data center flexibility: reducing peak while overall energy use increases

* 35:45 – Why we should talk about capabilities not capacity

* 37:00 – Closing, where to find Lynne

* 38:00 – Credits and thanks

Resources

Guest• Lynne Kiesling - LinkedIn, Knowledge Problem (Substack)

Company & Industry News• Google, Kairos Power, TVA collaborate on advanced nuclear• Reuters, Google to buy power from Kairos SMRs• Google, Fervo geothermal project operational• Crusoe secures 4.5 GW for AI data centers

B