US Opening News: US futures lower amidst looming gov't shutdown

Update: 2025-09-30

Description

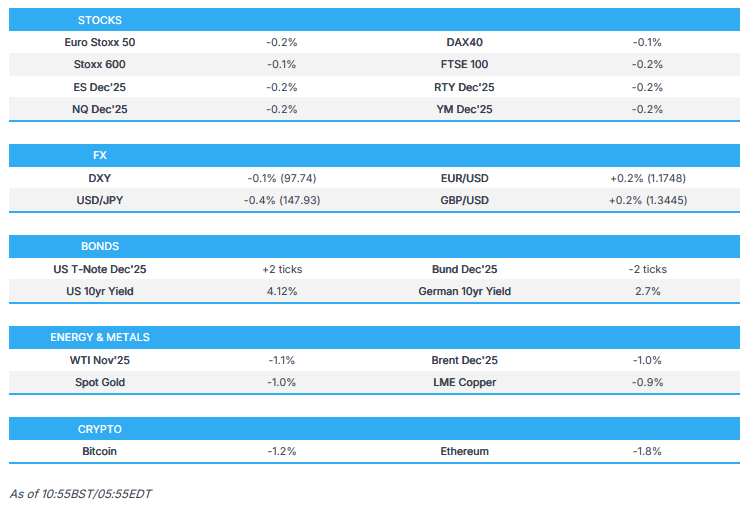

- European bourses & US futures modestly lower into a session of data & Fed speak, awaiting updates on the increasingly likely US gov't shutdown.

- DXY extending on recent pressure, EUR and GBP both firmer, JPY bid for a 3rd consecutive session, AUD bolstered by a hawkish-hold.

- Fixed benchmarks hit highs on cooler French HICP but have since trimmed with EGBs in the red after hotter German State CPIs, mainland due shortly

- Crude continues to falter, XAU hit another ATH but has since come under pressure.

- Looking ahead, highlights include US Consumer Confidence, JOLTS Job Openings. Speakers include RBA’s Bullock, ECB’s Cipollone, Elderson, Fed’s Goolsbee, BoE’s Lombardelli, Mann, Breeden. Earnings from Nike, Lamb Weston.

- Click for the Newsquawk Week Ahead.

</figure>

</figure>TRADE/TARIFFS

- The White House said US President Trump signed a proclamation adjusting imports of timber, lumber, and related derivatives into the US, imposing a 10% tariff on softwood, timber and lumber imports effective 14 October. It added that Trump intends to cap tariff rates for EU and Japanese wood products at 15%, according to Reuters.

- The White House confirmed new 25% tariffs on vanities and kitchen cabinets will take effect on 14 October, with imports of certain upholstered wooden products also subject to a 25% tariff. It announced tariffs on imported cabinets will rise from 25% to 50%, while tariffs on upholstered furniture will increase from 25% to 30% effective 1st January, unless trade agreements are reached beforehand, according to Reuters.

- South Korea’s Top Security Adviser Wi said it is challenging to strike a currency swap deal with the US, according to Reuters.

- EU Trade Commissioner Sefcovic says the EU and US are "very soon going to propose the post 2026 safeguard measures" on steel, working with tariff-rate quotas, to deal with "global overcapacity".

EUROPEAN TRADE

EQUITIES

- European bourses lower across the board, Euro Stoxx 50 -0.3%; broader market narrative is dictated by the looming US government shutdown.

- Sectors are mostly lower after a mixed start to the session, just Financial Services & Media remain in the green. Energy hit by ongoing crude softness. Gambling names impacted by late-night comments from Chancellor Reeves. Mining sector underpinned by initial XAU strength.

- Stateside, futures a touch softer in tandem with the above European performance; ES -0.2%, NQ -0.2%. Fresh catalysts light as we count down to data, Fed speak and the midnight ET shutdown.

- Equity specifics include Tesla's TeslaAI Weibo account announced that they are working to aggressively scale the humanoid AI programme, intend to introduce 3rd gen by end-2025 and start mass production in 2026. CEO Musk forecasts an annual production rate of 1mln units before 2030.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is extending on the modest downside seen since last Friday and scaling back some of last week's data-induced upside. Focus firmly on data, Fed speak and the increasingly likely government shutdown, a shutdown that will impact Friday's BLS report. DXY briefly slipped below yesterday's low @ 97.77 with the next downside target coming via the September 25th trough @ 97.37.

