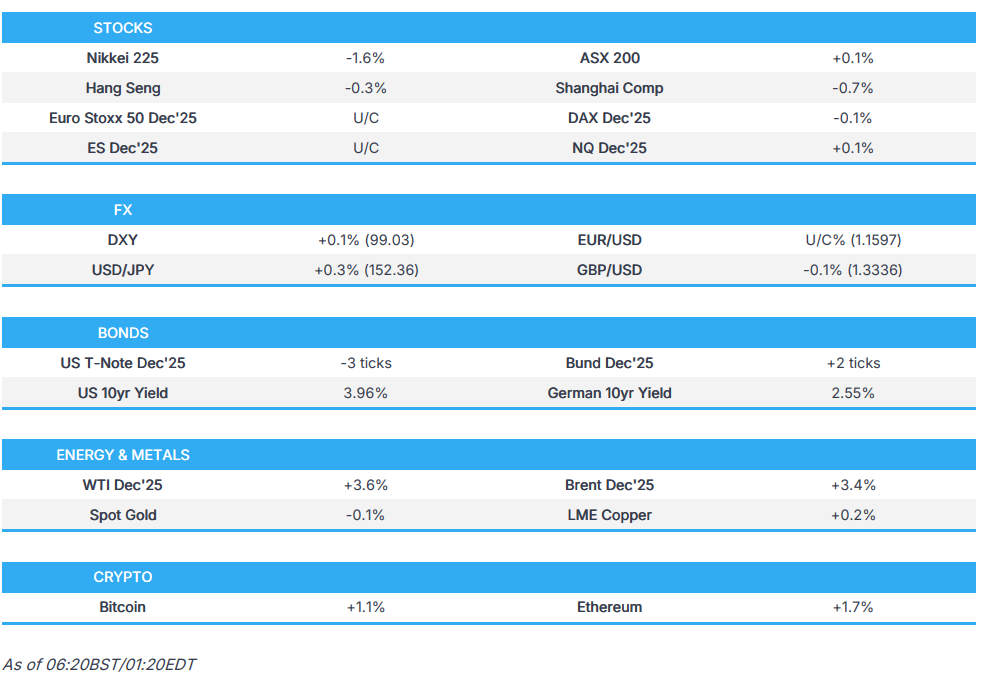

Europe Market Open: US-China frictions weigh on the risk tone & US imposes Russian sanctions, rallying crude

Update: 2025-10-23

Description

- US-China frictions weigh on the risk tone; Bessent said they are contemplating the next move if talks don't work out

- DXY posts modest gains, EUR pressured, while Sterling remains lower but is off the worst levels on Wednesday

- Fixed benchmarks struggled for direction, US 20yr was decent

- Crude supported by reports around Ukraine's use of Western long-range missiles, metals softer

- Looking ahead, highlights include US National Activity Index (Sep), Existing Home Sales (Sep), EZ Consumer Confidence Flash (Oct), Canadian Retail Sales (Aug), Australian Flash PMIs (Oct), (Suspended Releases: US Weekly Claims), CBRT Policy Announcement, CCP 4th Plenum (20th-23rd), European Council (23rd-24th), Speakers including ECB’s Lane, Fed's Bowman & Barr (Fed on Blackout), Supply from UK & US.

- Earnings from Dassault, Orange, STMicroelectronics, Beiersdorf, Nokia, BE Semiconductor, Intel, American Airlines, Freeport McMoRan, Honeywell, Dow, Southwest Airlines, Blackstone, PG&E, T-Mobile US & Valero Energy.

- Click for the Newsquawk Week Ahead.

</figure>

</figure>US TRADE

EQUITIES

- US stocks were in the red with pressure seen in the US afternoon amid reports that the Trump admin is mulling export controls to China on goods made with or containing US software, although some of the move attempted to pare as digestion of the further details seemed less extreme. Nonetheless, risk-off trade resumed into the close. Sectors were mixed with Industrials and Consumer Discretionary residing as the laggards, and Energy outperforming, buoyed by gains in the crude complex.

- SPX -0.53% AT 6,699, NDX -0.99% AT 24,879, DJI -0.71% AT 46,591, RUT -1.45% AT 2,452.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump’s administration is considering a plan to restrict globally produced exports to China made with or containing US software, while the new export controls under consideration by the US could curb exports on a wide range of goods to China, and the plan would retaliate against China's rare earth export restrictions if adopted, according to Reuters sources. However, the sources said that the measure, details of which are being reported for the first time, may not move forward, and administration officials could announce the measure to put pressure on China but stop short of implementing it, while narrower policy proposals are also being discussed.

- US President Trump said a long meeting is scheduled with Chinese President Xi in South Korea, and he thinks something will work out, while he thinks he will make a deal with Chinese President Xi and could make a deal on soybeans. Trump added that they could even make a deal on nuclear and thinks he will talk to Xi about Russian oil, as well as ending the war in Ukraine. Trump also commented that tariffs are vital and that they might go to the Supreme Court for the tariffs case.

