Europe Market Open: Trump and Xi confirm meeting next week, supporting market sentiment

Update: 2025-10-24

Description

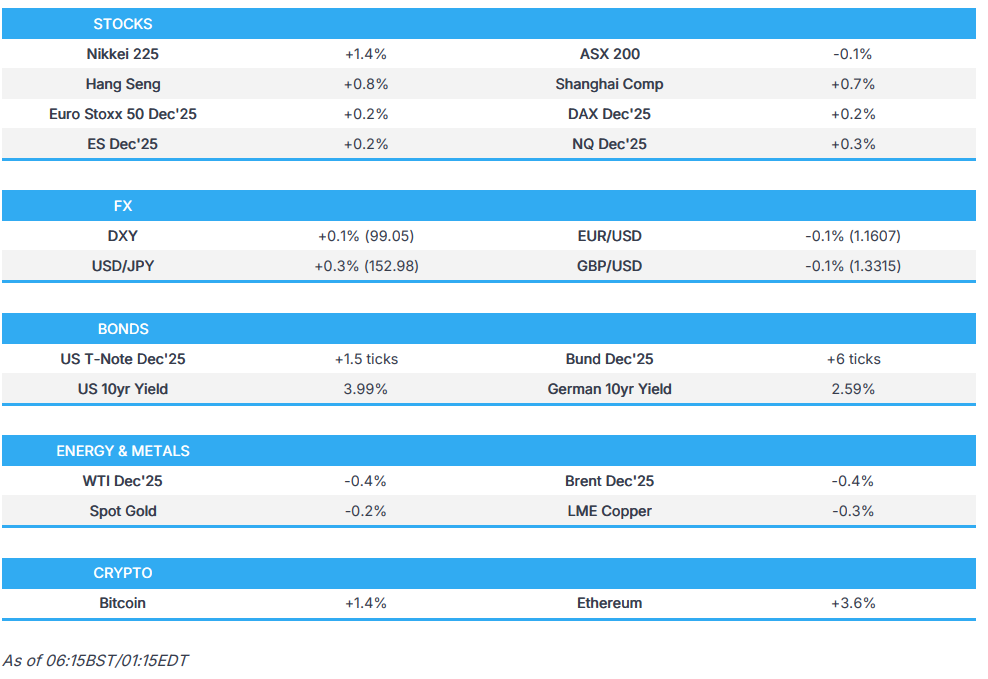

- US to probe China's 2020 trade compliance while Trump has "terminated" all trade talks with Canada

- Despite this, APAC bourses firmer as the region focuses on confirmation of a Trump-Xi meeting next week

- DXY firmer but rangebound, USD/JPY tested 153.00

- Fixed benchmarks remain subdued, USTs await CPI

- Crude pulled back from Thursday's rally, XAU is indecisive

- Looking ahead, highlights include UK Retail Sales (Sep), EZ, UK & US Flash PMIs (Oct), US CPI (Sep), (Suspended Releases: US Build Permits & US New Home Sales), CBR Policy Announcement, European Council (23rd-24th), Moody’s Credit Review on France, Speakers including ECB’s Cipollone & Nagel, Earnings from NatWest, Porsche, Sanofi, Eni, Saab, Procter & Gamble

- Click for the Newsquawk Week Ahead.

</figure>

</figure>US TRADE

EQUITIES

- US stocks gained with the major indices rebounding from Wednesday's downside, while there wasn't a specific headline trigger for the advances, with further encouragement seen following confirmation of a Trump-Xi meeting for next Thursday. EV maker Tesla (TSLA) completely pared the losses incurred following its earnings report, which was received poorly by investors. Healthcare came under pressure after an update from Molina (MOH), which cut its profit guidance amid a rise in medical costs. Conversely, Quantum computing names were bid on suggestions that the US was mulling equity stakes, although Yahoo Finance reported that the administration is not necessarily considering taking equity stakes, with sources stating that companies have approached the White House with proposals, but any potential investment (possibly via warrants or loans) would aim for taxpayer returns and use leftover Chips Act funds. Meanwhile, Energy names were higher amid gains in crude benchmarks, which surged after the US sanctioned Russian oil majors Rosneft and Lukoil over the Ukraine war.

- SPX +0.58% at 6,738, NDX +0.88% at 25,097, DJI +0.31% at 46,735, RUT +1.27% at 2,483.

- Click here for a detailed summary.

TARIFFS/TRADE

- US is to probe China's 2020 trade deal compliance, while an investigation could be announced on Friday, according to sources. The investigation could be announced as soon as Friday and would be filed by the USTR under Section 301 of the Trade Act, while NYT said the inquiry could pave the way for more tariffs on Chinese imports, although no such decision has yet been made.

- White House said regarding US President Trump's trip to Asia, that he will meet with Chinese President Xi on Thursday, Japanese PM on Tuesday and South Korea’s Leader on Wednesday. It was also reported that Trump said he thinks he will come out well from the meeting with Xi.

