Europe Market Open: Takaichi named Japanese PM, Trump reiterates tariff deadline and European equity futures are positive

Update: 2025-10-21

Description

- APAC stocks took their cues from the rally on Wall Street as the focus remained on US-China trade with some optimism following US President Trump's comments in which he stated that China has been respectful of them.

- US President Trump continued to tout a November 1st deadline for additional tariffs, he also reaffirmed that he will be meeting with Chinese President Xi and thinks they will reach a 'fantastic deal'.

- Japanese LDP leader Takaichi won the lower house vote (237 votes out of 465-seats) to become Japan's first female PM, as expected.

- European equity futures indicate a modestly positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with gains of 1.3% on Monday.

- Looking ahead, highlights include UK PSNB (Sep), Canadian CPI (Sep), NBH Policy Announcement, CCP 4th Plenum (20th-23rd), Speakers including ECB’s Nagel, Lane & Lagarde, Fed’s Waller, BoE's Bailey & Breeden, Supply from UK & Germany,

- Earnings from Netflix, Intuitive, Texas Instruments, Capital One Financial, Coca-Cola, GE Aerospace, Elevance Health, Lockheed Martin, Philip Morris, RTX, General Motors, 3M, Nasdaq & Danaher.

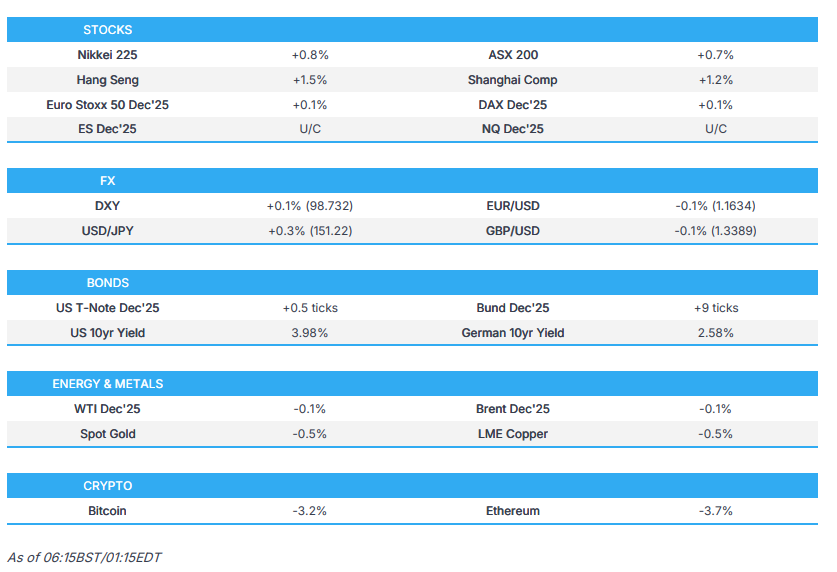

SNAPSHOT

<figure class="image"> </figure>

</figure>LOOKING AHEAD

- Highlights include UK PSNB (Sep), Canadian CPI (Sep), NBH Policy Announcement, CCP 4th Plenum (20th-23rd), Speakers including ECB’s Nagel, Lane & Lagarde, Fed’s Waller, BoE's Bailey & Breeden, Supply from UK & Germany, Earnings from Netflix, Intuitive, Texas Instruments, Capital One Financial, Coca-Cola, GE Aerospace, Elevance Health, Lockheed Martin, Philip Morris, RTX, General Motors, 3M, Nasdaq & Danaher.

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks gained in risk-on trade despite the very light newsflow to start the week amid the Fed blackout and lack of US data given the government shutdown. Nonetheless, headline action was sparse and comments from US President Trump largely echoed recent remarks in which he reaffirmed he will meet with Chinese President Xi and noted that if a deal is not made with China, they will face 100% tariffs (existing tariffs + 100% additional tariff threat) on November 1st.

- SPX +1.07% at 6,735, NDX +1.30% at 25,141, DJI +1.12% at 46,707, RUT +1.95% at 2,500.

- Click here for a detailed summary.

TARIFFS/TRADE

- US President Trump said China has been respectful of them and noted on China trade, that potential 155% tariffs will come November 1st unless they make a deal, while he is meeting with Chinese President Xi in South Korea.

- US President Trump said could threaten China on other things, including airplanes and will go to China sometime fairly early next year and have it sort of set. Trump added that the US and China have to thrive together and he wants China to buy soybeans.

- US President Trump and Australian PM Albanese signed a critical minerals agreement. There were later comments from President Trump who said there has been games with other countries, but no games with Australia, while Australian PM Albanese said the deal includes a joint venture on processing between US and Australia, as well as projects with Japan.

