US Market Open: US sanctions on Russia keep crude bid; US equity futures mixed post-Tesla, IBM and quantum news

Update: 2025-10-23

Description

- China published fourth plenum communique: approved five-year plan, and aiming for a 'big increase' in the level of tech self-reliance.

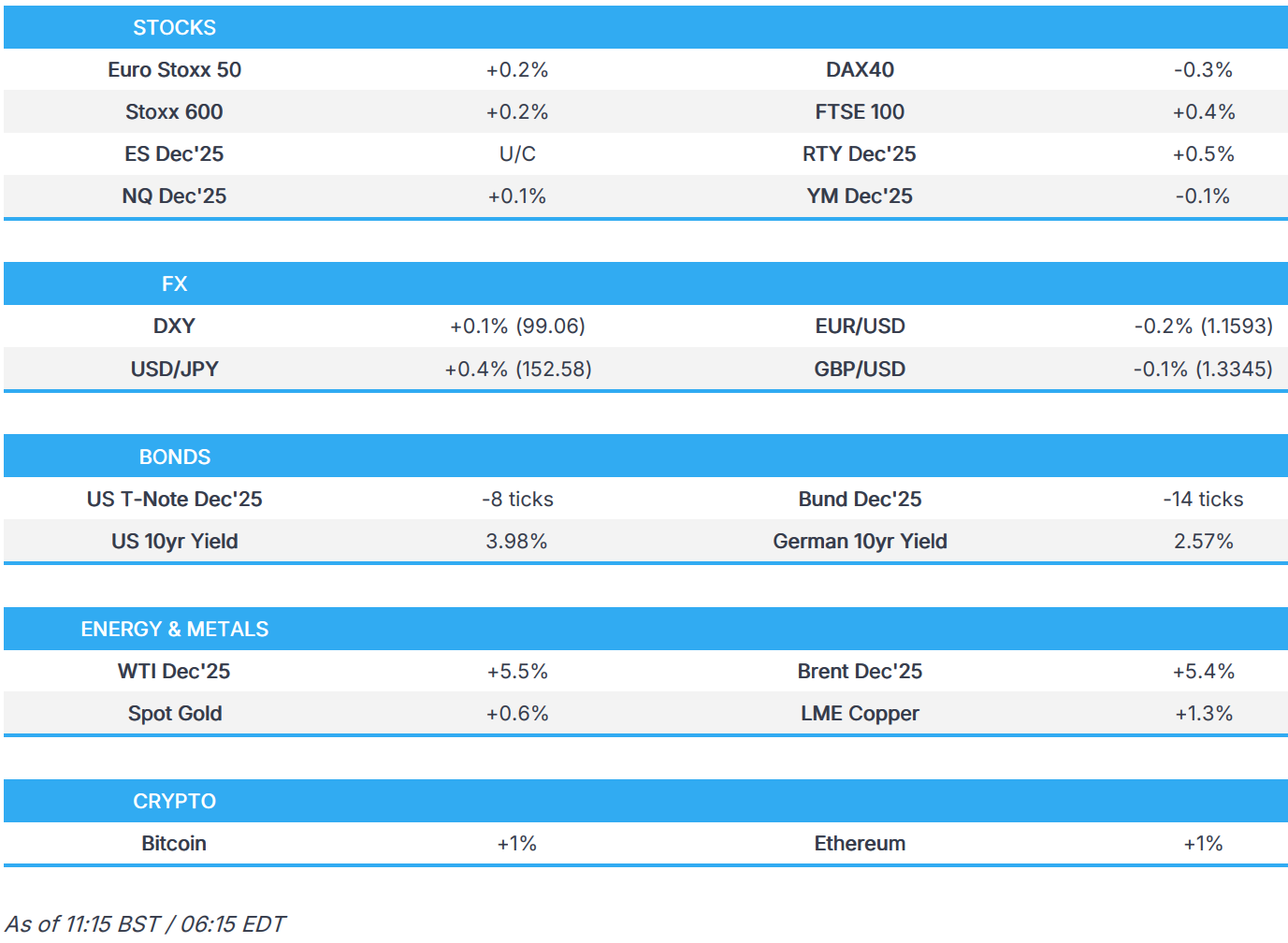

- European equities are mostly higher, whilst US equity futures are mixed; TSLA -3%, IBM -7.2%, Quantum stocks +10%.

