US Market Open: US equity futures flat, JPY bid on US-Japan trade agreement; Amazon to lay off 14k, Paypal signs deal with OpenAI

Update: 2025-10-28

Description

- US President Trump and Japanese PM Takaichi signed an agreement on the US-Japan alliance and framework for securing the supply of critical minerals and rare earths.

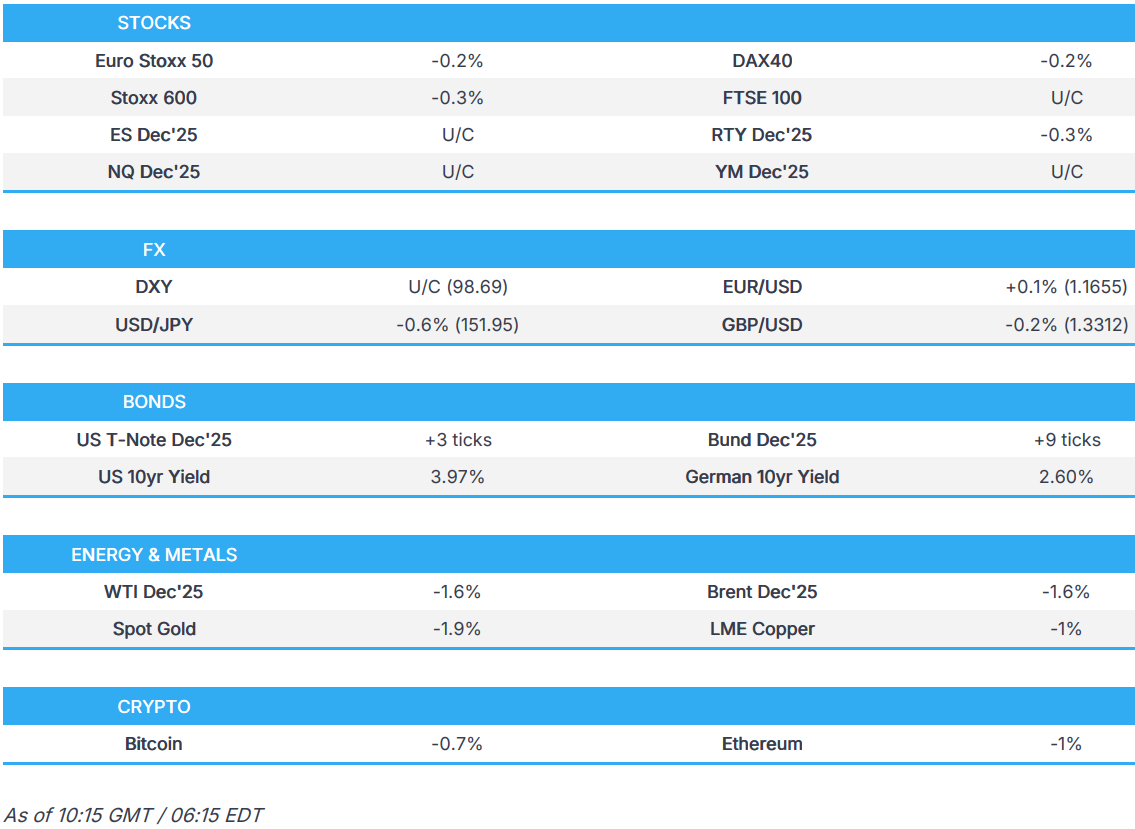

- European bourses are mostly lower; ES/NQ are flat, whilst the RTY is marginally lower ahead of a slew of earnings.

- USD flat/lower, JPY boosted on US-Japan trade developments and mild haven allure; GBP lags a touch.

- Bonds are firmer given the risk tone; USTs await supply.

- XAU briefly dipped under USD 3.9k/oz with base metals also broadly in the red; crude complex lower with some focus on reports that OPEC+ is looking at another oil production hike.

- Looking ahead, US Richmond Fed (Oct), US CaseShiller Home Prices (Aug), US Consumer Confidence (Oct), Supply from the US.

- Earnings from Visa, Electronic Arts, PPG Industries, SoFi, PayPal.

</figure>

</figure>TARIFFS/TRADE

- US President Trump and Japanese PM Takaichi signed an agreement on the US-Japan alliance and framework for securing the supply of critical minerals and rare earths. White House said that the US and Japan plan to use economic policy tools and coordinated investment to accelerate the development of diversified, liquid, and fair markets for critical minerals and rare earths. Furthermore, within six months of the framework’s date, Japan and the US intend to take measures to support projects that generate end products for delivery to buyers in the US, Japan, and like-minded nations, while they will work to secure their critical minerals and rare earths supply chains by addressing non-market policies and unfair trade practices.

- Japanese senior government official said Japan and the US governments are preparing to release a fact sheet that includes potential investment projects in the US, while the fact sheet will include power generation and automobile-related products as potential investment projects and is expected to include company names such as Mitsubishi Heavy Industries.

- China and ASEAN signed a free trade area 3.0 upgrade protocol, according to Xinhua.

EUROPEAN TRADE

EQUITIES

- European bourses opened mostly lower across the board, continuing the subdued mood seen in the APAC session. Price action today has been fairly choppy in a tight range, with traders ultimately awaiting this week's key risk events.

