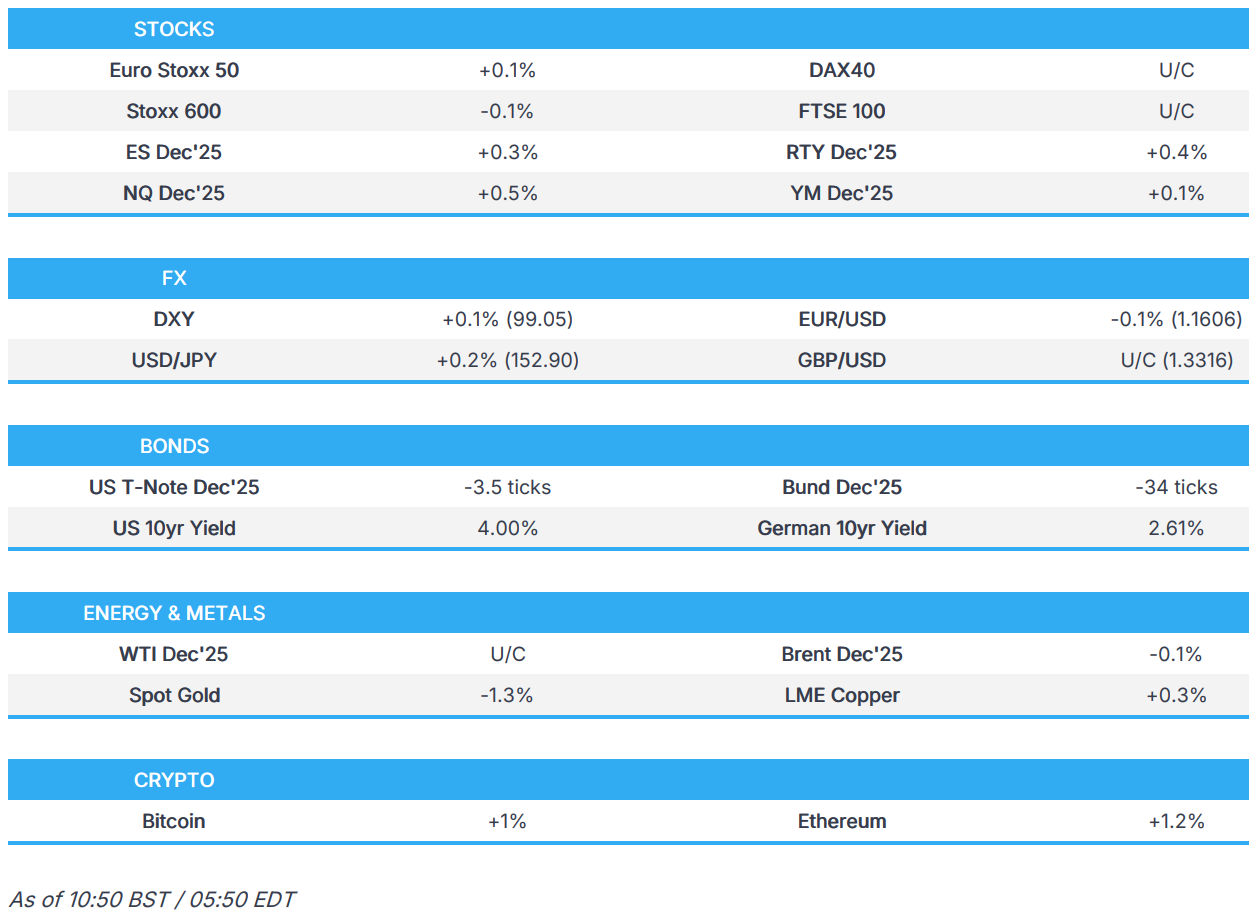

US Market Open: Trump terminates all trade talks with Canada, US equity futures & DXY gains into CPI

Update: 2025-10-24

Description

- US to probe China's 2020 trade compliance while Trump has "terminated" all trade talks with Canada.