- DXY is flat, Antipodeans lead whilst havens lag in quiet trade.

- Bonds are pressured as the risk tone sees pockets of improvement; decent UK auction sparked little move in Gilts at the time.

- New Russian sanctions push crude benchmarks higher, XAU continues to consolidate.

- Looking ahead, Existing Home Sales (Sep), EZ Consumer Confidence Flash (Oct), Canadian Retail Sales (Aug), Australian Flash PMIs (Oct), (Suspended Releases: US Weekly Claims), CBRT Policy Announcement, CCP 4th Plenum (20th-23rd), European Council (23rd-24th). Speakers including ECB’s Lane, Fed's Bowman & Barr (Fed on Blackout). Earnings from Intel, American Airlines, Freeport McMoRan, Blackstone, T-Mobile US & Valero Energy.

</figure>

</figure>TARIFFS/TRADE

- US President Trump’s administration is considering a plan to restrict globally produced exports to China made with or containing US software, while the new export controls under consideration by the US could curb exports on a wide range of goods to China, and the plan would retaliate against China's rare earth export restrictions if adopted, according to Reuters sources. However, the sources said that the measure, details of which are being reported for the first time, may not move forward, and administration officials could announce the measure to put pressure on China but stop short of implementing it, while narrower policy proposals are also being discussed.

- US President Trump said a long meeting is scheduled with Chinese President Xi in South Korea, and he thinks something will work out, while he thinks he will make a deal with Chinese President Xi and could make a deal on soybeans. Trump added that they could even make a deal on nuclear and thinks he will talk to Xi about Russian oil, as well as ending the war in Ukraine. Trump also commented that tariffs are vital and that they might go to the Supreme Court for the tariffs case.

- US Treasury Secretary Bessent said he was leaving on Wednesday for Malaysia to meet with Chinese officials and is hoping they can iron things out, while he will have two days of fulsome talks with Chinese officials in Malaysia. Bessent said it would be a shame to waste the first meeting of Trump and China's Xi during Trump's second term, as well as noted that he is contemplating the US and allies' next move if China talks fail.

- US Treasury Secretary Bessent said any export controls regarding China will be in coordination with G7 allies.

- Taiwan US envoy said they are close to reaching a trade agreement with the US.

- China Commerce Ministry says Vice Premier Lifeng will hold talks with the USA regarding trade in Malaysia within 24-27 October.

EUROPEAN TRADE

EQUITIES

- European bourses (STOXX 600 +0.2%) are mostly firmer but with some slight underperformance in the DAX 40, which is being pressured by post-earning losses in SAP (-2.4%).

- European sectors are mixed. Energy takes the top spot, joined closely by Consumer Products; the latter boosted by upside in Kering (+9%) after the Co. reported strong Q3 metrics. To the downside, Evolution (7%) weighs on the Travel & Leisure sector.

- US equity futures are mixed; the RTY gains, whilst the ES & NQ hold around the unchanged mark. Key pre-market movers: Tesla (-3%, profits slip despite reporting record rev.), IBM (-7%, top- and bottom-line beats but cloud rev. growth slows), Quantum stocks (US President Trump's administration is in talks to take equity stakes in quantum computing firms).

- Anti-obesity drug prescribing shows signs of levelling off, via Axios.