- European sectors opened mixed but now display a clear negative bias; Utilities takes the top spot, joined by Banks, whilst Basic Resources lags given the losses across metals prices. In terms of key movers today, HSBC (+2.5%, solid Q3 figures and raised RoTE guidance), BNP Paribas (-2.3%, missed expectations on bad loans), Novartis (-3.9%, Core EPS missed some analyst expectations).

- US equity futures (ES U/C NQ U/C RTY -0.3%) are mixed with the ES and NQ trading around the unchanged mark whilst the RTY is subdued. The DJIA saw some modest upticks following strong Q3 results from UnitedHealth, after the Co. beat on headline metrics and upgraded FY guidance.

- UnitedHealth Group Inc (UNH) Q3 2025 (USD): Adj. EPS 2.92 (exp. 2.84), Revenue 113.2bln (exp. 113.05bln), raises FY Adj. EPS to 16.25 (prev. guided 16.00).

- United Parcel Service Inc (UPS) Q3 2025 (USD): Adj. EPS 1.74 (exp. 1.3), Revenue 21.40bln (exp. 20.79bln); sees Q4 revenue around 24bln (exp. 23.87bln).

- Amazon (AMZN) announces organisational changes across the Co. that will impact some teammates; reduction in corporate workforce of approx. 14k roles. "We expect to continue hiring in key strategic areas while also finding additional places we can remove layers, increase ownership, and realise efficiency gains".

- PayPal (PYPL) signs deal with OpenAI to become the first payments wallet in ChatGPT, via CNBC.

- Axios suggests the spotlight is on three AI firms, Oracle (ORCL), Broadcom (AVGO) and Palantir (PLTR), as Wall Street moves attention away from the Mag 7.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- DXY is essentially flat and trades towards the upper end of a 98.56 to 98.79 range. Initial European action saw mild pressure in the Dollar, hampered by strength in the JPY and as the USD/CNY was once again fixed lower. Most trade-related headlines have been focused on US-Japan (discussed below), and with traders now counting down the clock to the Fed policy announcement on Wednesday. Before that, focus will be on US Consumer Confidence and the S&P Case-Shiller house price index later today.

- JPY is the clear G10 outperformer today, for three main factors. 1) Haven allure, given the subdued risk tone (also reflected in modest CHF upside), 2) some jawboning from the Japanese Economy Minister who said it is important to avoid rapid, short-term fluctuations in foreign exchange moves, 3) positive US-Japan trade developments. On the latter, US President Trump and Japanese PM Takaichi signed an agreement on the US-Japan alliance and framework for securing the supply of critical minerals and rare earths. Trump appeared pleased with the meeting, offering Takaichi "anything you want". USD/JPY trades towards the mid-point of a 151.77-152.87 range.

- EUR is flat vs the Dollar. Focus today has been on the latest ECB SCE; 1yr inflation expectation revised a touch lower whilst the 3yr and 5yr remained unchanged - little move on this release. The ECB BLS, at the same time, highlighted that "Demand for loans to firms increased slightly, but is still weak overall". Overall, traders are now awaiting the ECB policy decision on Thursday, but will likely lack fireworks given that markets almost entirely price in no change to the current rate. EUR/USD in a 1.1645 to 1.1667 range.

- GBP is slightly softer vs the Dollar. Started the European session flat, but was subject to a bout of pressure soon after. Nothing really behind the downside, but perhaps as traders focused on the recent FT article, which highlighted that the OBR is expected to cut its trend productivity growth forecast by about 0.3%, which is said to threaten a GBP 20bln hit to UK public finances. The move could also be technical, with EUR/GBP making a breach just above the 0.8750 mark, to make a peak at 0.8764.

- Antipodeans are essentially flat, and ultimately little reactive to the subdued risk-tone and the pressure across the metals space.

- PBoC set USD/CNY mid-point at 7.0856 vs exp. 7.1029 (Prev. 7.0881)

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- A firmer start to the day, but only modestly so for USTs. USTs at a 113-18+ peak, taking out the 113-16 peak from Monday and now approach the cluster of highs from last week between 113-20+ to 113-29. Upside that comes as equities fail to sustain the momentum seen yesterday to the benefit of FX havens and fixed, though XAU continues to slide; note, JPY also influenced by overnight trade developments. For fixed, specific a little light since Monday’s auctions. Firstly, the 2yr sale passed without impact, featuring an in-line cover though it did see the first tail, 0.1bps, for a 2yr tap since April. Thereafter, the 5yr tap stopped through by 0.1bps vs when issued, improving from the last outing. Additionally, the b/c marginally surpassed the six-auction average. Ahead, USD 44bln of 7yr notes due.

- Bunds were firmer early doors, in-fitting with the above. A move that has since continued, as, despite European equity sentiment lifting off worst levels, the tone remains a tepid one for the region. Bunds to a 129.73 peak, as is the case in USTs, this takes us above Monday’s 129.64 peak and closer to but yet to test the cluster of highs from last week between 130.02 and 130.38. For EGBs generally, the latest ECB SCE passed without impact with the 3yr and 5yr inflation views maintained while the 1yr view eased to 2.7% (prev. 2.8%). Ahead, a German Bobl tap.

- Elsewhere, France remains in focus as the debate around potential wealth taxes opens up day. The results of this will likely determine whether Lecornu’s 2nd attempt at government lasts or not in the near-term, as the Socialist Party have made clear that a workable compromise on wealth taxes is a key condition for their support.

- Gilts gapped higher, acknowledging the modest bullish bias in EGBs that emerged into the European cash equity open. O

Comments

In Channel