- EUR fractionally firmer against the USD, peaked just above 1.750 thus far. Modest move on the hotter-than-expected German state CPIs, no reaction to the cooler harmonised French measures. As we count down to the mainland German series, we also await several ECB speakers. Thus far, EUR/USD has ventured as high as 1.1761, taking out yesterday's best @ 1.1754.

- JPY firmer vs USD for the 3rd consecutive session. USD/JPY below the 148.37 200-DMA and looking to the 50-DMA at 147.77. Modest strength on the latest BoJ SOO, as while the document was mixed the undertones were hawkish and signal the BoJ is moving closer to further tightening.

- Sterling firmer against the USD, relatively contained vs the EUR. UK drivers light as we await the speech from PM Starmer at the Labour conference, though he is unlikely to add anything new on the fiscal side of things vs Reeves on Monday. Cable is eyeing yesterday's peak @ 1.3457. If breached, the 50DMA kicks in @ 1.3465.

- Antipodeans outperform, initially gaining on a firmer Yuan fixing. Thereafter, extended as the RBA left rates unchanged in a unanimous decision but with the tone hawkish. AUD/USD has made its way back onto a 0.66 handle with a current session peak @ 0.6613. The next target comes via last week's high @ 0.6628.

- PBoC set USD/CNY mid-point at 7.1055 vs exp. 7.1166 (Prev. 7.1089)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- Benchmarks contained overall into a session dominated by US data, with JOLTS and the labour metrics within consumer confidence likely to draw even greater attention than usual owing to the real possibility that Friday's BLS report is delayed. Thus far, USTs to a 112-22 peak and looking to 112-31+. However, the strength was knocked in the mid-European morning by a move lower in EGBs on German state CPIs.

- Bunds initially bid, got to a 128.79 peak with gains of c. 20 ticks. A high that occurred after slightly cooler than expected French preliminary inflation data, following Spain on Monday. However, this was shortlived as Germany’s state CPIs saw a larger increase from the prior than consensus for the mainland implies and sent Bunds from the mentioned peak to a 128.54 trough, lower by six ticks at worst.

- Gilts opened on the front foot, got as high as 91.01 with gains of 12 ticks before succumbing to the pullback seen in fixed generally after the German state CPIs. Currently, Gilts reside below opening levels but near enough unchanged vs Monday’s close.

- Japan sold JPY 2.7tln in 2-year JGBs; b/c 2.81x (prev. 2.84x); average yield 0.949% (prev. 0.863%); Lowest cover ratio since September 2009.

- Click for a detailed summary

COMMODITIES

- Crude benchmarks continue to sell off following yesterday's substantial move lower. At worst, benchmarks hit lows of USD 62.45/bbl and USD 66.10/bbl in WTI and Brent respectively.

- Newsflow for the space light, as such the move is likely a continuation of the bearishness from Monday which was driven by reports of an increased global oil supply from OPEC+ and the reopening of the Ceyhan pipeline.

- Initially, spot gold extended on yesterday’s gains to a new ATH at USD 3871/oz. However, the precious metal has since lost its allure and has found itself under increasing pressure. Down to a USD 3793/oz low. No clear fundamental driver behind the gold pullback this morning, instead it seems to be a function of some profit taking in XAU with a view that the recent move may be a little stretched.

- Base metals remain muted throughout the European session, with 3M LME Copper trading in a tight c. USD 100/t range. Copper got to just shy of yesterday’s high, peaking at USD 10.44k/t before falling to a low of USD 10.35k/t and oscillating within these bounds during the European morning.

- China bans all BHP (BHP LN) iron ore cargoes as pricing dispute continues, according to Bloomberg citing sources.

- Click for a detailed summary

NOTABLE DATA RECAP

- UK GDP QQ (Q2) 0.3% vs. Exp. 0.3% (Prev. 0.3%); YY (Q2) 1.4% vs. Exp. 1.2% (Prev. 1.2%)

- German Retail Sales YY Real (Aug) 1.8% vs. Exp. 1.8% (Prev. 1.9%); MM Real (Aug) -0.2% vs. Exp. 0.6% (Prev. -1.5%)

- German Import Prices MM (Aug) -0.5% vs. Exp. -0.2% (Prev. -0.4%); YY (Aug) -1.5% vs. Exp. -1.4% (Prev. -1.4%)

- French CPI (EU Norm) Prelim YY (Sep) 1.1% vs. Exp. 1.3%; MM (Sep) -1.1% vs. Exp. -0.90% (Prev. 0.50%)

- Swiss KOF Ind

Comments

In Channel