- Click for the sessions European pre-market equity newsflow

- Click for the additional news

- Click for a detailed summary

FX

- USD is slightly firmer/flat and trades within a very narrow 98.92-99.10 range; lack of data releases and Fed speak (due to blackout) has led to quiet trade for the Dollar. However, this should all pick-up on Friday, with the BLS set to release US CPI, despite the government shutdown. There have been some important trade-related newsflow recently; Reuters reported that the Trump administration is mulling a plan to restrict globally produced exports to China made with or containing US software. Though the piece suggested that the US may not go forward with the plan, and may only be used to apply pressure on China amid trade negotiations. On that, Treasury Secretary Bessent is set to meet with China’s VP in Malaysia over the weekend; Bessent said he hopes “to iron things out”.

- EUR is flat/incrementally lower vs USD. EUR/USD is currently trading in a 1.1591-1.1614 range, which is towards the mid-point of Wednesday’s bounds. Overnight, ECB’s Kazaks said “it may well be the case that the next rate move could as easily be a hike as a cut” – comments which are in contrast to Villeroy (cut more likely than hike) and Kocher (sees equal chance).

- JPY is right at the foot of the G10 pile, alongside haven peer CHF; nothing really driving the “risk-on” sentiment seen in the FX-space today, but perhaps some focus on US Treasury Secretary Bessent’s meeting with China VP this weekend – it is worth caveating that other trade-related reporting has been broadly negative (discussed above). Newsflow out of Japan has been very light, with USD/JPY largely moving at the whim of the Dollar; currently trades at the upper end of a 151.82-152.66 range, a peak which marks a WTD best. Further upside could see a breach back above 153.00 and then to the 10th October high at 152.27.

- GBP is flat, taking a breather following the prior day’s subdued trade in the aftermath of a softer-than-expected inflation report. Newsflow since has been incredibly light, and this has been reflected in Cable, which currently trades in a narrow 1.3329-1.3362 range; at the mid-point of Wednesday’s confines.

- Antipodeans are at the top of the G10 pile, but little fresh behind the strength; though upside which seemingly coincided with an early-morning uptick in copper prices.

- PBoC set USD/CNY mid-point at 7.0918 vs exp. 7.1205 (Prev. 7.0954)

- Click for a detailed summary

FIXED INCOME

- USTs were softer by a tick or two in APAC trade and have continued to dip into and throughout the European morning. Pressure a function of the pockets of improvement in the risk tone as the US-China situation isn't perhaps as bad as first thought, a point added to by the fact the US’ Bessent and China’s He are still set to meet in Malaysia from tomorrow.

- Thus far, down to a 113-16+ trough with downside of nine ticks at most and approaching the 113-10 WTD base. Ahead, Fed's Barr and Bowman are scheduled, but the blackout means this will be a non-event. Data-wise, the shutdown continues to limit, but any comments from the KC survey on inflation are of note ahead of Friday's CPI.

- EGBs followed suit to the above. Bunds below the 130.00 mark, matching the 129.24 low from Tuesday, but yet to test 129.76 from Monday. EGBs hit by the better tone around trade as outlined above. Further pressure for fixed income also stemming from the continued advances in energy prices, biasing yields higher.

- Gilts, unsurprisingly, saw a softer start after closing with gains of nearly 60 ticks on Wednesday. Gilts opened lower by a handful of ticks and despite a brief move into the green have since conformed to the bearish bias and trade lower by 15 ticks, an amount comparable to Bunds.

- UK sells GBP 4.75bln 4.125% 2035 Gilt: b/c 2.83, average yield 4.00%, tail 0.7bps

- Click for a detailed summary

COMMODITIES

- Crude benchmarks are strong today as the US placed new sanctions on Russian oil companies. After an initial c. USD 1.30/bbl move late on Wednesday, WTI and Brent trended higher during APAC trade from USD 59.72/bbl and USD 63.86/bbl respectively to peak at USD 60.90/bbl and USD 65.04/bbl. Currently, benchmarks are continuing to trade higher to new session highs at USD 61.79/bbl and USD 65.96/bbl respectively. To recap, late in Wednesday’s session, the US placed sanctions on Russian oil companies Rosneft and Lukoil because of

Comments

In Channel