- European bourses opened firmer but now off best levels whilst US equity futures are in the green; INTC +8.3%.

- USD slightly higher into CPI, EUR boosted on German PMIs but now pared.

- Bunds & Gilts hit by PMIs, OATs look to Moody's, USTs await CPI.

- Crude gives back recent strength, XAU also on the backfoot around USD 4.06k/oz.

- Looking ahead, US Flash PMIs (Oct), US CPI (Sep), CBR Policy Announcement, European Council (23rd-24th), Moody’s Credit Review on France, Speakers including ECB’s Cipollone & Nagel, Earnings from Procter & Gamble.

</figure>

</figure>TARIFFS/TRADE

- US Trade Representative Greer is to travel to Malaysia, Japan and South Korea.

- South Korea's Industry Minister said South Korea wants the US investment package to be smaller than USD 350bln as part of the tariff deal, while it was separately reported that South Korea and the US remain far apart on key sticking points in trade negotiations, although some progress has been made, according to a senior presidential aide.

- China's Commerce Minister said regarding ties with the US, that dialogue and cooperation is the only right choice and can find a solution and correct way of coexistence. The minister also noted regarding FDI that they will not will not engage in zero-sum games in opening up and attracting investment, while they will further lower market access barriers to foreign investors.

- US President Trump posted "Canada has fraudulently used an advertisement, which is FAKE, featuring Ronald Reagan speaking negatively about Tariffs...They only did this to interfere with the decision of the U.S. Supreme Court, and other courts. TARIFFS ARE VERY IMPORTANT TO THE NATIONAL SECURITY, AND ECONOMY, OF THE U.S.A. Based on their egregious behaviour, ALL TRADE NEGOTIATIONS WITH CANADA ARE HEREBY TERMINATED."

- Canada reportedly limits how many American vehicles Stellantis (STLAM IM) and GM (GM) can import tariff-free, while the move comes after companies dropped some Canadian production, according to CBC. Canada's government later confirmed significant reductions to import quotas of General Motors (GM) and Stellantis (STLA IM), reducing the annual remissions quotas for General Motors by 24.2% and for Stellantis by 50%.

- Japan and US agree to cooperate on AI and next-gen telecom standards, according to Nikkei.

EUROPEAN TRADE

EQUITIES

- European equities (STOXX 600 -0.2%) are softer after initially opening with upside. European market sentiment has failed to follow APAC and Wall Street where the tone was supported after confirmation of next weeks Xi and Trump meeting. There’s been no clear macro driver for the recent losses.

- European sectors have opened slightly negative this morning. Technology (+0.9%) takes the top spot, with sentiment boosted by post-earning strength in Intel (+8.3%). Financial Services is in second place driven by gains in LSEG (+4.3%) after a broker upgrade from JP Morgan. Real Estate is found at the bottom of the pack.

- US equity futures are firmer (ES +0.3% NQ +0.4% RTY +0.5%), as markets await US CPI later today. Pre-market movers today include; Intel (+8.3%, Q3 beat), Google (+1.4%, Anthropic said it will expand its deal with Google to use up to 1mln AI chips).

- EU Commission finds TikTok and Meta (META) in breach of their transparency obligations under Digital Services Act; firms can now take measures to remedy the breaches.

- China smartphone shipments (Aug): 22.6mln, -6% Y/Y (prev. +16.1%), via CAICT; foreign branded 1.306mln, -30.2% Y/Y (prev. +15.6%).

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is marginally firmer today, as traders digest a slew of trade-related updates and ahead of the much-awaited delayed US CPI report for September. DXY is currently in a 98.89-99.10 range. In brief, consensus looks for headline CPI to rise +0.4% M/M (prev. 0.4%), with the annual rate seen rising to 3.1% Y/Y (prev. 2.9%). On the trade front, the White House confirmed that the POTUS will meet a number of Asian leaders next week, namely Chinese President Xi on Thursday. It was also reported that Trump said he thinks he will come out well from the meeting with Xi.