- US Treasury Secretary Bessent said he was leaving on Wednesday for Malaysia to meet with Chinese officials and is hoping they can iron things out, while he will have two days of fulsome talks with Chinese officials in Malaysia. Bessent said it would be a shame to waste the first meeting of Trump and China's Xi during Trump's second term, as well as noted that he is contemplating the US and allies' next move if China talks fail.

- US Treasury Secretary Bessent said any export controls regarding China will be in coordination with G7 allies.

- Taiwan US envoy said they are close to reaching a trade agreement with the US.

NOTABLE HEADLINES

- US President Trump said interest rates are down, while he criticised the Fed chair, and noted that he will be doing something very quickly to get beef prices down.

- US President Trump posted on Truth regarding cattle ranchers in which he commented, "It would be nice if they would understand, but they also have to get their prices down, because the consumer is a very big factor in my thinking, also!"

- US Treasury Secretary Bessent said they might see CPI coming down next month and the month after, while he thinks housing prices are a lagging indicator, and they are going to see substantial tax refunds for Americans.

- US House Ways and Means Committee Chair Smith said lawmakers are weighing a stopgap bill through December 2026, according to Bloomberg's Wasson.

- US House Minority Leader Jeffries hopes they can get the shutdown resolved by the end of October.

- US Republican Senators are said to consider a bill to keep SNAP program benefits flowing during the government shutdown, according to POLITICO.

- US President Trump's administration is in talks to take equity stakes in quantum computing firms, according to WSJ.

APAC TRADE

EQUITIES

- APAC stocks were mostly subdued following the negative handover from Wall St, where sentiment was weighed on by US-China frictions.

- ASX 200 traded rangebound as participants digested quarterly updates, and with gains in energy and utilities offsetting the weakness in tech and mining.

- Nikkei 225 underperformed after gapping lower at the open to beneath the 49,000 level despite a weaker currency.

- Hang Seng and Shanghai Comp were negative with the mainland pressured amid US-China tensions after reports that the Trump admin considers restricting globally-produced exports to China made with or containing US software.

- US equity futures attempted to nurse some of the prior day's losses, but with the rebound contained following several earnings releases, including mixed results from Tesla, which topped revenue forecasts but missed on the bottom line.

- European equity futures indicate an uneventful cash market open with Euro Stoxx 50 futures flat after the cash market finished with losses of 0.8% on Wednesday.

FX

- DXY eked slight gains but with the upside capped after its choppy performance and as participants largely await the US CPI on Friday ahead of next week's FOMC. There remained little sign of progress regarding the government shutdown, although House Ways and Means Committee Chair Smith remarked that lawmakers are weighing a stopgap bill through December 2026, while House Minority Leader Jeffries hopes they can get the shutdown resolved by month-end.

- EUR/USD trickled lower following the prior day's fluctuations with the single currency back beneath the 1.1600 handle, while there was little reaction to recent ECB rhetoric, with Kazaks stating it may well be the case that the next rate move could as easily be a hike as a cut.

- GBP/USD remained subdued but is off the lows seen in the aftermath of yesterday's softer-than-expected UK CPI data.

- USD/JPY continued to advance after breaking back above the 152.00 level, with PM Takaichi said to proceed with fiscal reform both in terms of spending and revenue.

- Antipodeans were constrained amid the subdued risk appetite and absence of tier-1 data releases.

- PBoC set USD/CNY mid-point at 7.0918 vs exp. 7.1205 (Prev. 7.0954)

FIXED INCOME

- 10yr UST futures struggled for direction after recent indecision amid focus on US/China relations and following an overall decent 20yr auction stateside.

- Bund futures remained afloat after rebounding from the trough seen in the aftermath of yesterday's Bund issuance.

- 10yr JGB futures were ultimately flat amid the absence of tier-1 data and pertinent catalysts, while an enhanced liquidity auction for longer-dated JGBs failed to spur price action.

COMMODITIES

- Crude futures rallied with the advances facilitated by geopolitical headlines including reports that the Trump admin lifted a key restriction on Ukraine's use of Western long-range missiles, which Trump later refuted, while the US Treasury Department announced sanctions on Russia targeting Russia's Rosneft and Lukoil.

- Russian oil supply to India is set to fall to near zero, according to sources cited by Bloomberg.

- Indian state refiners reviewing bills of lading for Russian oil cargoes arriving post-November 21st to ensure no supply comes directly from US-sanctioned Rosneft and Lukoil, according to a source cited by Reuters

- Spot gold was mildly lower in rangebound trade as price action calmed down from yesterday's fluctuations.

- Copper futures lacked conviction with demand hampered alongside the mostly subdued risk appetite.

CRYPTO

- Bitcoin steadily gained overnig

Comments

In Channel