- White House Fact Sheet on Critical Minerals Deal with Australia stated that both governments are to invest over USD 3bln in the next six months and recoverable resources are estimated at USD 53bln.

- US Trade Representative Greer said they will take action over Nicaragua's labour rights policies and he proposed additional duties of up to 100% on Nicaragua following the conclusion of a Section 301 investigation, while he proposed to suspend all of Nicaragua's benefits under the Central America-Dominican Republic Free Trade Agreement, either immediately or phased in over 12 months.

NOTABLE HEADLINES

- US appeals court allowed US President Trump to send troops to Portland, Oregon. In relevant news, the state of Illinois asked US Supreme Court to hear the case for blocking Trump's plan to deploy National Guard troops to Chicago.

- US Director of Federal Housing Pulte said the Trump administration is opportunistically evaluating an offering for Freddie and Fannie, which could occur as early as the end of 2025.

APAC TRADE

EQUITIES

- APAC stocks took their cues from the rally on Wall Street as the focus remained on US-China trade with some optimism following US President Trump's comments in which he stated that China has been respectful of them and although he continued to tout a November 1st deadline for additional tariffs, he also reaffirmed that he will be meeting with Chinese President Xi and thinks they will reach a 'fantastic deal'.

- ASX 200 climbed to a fresh record high with the advances led by the mining and resources sectors after Australia and the US signed a critical minerals agreement, and with mining giant BHP gaining following its quarterly production update.

- Nikkei 225 rallied and briefly approached to near the 50k level before fading some of the gains, while attention was on the PM vote in parliament where Abe-protege Takaichi was elected to become Japan's first female PM, and which is seen to potentially delay or slow the BoJ hiking rates.

- Hang Seng and Shanghai Comp were higher amid the hopes for an improvement in US-China trade relations and with the ongoing plenum where China is to map out its next five-year plan.

- US equity futures held on to recent spoils but with further upside capped with earnings season set to pick up.

- European equity futures indicate a modestly positive cash market open with Euro Stoxx 50 futures up 0.1% after the cash market closed with gains of 1.3% on Monday.

FX

- DXY held on to the prior day's mild gains in rangebound trade amid very light newsflow and with the Fed on a blackout period, while there remains a lack of US data given the ongoing government shutdown, although, White House Economic adviser Hassett thinks the shutdown is likely to end sometime this week, but did not provide any reasons why, and added if the shutdown doesn't end, the White House is to look at stronger measures. Nonetheless, the focus remained on US-China trade amid hopes for improving trade ties after President Trump remarked that China has been respectful of them, and although he warned that potential 155% tariffs will come on November 1st unless they make a deal, he also reaffirmed that he will be meeting with Chinese President Xi and thinks they'll end up with a strong trade deal.

- EUR/USD lacked direction with the single currency stuck near the prior day's trough, with little impact seen following comments from ECB officials including Nagel who said they can remain in wait-and-see mode on rates.

- GBP/USD marginally softened and breached the 1.3400 level to the downside in the absence of any UK-specific catalysts.

- USD/JPY edged higher and reverted to the 151.00 territory amid the fresh record highs in Tokyo stocks with focus on the parliamentary vote in which LDP leader Takaichi won to become Japan's first female Prime Minister.

- Antipodeans failed to benefit from the positive risk appetite with NZD/USD the laggard after slightly softer exports and credit card spending data.

FIXED INCOME

- 10yr UST futures were contained amid the Fed blackout and absence of data, while attention remained on US-China trade.

- Bund futures traded little changed near the 130.00 level amid a lack of haven demand and ahead of issuances.

- 10yr JGB futures kept afloat with mild upside amid the Japanese PM vote at the Diet which LDP leader Takaichi won, while participants also digested a 10-year Japan Climate Transition Bond auction which resulted in a slightly higher bid-to-cover than previous.

COMMODITIES

- Crude futures were subdued after the recent choppy performance and with very light fresh catalysts.

- Kazakhstan Energy Ministry said suspension of operations at the Orenburg gas processing plant did not affect gas supplies to Kazakhstan, while gas reception at the Orenburg gas processing plant is expected to resume soon.

- Iraqi PM's office said Iraq will sign an agreement with Excelerate Energy (EE) to supply US gas to Iraq.

- Spot gold marginally pulled back from record highs after advancing yesterday amid rate cut bets for next week's FOMC.

- Copper futures lacked conviction despite the positive risk appetite, with upside contained following the prior day's swings.

CRYPTO

- Bitcoin retreated throughout the session and approached the 108k level to the downside.

NOTABLE ASIA-PAC HEADLINES

Comments

In Channel