- Up the northern border, Trump cancelled all trade negotiations with Canada, due to anti-tariff ads. In an immediate reaction, USD/CAD moved higher by 25 pips to 1.4030 from 1.4005 over two minutes; currently trading around 1.4028. ING suggests that the BoC would be more likely to deliver a 25bps cut at next week’s meeting, given how much trade uncertainty/existing tariffs are weighing on Canadian businesses.

- EUR is essentially flat/modestly lower vs the Dollar. Focus today has been on a slew of PMIs. Starting by way of release order; France was subdued, Germany upbeat and EZ-wide metrics also resilient. Delving into price action in detail, a slight tick lower in the Single-Currency on the downbeat French metrics, but then jumped higher and made fresh highs on the German figures, rising from 1.1607 to 1.1628. The pair has gradually cooled from those highs since.

- JPY is the marginal G10 underperformer today, continuing the pressure seen in the APAC session. USD/JPY is currently trading at the upper end of a 152.47-153.06 range; peak marks a fresh WTD high and now approaching last week’s best at 153.27. Focus for the region has been on inflation, whereby Japan’s National CPI Y/Y rose from the prior (in-line with expectations); the core figure also rose (as expected), whilst the super-core metric fell more-than-expected. From a policy perspective, the elevated inflation figures play in favour of a hike for the BoJ; ING opines that the ongoing US-China trade spat will keep the BoJ wary of hiking rates in October, and instead favour December.

- GBP is modestly lower vs the Dollar. Focus for the UK today was on Retail Sales, which topped analyst expectations; headline M/M +0.5% (exp. -0.2%), the Ex-Fuel figure cooled from the prior but not as much as expected. Thereafter, Cable slipped from those levels heading into the PMI metrics, which were overall resilient; Services ticked a little higher, whilst Manufacturing topped the most optimistic of analyst expectations. The accompanying report suggested that “Companies are clearly treading cautiously in terms of spending, investment and hiring ahead of the upcoming Budget”. Overall, Cable lifted from 1.3302 to 1.3321; the midpoint of the day’s range. On the Budget, it was reported that Chancellor Reeves is mulling raising income tax at next month's budget, according to The Guardian.

- Antipodeans are modestly lower vs USD, after trading with modest gains overnight, which was facilitated by the generally positive risk tone. However, this has subsided a touch in recent trade. AUD/USD trades in a 0.6641-0.6707 range, and within the confines of this week’s range; NZD/USD trades in a 0.5743-0.5759 range, the high for the day just shy of the WTD best at 0.5761 and then the 21 DMA at 0.5763 thereafter.

- PBoC set USD/CNY mid-point at 7.0928 vs exp. 7.1192 (Prev. 7.0918).

- Click for a detailed summary

- Click for NY OpEx Details

FIXED INCOME

- USTs are contained overnight despite a handful of trade updates, with USTs very much waiting for the upcoming US September CPI report. A series that is being released, despite the shutdown, to facilitate social security adjustments. Consensus looks for headline CPI to rise +0.4% M/M (prev. 0.4%), with the annual rate seen rising to 3.1% Y/Y (prev. 2.9%). The core rate is expected to rise by +0.3% M/M (prev. 0.3%), with the annual rate of core inflation seen unchanged at 3.1%. Elsewhere, we await updates on the trade front. Firstly, a potential investigation into China’s adherence with Section 301 terms from Trump’s first term. Secondly, further details on Thursday’s upcoming Trump-Xi meeting. Finally, relations between the US and Canada have deteriorated significantly with Trump stopping discussions following the release of a Canadian tariff video.

- Bunds were contained early doors, holding just under the 130.00 mark. Thereafter, the softer-than-expected French PMIs pushed the benchmark to a 130.07 peak and also

Comments

In Channel