- US Trade Representative Greer is to travel to Malaysia, Japan and South Korea.

- South Korea's Industry Minister said South Korea wants the US investment package to be smaller than USD 350bln as part of the tariff deal, while it was separately reported that South Korea and the US remain far apart on key sticking points in trade negotiations, although some progress has been made, according to a senior presidential aide.

- French President Macron told the EU to consider using its strongest trade tool on China, while it was also reported that German Chancellor Merz said they did not make a decision on a coercion instrument and want a solution regarding China.

- China's Commerce Minister said regarding ties with the US, that dialogue and cooperation is the only right choice and can find a solution and correct way of coexistence. The minister also noted regarding FDI that they will not will not engage in zero-sum games in opening up and attracting investment, while they will further lower market access barriers to foreign investors.

- US President Trump posted "Canada has fraudulently used an advertisement, which is FAKE, featuring Ronald Reagan speaking negatively about Tariffs...They only did this to interfere with the decision of the U.S. Supreme Court, and other courts. TARIFFS ARE VERY IMPORTANT TO THE NATIONAL SECURITY, AND ECONOMY, OF THE U.S.A. Based on their egregious behaviour, ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED."

- Canada reportedly limits how many American vehicles Stellantis (STLAM IM) and GM (GM) can import tariff-free, while the move comes after companies dropped some Canadian production, according to CBC. Canada's government later confirmed significant reductions to import quotas of General Motors (GM) and Stellantis (STLA IM), reducing the annual remissions quotas for General Motors by 24.2% and for Stellantis by 50%.

NOTABLE HEADLINES

- A report that the administration is in talks for the government to take equity stakes in quantum computing companies is not necessarily something the Trump administration is considering, and what is under consideration could be warrants or loans and may not necessarily be with the companies mentioned in the article, according to Yahoo Finance citing sources. Furthermore, it was separately reported that the Trump administration is in early-stage conversations with quantum computing companies to discuss potential financial support, according to Bloomberg.

APAC TRADE

EQUITIES

- APAC stocks were mostly higher as the region took impetus from the rebound on Wall St, where energy names were underpinned amid surging oil prices and with the improved risk sentiment also facilitated by confirmation of a Trump-Xi meeting for next Thursday.

- ASX 200 lagged as gains in tech were offset by weakness in defensives and the top-weighted financials sector.

- Nikkei 225 rallied at the open and reclaimed the 49,000 status alongside a weaker currency, while the latest CPI data from Japan printed mostly in line with forecasts but showed an acceleration in the headline and core figures.

- Hang Seng and Shanghai Comp conformed to the upbeat mood following confirmation of a Trump-Xi meeting next week, although gains were capped as it was also reported that the US is to probe China's 2020 trade deal compliance, while an investigation could be announced on Friday.

- US equity futures kept afloat after the prior day's gains and as participants digested earnings, including from Intel, which beat on top and bottom lines.

- European equity futures indicate a higher cash market open with Euro Stoxx 50 futures up 0.2% after the cash market closed with gains of 0.5% on Thursday.

FX

- DXY kept afloat in rangebound trade following recent upside in yields and as participants braced for incoming CPI data.

- EUR/USD lacked demand after the prior day's indecisive performance in which the single currency traded both sides of the 1.1600 level, but within relatively tight parameters, before reverting to flat territory.

- GBP/USD languished near this week's post-CPI lows with the currency unaffected by recent BoE comments and a report that UK Chancellor Reeves is mulling raising income tax at next month's Budget announcement.

- USD/JPY extended on gains and approached the 153.00 level following recent upside in US yields and the positive risk environment.

- USD/CAD was briefly underpinned and climbed above the 1.4000 level after US President Trump posted that all trade negotiations with Canada are terminated due to a fake ad featuring Ronald Reagan speaking negatively about tariffs.

- Antipodeans traded steadily overnight and held on to the prior day's spoils after benefitting from the rise in oil prices and heightened risk appetite.

- PBoC set USD/CNY mid-point at 7.0928 vs exp. 7.1192 (Prev. 7.0918).

FIXED INCOME

- 10yr UST futures were subdued after retreating yesterday as yields climbed alongside the surge in oil prices, while all focus turns to the US CPI report.

- Bund futures remained lacklustre following the prior day's retreat to a sub-130.00 territory.

- 10yr JGB futures attempted to nurse some of its recent losses with support seen around the 136.00 level, albeit with the rebound limited after Japanese CPI data printed mostly in line with estimates but showed an acceleration in the headline and core readings.

COMMODITIES

- Crude futures slightly pulled back following the prior day's rally, which had been spurred by the US sanctioning Russian oil majors Rosneft and Lukoil over the Ukraine war, while Chinese state oil firms were also said to suspend seaborne Russian oil purchases due to worries related to Western sanctions.

- Spot gold t

Comments

In Channel